Sustainability has moved from the margins to the boardroom, with CEOs now leading ESG strategies globally in nearly half of major corporations.

KPMG's latest research shows that while ESG governance structures are strengthening, many organisations still face skills gaps, uneven accountability, and limited resources, raising questions about how effectively sustainability is truly embedded across corporate operations.

Boards Now Lead ESG Strategy

Sustainability has become a board-level responsibility, driven by rising regulatory demands, investor scrutiny, and long-term business risk.

KPMG's global research, based on interviews with 50 chief sustainability officers and ESG leaders, finds that ESG governance is no longer a peripheral function.

In almost half of the surveyed companies, the CEO now leads sustainability, with most boards treating ESG as a strategic or purpose-driven priority.

However, maturity remains uneven. While advanced corporates have integrated ESG into decision-making, reporting, and executive incentives, many still operate with small sustainability teams, fragmented governance structures, and limited cross-functional ownership.

More than half of firms have three or fewer staff working on non-financial reporting, even as ESG disclosure obligations expand under regulations like the EU's Corporate Sustainability Reporting Directive (CSRD).

The question facing corporate leaders is no longer whether to embed ESG in governance, but how to do so effectively, at scale, and with measurable impact.

ESG Reaches the Boardroom

KPMG's findings confirm a structural shift: sustainability is now anchored at the top of corporate hierarchies.

About one-quarter of firms have a dedicated board-level sustainability committee, while another fifth manages ESG through audit or risk committees, reflecting its growing link to reporting and compliance.

In two-tier board systems, ESG is often grouped with audit or risk oversight, though several companies plan to create standalone sustainability committees. In one-tier boards, ESG typically appears on the agenda twice yearly, often led by the chief sustainability officer.

This shift signals a broader redefinition of corporate accountability, where sustainability performance is increasingly scrutinised alongside financial results.

Who Controls ESG Decisions?

Decision-making authority over ESG varies, but power is increasingly centralised:

- CEO leads ESG in almost half of the companies

- Chief Sustainability Officer (CSO) is the second most common leader

- Other roles include CFOs, Chief Risk Officers, and Heads of Supply Chain

More than two-thirds of companies have a formal ESG decision-making body (often a sustainability committee or council), typically including finance, HR, legal, and C-suite executives.

About 25% are chaired by the CEO, with a similar share chaired by the CSO.

Who Leads ESG at Board Level

| Role | Number of Firms |

|---|---|

| Chief Executive Officer | 23 |

| Chief Sustainability Officer | 9 |

| Chief Financial Officer | 5 |

| Chief Corporate Affairs Officer | 3 |

| Chief Human Resources Officer | 3 |

| Others (COO, Chair, CTO) | 7 |

However, responsibility does not always equal capacity. Many sustainability units remain small, with over two-thirds employing fewer than 10 full-time staff, decreasing execution power despite strategic directions.

Why Strong ESG Governance Matters

Companies with mature ESG governance structures gain three strategic advantages:

- Regulatory resilience – Better preparedness for CSRD and future disclosure rules

- Investor confidence – Clear accountability strengthens capital market trust

- Operational alignment – ESG becomes embedded in daily business decisions

Almost all firms integrate ESG strategy, targets, and KPIs within sustainability units, while execution is delegated to business units and regions. This hybrid model supports both oversight and local ownership.

Key ESG themes dominate corporate strategies:

- Decarbonisation and net-zero transition

- Diversity, equality and inclusion

- Human rights in the value chain

- Circular economy initiatives

Nature and biodiversity are gaining relevance but remain less embedded in core strategies.

This evolution reflects a shift from symbolic ESG commitments to operational transformation.

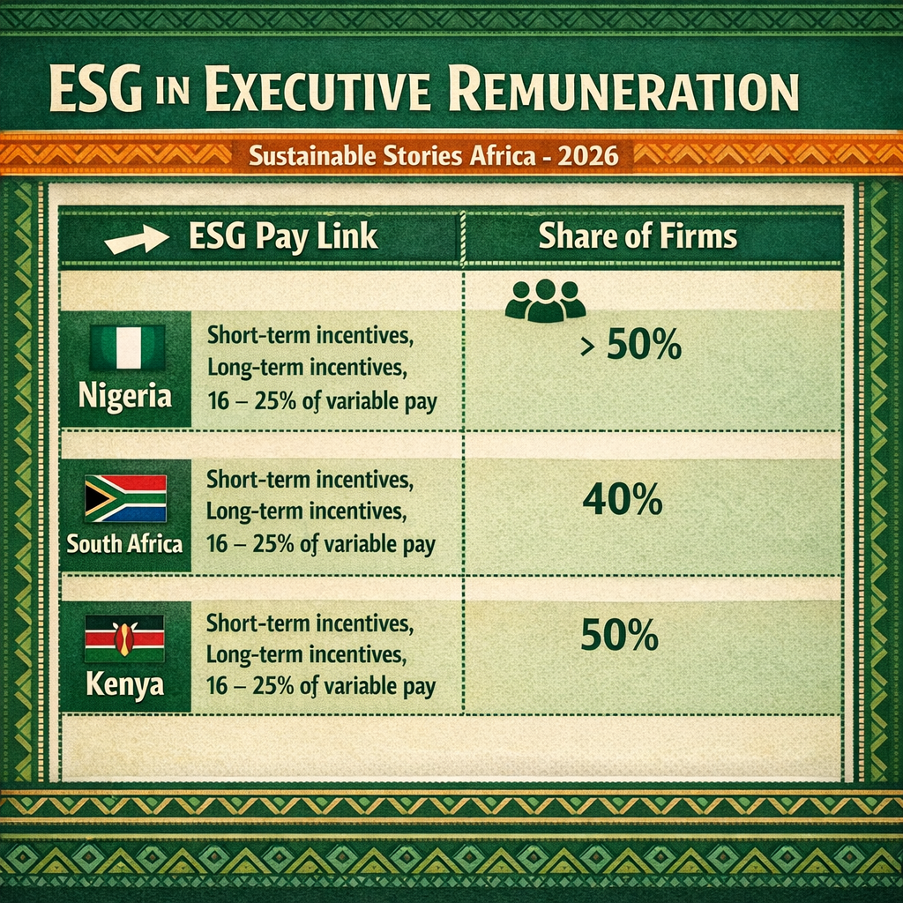

Linking ESG to Executive Pay

ESG is increasingly tied to performance management:

- Just under half of firms include ESG in corporate KPIs

- More than a quarter include ESG in management-level reviews

- Over half link ESG to short-term executive incentives

- Two-fifths link ESG to long-term incentives

Notably, 16–25% of variable executive pay is now tied to ESG indicators in nearly half of companies. Many expect this share to rise and extend to middle management.

ESG in Executive Remuneration

| ESG Pay Link | Share of Firms |

|---|---|

| Short-term incentives | >50% |

| Long-term incentives | 40% |

| 16–25% of variable pay | 50% |

This alignment signals that ESG is no longer just a reporting exercise; it now shapes leadership behaviour and accountability.

PATH FORWARD – From Structure to Impact

ESG governance has entered the boardroom; however, execution capacity still falls behind ambition. Companies must strengthen cross-functional collaboration, expand sustainability skills, and embed ESG accountability across business units.

By linking governance, incentives, and strategy, organisations can transform ESG from a compliance function into a long-term value driver.