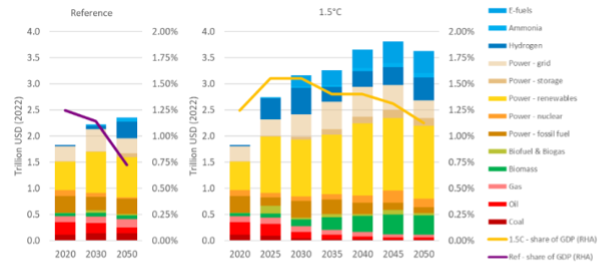

Governments worldwide deploy corporate tax breaks to catalyse sustainable investment. Yet recent analysis by the World Bank reveals that fewer than one in ten incentives target genuinely green activities, while support for polluting sectors remains more common.

For Africa and emerging markets, the lesson is stark: design, transparency and alignment matter. Poorly structured tax breaks risk delaying rather than driving the low-carbon transition.

Incentives Misaligned with Green Goals

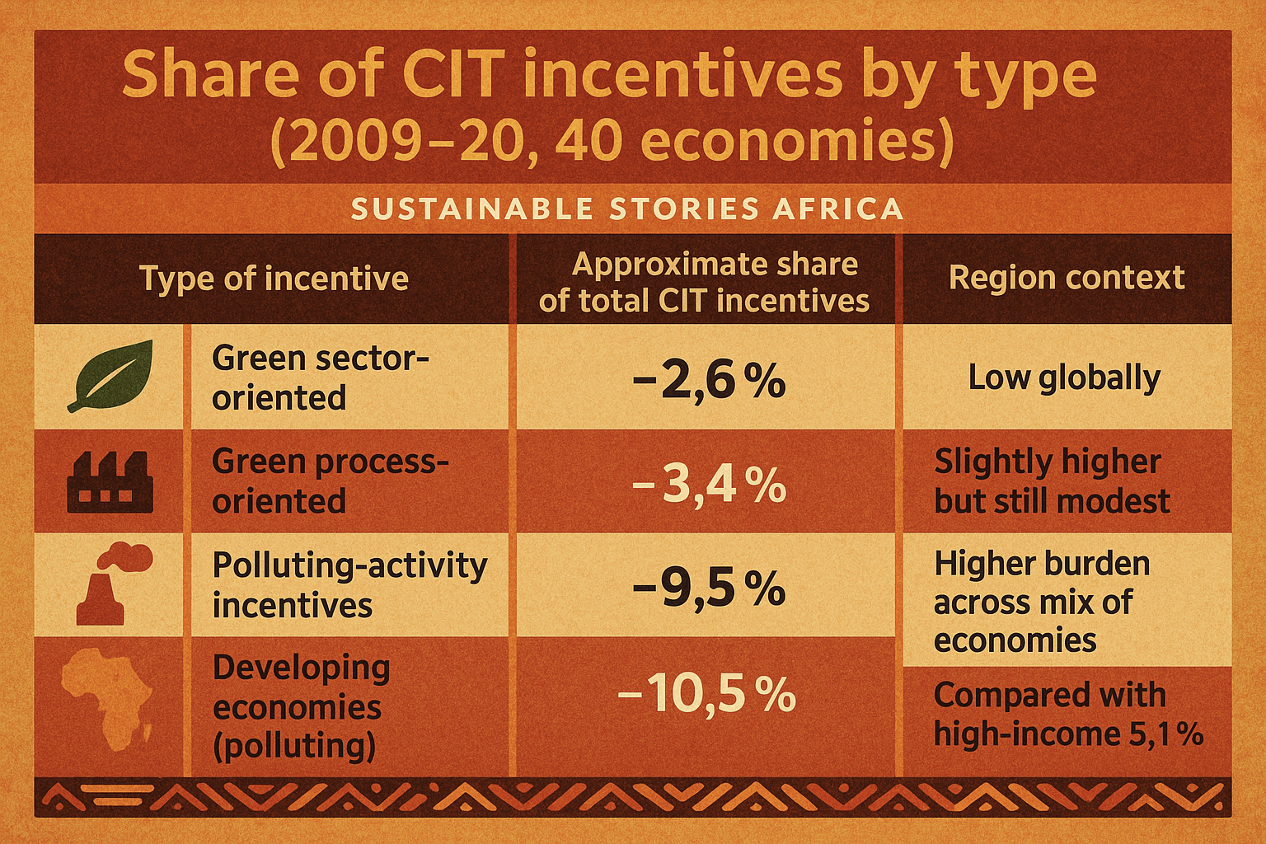

In an era when climate imperatives demand urgent action, many countries have turned to corporate income tax (CIT) incentives as a policy lever. Yet a new database covering 40 economies shows that only about 2.6 % of CIT incentives are directed at green sector-oriented investments and about 3.4 % at green process-oriented ones compared with 9.5 % for incentives favouring polluting activities.

The imbalance is even more severe in developing economies: activities which are termed as more hazardous to climate imperatives have incentives averaging 10.5 % versus 5.1 % in high-income countries.

This counterintuitive set of numbers sets the tone: the potential of tax incentives to promote green growth is real; however, so too is the risk they entrench business-as-usual.

Share of CIT incentives by type (2009-20, 40 economies)

| Type of incentive | Approximate share of total CIT incentives | Region context |

|---|---|---|

| Green sector-oriented | ~2.6% | Low globally |

| Green process-oriented | ~3.4% | Slightly higher but still modest |

| Polluting-activity incentives | ~9.5% | Higher burden across mix of economies |

| Developing economies (polluting) | ~10.5% | Compared with high-income ~5.1% |

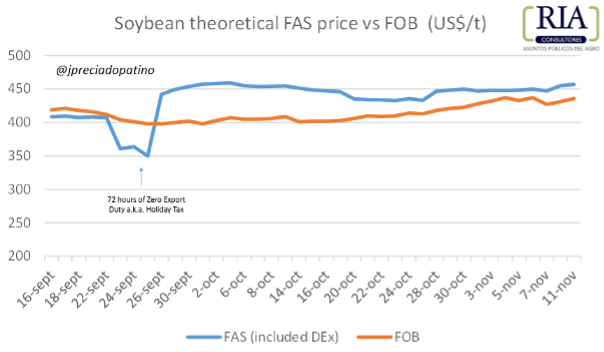

Why It Matters for Africa’s Green Transition

For African governments facing constrained fiscal space and urgent climate adaptation needs, tax incentives offer an appealing tool. But the effectiveness depends entirely on the design, targeting and oversight of the incentive regime.

Key design issues emerge:

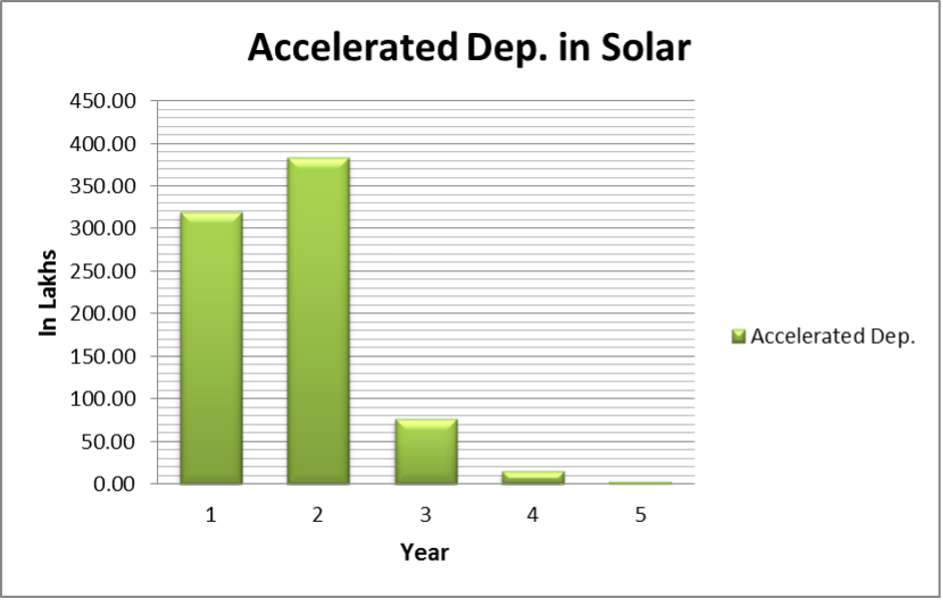

- Most green incentives (85 %) employ accelerated depreciation, tax holidays or reduced tax rates.

- Tax holidays — common in developing countries — are ranked among the least cost-effective vehicles globally.

- The global minimum corporate tax framework (15 % for large multinationals) narrows the margin for generous corporate tax breaks.

In African jurisdictions, where private-sector green investment must scale, poorly focused tax incentives can dilute public revenues and shift the burden of climate transition onto the public purse without delivering real green growth.

Crafting Effective Green Tax Incentives

What could the ideal incentive look like for African economies? Based on the World Bank findings, three principles emerge:

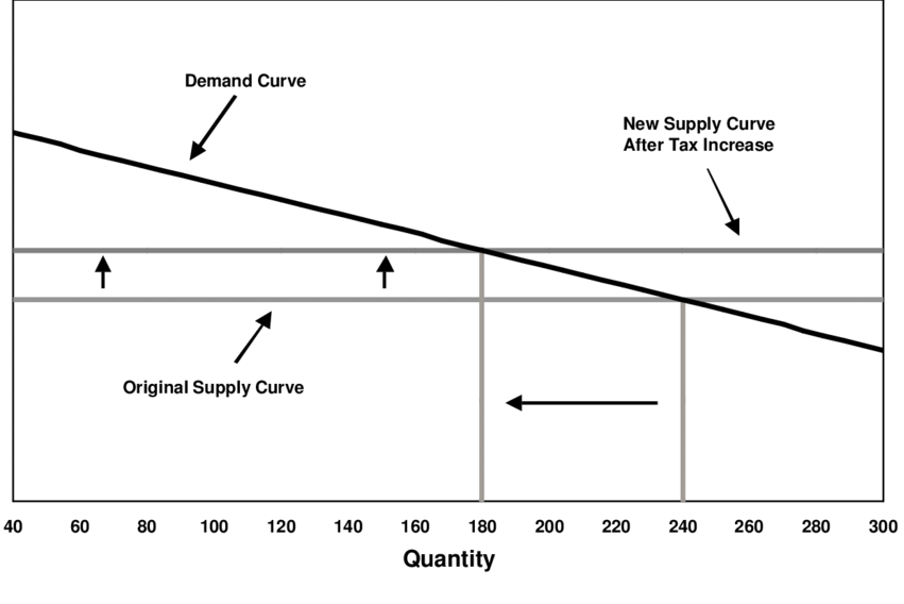

- Targeting: Distinguish explicitly between incentives for green-sector investment (e.g., renewables, battery manufacturing) versus process-oriented (e.g., recycling) and phase-out support for polluting-sector subsidies.

- Cost-effectiveness: Prioritise instruments with proven outcomes (accelerated depreciation, investment tax credits) over broadly-applied tax holidays.

- Transparency & monitoring: Create public inventories of tax incentives, including cost, uptake and environmental outcomes — only 4 of the 40 economies studied offer green incentives without polluting ones co-existing.

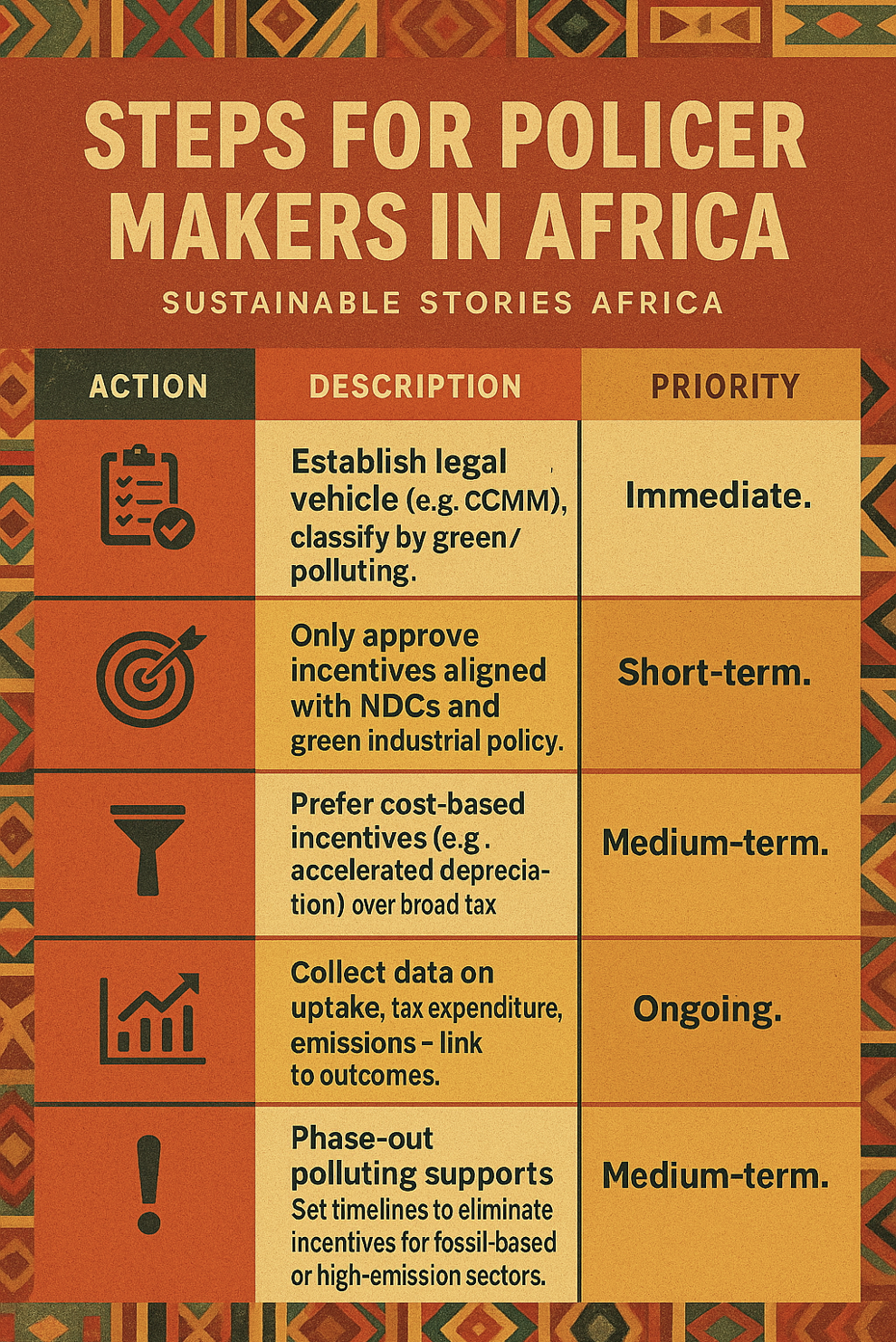

Infographic: Key design levers for green tax incentives

These steps are crucial if African nations are to align tax policy with development goals, mobilise private capital and avoid reinforcing carbon-intensive pathways.

Steps for Policy Makers in Africa

The table below summarises recommended actions for finance ministries, tax authorities and development partners in the African context:

| Action | Description | Priority |

|---|---|---|

| Inventory and review | Map all existing CIT incentives, classify by green/ polluting | Immediate |

| Align tax incentives with climate strategy | Only approve incentives aligned with NDCs and green industrial policy | Short-term |

| Use targeted instruments | Prefer cost-based incentives (e.g., accelerated depreciation) over broad tax holidays | Medium-term |

| Monitor & evaluate | Collect data on uptake, tax expenditure, emissions - link to outcomes | Ongoing |

| Phase-out polluting supports | Set timelines to eliminate incentives for fossil-based or high-emission sectors | Medium-term |

African governments that adopt these steps can improve the returns on tax-expenditure, safeguard revenues and channel incentive architecture toward climate goals.

Path Forward – Design, Target, Monitor, Phase-Out, Report

Looking ahead, the six-word mantra encapsulates the essential path: Design, Target, Monitor, Phase-Out, Report.

In practice, this means that African economies must design incentive systems with clarity, target them toward genuine green investment, monitor performance rigorously, phase out perverse or polluting incentives, and report transparently to build credibility.

If executed well, tax incentives can become a meaningful lever in the continent's green growth journey, bridging policy, private investment and climate outcomes.

However, the real test is in the execution: without strict alignment, the risk remains that tax breaks will continue to reward the status quo rather than drive the transition. The time for strategic tax-policy design is now.

Culled From: https://blogs.worldbank.org/en/psd/corporate-tax-incentives-for-green-growth--where--when--and-how-