Nigeria's economy is showing early signs of stabilisation after two years of painful reforms, including the removal of fuel subsidy and currency liberalisation.

However, rising public debt, weak capital spending, and mounting security risks threaten to derail the country's fragile recovery.

The CFG Advisory's 2026 forecast warns that without urgent fiscal restructuring, asset sales, and productivity-led reforms, Nigeria risks missing its growth and poverty-reduction targets.

Reforms Tested by Fiscal Reality

Nigeria enters 2026 at a delicate economic crossroads. After two years of difficult reforms, marked by the removal of fuel subsidies, currency devaluation, and inflationary pressure, macroeconomic conditions are stabilising.

Foreign reserves are stronger, inflation is easing, and the naira now trades under a more transparent market-driven system. Foreign portfolio inflows reached $21 billion by October 2025, while business confidence improved, reflected in positive Purchasing Managers' Index readings.

However, beneath the surface, deep fiscal strains persist. Government debt now exceeds $100 billion, with 60% of revenues, including $15 billion in fuel subsidy savings, absorbed by debt servicing. Capital projects with strong multiplier effects remain underfunded, limiting growth momentum.

The CFG Advisory's 2026 Economic Forecast projects 5% GDP growth, single-digit inflation, a sub-20% monetary policy rate, and an exchange rate of N1,400 – N1,500 per dollar.

However, achieving sustainable prosperity will depend on decisive fiscal restructuring, productivity-led growth, and security stabilisation.

Stabilisation Meets Structural Constraints

For the first time since independence, Nigeria experienced direct foreign military intervention when the US Navy struck Islamic terrorist bases in the northwest on Christmas Day.

The move placed Nigeria firmly within global counterterrorism dynamics but also raised concerns about long-term geopolitical implications.

Meanwhile, economic reforms have delivered short-term stability. Inflation has moderated, reserves are robust, and the naira operates under a transparent FX regime.

However, fiscal performance remains weak. Revenue collections consistently fall short of targets, forcing record budget deficits and limiting growth-oriented spending.

Growth Slows Below Poverty Threshold

Nigeria's rebased GDP now stands at $280 billion, dropping the country from Africa's largest to its fourth-largest economy.

Growth slowed to 3.98% in Q3 2025, down from 4.23% the previous quarter. While non-oil sectors are driving expansion, growth remains far below the 8% to 10% required to lift 140 million Nigerians out of poverty.

A comparison with Indonesia underscores Nigeria's missed opportunities. In the late 1990s, both countries had GDPs just under $200 billion.

By 2025, Indonesia's GDP reached $1.4 trillion, while Nigeria's stagnated at $280 billion, a staggering growth differential of $1.2 trillion driven by long-term policy choices.

Key 2026 Macroeconomic Projections

| Indicator | Projection |

|---|---|

| GDP Growth | 5% |

| Population | 237 million |

| Inflation | 10% |

| MPR | 17% |

| FX Rate | N1,400 – N1,500 |

| Total Debt | $125bn |

| Foreign Reserves | $48bn |

Productivity-Led Growth Offers Hope

The CFG Advisory argues Nigeria must pivot from stabilisation to productivity-led growth. Structural reforms should focus on employment creation, industrial development, and private-sector investment.

However, capital budgets, the traditional engine of multiplier-driven growth, remain underfunded. International lenders have warned against Nigeria's 56% year-on-year budget expansion, urging alignment with realistic revenue forecasts.

Debt restructuring is central to recovery. Recommendations include selling oil and gas joint-venture assets, privatising concessions, and consolidating NNPC oil-forward contracts into structured debt instruments to improve transparency and liquidity.

With reforms, Nigeria could restore oil and gas investment, down from $22 billion in 2009/2014 to under $3 billion in 2024, and raise production to 2.5 million barrels per day, strengthening FX inflows.

Fiscal Discipline Must Lead Recovery

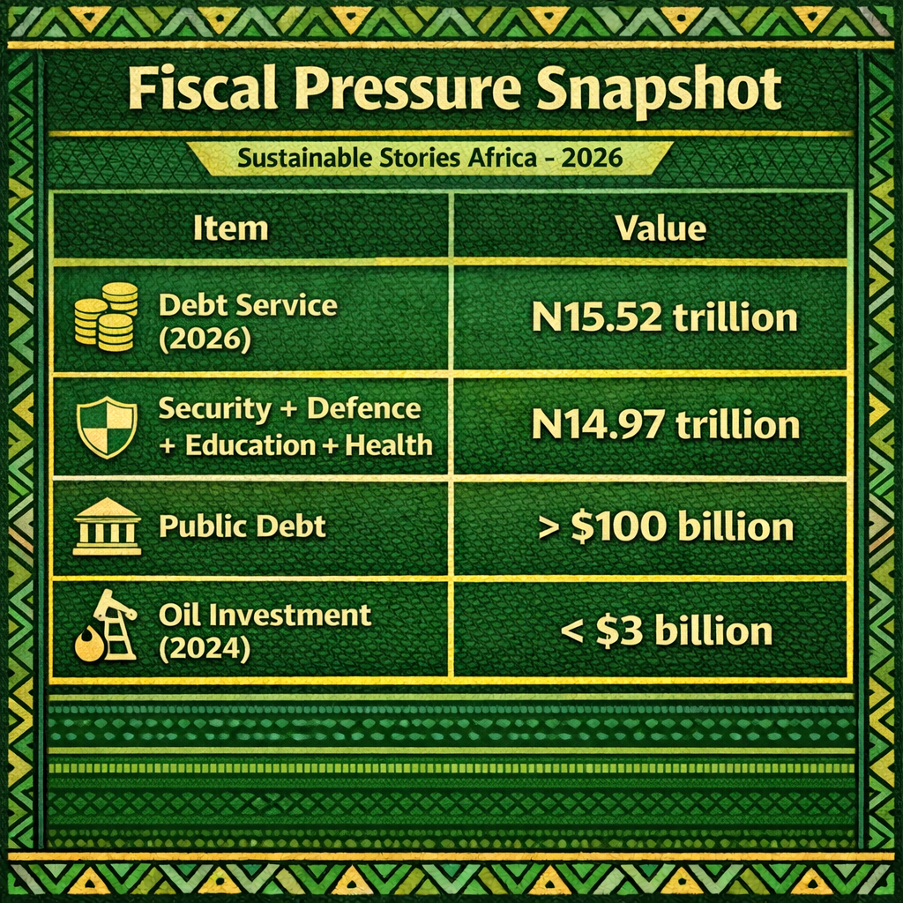

Nigeria's fiscal position is increasingly unsustainable. The N15.52 trillion 2026 debt-service bill exceeds combined spending on security, defence, education, and health. All fuel subsidy savings are now diverted to debt payments.

Fiscal Pressure Snapshot

| Item | Value |

|---|---|

| Debt Service (2026) | N15.52 trillion |

| Security + Defence + Education + Health | N14.97 trillion |

| Public Debt | > $100 billion |

| Oil Investment (2024) | < $3 billion |

The CFG Advisory urges urgent sale of assets, reducing government stakes in 74 concession assets to 49%, to raise $50 billion, recapitalise NNPC, and restore fiscal flexibility.

It also calls for interest-rate cuts to stimulate growth and a renewed social-intervention programme to cushion households.

PATH FORWARD – Reforms Need Human Impact

Nigeria's stabilisation gains will only translate into inclusive growth if fiscal reforms shift toward productivity, capital investment, and debt sustainability.

Asset sales, private-sector leadership, and targeted social support can restore confidence, unlock investment, and enable Nigeria move closer to its long-term development ambitions.