Africa's development story is shifting from aid dependency to capital mobilisation.

Over a period of five years, FSD Africa has helped mobilise and catalyse $1.7 billion to deepen local markets, unlock domestic capital and finance climate resilience.

As official development assistance contracts, the continent's future hinges on stronger financial systems. The 2025 Impact Report offers a data-backed roadmap for businesses, regulators and investors seeking scalable, locally anchored growth.

Unlocking Africa's Capital for Sustainable Transformation

Africa's future will not be financed by aid alone. It will require financing from local capital markets.

Between 2021 and 2025, FSD Africa contributed to the mobilisation and investment of $1.7 billion (£1.3 billion) in priority sectors, strengthening domestic financial systems and supporting over 22,000 jobs.

Over 50% of financing was mobilised in local currency, reducing foreign exchange risk and reinforcing economic resilience.

At a time when OECD estimates show official development assistance falling by 9–17%, the continent faces a decisive choice: deepen domestic capital markets or remain exposed to volatile external funding cycles. The FSD Africa Impact Report 2025 presents a five-year blueprint for how catalytic capital, regulatory reform and patient investment can build sustainable markets — and what African businesses can learn from it.

Africa's $1.7 Billion Market-Building Moment

The headline numbers are clear.

Between 2021–2025, FSD Africa and partners mobilised and catalysed $1.7 billion, supported 22,100 jobs, improved access to basic services for over 1 million people, and enabled 181,100 people to better adapt to climate change.

Crucially:

- 56% of transactions were financed in local currency

- Over $922 million mobilised was domestic capital

In a continent where less than 2.7% of pension fund assets are allocated to productive sectors such as infrastructure, the message is unmistakable: Africa's growth constraints are more related to allocation, structure and confidence, rather than the scarcity of capital.

Systemic Reform Meets Strategic Capital

The report highlights a balanced, market-building approach built on two pillars:

- Systemic reform – policy, regulatory and market infrastructure development.

- Strategic capital deployment – patient, risk-tolerant investment through FSD Africa Investments (FSDAi).

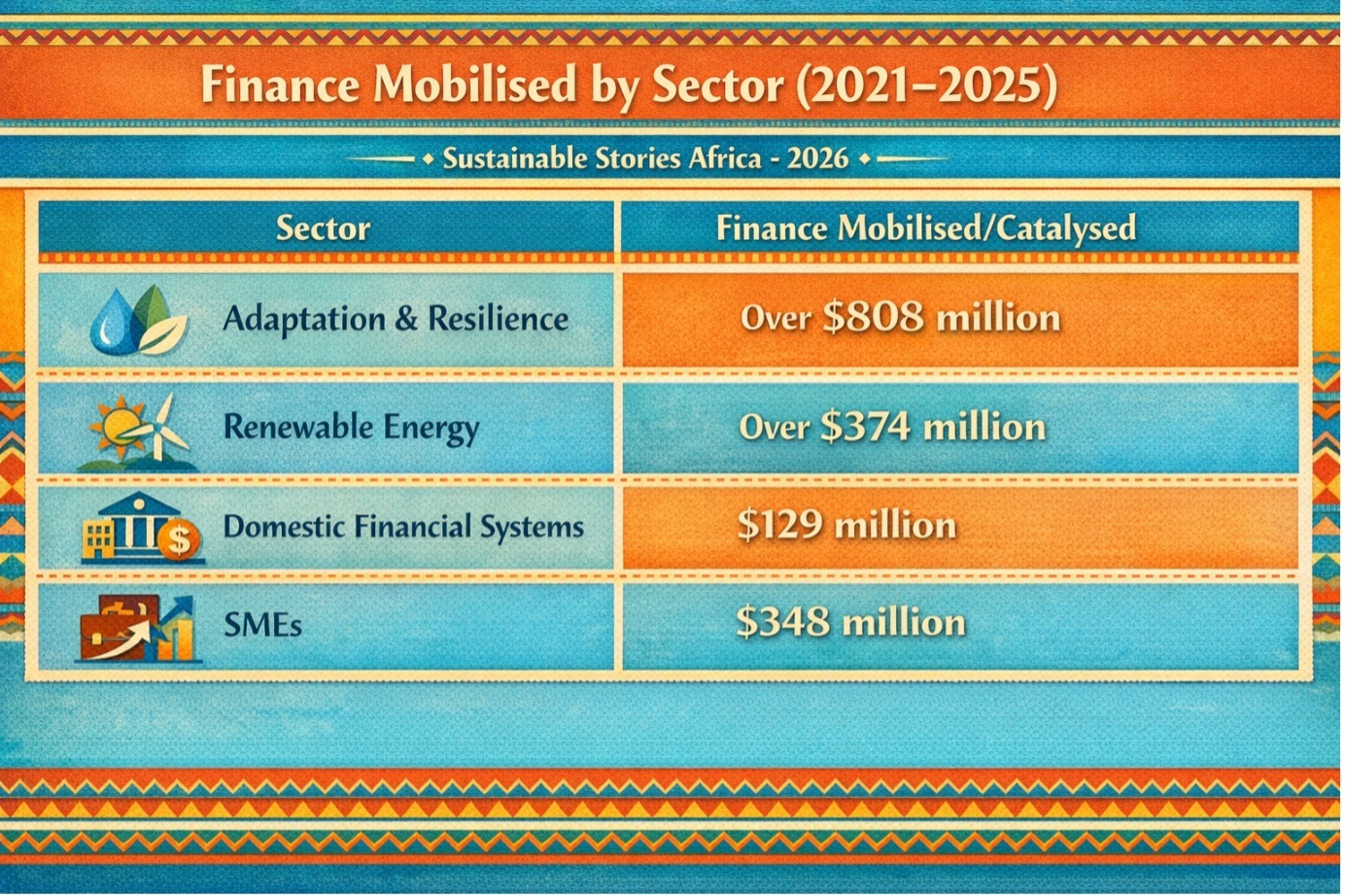

Finance Mobilised by Sector (2021–2025)

| Sector | Finance Mobilised/Catalysed |

|---|---|

| Adaptation & Resilience | Over $808 million |

| Renewable Energy | Over $374 million |

| Domestic Financial Systems | $129 million |

| SMEs | $348 million |

Case Study

- Ethiopia's Securities Exchange – Launched in January 2025, Ethiopia's first-ever securities exchange secured $26 million, more than double its $11 million target, and is projected to mobilise $4.4 billion in its first decade.

For African corporates, this signals something profound: new domestic listing platforms are emerging to reduce reliance on external borrowing.

- Renewable Energy & Innovation – Despite holding 60% of the world's best solar resources, Africa receives only 3.3% of global climate finance.

Through green bonds, geothermal risk facilities and climate-tech accelerators, FSD Africa helped:

- Raise $110 million for BURN Manufacturing

- Support 20 climate start-ups via Catalyst Fund

- Deliver climate solutions to over 1.3 million individuals and businesses

The takeaway: Catalytic capital unlocks follow-on investment when paired with regulatory clarity and stakeholder alignment.

Why This Matters for African Businesses

The deeper insight from the report is structural.

Africa's adaptation finance needs are estimated at $70 billion annually through 2030; however, currently, only 5% is attributable to the private sector.

SMEs, which account for 50% of employment and 40% of GDP, remain trapped in the "missing middle" financing gap.

For businesses, the lessons are direct:

- Local Currency Financing Reduces Structural Risk – Over half of mobilised capital was through local currency, a strategic hedge against FX volatility.

- Market Infrastructure Attracts Capital – The Ethiopian Securities Exchange and subnational green bonds in Tanzania demonstrate that credible platforms crowd in investors.

- Gender-Inclusive Investing Is an Underpriced Opportunity – Women-led enterprises in Senegal:

- Represent 40% of entrepreneurs;

- However, only 3.5% successfully raise institutional capital.

- Funds like WIC Capital highlight how blended finance and governance support can triple investment value.

- Early-Stage Risk Absorption Is Essential - Climate markets require patient, first-loss capital to prove viability before institutional investors enter.

Strategic Imperatives for African Enterprises

For African boards, CFOs and sustainability leaders, the report suggests five strategic actions:

- Align with Domestic Capital Pools – Pension funds and insurers are growing. Structure bankable instruments locally.

- Embed ESG Into Governance Early – Green bonds and carbon markets demand institutional-grade reporting.

- Design for Bankability – Investment-ready pipelines unlock catalytic funding.

- Leverage Blended Finance Models – First loss and anchor capital structures de-risk growth.

- Build Regulatory Partnerships – Policy alignment accelerates capital mobilisation.

The next phase (2025–2030) sets ambitious targets:

- Mobilise $13 billion in private capital

- 84% in local currency

- Reach 80 million people with improved services

- Create or support 200,000 jobs

This is no longer about experimentation. It is about scale.

Learning Points for African Businesses

From an SSA editorial lens, the FSD Africa Impact Report offers five Sustainable Stories Africa learning principles:

- Capital Follows Confidence – Institutional capital flows when governance, transparency and infrastructure are in existence.

- Domestic Markets Are Strategic Assets – Self-determined growth depends on local currency liquidity and an increased number of domestic investors.

- Catalytic Capital Multiplies Impact – Risk absorption at early stages unlocks exponential follow-on funding.

- Climate Finance Is a Systems Challenge – Project design, policy alignment and stakeholder trust matter as much as funding volume.

- Data and Impact Reporting Build Credibility – Clear targets, adaptive management and transparent reporting enhance investor trust.

Path Forward – Scaling Catalytic Capital Markets

Africa's growth will hinge on stronger domestic financial architecture, deeper local currency markets and expanded institutional participation.

Catalytic capital must continue absorbing early-stage risks while regulators build the frameworks that sustain confidence.

The next five years demand alignment between boards, policymakers, fund managers and development partners. The opportunity is clear: unlock Africa's capital to transform its future.