As capital around the globe pivots to sustainability, Africa's investment terrain is being reshaped by ESG flows. Nations once seen as peripheral are now front and centre for global capital, with some building entirely new financial architectures for climate-aligned growth.

This feature takes you into the numbers behind the shift, spotlights ten leading countries and charts what comes next for Africa's ESG investment agenda.

Green Capitals Rising Across Africa

Africa's sustainable-finance epoch has shifted into high gear. In 2025, ESG-aligned investment flows across the continent are no longer niche but central to how global capital is deployed.

According to data compiled by The African Exponent, the ranking of the continent's top ten ESG-investment destinations reveals that countries such as Mauritius and South Africa are becoming major gateways, while more frontier markets like Namibia and Rwanda are emerging fast.

The implication is that Africa's 2025 investment map is being redrawn: governance, climate-transition readiness and strategic de-risking are now as important as traditional metrics of GDP and commodity wealth.

Yet, as capital floods in, the story is also one of uneven readiness: policy frameworks, governance regimes and project-pipeline quality vary widely across the continent.

The coming period will test whether ESG flows translate into measurable development outcomes rather than just headline numbers.

The ESG Investment Surge – Capital Flows Turn Green in Africa

Across Africa, ESG finance is reshaping the capital markets narrative in real time. The article projects that in 2025, ESG-investment flows will mark a meaningful shift in where and how money is invested in Africa, from conventional extractives to a broader green and social-governance spectrum. For example:

- Mauritius tops the list by virtue of acting as Africa's "green finance hub" — not just as a recipient of projects, but as a conduit for large-scale ESG-focused capital flows across the continent.

- South Africa is seen as harnessing its deep capital markets and transition agenda (including green hydrogen, IPPs and social transition programmes) to attract ESG capital.

- Frontier states such as Namibia and Rwanda are cited as rising destinations because of unique assets (hydrogen in Namibia; governance, policy clarity and urban-green infrastructure in Rwanda).

Metric Table – Top 10 Countries Ranked by ESG Positioning (2025 provisional)

| Rank | Country | Role in ESG Flows |

| 1 | Mauritius | Green-finance gateway, sovereign blue/green bonds |

| 2 | South Africa | Advanced markets, transition assets, capital depth |

| 3 | Egypt | Large-scale grid and transition projects |

| 4 | Nigeria | Africa's largest economy, huge potential for an ESG pipeline, though governance risk |

| 5 | Kenya | Climate-tech and renewable pipeline (East Africa) |

| 6 | Namibia | Hydrogen hub, new-economy transition pipeline |

| 7 | Morroco | Renewable energy leader (solar/wind); green industrialisation & export projects |

| 8 | Rwanda | Governance leader, green-urban infrastructure |

| 9 | Côte d'Ivoire | Emerging West-African ESG destination, infrastructure and investment upgrade |

| 10 | Ghana | Growing ESG-investment interest, regional hub potential |

This surge is being reinforced by a global backdrop of tougher ESG disclosure, green-bond issuance growth and increasing investor demand for impact plus return.

For Africa, this moment presents a convergence of factors - natural-resource and transition-asset opportunity, renewed capital interest, and a regulatory/finance architecture in flux.

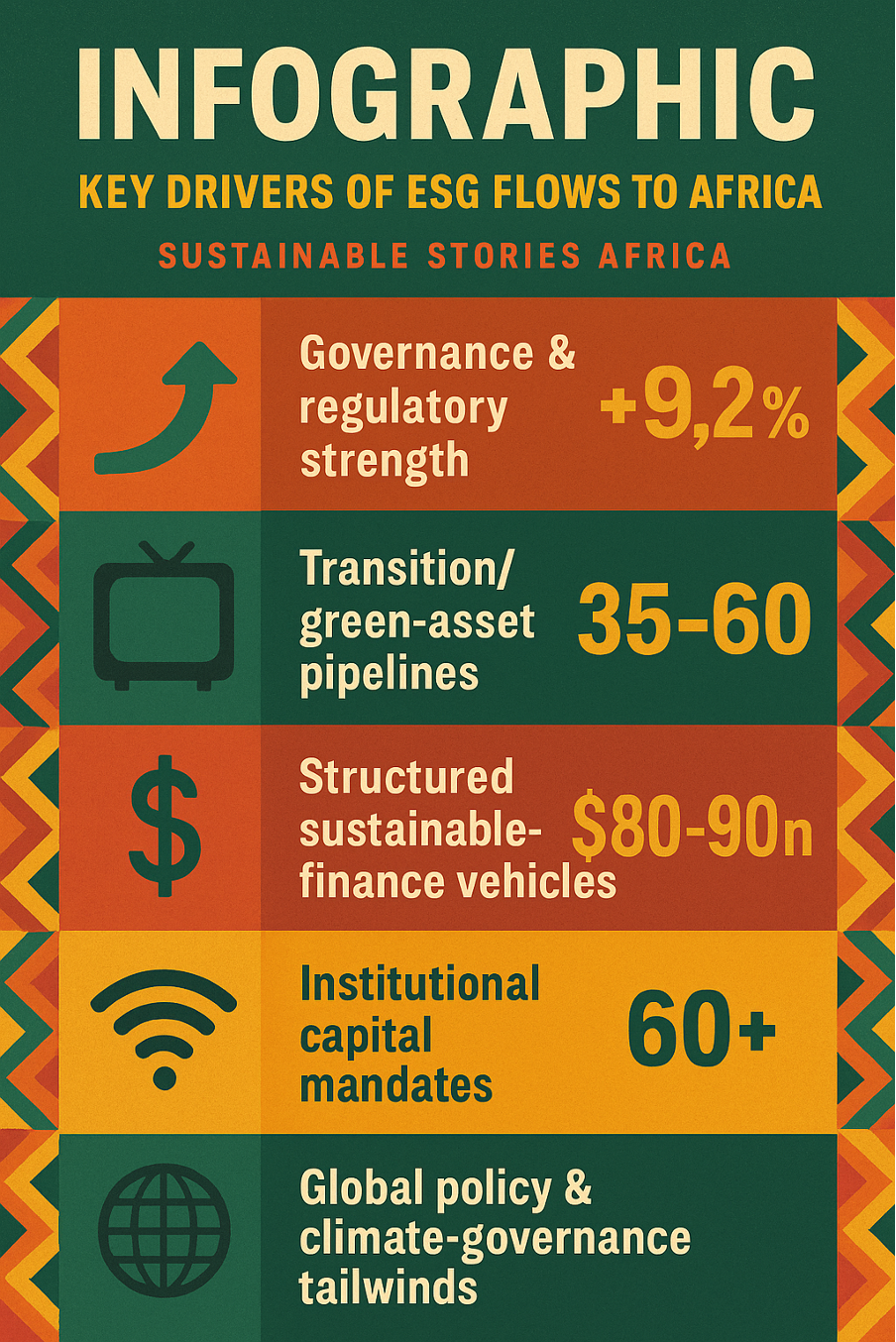

Drivers Behind Africa's ESG Capital Influx

Several interlocking drivers are propelling the interest in ESG flows into Africa:

- Governance and de-risking platforms – Countries like Mauritius and Rwanda are winning favour because they offer jurisdictions with strong rule-of-law, disclosure frameworks and investor protections. These attributes lower perceived risk for ESG capital.

- Transition asset opportunity – From Namibia's hydrogen prospects to Kenya's off-grid renewables, Africa offers new-economy investments aligned with global net-zero paths, offering both return and impact.

- Green-finance structuring – The rise of green bonds, blended-finance vehicles and ESG-rating frameworks is making Africa more investable. For instance, the green-bond market in Africa surpassed $15 billion in cumulative issuance by 2024.

- Institutional capital reallocation – Pensions, sovereign funds and DFIs are increasingly committing to ESG mandates, forcing them to allocate to emerging-market sustainable finance — Africa is increasingly in that portfolio.

- Global policy tailwinds – The global shift to decarbonisation, combined with climate-finance commitments and ESG regulatory tightening, is directing capital toward Africa's transition-aligned opportunities.

Together, these drivers are aligning at the continent-level, opening the possibility of a structural shift away from the old "commodity-flows only" model.

What ESG Capital Means for African Development

For African economies, deeper ESG flows carry multiple potential benefits:

- Economic diversification: Rather than depending solely on extractives, ESG investment supports new sectors — renewables, circular economy, green infrastructure — opening new growth paths.

- Governance and transparency ripple-effects: Countries with strong ESG frameworks typically see improvements in disclosure, institutional quality and investment-confidence metrics, which benefits the broader economy.

- Social and climate-resilience outcomes: Capital directed to climate-resilient infrastructure, clean energy access, green jobs and inclusive growth aligns with SDG pathways.

- Global integration and profile-raising: Being recognised as an ESG-investable destination can draw further capital, build human-capital skills and strengthen institutions.

Yet, the desire alone is insufficient: action and capability must follow. The risk is that capital lands but is not translated into sustained structural change.

Potential Gains vs. Required Preconditions:

| Potential Gain | Required Preconditions |

| New growth sectors (green jobs, tech) | Clear regulatory regime, pipeline of bankable projects |

| Improved governance and disclosure | Strong institutions, independent oversight |

| Climate-resilience infrastructure | Access to finance, project implementation capacity |

| Enhanced investor confidence | Stable macro-political environment, de-risking tools |

The upshot: African countries that can credibly meet the preconditions stand to capture outsized benefits from the ESG wave.

From Policy to Pipeline: Africa's ESG Shift Underway

Some countries are already moving from ambition to action. Key signals include:

- Mauritius is issuing one of Africa's first sovereign blue-bonds in 2024 to fund marine conservation and climate-resilient fisheries.

- South Africa is leveraging the Just Energy Transition Partnership (JETP) funding to accelerate grid-upgrade, IPP development and hydrogen valley projects in the Limpopo region.

- Kenya and Rwanda are developing climate-tech, urban-green infrastructure and streamlined regulatory regimes that reduce friction for ESG investors.

Nevertheless, significant gaps remain.

- Project-pipeline volume and bankability: Many potential deals still lack the scale, risk-mitigation structures and investor readiness required for major institutional ESG capital.

- Governance and transparency: While some nations stand out, many still face weak investor-protection regimes, ambiguous regulatory frameworks and political risk.

- Local-financial-ecosystem integration: For ESG capital to stick and translate into local development, domestic capital markets, pension fund alignment, and local-institution capability need strengthening.

- Measuring impact and disclosure: For ESG flows to maintain credibility, robust frameworks for tracking social/environmental outcomes matter — this remains nascent in many market

Infographic – Key Action Areas for ESG Capital Uptake in Africa:

- Bankable project pipeline

- De-risking frameworks (guarantees, blended finance)

- Strengthened governance & disclosure

- Local-capital-market development

- Impact-measurement systems

The central message: capital is ready, what Africa now needs is scale, structure and systemic readiness.

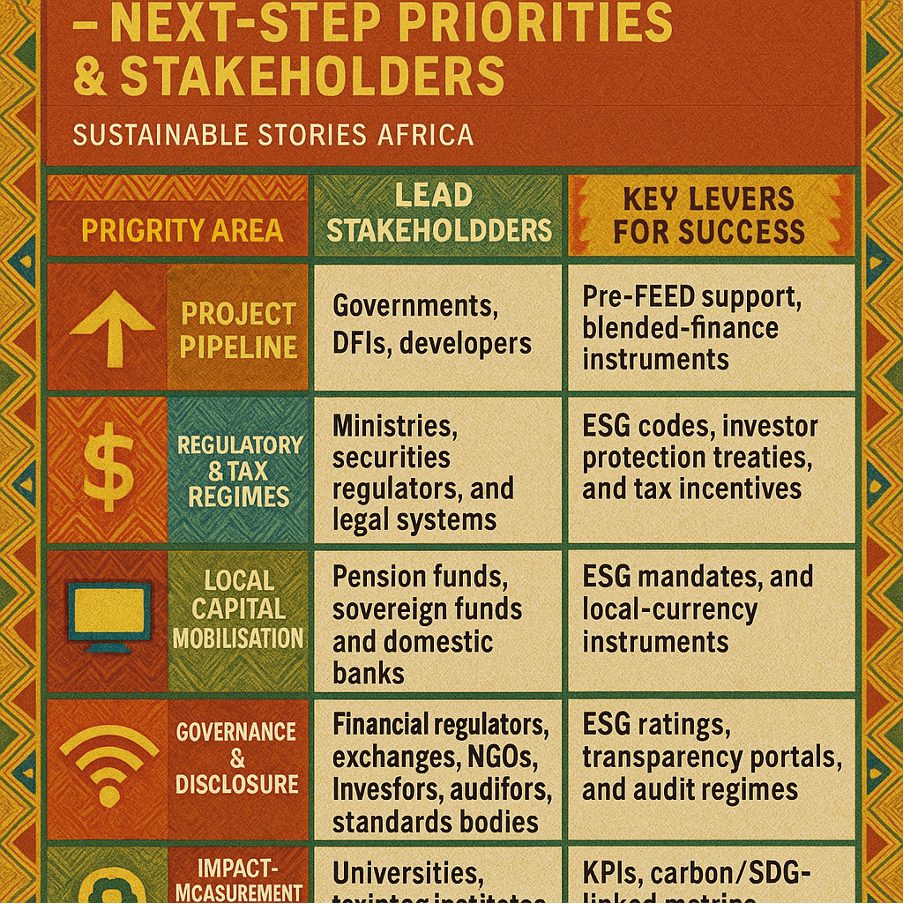

Path Forward – Build, Bridge, Bank for Green Growth

To ensure that ESG investment flows are not fleeting but transformational, African policymakers, investors and development partners must focus on the following strategic priorities:

- Build bankable pipelines: Governments should prioritise project preparation — e.g., renewable-energy IPPs, green infrastructure, circular-economy ventures — with structured documentation, de-risking mechanisms and clear return profiles.

- Bridge jurisdictions to global capital: Countries like Mauritius demonstrate how regulatory and tax frameworks can act as gateways. More African countries should adopt ESG-friendly legal regimes and international investor-protection treaties.

- Bank local ecosystems: Domestic capital sources — pension funds, sovereign wealth funds, domestic banks — must be mobilised and aligned with ESG standards so that flows become sustained and integrated.

- Enhance governance & transparency: Disclosure, ESG-rating frameworks and institutional integrity underpin investor confidence. Continuous improvement here will unlock lower-cost capital.

- Scale impact measurement: Investors increasingly demand measurable outcomes: carbon-reduction metrics, job creation, inclusive growth. African markets must adopt standardised reporting.

- Grow local skills and innovation: The shift to sustainable finance needs human capital preparation from green engineering to ESG accounting to impact-tech to sustain the growth of projects and ecosystems.

Proposed Framework Table – Next-Step Priorities & Stakeholders

Priority Area | Lead Stakeholders | Key Levers for Success |

|---|---|---|

Project Pipeline | Governments, DFIs, developers | Pre-FEED support, blended-finance instruments |

Regulatory & Tax Regimes | Ministries, securities regulators, and legal systems | ESG codes, investor protection treaties, and tax incentives |

Local Capital Mobilisation | Pension funds, sovereign funds, and domestic banks | ESG mandates, and local-currency instruments |

Governance & Disclosure | Financial regulators, exchanges, NGOs | ESG ratings, transparency portals, and audit regimes |

Impact Measurement | Investors, auditors, standards bodies | KPIs, carbon/SDG-linked metrics, public reporting |

Human-Capital Development | Universities, training institutes, and industry | Curricula, certification programmes, green-finance labs |

By adopting such a multifaceted approach, Africa can move from the early-stage promise of ESG flows to a sustainable new paradigm of growth, governance and inclusion.

The contours of Africa's investment future are shifting. ESG capital is no longer peripheral; it is becoming central to how the continent's economies are being re-imagined.

Countries that combine governance strength, transition-asset opportunity and structural readiness are rising to the top of the inflow rankings.

But inflows aren't a guarantee of transformation: real benefit will come when capital is matched by credible pipelines, robust institutions, local-ecosystem development and measurable outcomes.

The coming decade will determine whether Africa's ESG moment evolves into sustained development momentum — or remains a headline-driven cycle.

Culled From: Top 10 African Countries with the Largest ESG Investment Flows in 2025