Frontier market economies are home to 1.8 billion people, over 20% of humanity; however, they account for just 5% of global output.

Over the next 25 years, they be responsible for driving more population growth than the rest of the world combined.

But growth has lagged. Investment has slowed. Sovereign defaults have risen. The question is no longer about potential to scale. It is about whether frontier markets can convert financial access into sustained prosperity.

Frontier Markets at Demographic Turning Point

Frontier market economies, with significant potential for scaling but having limited access to global financial markets, are entering a decisive phase in global economic history.

According to the World Bank's January 2026 Global Economic Prospects report, these economies account for more than 1.8 billion people today, projected to increase the global population in the next two and half decades, compared to the rest of the world combined.

However, their economic footprint remains modest. Frontier markets account for roughly 5% of global GDP, despite hosting over 20% of the world's population.

Real GDP per capita in the median frontier market is now less than one-third that of the typical emerging market, a wider gap than in 2000.

At a time when working-age populations are shrinking across advanced economies, frontier markets are projected to see a 568 million increase in working-age people between 2025 and 2050. The demographic dividend is clear. The development dividend is not.

Population Rising, Output Lagging

Frontier markets are pivotal to global job creation. More than 230 million young people are expected to reach working age by 2035. However, investment growth has slowed dramatically: annual per-capita investment growth fell from over 5% in the 2000s to roughly 2% in the early 2020s.

Poverty rates have more than halved since 2000, but are about five times higher than in emerging markets. Meanwhile, sovereign default events in frontier markets have exceeded those in all other country groups combined in recent years.

The contradiction is stark: rising financial openness, but limited convergence.

Financial Access Without Full Integration

Frontier markets occupy an "intermediate" space in global finance. They are more integrated than other developing economies but lower than emerging markets.

De jure financial openness has increased significantly since 2000. Portfolio liabilities in the median frontier market more than tripled between 2001 and 2023.

However, financial development remains shallow, with wider bank lending–deposit spreads and weaker institutional frameworks compared with those of their emerging markets counterparts.

Capital inflow surges often boost output growth but are frequently followed by sudden stops. For frontier markets, the probability of a stop almost doubles following a surge. Portfolio flows are especially volatile.

In short: access without resilience creates vulnerability.

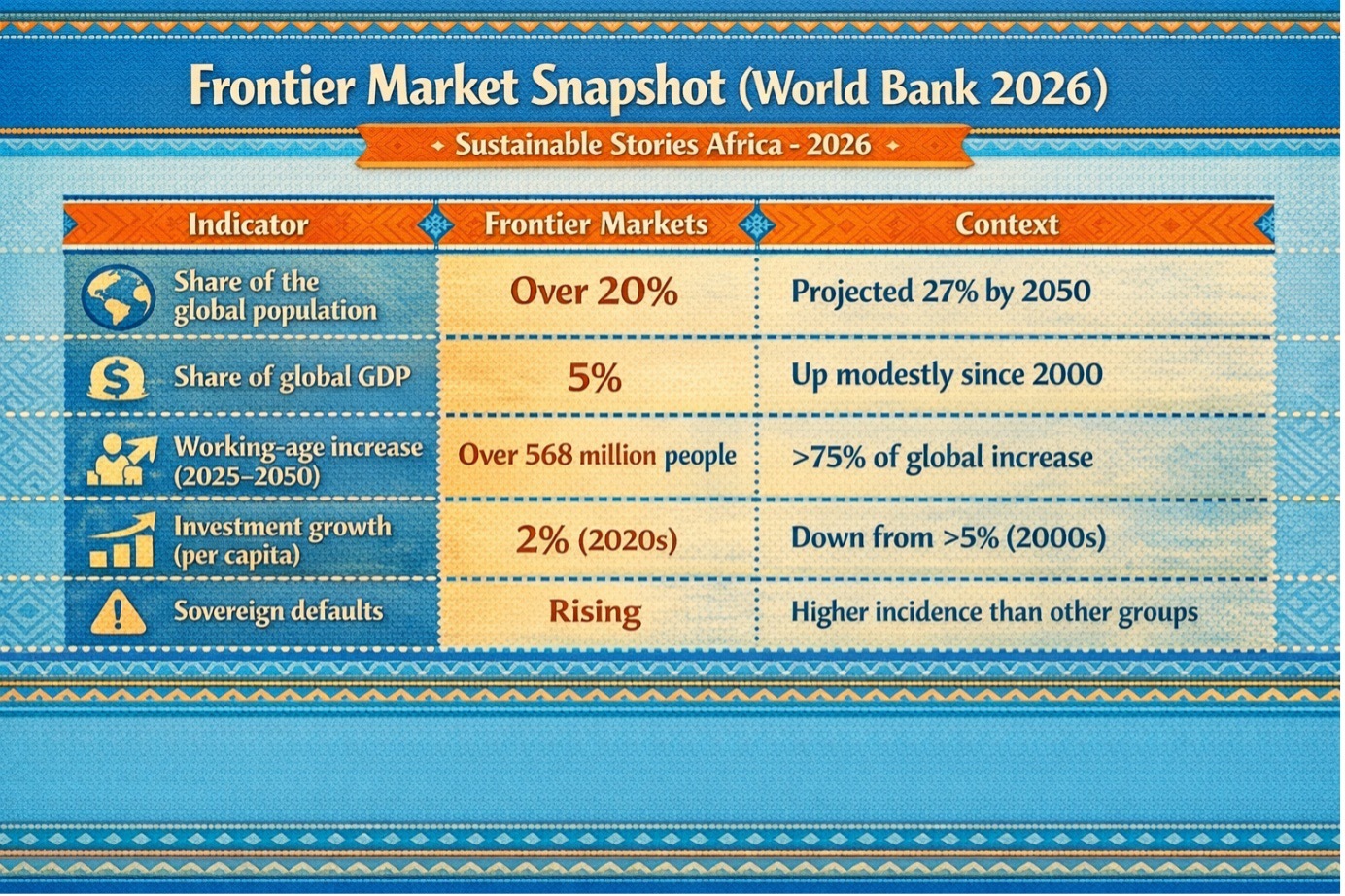

Frontier Market Snapshot (World Bank 2026)

| Indicator | Frontier Markets | Context |

|---|---|---|

| Share of the global population | Over 20% | Projected 27% by 2050 |

| Share of global GDP | 5% | Up modestly since 2000 |

| Working-age increase (2025 – 2050) | Over 568 million | >75% of global increase |

| Investment growth (per capita) | 2% (2020s) | Down from >5% (2000s) |

| Sovereign defaults | Rising | Higher incidence than other groups |

Lessons from Faster-Growing Peers

Not all frontier markets have underperformed. Some have graduated.

Between 2012 and 2025, Bulgaria, Costa Rica, Panama, and Romania reached high-income status.

Common features among faster-growing frontier markets include:

- Stronger capital accumulation

- Improved governance

- Narrower lending spreads

- Better debt containment

Development strategies varied:

- Kazakhstan leveraged energy investment.

- Viet Nam advanced value-added manufacturing.

- Rwanda emphasised services and tourism.

There is no single blueprint. But institutional credibility, investment discipline, and macroeconomic stability consistently appear.

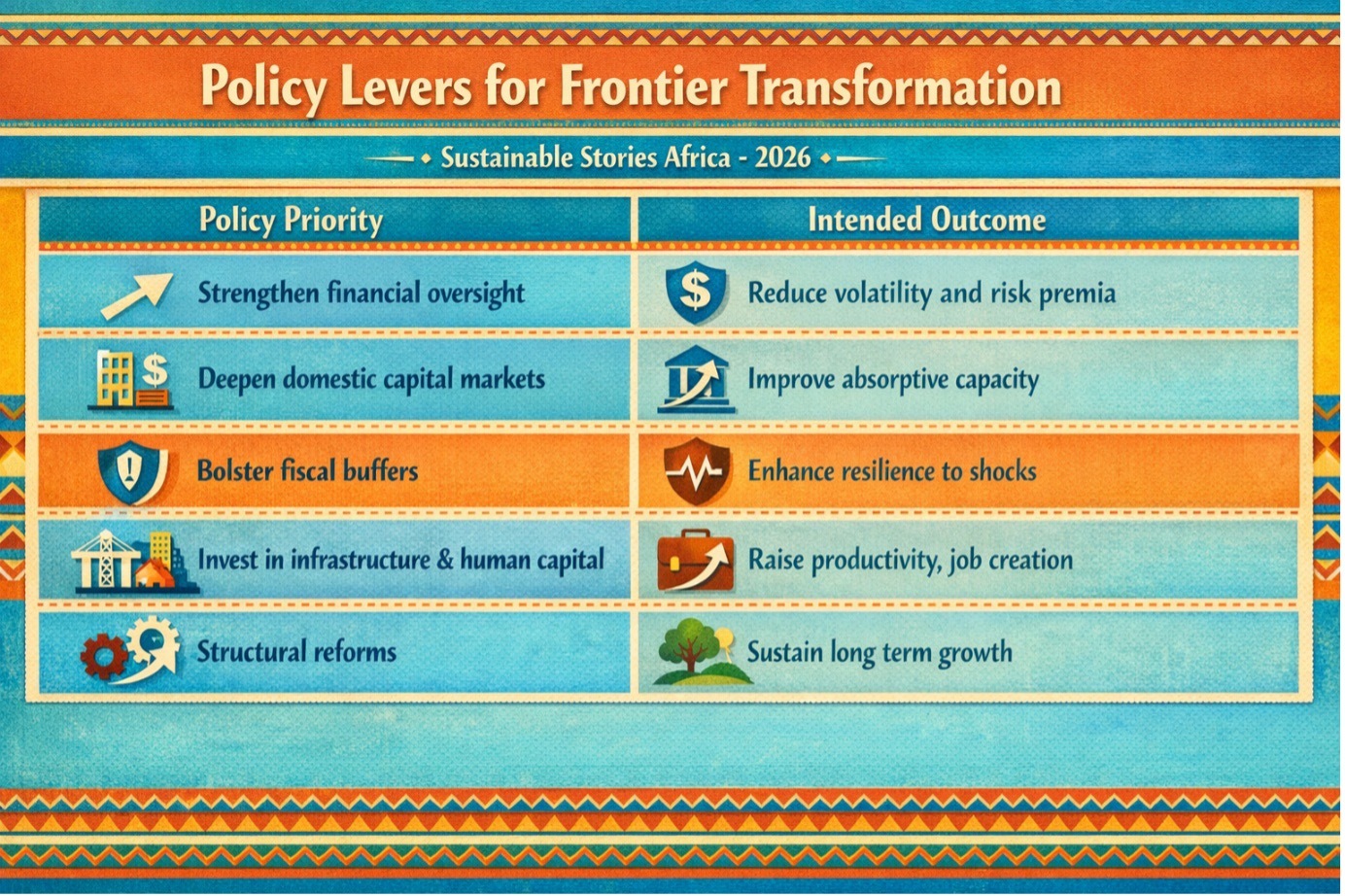

Policy Levers for Frontier Transformation

| Policy Priority | Intended Outcome |

|---|---|

| Strengthen financial oversight | Reduce volatility and risk premia |

| Deepen domestic capital markets | Improve absorptive capacity |

| Bolster fiscal buffers | Enhance resilience to shocks |

| Invest in infrastructure & human capital | Raise productivity, job creation |

| Structural reforms | Sustain long-term growth |

Inclusion in global financial indexes does not guarantee prosperity. It is an opportunity conditional on reform.

With ageing populations across advanced and emerging markets, frontier markets will increasingly shape global growth trajectories. The question now is execution.

Path Forward – Turning Demography Into Durable Growth

Frontier markets must pair financial openness with institutional depth. Policy credibility, fiscal discipline, and resilient domestic financial systems will determine whether capital inflows translate into productivity gains.

With 568 million additional working-age citizens on the horizon, the stakes are generational. If reforms anchor macro stability and catalyse investment, frontier markets can become engines of global job creation rather than case studies in missed potential.