InfraCredit 2024: Guarantees, Impact, ESG Discipline

InfraCredit’s Sustainability & Impact Report 2024 frames sustainability as a core condition of infrastructure credit enhancement, anchored on environmental and social (E&S) risk screening and impact measurement across the lifecycle of a guarantee.

The report states that InfraCredit’s Environmental & Social (E&S) Policy makes project eligibility contingent on the ability to deliver “comprehensive sustainability outcomes” beyond revenue generation, including environmentally responsible practices and inclusive social and economic impact.

Operationally, the report outlines a three-stage E&S risk assessment process: Origination (Preliminary Assessment), Due Diligence & Structuring, and Financial Approval, supported by an E&S Risk Assessment framework to identify and address E&S risks before approvals.

It also links risk discipline to sustained financial strength, noting that InfraCredit has maintained an ‘AAA’ rating with a stable outlook from GCR, Agusto & Co, and Fitch Ratings, and describes this as a first for a local-currency guarantor in sub-Saharan Africa.

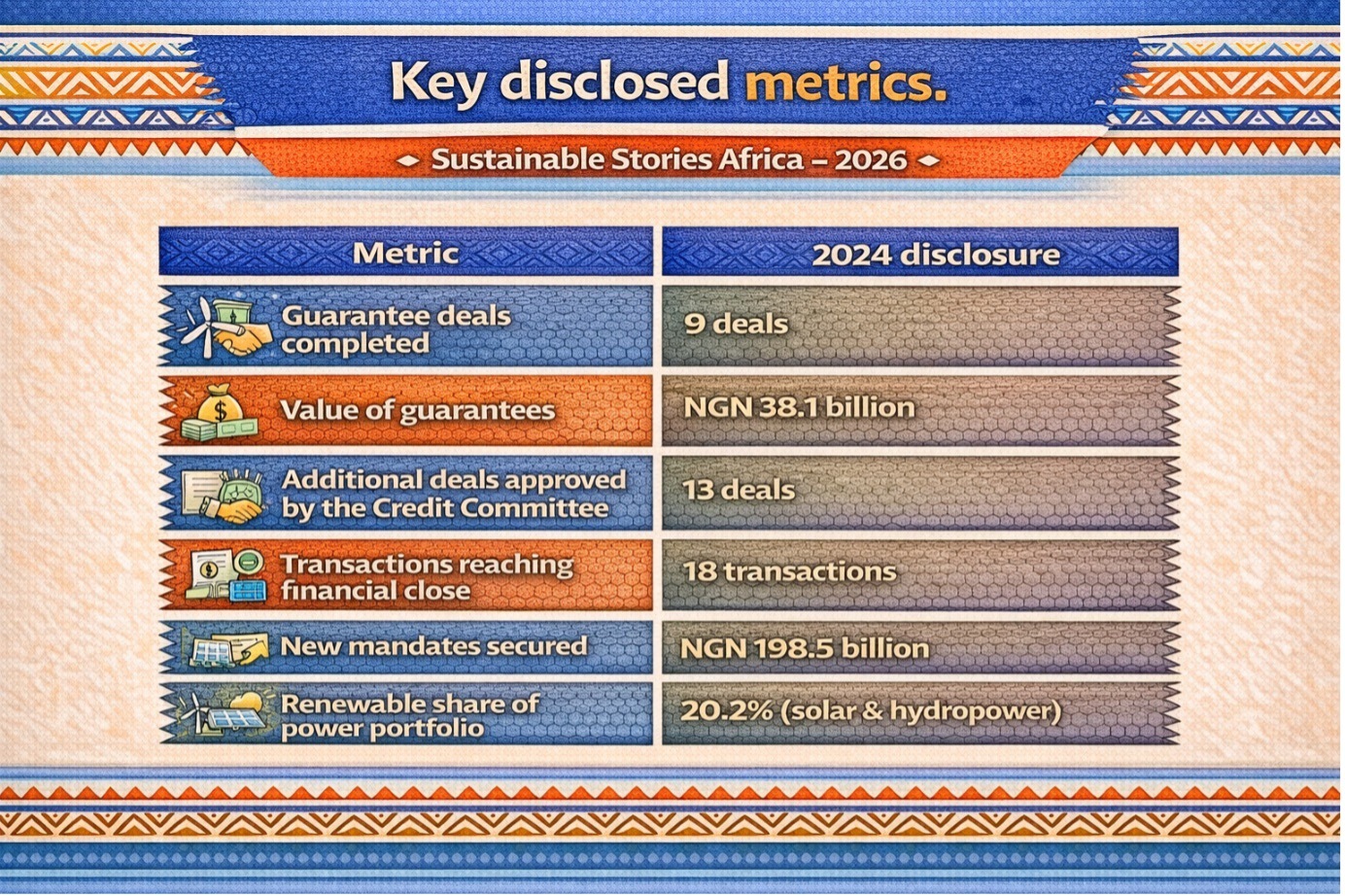

Regarding business outcomes, InfraCredit reports completing nine guarantee deals totalling N38.1 billion in guarantees. Its Credit Committee has approved 13 additional deals, and 18 transactions have reached financial close, securing N198.5 billion in new mandates from those 18 deals.

Strategically, InfraCredit positions its impact objectives across market, project, and end-user levels, and describes a Monitoring, Evaluation and Learning (MEL) framework with indicator/log frame use, an Excel-based development impact assessment tool, and investee KPI reporting validated through centralised processes and “external evaluations.”

Climate-wise, the report cites portfolio requirements aligned with the IFC Performance Standards (including a threshold that portfolio companies should not produce more than 25,000 tCO₂e annually) and states that renewable energy (solar/hydropower) is 20.2% of the power portfolio as of December 2024.

SDG Alignment

What the report discloses

- InfraCredit states that its material sustainability topics are linked to the UN Sustainable Development Goals (SDGs).

- The report presents a material-topics-to-SDGs mapping table structure (“Matrix No / Our Material Topics / SDGs”).

- SDG linkage is also referenced at the impact measurement level: InfraCredit states each transaction has an MEL plan with “key impact indicators, aligned with the Sustainable Development Goals (SDGs).”

Where SDG-type impacts are located

- The report is Nigeria-focused on footprint language, stating it has “a robust presence throughout Nigeria,” with impacts across regions via projects/investments.

Table: Material topics the report links to SDGs (SDG numbers not visible in extracted text)

Topic cluster | Material topics listed in the SDG-linked matrix |

|---|---|

Environmental | Resource Efficiency; Energy Efficiency & Renewable Energy; Waste Management; Climate Change; Biodiversity Impacts |

Social | Training and Education; Health and Safety; Employment Practices; Human Rights; Access to Infrastructure; Diversity, Inclusion & Equal Opportunities |

Governance/Cross-cutting | Economic Performance; Indirect Economic Impacts; Tax; Anti-corruption; Data Protection and Cyber Security; Risk Management; Corporate Governance & Ethical Business Practice; Stakeholder Engagement; Regulatory Compliance; Responsible Investments |

Constructive note (SDG tracking): SDG benchmarking would be strengthened by publishing an SDG index with explicit SDG numbers/targets per initiative and KPI.

ESG Management

Governance and oversight

- The Board operates through committees, including the New Business Committee, Board Credit Committee, Board Risk & Capital Committee, Board Audit Committee, Board Remuneration & Nomination Committee, and Board Finance & General-Purpose Committee.

- The report positions the ESG team as pivotal to governance controls that “identify, assess, and manage” ESG risks and drive positive impact.

Policies, standards, and frameworks used

- InfraCredit describes an Environmental & Social (E&S) Policy guiding standards, review/management processes, and implementation guidance aligned with relevant laws/regulations and global standards.

- It reports alignment to UN Principles for Responsible Investment (UNPRI) and describes collaboration to support PRI implementation via working groups/partnerships.

- It states it is a signatory to the Impact Principles, positioning these as embedded “across all stages” of the project guarantee lifecycle.

Assurance/verification status

- In the GRI content index, “External Assurance” is listed as “Not Available.”

Initial Areas of Impact

Reported impact channels (how InfraCredit says impact happens)

- The report frames a Theory of Change (ToC) spanning market, project, and end-user levels, including job creation and improved access/reliability/resilience of infrastructure with “better livelihoods.”

- It states InfraCredit enables “local currency guarantees” that improve access to long-tenor financing for viable infrastructure projects and prioritises SDG-aligned initiatives delivering economic growth, livelihoods, and climate resilience.

Examples of stated interventions/programmes

- Sea Turtle Conservation Project (TCP) with Lagos Free Zone Company, supported by KfW Development Bank, addressing habitat degradation, illegal harvesting, and illicit trade with community participation around coastal nesting sites.

- Capacity building via Infrastructure Knowledge Exchange Programmes for investors and regulators (knowledge-sharing and transparency).

- Climate-oriented product concept: Climate-Smart Productive Use Equipment (PUE) model intended to support smallholder farmers with clean energy for agro-processing.

Metrics for Definition

Key disclosed metrics

Metric | 2024 disclosure |

|---|---|

Guarantee deals completed | 9 deals |

Value of guarantees | NGN 38.1 billion |

Additional deals approved by the Credit Committee | 13 deals |

Transactions reaching financial close | 18 transactions |

New mandates secured | NGN 198.5 billion |

Renewable share of power portfolio | 20.2% (solar & hydropower) |

Measurement system

- MEL framework includes indicator/logframe, Excel-based development impact assessment tool, and investee KPI reporting validated through centralised processes and “external evaluations.”

- Impact scores are assigned across categories, including job creation, gender/youth inclusion, climate change, economic contributions, and quality of access to infrastructure services.

- Environmental and social monitoring is embedded in legal agreements as E&S and Development Impact (DI) covenants.

Verification/assurance

- External assurance is stated as not available in the GRI index.

- The report states investee KPIs are validated through centralised processes and external evaluations (verification type not specified as assurance).

Areas of Focus

Forward priorities and timelines

- Clean Energy Transition Strategy: InfraCredit reports a “10 to 20-year roadmap” to transition its investment portfolio in alignment with the Paris Agreement, focusing on sectors including energy supply, transportation, and urban/semi-urban/rural infrastructure, with “seven key milestones.”

- Climate risk integration: InfraCredit states it integrates climate risk assessments into investment decision-making for resilience against climate risks such as extreme weather events and resource scarcity.

- Operational footprint measures: it cites intent to reduce internal carbon footprint via energy-efficient office management, waste reduction, and responsible resource consumption.

Materiality Concepts

Method and governance relevance

- InfraCredit describes materiality assessment as a process to align sustainability initiatives with stakeholder expectations and long-term value creation, using stakeholder engagement, research on industry trends/regulation/best practice, and prioritisation by stakeholder significance and business impact.

- It states materiality assessment is “continuous” and will be reviewed/updated as expectations and industry dynamics evolve.

Materiality matrix and outputs

- The report states the materiality matrix displays importance to stakeholders and impact on the business, guiding communication and action strategies.

- It lists 21 material topics.

Sustainability Risk Management Concepts

Risk management approach (E&S + governance structures)

- InfraCredit states it conducts pre-guarantee E&S due diligence and post-guarantee monitoring, using structured E&S action plans to mitigate legal non-compliances.

- It describes systematic assessment of environmental and social risks using transaction-appropriate tools to determine the nature/scope of involvement and guide decision-making through the investment lifecycle.

- Oversight structures include the Board Risk & Capital Committee (risk management functions/practices; portfolio quality/performance) and Board Audit Committee (internal controls and compliance).

Risks explicitly signposted (examples)

- Climate/portfolio emissions constraint: climate approach references IFC Performance Standards and a condition that portfolio companies do not produce more than 25,000 tCO₂e annually and must quantify direct emissions.

- Supply chain risk: The procurement section states that supply chain risks can disrupt operations, damage reputation, or affect financial performance, and describes a solar-panel supply chain risk assessment framework.

Sustainability Strategy Concepts and Management

How the strategy is defined in the report

- Sustainability as eligibility + risk control: E&S policy makes sustainability outcomes a gate for project eligibility.

- Impact strategy through ToC + MEL: impact objectives and measurement are structured across market/project/end-user levels with MEL plan per transaction and DI covenants.

- Responsible investment alignment: UNPRI + Impact Principles positioning as portfolio-wide discipline and “mitigation of impact washing.”

Strategy pillars

- E&S risk governance and compliance (E&S due diligence, monitoring, action plans).

- Climate action integration (renewable energy, energy efficiency, adaptation; climate risk assessment).

- Impact measurement discipline (MEL framework, indicators/logframe, DI database/tool).

- Ethics and integrity controls (anti-corruption policy; ISO 37001 certification).

Disclosure Improvements

What is already strong

- Clear E&S gating logic for project eligibility and lifecycle screening is stated with defined stages (origination → diligence → approval).

- Materiality is treated as a living system, with stakeholder engagement + periodic refresh commitment.

- Quantitative headline metrics are provided to guarantee transaction activity and the renewable share of the power portfolio.

What would strengthen automated ESG tracking?

- Publish a machine-readable SDG index. The report states that the material topics are linked to the SDGs. Add a table that maps each material topic and flagship programme to explicit SDG numbers and (where possible) SDG targets.

- Clarify assurance scope or transition to limited assurance for selected KPIs. The GRI index lists external assurance as “Not Available.” A limited assurance statement for a small set of KPIs (e.g., renewable share, mandate volumes, portfolio climate metrics) would improve comparability.

- Close the “Not Disclosed” gaps in GRI-aligned metrics. The GRI index shows several environmental indicators as “Not Disclosed” (e.g., energy consumption and waste quantities). Adding definitions, boundaries, and year-on-year values would improve time-series tracking.

- Turn the climate screening thresholds into portfolio reporting. The report references IFC Performance Standards and an emissions threshold for portfolio companies. This would include converting these standards into portfolio disclosure (e.g., number/% of portfolio companies reporting emissions, aggregate financed emissions proxy where feasible), which would strengthen climate accountability.

- Standardise impact KPI definitions in the MEL system. The MEL framework and DI covenants are described as a KPI dictionary (units, frequency, owner, validation method), which would make the “external evaluations” claim more auditable for ESG tracking.

Kindly note that Sustainable Stories Africa (SSA) has conducted this review independently, without any financial, material or other inducements, to ensure objectivity, integrity and transparency in highlighting InfraCredit’s sustainability disclosures.