Across Africa's boardrooms and factory floors, companies are wrestling with their commitments under the ESG (environmental, social and governance) banner. However, persistent mistakes reveal the gap between intention and impact.

Smart firms are now rewiring strategy, systems and oversight to turn ESG from a checkbox to a business catalyst.

The cost of mis-measured sustainability

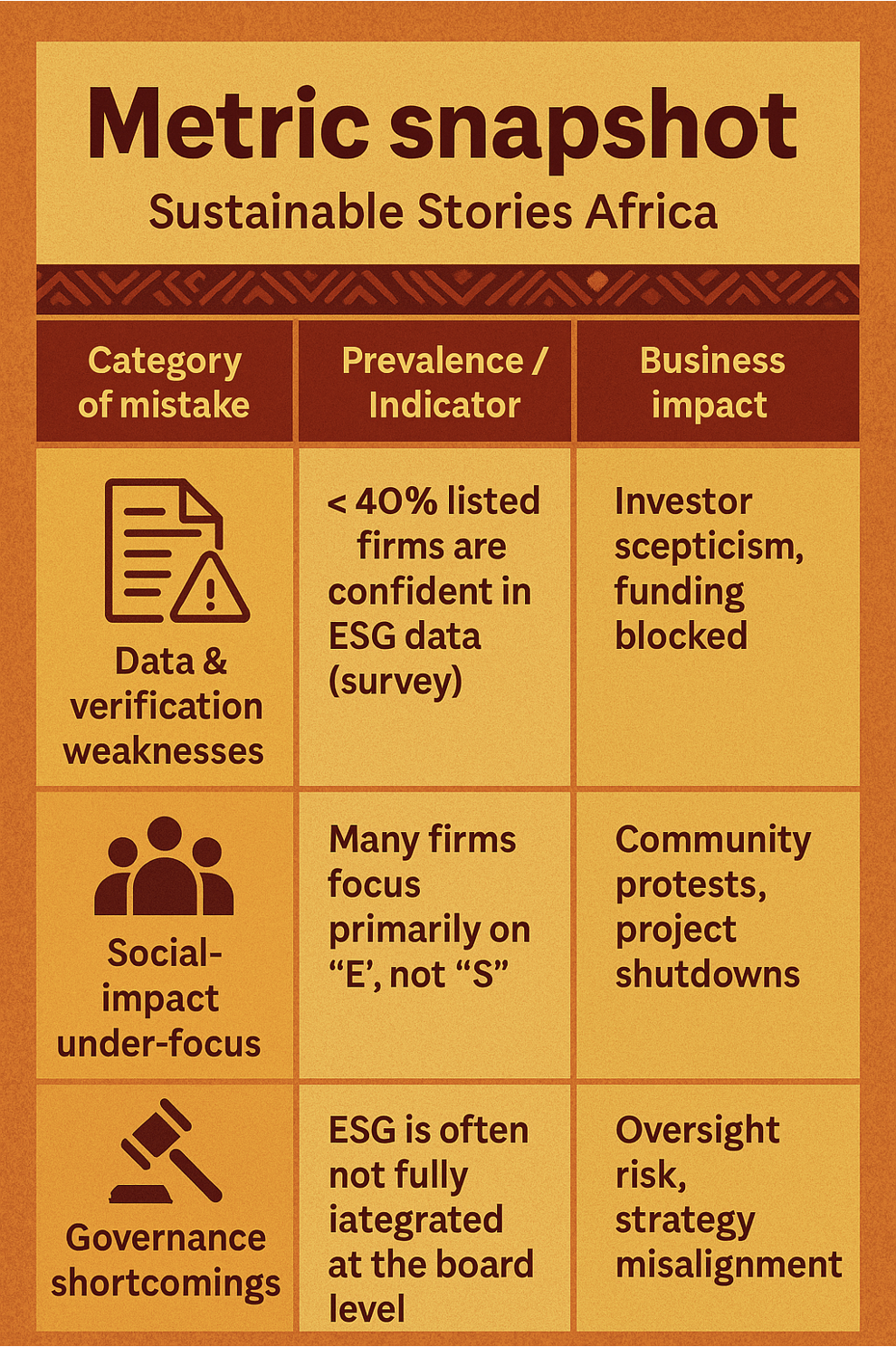

In Africa, companies aiming to ride the ESG wave risk being washed out by their own shortcomings. A recent analysis by ESG In Action Africa identifies key missteps: sidelining the 'S' in ESG (social), under-investing in data and systems, and weak governance at the board level.

A 2023 survey found that fewer than 40% of South African firms could confidently validate their ESG data.

The stakes are real. Delayed projects, higher costs and licence-to-operate risks now stem from both environmental regulation and social grievances, data failure and shallow governance.

Metric snapshot

| Category of mistake | Prevalence / Indicator | Business impact |

|---|---|---|

| Data & verification weaknesses | < 40% listed firms are confident in ESG data (survey) | Investor scepticism, funding blocked |

| Social-impact under-focus | Many firms focus primarily on "E", not "S" | Community protests, project shutdowns |

| Governance shortcomings | ESG is often not fully integrated at the board level | Oversight risk, strategy misalignment |

Why doubling down on metrics matters

Globally, ESG is moving from optional to essential. Companies in Africa operate in a landscape where regulatory pressure, investor scrutiny and community expectations are rising fast. Data, governance and social engagement are no longer back-office concerns; they are front-line value drivers.

When ESG is treated as a standalone report rather than embedded in the business, risks escalate. According to a 2024 academic study, companies with ESG controversies suffered measurable profitability hits.

Conversely, African firms that get their metrics right are unlocking cost savings, operational resilience and stronger stakeholder relationships. The question isn't whether to do ESG, it is about how to do it well.

From box-ticking to business value

The best-performing companies aren't just avoiding mistakes; they are building. They want:

- Robust ESG data systems: real-time tracking, verification, and ownership of metrics.

- Balanced ESG emphasis: integrating social and governance issues into the "E"-heavy narrative.

- Governance at the top: board-level oversight, ESG literacy, strategic alignment.

- Materiality-driven focus: prioritising issues that truly affect operations and stakeholders.

What smart companies in Africa are doing differently

| Focus area | What they implement | Result |

|---|---|---|

| Data systems | Digital dashboards, third-party verification. | Enhanced investor trust. |

| Social governance | Community-partner models, stakeholder KPIs. | Lower disruption risk. |

| Board oversight | ESG committees, training, and integrated risk frameworks. | Stronger strategic alignment. |

Practical steps to close the gap

- Invest in ESG data infrastructure: Start with the highest material metrics, build dashboards, and enable audit trails. ESG In Action Africa argues that "without reliable data, ESG is just rhetoric."

- Equal-weight Social and Governance: In Africa, social risk often drives business disruption. Treat "S" and "G" with the same rigour as "E".

- Embed ESG in governance: Boards must own the ESG agenda, not delegate vaguely. Strategy, risk and ESG must align.

- Prioritise material issues: Conduct a materiality assessment specific to the region/sector. Avoid mimicry of global templates.

- Link ESG to business value: Show how ESG metrics connect to revenue, cost, and licence-to-operate. Move beyond compliance to value creation.

Path Forward – Metrics Unlock Africa's ESG Value Engine

As African companies navigate the transition from intention to impact, metrics are central. Getting ESG data right, amplifying social governance and embedding governance at the board are no longer optional. They are strategic imperatives, because Africa's ESG journey demands local relevance, operational rigour and measurement integrity.

For the continent's businesses, the path forward requires moving from superficial reporting to true system-change. The companies that succeed will be those who convert ESG from cost to strategic asset, who understand that value lies not in certification but in execution and accountability. Metrics will be the engine, trust the currency, and value will be the reward.

Culled From: https://esginactionafrica.com/2025/07/21/top-esg-mistakes-in-africa-and-what-smart-companies-are-doing-differently/