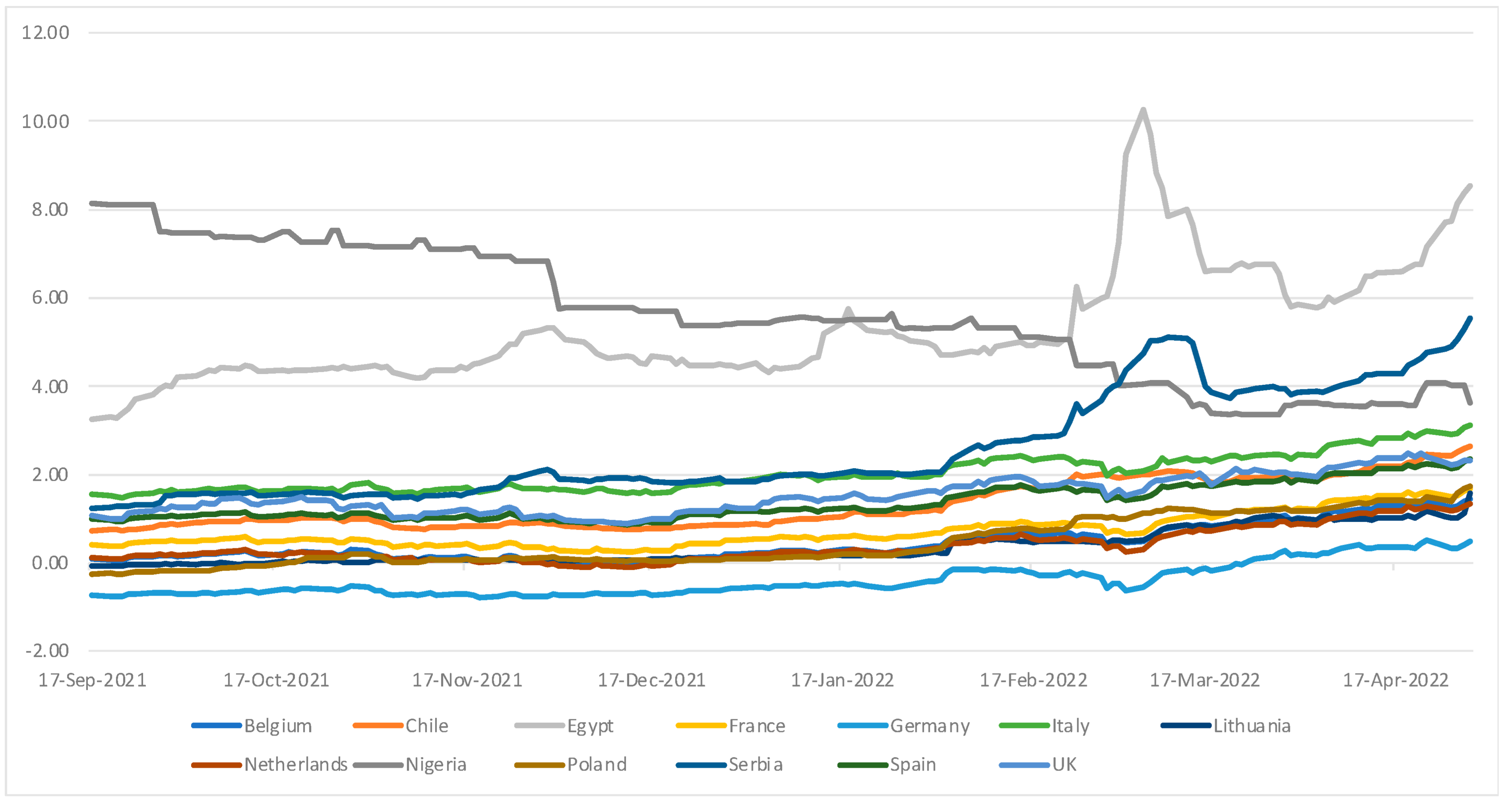

Emerging-market sovereigns are increasingly issuing green, social and sustainability (GSS) bonds, yet a recent World Bank review finds gaps in reporting standards and investor disclosures, raising questions about the quality of sustainable investment.

For African and developing economies, meeting investor demands for transparency is becoming a critical step if capital markets are to finance the climate transition and sustainable growth.

Demand for Transparency Grabs Centre-Stage

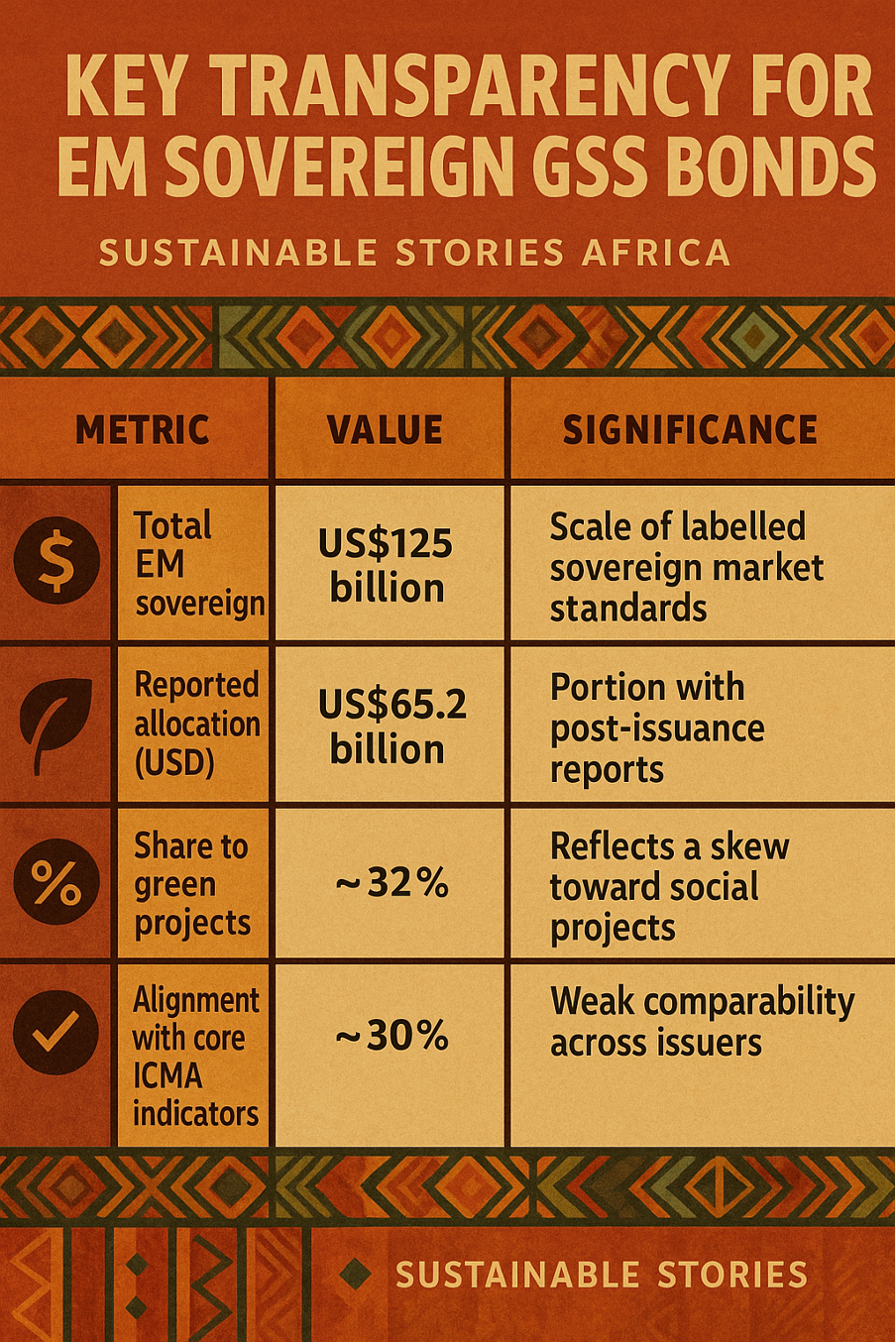

Issuance of labelled sovereign GSS bonds by 26 emerging-market (EM) countries reached US$125 billion as of 30 June 2024. Of that amount, EM sovereigns reported allocation of US$65.2 billion, with only 32 % earmarked for green projects and 68 % for social uses.

Yet crucially, only about 30 % of reported impact indicators align with the core metrics recommended by the International Capital Markets Association (ICMA) framework — meaning comparability and investor confidence remain limited.

For Africa's sovereign issuers, already facing both a funding gap and investor scrutiny, the message is clear; it is central to accessing capital markets.

Key Transparency Metrics for EM Sovereign GSS Bonds

| Metric | Value | Significance |

|---|---|---|

| Total EM sovereign GSS issuance | US$125 billion | Scale of labelled sovereign market |

| Reported allocation (USD) | US$65.2 billion | Portion with post-issuance reports |

| Share to green projects | ~32% | Reflects a skew toward social projects |

| Alignment with core ICMA indicators | ~30% | Weak comparability across issuers |

Why This Matters for Africa's Growth Trajectory

Developing economies across Africa require vast investment to meet the Sustainable Development Goals (SDGs) and climate goals. The World Bank estimates the need at US$6.9 trillion to US$7.6 trillion between 2023 and 2030 for EMs.

For sovereign issuers, transparency in bond issuance matters for several reasons:

- Investor appetite: Institutional investors increasingly demand strong disclosure of project-level impact and use-of-proceeds.

- Credibility and pricing: Transparent issuers may benefit from lower borrowing costs and deeper investor pools.

- Alignment with global standards: Without aligning reporting to ICMA and similar frameworks, comparability suffers and 'greenwashing' risk rises.

For many African states entering GSS-bond markets, this means building robust reporting systems, not simply issuing labelled bonds.

What Sovereigns Can Do to Strengthen Trust

To meet investor demands and improve outcomes, sovereign issuers should focus on three converging levers:

- Standardised reporting: Ensure post-issuance allocation and impact reports follow globally accepted metrics and frameworks. Only ~30% currently align with ICMA core indicators.

- Balanced use of proceeds: Address skew toward social projects by building a pipeline of credible green investments in the African context, which means renewables, sustainable water, and nature-based solutions.

- Institutional capacity building: Debt-management offices, ministries of finance and central banks need tools, training and systems for investor engagement, disclosure and reporting.

Infographic: Pillars of Sovereign GSS Bond Transparency

Roadmap for African Sovereign Issuers

Recommended sequential actions

| Phase | Action | Lead Stakeholder |

|---|---|---|

| Immediate | Map existing labelled bonds and conduct a disclosure gap audit | Ministry of Finance/Debt Office |

| Short-term | Adopt and publish post-issuance reports aligned with ICMA and global good practice | Debt Management Office |

| Medium-term | Build investor-engagement platforms, publish use-of-proceeds and impact data regularly | Finance Ministry with central bank support |

| Ongoing | Monitor and review the pipeline of green/social projects, refine reporting, and publish external verifications | Sovereign issuer + external auditor |

By taking these steps, African sovereigns can build market credibility, attract broader investor bases, and reduce the cost of capital.

Path Forward – Disclose, Measure, Align, Build, Engage, Sustain

Looking ahead, the six-word mantra captures the essence of the journey: "Disclose, Measure, Align, Build, Engage, Sustain."

For African sovereign issuers, the path forward is clear: start with disclosure, measure impacts rigorously, align to global standards, use local emphasis, build institutional capacity, engage investors openly, and sustain transparent practices.

When pursued effectively, this could transform labelled sovereign borrowing from niche transactions into a scalable avenue for climate and development finance, thereby helping African countries tap into deeper global capital markets. The real challenge lies not in issuing bonds, but in sustaining the integrity and transparency that investors now expect.

Culled From: https://blogs.worldbank.org/en/allaboutfinance/emerging-market-sovereign-issuers-address-demand-for-transparenc