The new global baseline for sustainability reporting - IFRS S1 and IFRS S2 - opens a pivotal chapter for African enterprises. With jurisdictions gearing up for adoption, companies must align governance, strategy, risk management and metrics to meet investor-centric demands.

In Nigeria and beyond, the momentum is building, but the road remains complex. This feature unpacks how entities should respond now and what a credible pathway looks like.

Global Standards, Local Stakes

On 26 June 2023, the International Sustainability Standards Board (ISSB) issued IFRS S1 and IFRS S2. The first two global sustainability-disclosure standards aimed at harmonising how companies report sustainability-related financial information.

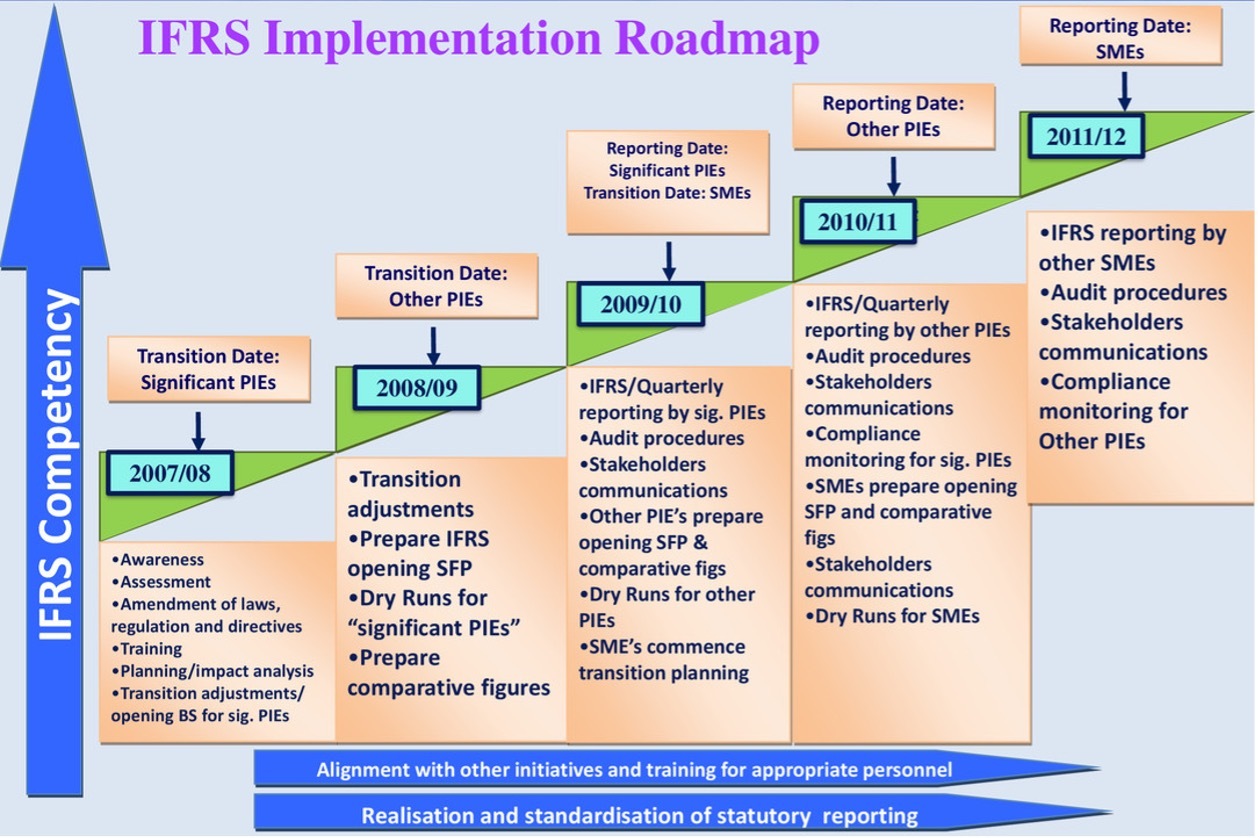

These standards carry immediate relevance for Africa: countries such as Nigeria are mapping adoption road maps.

For corporate Africa, the implications are two-fold: compliance is necessary, but the business opportunity lies in embedding climate and sustainability into value-creation rather than ticking boxes.

IFRS S1 & S2 Sustainability Reporting Guide. Navigating the Future of Corporate Transparency - A Comprehensive Guide to IFRS S1 & S2 Sustainability Reporting Standards, developed by FinPolNomics Green Finance, provides a quick self-assessment guide that would help organisations test their levels of preparedness.

The Investor Focus and Global Baseline

IFRS S1 sets out general requirements for disclosure of sustainability-related financial information. It mandates disclosures about governance, strategy, risk management, and metrics & targets.

IFRS S2 focuses on climate-related disclosures, such as emissions, scenario analysis, and transition planning.

From a data point of view, a global investor survey revealed 69 % of investors said they would increase investment in companies that manage sustainability issues well.

Core contents of IFRS S1 & S2

| Core Content | Description |

|---|---|

| Governance | Oversight, controls, and processes to manage sustainability-related risks/opportunities. |

| Strategy | Company's approach to sustainability-related risks/opportunities and effects on business model. |

| Risk Management | How the entity identifies, assesses, prioritises and monitors sustainability-related risks and opportunities. |

| Metrics & Targets | Performance measures, progress toward targets, scope 1-3 emissions in the climate context. |

In Nigeria, the Financial Reporting Council of Nigeria's Adoption Readiness Working Group has indicated that IFRS S1 & S2 could become mandatory for public interest entities by 2028.

Business case Beyond Compliance

Adopting IFRS S1 & S2 isn't just regulatory; it influences access to capital, stakeholder trust and long-term resilience.

Practical requirements

- Entities must assess and disclose material sustainability-related risks and opportunities.

- They must simultaneously report sustainability disclosures and financial statements (or near the same period).

- Early adoption relief allows first-year focus on climate only; full sustainability disclosures may follow in year 2.

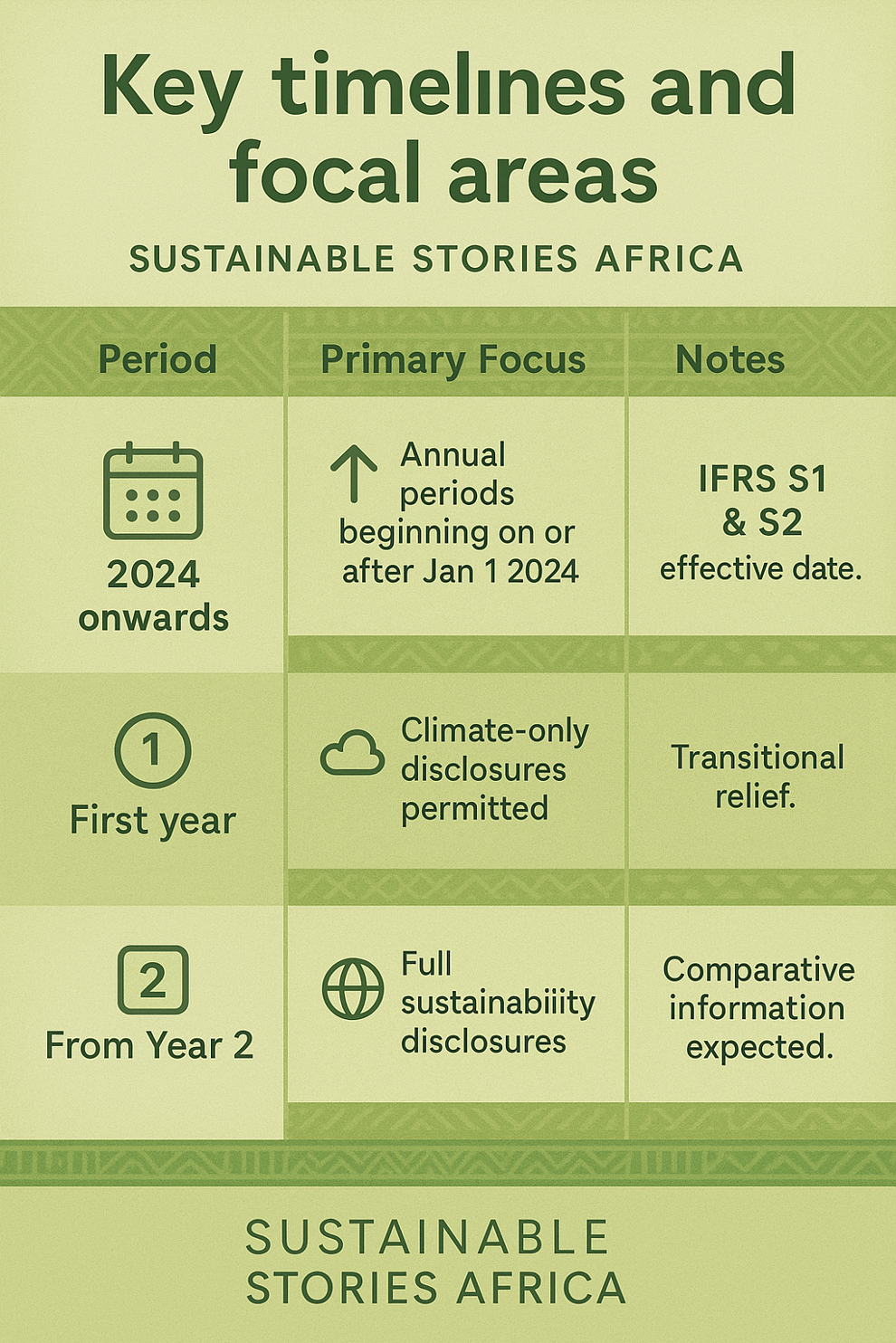

Key timelines and focal areas

| Period | Primary Focus | Notes |

|---|---|---|

| 2024 onwards | Annual periods beginning on or after Jan 1 2024 | IFRS S1 & S2 effective date. |

| First year | Climate-only disclosures permitted | Transitional relief. |

| From Year 2 | Full sustainability disclosures | Comparative information expected. |

For African corporates, this means building data systems, governance structures and processes now long before the mandatory deadlines.

How to Embark on Implementation – Step-by-step roadmap

- Governance assessment: review if board/committee oversight covers sustainability issues; define responsibilities and upskill.

- Strategy alignment: integrate sustainability-related risks/opportunities into corporate strategy and value-chain decisions.

- Risk & opportunity mapping: identify material sustainability-related risks (physical, transition) and opportunities across the value chain.

- Metrics & targets setup: define relevant KPIs (e.g., Scope 1-3 emissions for climate) and set targets.

- Data & disclosure readiness: ensure data is "reasonable and supportable" and disclosure aligns with financial-reporting timelines.

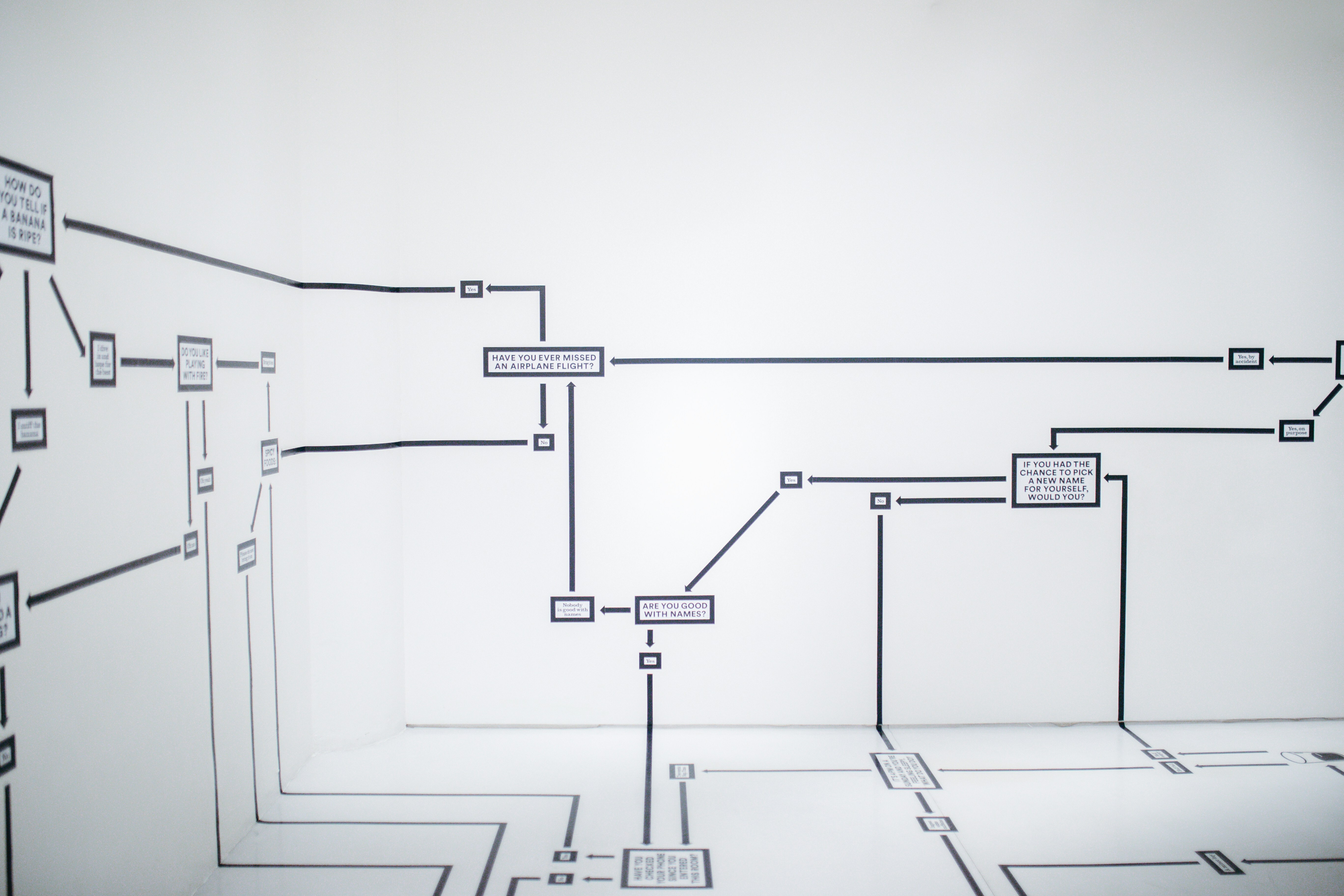

Infographic: Implementation Flow

Roadblocks to anticipate

- Lack of capacity or data infrastructure.

- Inconsistent definitions and metrics (especially for Scope 3 emissions).

- Integrating sustainability processes into traditional financial-reporting cycles.

Quick wins within 6-12 months

- Conduct a gap-analysis of existing sustainability disclosures vs IFRS S1 & S2 requirements.

- Identify a board/committee oversight mechanism for sustainability.

- Start capturing baseline data on climate-related metrics (e.g., emissions, energy).

- Engage with auditors/consultants on readiness for assurance of disclosures.

Immediate Action Checklist

| Action | Responsible Party | Timeline |

|---|---|---|

| Gap-analysis vs IFRS S1/S2 requirements | ESG/sustainability team | 0–3 months |

| Board-level sustainability oversight review | Board Secretary/CSO | 3–6 months |

| Baseline emissions & energy data capture | Operations/Finance | 3–9 months |

| Disclosure process linkage to financials | Finance & Reporting | 6–12 months |

Embed IFRS Baseline, Unlock Value

African organisations should view IFRS S1 & S2 not as a compliance burden but as an opportunity to embed sustainability into core business and unlock value: lower cost of capital, improved resilience, stronger stakeholder trust.

By embedding these standards, companies can move from ad-hoc sustainability reporting to integrated disclosures where governance, strategy, risk-management and metrics are aligned with enterprise value creation.

Key metrics to track

- Percentage of board meetings with sustainability agenda item.

- Scope 1-3 emissions per unit of revenue.

- Sustainability-related expenditure as % of OPEX/CAPEX.

- Number of material sustainability-related risks approved by the risk committee.

For African companies, the timeline is short. The first full application of IFRS S1 & S2 may already have begun with 2024 reporting periods. The firms that move early, building robust governance, data systems, and strategy linkages, will position themselves for the shift to "decision-useful" sustainability disclosures and the investor scrutiny that accompanies them.