As climate change and financial exclusion intersect, emerging markets stand at a crossroads: will sustainability finance reinforce inequality, or foster broad-based resilience? A World Bank analysis shows how integrating inclusion and green finance can trigger a virtuous cycle.

For Africa's regulators and institutions, the stakes are high: inclusive green-finance policies could simultaneously build climate resilience and expand access to capital.

When Finance Excludes, Risk Amplifies

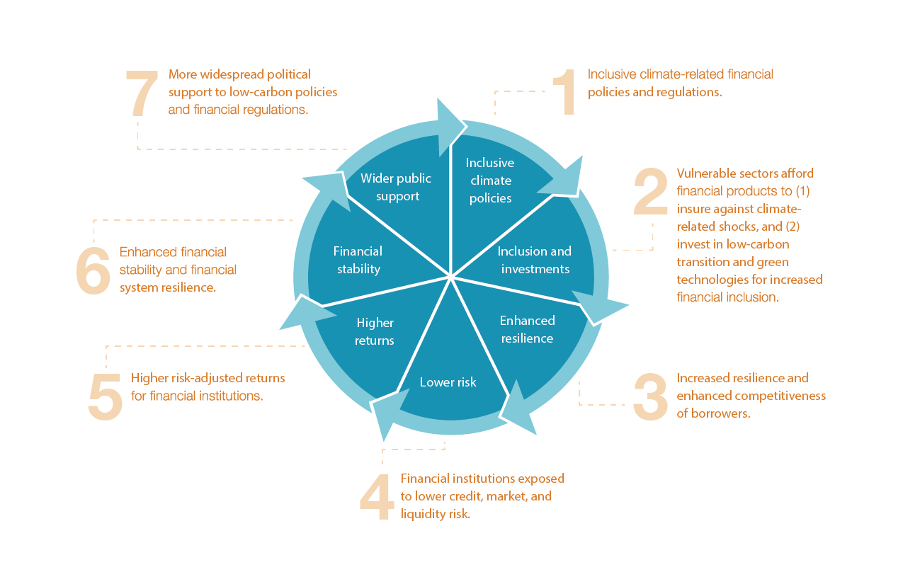

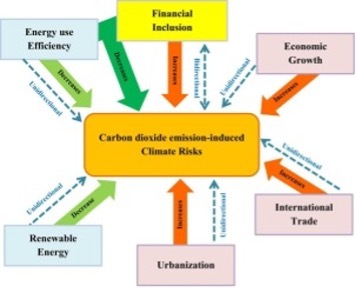

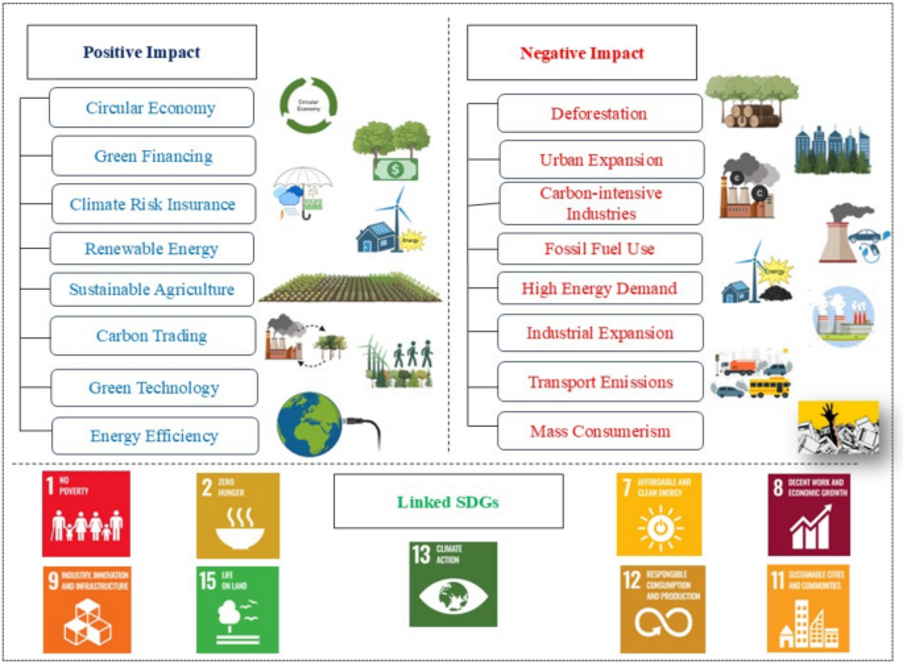

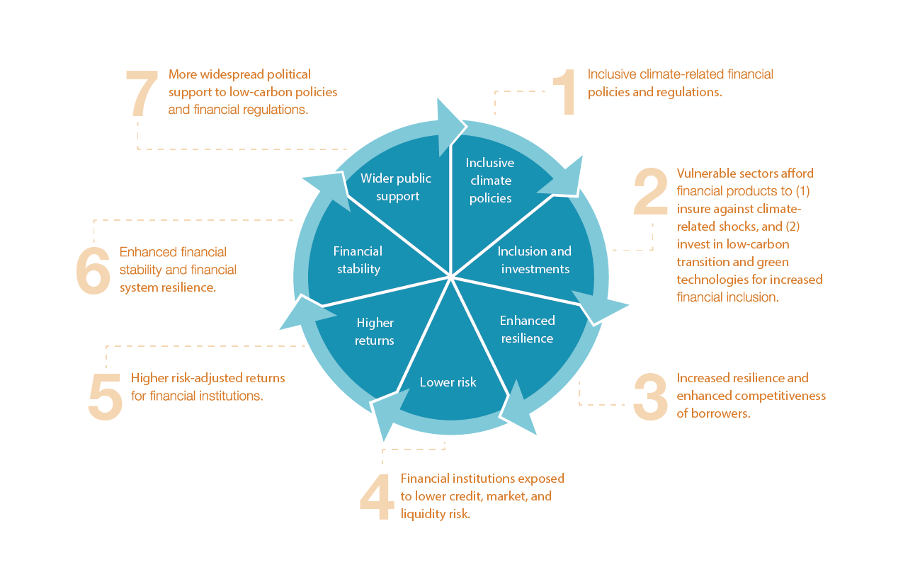

Driving a virtuous cycle of inclusive green finance underscores a looming danger: climate change, if unmanaged in the financial sector context, can deepen exclusion and threaten stability.

In vulnerable economies, low-income households and small & medium enterprises (SMEs) often face both high climate risk and limited access to finance. Across Africa's financial landscape, rising due diligence costs in green lending are quietly pushing banks away from smaller borrowers, widening an exclusionary gap that shuts out vulnerable enterprises from climate finance and undercuts the promise of an inclusive transition.

Inclusive green finance can spark a virtuous cycle, reducing risk, expanding access, and building a more resilient financial system.

Infographic: Vicious vs. Virtuous Cycle of Green Finance

Key structural risk factors

| Factor | Implication |

|---|---|

| High-climate risk exposure among vulnerable clients | Higher NPLs and asset devaluation risk |

| High transaction/due diligence cost for small loans | Banks may exclude low-income clients |

| Lack of climate information and credit data | Market fails to price risk, reducing lending |

Inclusive Green Finance: Why It Matters

For Africa and other developing regions, the intersection of financial inclusion and green finance is critical. The blog argues that supervisors and regulators can leverage policy to turn the vicious cycle into a virtuous one.

Why this matters for African markets:

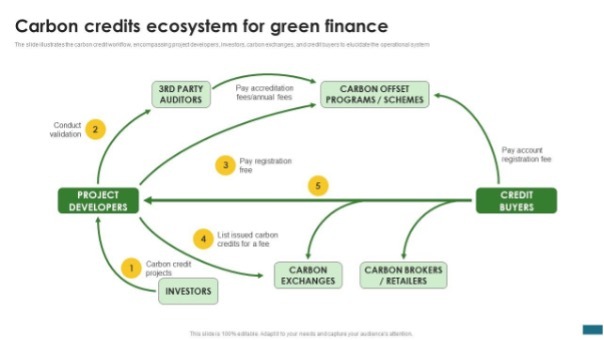

- Expanding access to green finance for underserved firms and households helps to mitigate climate risk across the economy.

- Inclusive finance broadens the investor and borrower base, reducing concentration risk and enhancing system stability.

- Building information systems (e.g., climate-credit registries) lowers due diligence costs and supports smaller lending.

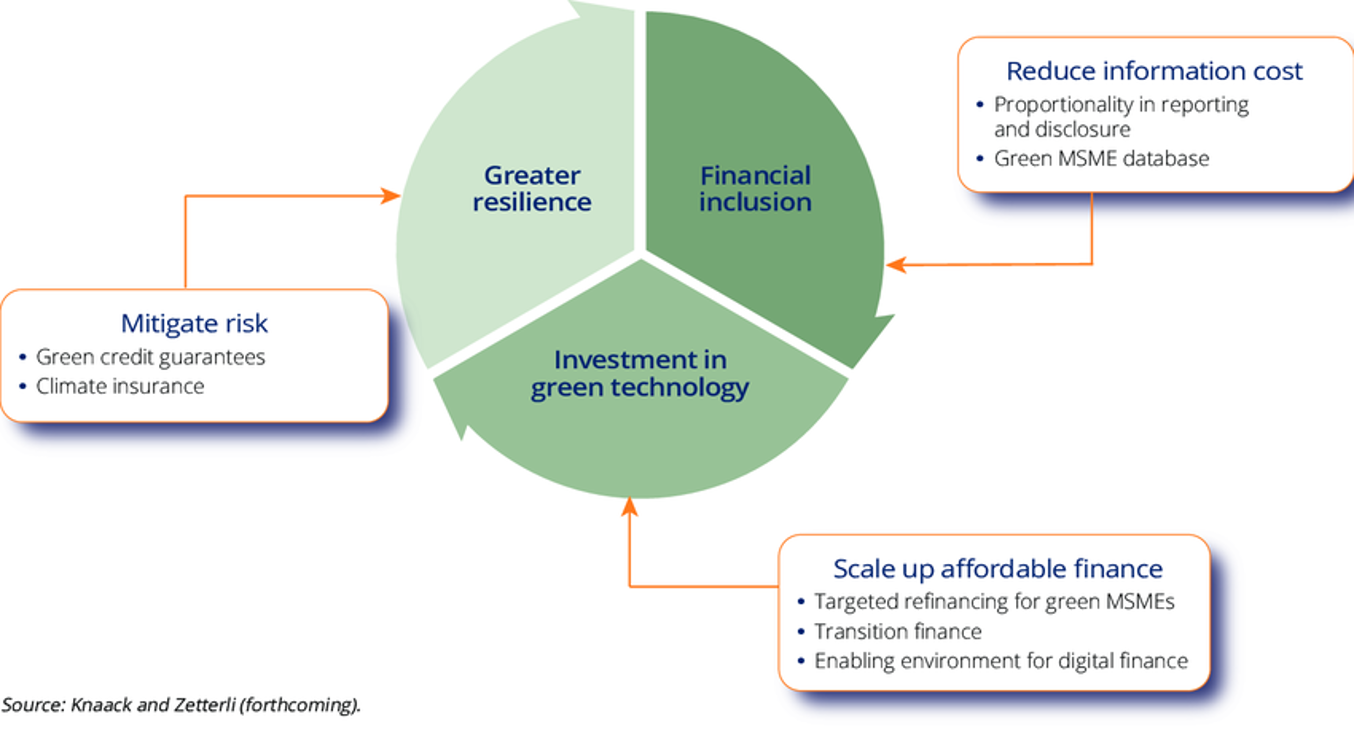

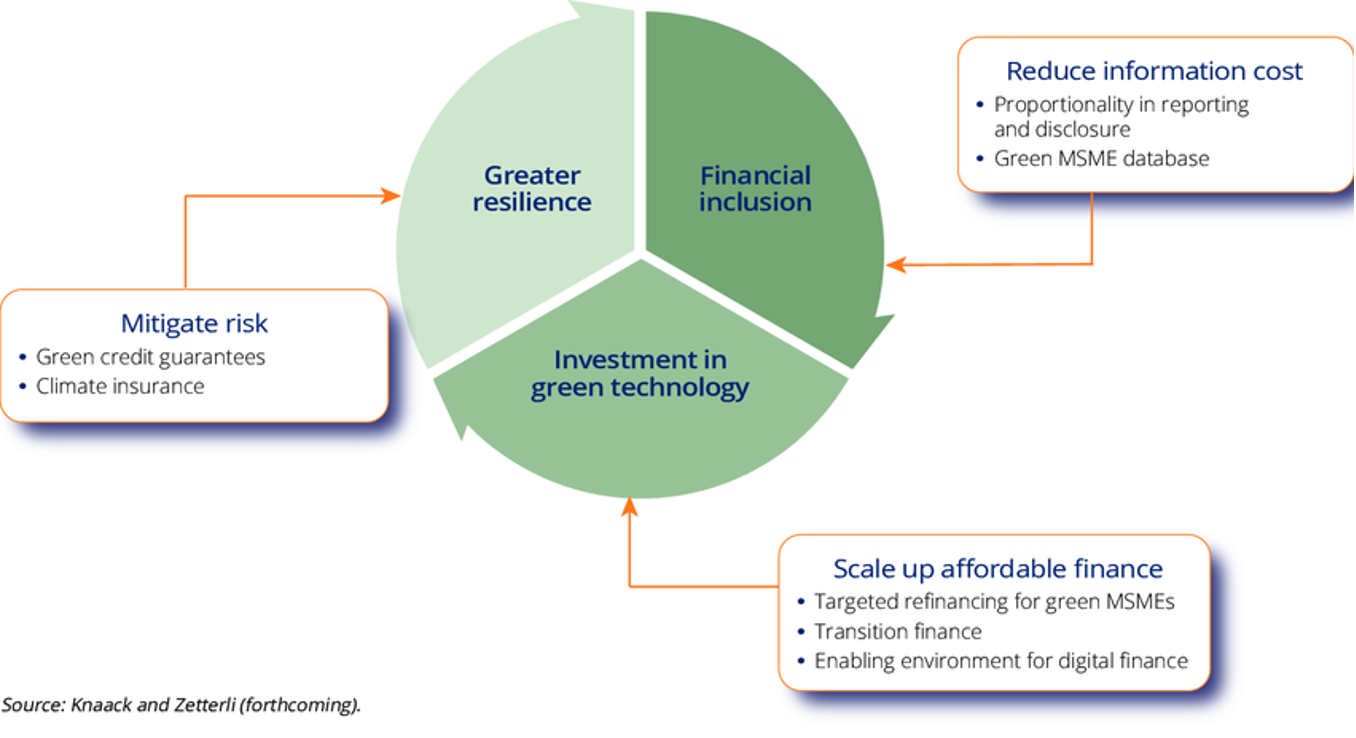

Infographic: Inclusive Green Finance in Action

Policy levers and expected outcomes

| Policy Lever | Expected Outcome |

|---|---|

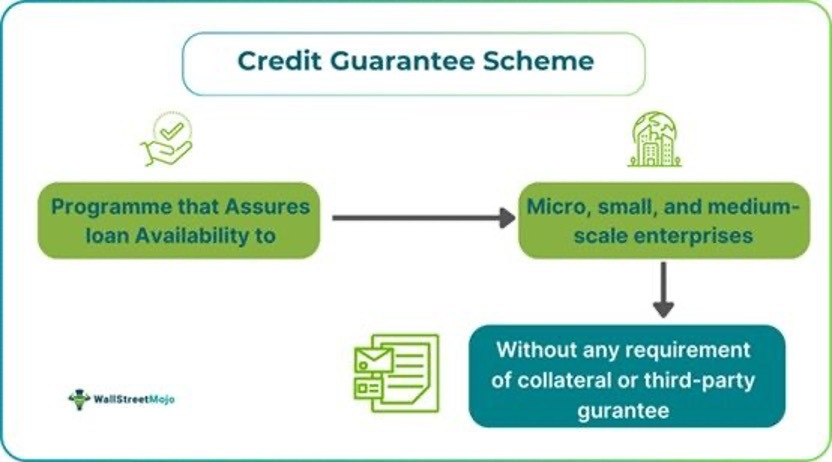

| Green credit guarantee schemes (focus on SMEs) | Increased green-loan uptake by underserved |

| Green credit information system | Lower risk assessment cost, better data flow |

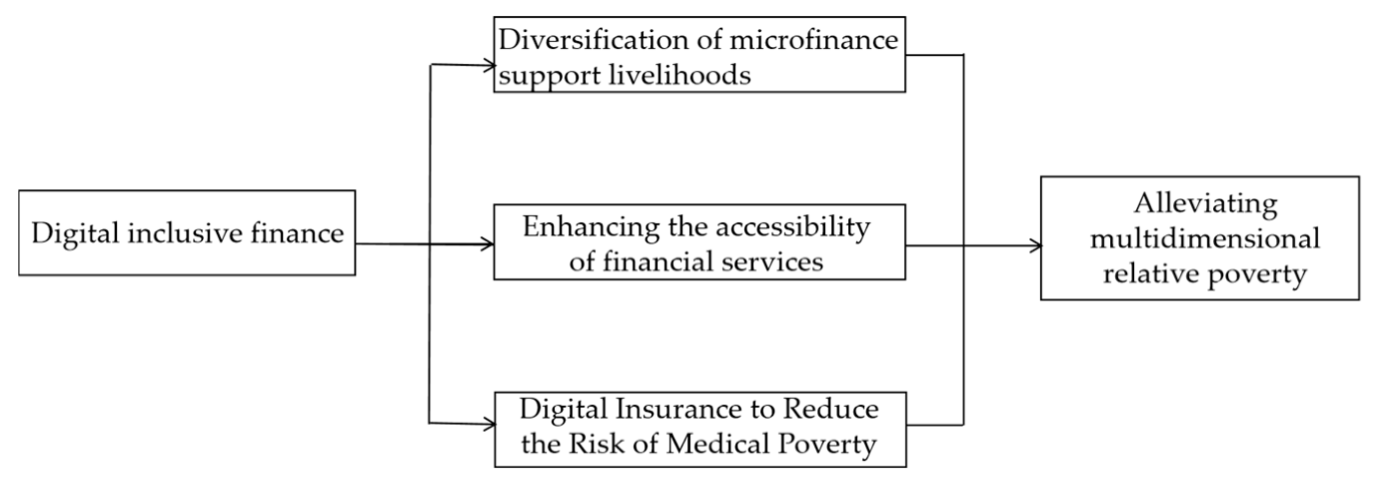

| Inclusive climate-insurance products | Increased resilience for vulnerable clients |

| Proportionate regulatory/supervisory framework | Lower exclusion of small clients |

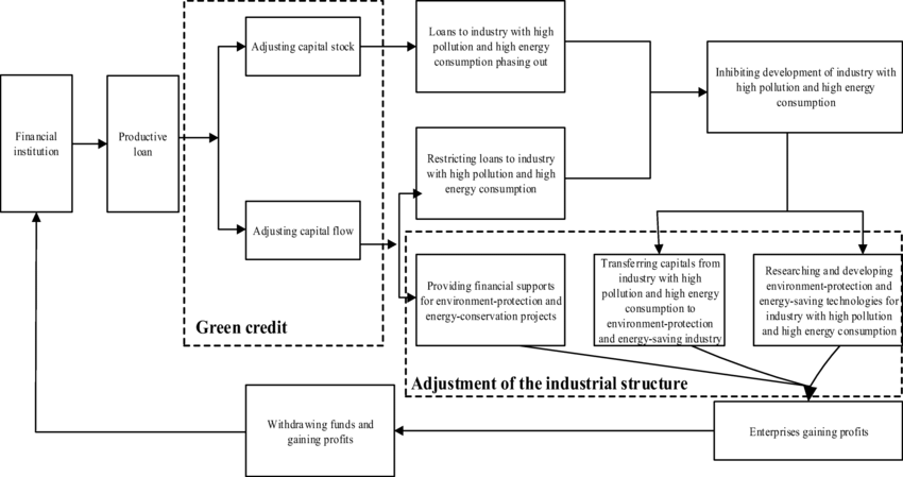

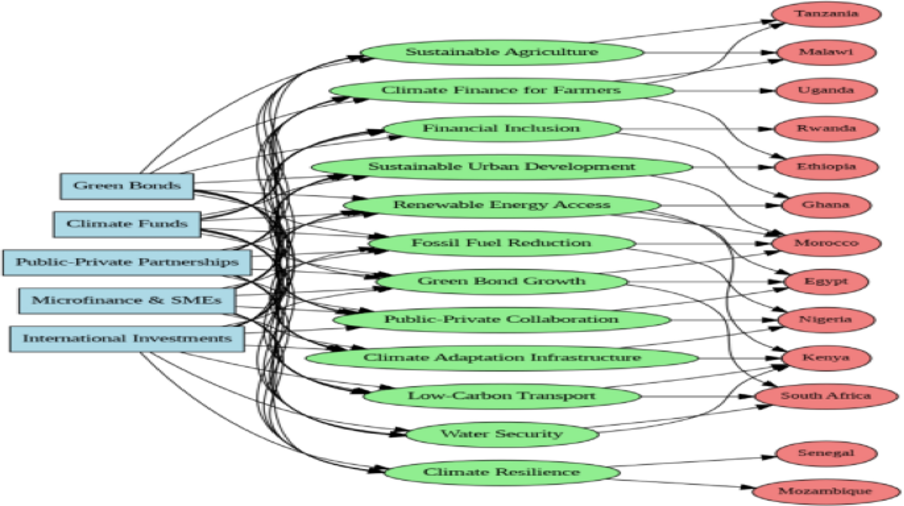

Designing the Cycle for African Markets

To foster the virtuous cycle in African settings, the blog outlines targeted approaches:

- Tailor regulations to risk-profile and capacity: avoid one-size-fits-all mandates that push out small clients.

- Subsidise or standardise due diligence and information infrastructure so that small borrowers can access green finance at scale.

- Embed inclusive green finance into capacity-building for regulators and financial institutions—so climate-and-inclusion become integrated, not separate silos.

Infographic: Building the Virtuous Cycle

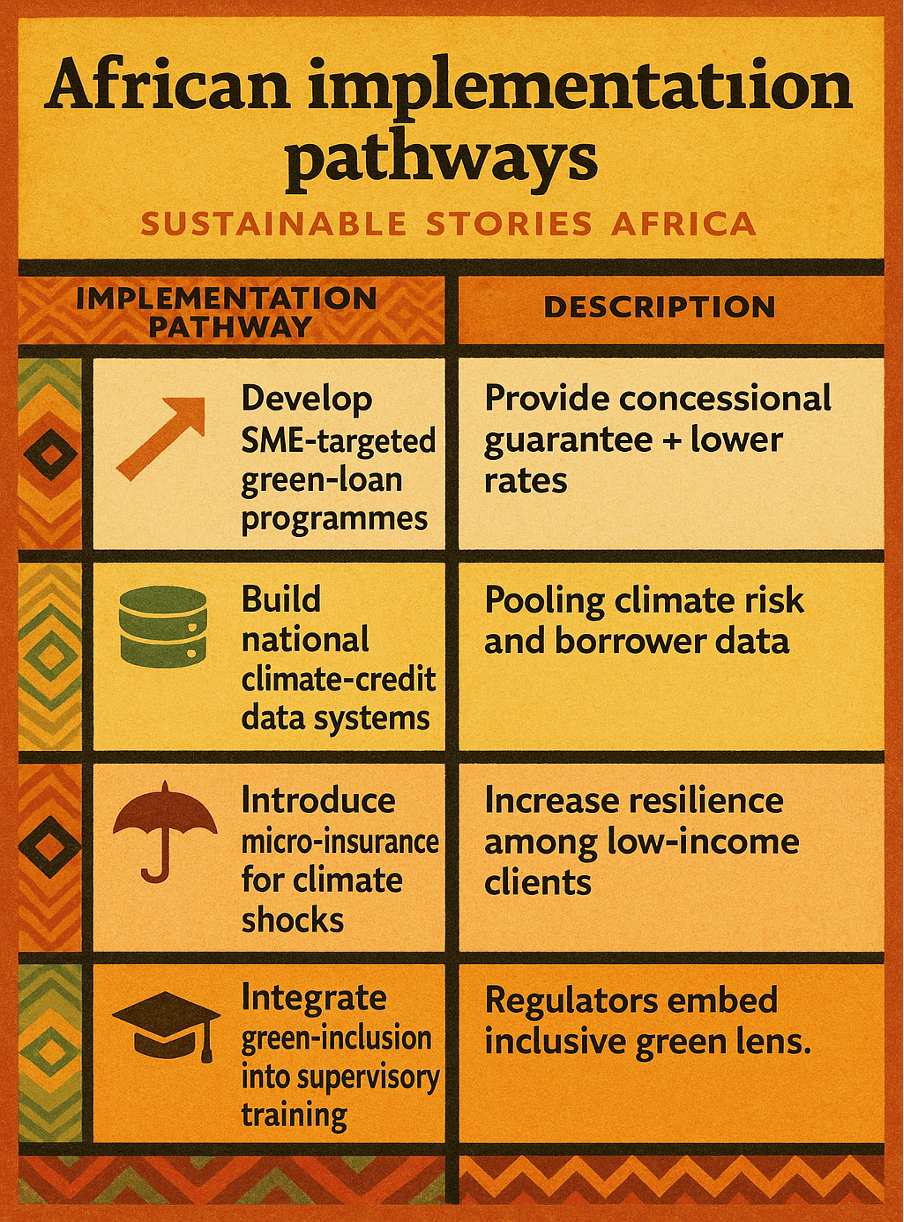

African implementation pathways

Implementation Pathway | Description |

|---|---|

Develop SME-targeted green-loan programmes | Provide concessional guarantee + lower rates |

Build national climate-credit data systems | Pooling climate risk and borrower data |

Introduce micro-insurance for climate shocks | Increase resilience among low-income clients |

Integrate green-inclusion into supervisory training | Regulators embed inclusive green lens |

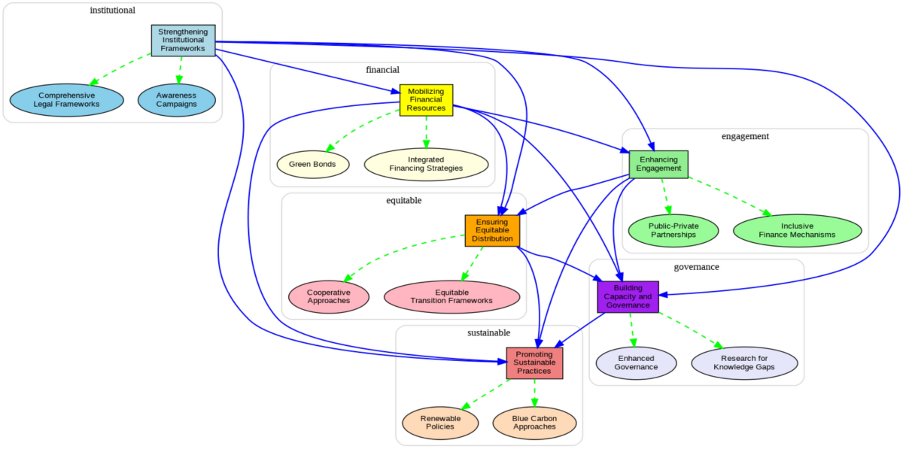

What Needs To Happen Now

For African financial-sector stakeholders, the blog's recommended actions include:

- Establishing green guarantee funds or mechanisms that lower lending costs for underserved green borrowers.

- Setting up climate-information systems or registries that make borrower climate credentials easier to evaluate.

- Designing proportionate regulation that reduces climate-finance cost burdens for small firms, while safeguarding risk.

- Training regulators and financial institutions in inclusive green-finance practices and disclosure frameworks.

Path Forward – Include, Finance, Build Resilience, Sustain Access

Looking ahead, the six-word mantra encapsulates the necessary journey: Include, Finance, Build Resilience, Sustain Access.

Putting this into practice in African markets means expanding access to green finance for low-income households and SMEs, structuring mechanisms so that lending is viable, building institutional systems to monitor and mitigate climate risk, and maintaining access over the long term.

If done effectively, inclusive green finance can simultaneously advance climate resilience, financial stability and broad-based economic inclusion. The ultimate test will be in execution.

Culled From: https://blogs.worldbank.org/en/psd/driving-a-virtuous-cycle-of-inclusive-green-finance