More than 80% of major global companies now disclose some climate-related information; however, only between 2% and 3% report fully across all recommended pillars.

Climate Disclosure Enters Implementation Era

Corporate climate disclosure has moved beyond aspiration. It is now an implementation story.

The IFRS Foundation's November 2024 report on corporate climate-related disclosures reveals that 82% of 3,814 public companies reviewed disclosed information aligned with at least one of the 11 TCFD recommended disclosures in fiscal year 2023, up from 73% in 2022.

However, only between 2% and 3% reported comprehensively across all 11 recommendations.

More importantly, the architecture of global climate disclosure is changing gently. Since the issuance of IFRS S1 and IFRS S2 in June 2023, more than 1,000 companies have referenced the ISSB Standards in their reports between October 2023 and March 2024.

Meanwhile, 30 jurisdictions, which represent approximately 57% of global GDP, more than 40% of market capitalisation and over 50% of global greenhouse gas emissions, are moving to introduce ISSB Standards into their legal and regulatory frameworks.

The era of voluntary alignment is giving way to regulated comparability.

Disclosure Is Rising, Depth Is Not

Climate disclosure coverage is expanding rapidly.

In fiscal year 2023:

- 82% of companies disclosed at least one TCFD-aligned disclosure

- 44% disclosed at least five

- Only 2–3% disclosed all 11

The most reported disclosure? Greenhouse gas emissions are disclosed by 63% of companies.

The least reported? The resilience of the strategy under climate scenarios is just 11%.

This asymmetry matters. Metrics are easier than scenario-based strategy integration. Reporting emissions is simpler than explaining how a 2°C pathway affects capital allocation.

Disclosure breadth has improved. Disclosure depth remains uneven.

From TCFD Legacy to ISSB Standardisation

The report confirms the formal transition from the Financial Stability Board's TCFD to the ISSB framework. IFRS S2 integrates the TCFD's four core pillars of governance, strategy, risk management, and metrics and targets. Companies applying ISSB Standards no longer need to report TCFD compliance separately.

The AI-based review of 3,814 companies across eight industries and five regions shows:

- Reporting increased across all 11 disclosures between 2022 and 2023

- Europe leads with the highest disclosure rates (average 6.4 disclosures per company)

- Africa averages 3.7 disclosures per company

- Companies above $12.3 billion market capitalisation report more extensively than smaller firms

The energy and insurance sectors show the highest alignment, averaging 5.5 disclosures per company. Technology and consumer goods lag.

The data signals a maturity divide, by geography, by industry, and by company size.

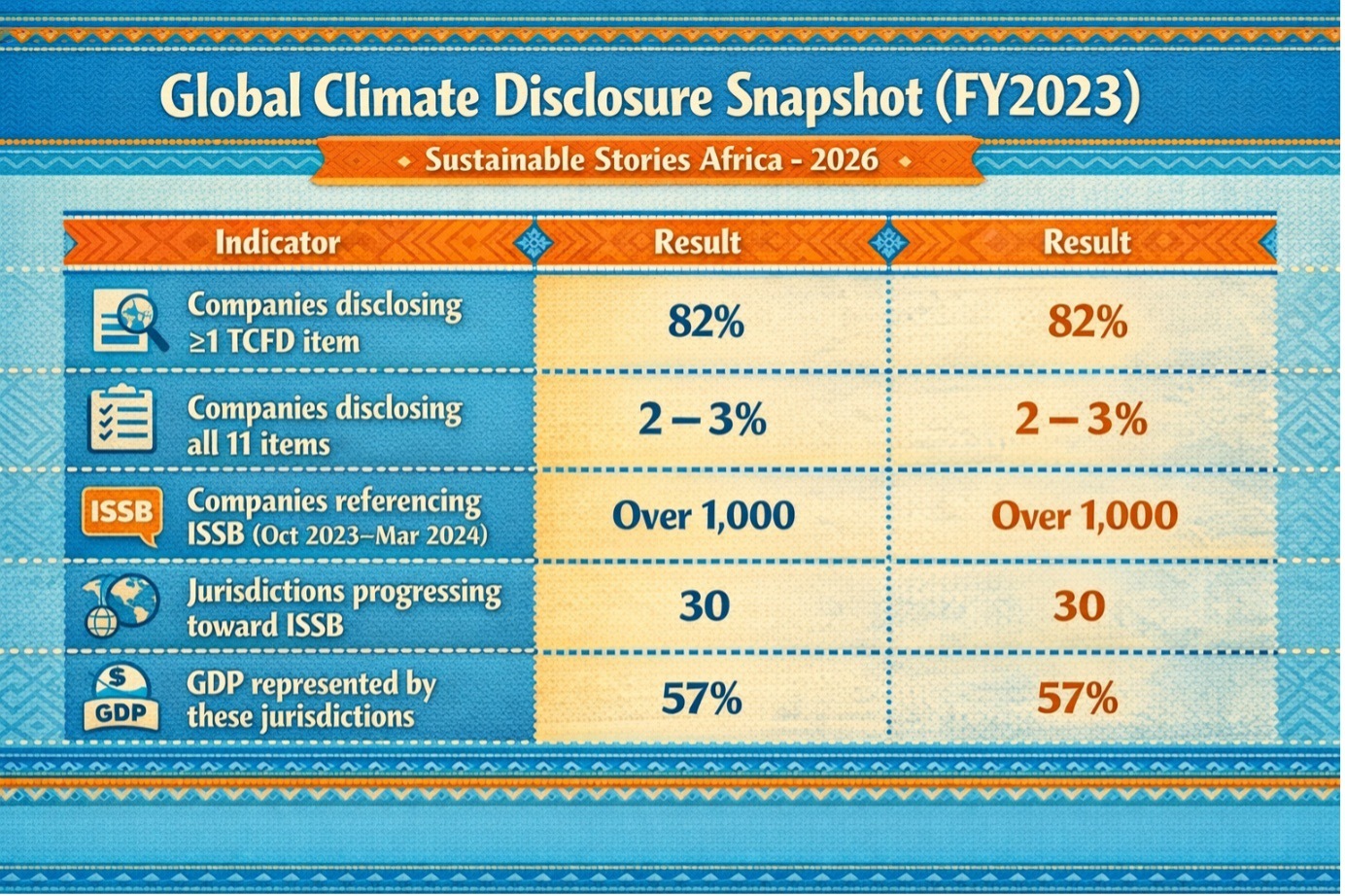

Global Climate Disclosure Snapshot (FY2023)

| Indicator | Result |

|---|---|

| Companies disclosing ≥1 TCFD item | 82% |

| Companies disclosing all 11 items | 2–3% |

| Companies referencing ISSB (Oct 2023–Mar 2024) | Over 1,000 |

| Jurisdictions progressing toward ISSB | 30 |

| GDP represented by these jurisdictions | 57% |

Interoperability, Assurance, Capital Confidence

The most significant structural development is the momentum across jurisdictions.

The 30 jurisdictions advancing toward ISSB adoption span both TCFD-aligned markets and new adopters across Africa, Latin America and Asia-Oceania.

Interoperability has become central. The IFRS Foundation has ensured coordination, aligning ISSB Standards, European Sustainability Reporting Standards (ESRS), and the US SEC climate rule. Collaboration with GRI continues to reduce duplication.

The Jurisdictional Guide (May 2024) aims to minimise regulatory fragmentation.

Why does this matter? Fragmentation increases costs, undermines comparability, and weakens capital market efficiency. Investors require consistency. Lenders require reliability. Assurance enhances trust.

ISSB Standards move climate disclosure from "recommended" to "required," from separate sustainability reports to integration within financial reports, from a general-purpose perspective.

That shift alters board accountability.

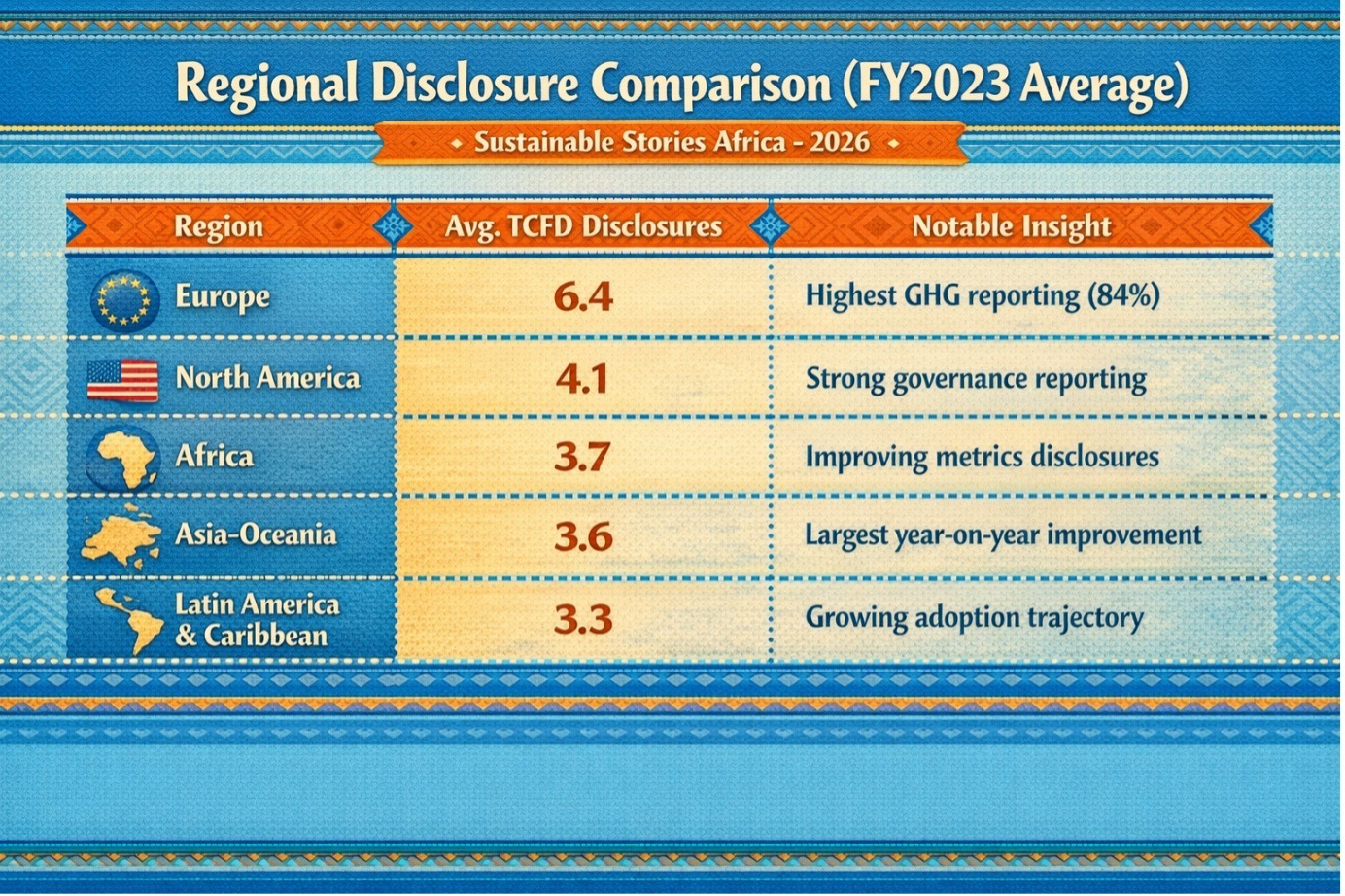

Regional Disclosure Comparison (FY2023 Average)

| Region | Avg. TCFD Disclosures | Notable Insight |

|---|---|---|

| Europe | 6.4 | Highest GHG reporting (84%) |

| North America | 4.1 | Strong governance reporting |

| Africa | 3.7 | Improving metrics disclosures |

| Asia-Oceania | 3.6 | Largest year-on-year improvement |

| Latin America & Caribbean | 3.3 | Growing adoption trajectory |

Boards Must Move Beyond Emissions Reporting

The report's conclusion is clear: progress is encouraging, but insufficient.

Few companies fully articulate governance, resilience strategies, risk integration, and forward-looking financial implications. Scenario analysis disclosure remains limited. Integration into financial statements is evolving.

For African markets, the opportunity is structural. Jurisdictions introducing ISSB Standards can avoid legacy fragmentation and embed global comparability from the start.

For boards, the implication is unmistakable:

- Integrate climate risks into financial planning

- Align reporting cycles with general-purpose financial reports

- Invest in internal capability and digital taxonomy readiness

- Prepare for assurance expectations

The move from TCFD to ISSB is not cosmetic. It is a governance transition.

Path Forward – Standardise, Integrate, Assure, Compare

The next phase of climate disclosure hinges on disciplined adoption of ISSB Standards without jurisdictional dilution, strengthened interoperability, and credible assurance frameworks. Governments must align regulatory frameworks while avoiding fragmentation.

Companies must shift from emissions reporting to strategy resilience and financial integration. Investors increasingly expect comparability, connectivity and forward-looking clarity. Climate disclosure is no longer optional; it is a form of capital infrastructure.