Uganda’s National Social Security Fund (NSSF) frames sustainability as a significant part of its operations (“not an add-on”) and positions the Board as accountable for delivering ESG commitments, supported by committee oversight spanning ethics, environment, stakeholder engagement, and sustainability/community development.

The report states it was prepared with consideration for multiple governance and reporting references, including King IV, the Integrated Reporting Framework, GRI Standards, SDGs, IFRS, and TCFD, and notes ongoing work following the adoption of IFRS S1 and S2 standards.

On climate, NSSF discloses an ambition to develop a net-zero roadmap to 2050 covering Scopes 1, 2, and 3 and reports a 2024 pledge targeting a 13.58% reduction in GHG emissions versus a 2024 baseline assessment, while also stating that the baseline external assessment was not achieved and that a detailed GHG emissions analysis is not included due to insufficient monitoring and evaluation mechanisms.

On social and economic outcomes, the Managing Director highlights programmes and results, including Borderless Education (digital learning materials planned for 300 rural schools), pilots for affordable healthcare products for the informal sector, and the Hi-Innovator Programme (since its inception - 438 startups supported; 38,563 direct and 163,760 indirect jobs created).

The report also describes membership expansion efforts targeting the onboarding of the informal sector and a goal of 15 million members by 2035. Financially, it reports an 11.5% interest rate credited to 2,303,230 member accounts (vs 2,168,210 the prior year) and documents engagement metrics for the Annual Members Meeting.

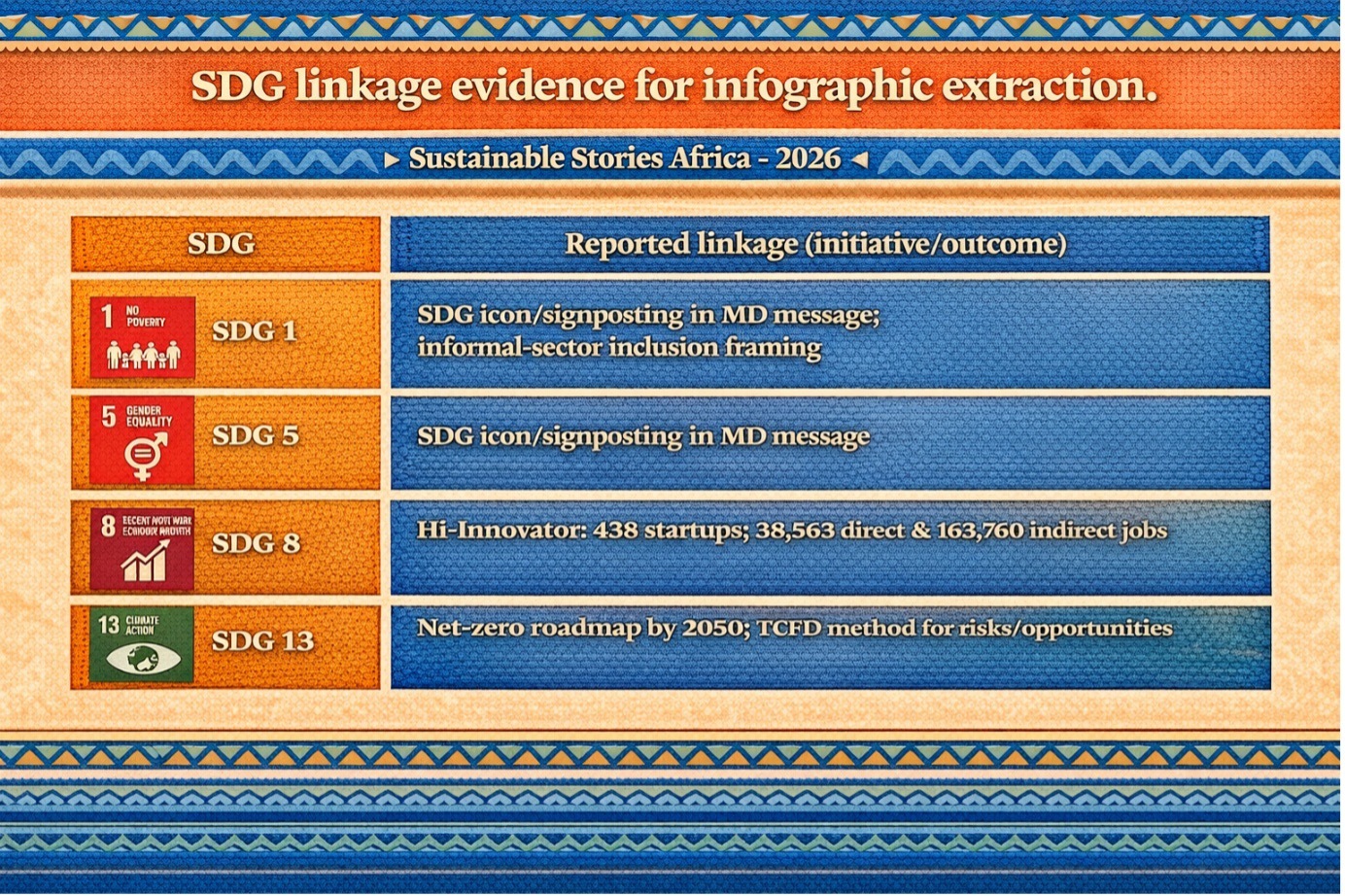

SDG Alignment

SDGs explicitly signposted in leadership messaging

The Managing Director's message foregrounds SDG 1 (No Poverty), SDG 5 (Gender Equality), SDG 8 (Decent Work and Economic Growth), and SDG 13 (Climate Action).

How SDGs show up in initiatives

- SDG 4 (Quality Education) linkage is stated through Borderless Education, planned to deliver digital learning materials to 300 rural schools.

- SDG 8 (Decent Work) linkage is evidenced through Hi-Innovator support to 438 startups and reported job creation (38,563 direct; 163,760 indirect).

- SDG 13 (Climate Action) alignment is expressed via a net-zero ambition by 2050 and application of TCFD for climate risk/opportunity evaluation.

- SDG 1 / SDG 8 adjacency is implied by informal-sector expansion and financial inclusion products (e.g., “Smartlife” noted as a voluntary savings product for informal workers).

Geography of SDG impact

Impacts and programmes are framed nationally (Uganda) with implementation referenced across “multiple districts” and “11 districts” for livelihoods, but the report excerpt does not provide a single SDG-by-district scorecard.

SDG linkage evidence for infographic extraction

SDG | Reported linkage (initiative/outcome) |

|

|---|---|---|

SDG 1 | SDG icon/signposting in MD message; informal-sector inclusion framing |

|

SDG 5 | SDG icon/signposting in MD message |

|

SDG 8 | Hi-Innovator: 438 startups; 38,563 direct & 163,760 indirect jobs |

|

SDG 13 | Net-zero roadmap by 2050; TCFD method for risks/opportunities |

|

ESG Management

Governance and oversight

- The report assigns ESG delivery responsibility to the Board, supported by committees covering Social & Economic Development, Ethics, Environment, Stakeholder Engagement and Management, and Sustainability and Community Development.

- The Board approved the 2025 Sustainability Report on 22 September 2025 and states it reviewed the report for accuracy and fair reflection of performance.

Reporting frameworks referenced

The NSSF states that the ESG report was prepared with consideration given to King IV, the Integrated Reporting Framework, GRI, SDGs, IFRS, and also references TCFD adoption among frameworks/standards.

Assurance approach

The Internal Audit function is presented as a central assurance mechanism, with a plan to expand scope over the next 12 months to review ESG frameworks as part of assurance activities, and to provide assurance across six capitals (manufactured, financial, natural, intellectual, human, social/relationship).

Initial Areas of Impact

The report’s early impact narrative clusters around:

- Inclusive coverage expansion (informal sector): onboarding campaigns and sector-specific drives (market vendors, boda-boda operators, farmers), plus 13 community-based livelihoods programmes and a livelihoods cohort in 11 districts.

- Member value/financial delivery: declared 11.5% interest, credited to 2,303,230 accounts (vs 2,168,210 prior year), and reported digital reach for the Annual Members Meeting.

- Enterprise and jobs: Hi-Innovator outcomes since inception, 438 startups, 38,563 direct and 163,760 indirect jobs.

- Education and social protection pilots: Borderless Education (300 rural schools) and piloting affordable healthcare products for informal-sector needs.

- National development real assets: reference to projects such as Lubowa Housing Estate, Temangalo, and Pension Towers as part of the national development contribution framing.

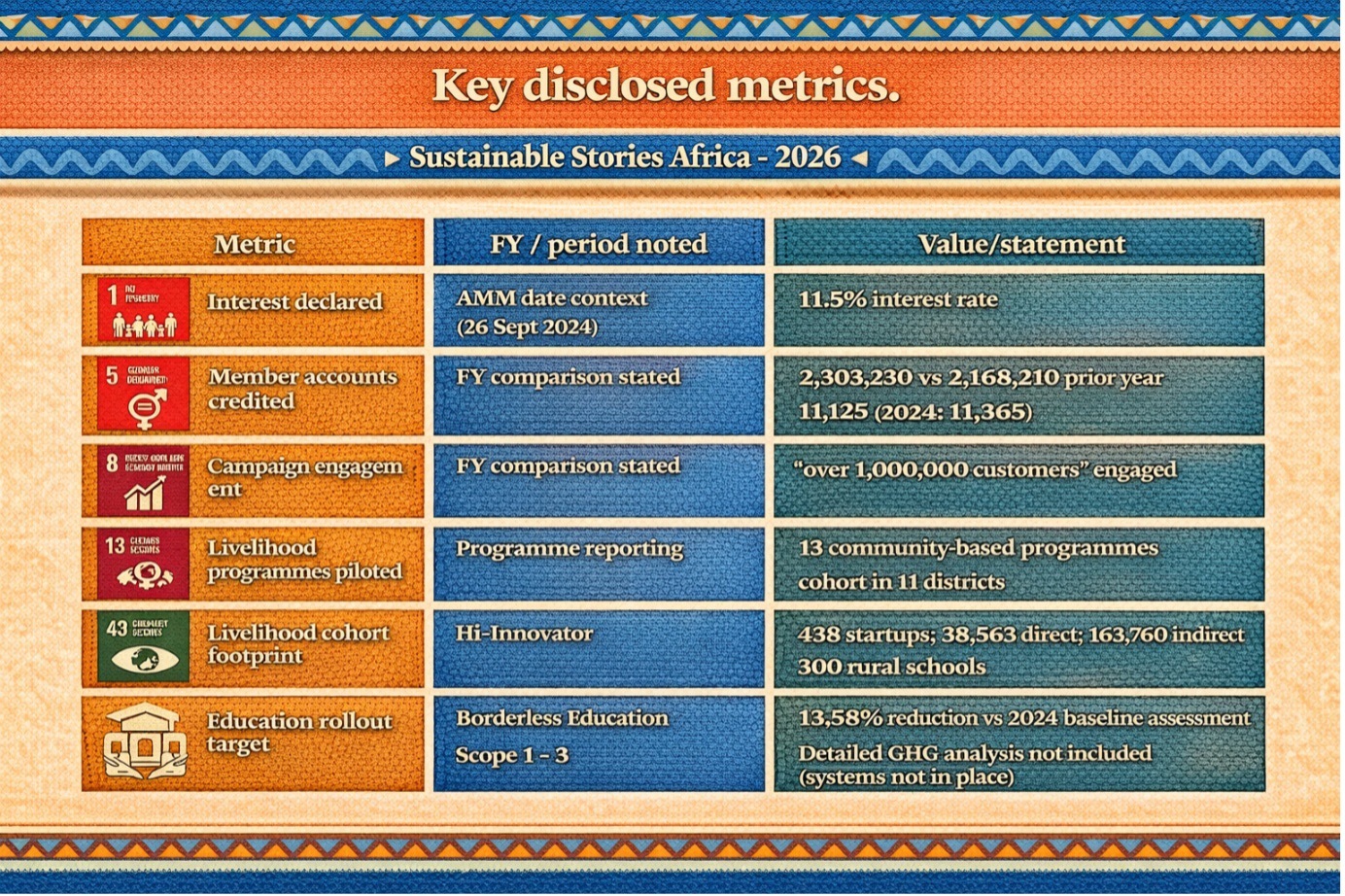

Metrics for Definition

The report provides several quantifiable indicators, while also flagging gaps in emissions quantification.

Key disclosed metrics

Metric | FY / period noted | Value/statement |

|

|---|---|---|---|

Interest declared | AMM date context (26 Sept 2024) | 11.5% interest rate |

|

Member accounts credited | FY comparison stated | 2,303,230 vs 2,168,210 prior year |

|

AMM real-time views | FY comparison stated | 11,125 (2024: 11,365) |

|

Campaign engagement | AMM context | “over 1,000,000 customers” engaged |

|

Livelihood programmes piloted | Programme reporting | 13 community-based programmes |

|

Livelihood cohort footprint | Programme reporting | cohort in 11 districts |

|

Startups supported (since inception) | Hi-Innovator | 438 startups |

|

Jobs created (since inception) | Hi-Innovator | 38,563 direct; 163,760 indirect |

|

Education rollout target | Borderless Education | 300 rural schools |

|

GHG reduction pledge | 2024 pledge | 13.58% reduction vs 2024 baseline assessment |

|

Emissions inventory completeness | Scope 1 – 3 | Detailed GHG analysis not included (systems not in place) |

|

Verification/assurance status

The report describes Internal Audit-led assurance and a planned expansion to review ESG frameworks; it does not, in the cited sections, describe external limited/reasonable assurance over ESG KPIs.

Areas of Focus

Forward priorities are stated as:

- Vision 2035 (“50:50:95”): 50% workforce coverage, UGX 50 trillion in assets, and 95% stakeholder satisfaction as a measurement agenda.

- Coverage expansion: target 15 million members by 2035, with focus on informal sector participation.

- Net Zero 2050: roadmap development for Scopes 1 – 3.

- Reporting system upgrades: phased approach to integrating IFRS S1/S2, including incorporation into finance policy/procedures and engagement with national roadmap discussions.

Materiality Concepts

Material topics disclosed

The report states that the following ESG topics were identified as key to strategy, spanning environmental, social, and governance items, including carbon emissions, biodiversity, real estate portfolio, post-consumer waste, sustainable investments, diversity & inclusion, social impact (CSI), employee well-being, relevance to members, ethics & compliance, regulatory compliance, and political interference.

Materiality process notes (how it was framed)

The report notes the assessment focused on impact rather than activity/input and provides a “next steps/action/progress/target” style table structure in the same section.

Materiality matrix publication: in the extracted sections available here, a scored matrix graphic is not shown; however, the topic set is clearly enumerated.

Sustainability Risk Management Concepts

Approach and structures

- TCFD is explicitly referenced as the methodology applied to evaluate and disclose climate risks and opportunities.

- Internal Audit is positioned as a control function tracking ESG-related regulatory changes and expanding review coverage of ESG frameworks over 12 months.

Key risks signposted (from disclosed topic set and climate section)

- Climate/transition risk: climate change impacts on Uganda (with agriculture referenced) and the need for a robust net-zero baseline system.

- Data/measurement risk: The report states that baseline assessment was not achieved, and emissions analysis is not included due to missing monitoring/evaluation mechanisms.

- Governance risk: “political interference” is explicitly listed among governance-related ESG topics.

- Regulatory compliance risk: “regulatory compliance” and ESG framework updates are repeatedly referenced.

Sustainability Strategy Concepts and Management

How the strategy is defined

The report includes an explicit leadership statement: “sustainability is not a parallel agenda” and frames sustainability as “how we build Uganda’s future.”

Strategy levers (bullet-ready for infographic layout)

The report summarises sustainability through a set of levers:

- Social responsibility: affordable housing, mixed-use developments, and financial literacy.

- Governance and reporting: governance structures and adoption of IR Framework and IFRS standards.

- Sustainable investments: ESG-compliant companies, green building, renewable energy, infrastructure.

- Employee wellness: mental health campaigns, checkups, wellness programmes.

- Stakeholder engagement & partnerships: regular stakeholder communication and collaborations to address societal needs.

- Net Zero 2050: roadmap development across Scopes 1– 3.

Is the strategy being updated?

The report indicates an iterative integration of IFRS S1/S2 into the sustainability framework, aligning a phased approach to standards adoption, implying continued refinement in future cycles.

Disclosure Improvements

NSSF’s report establishes governance, ownership, and a clear direction of travel (Vision 2035, Net Zero 2050), but the next edition can move from ambition-led narrative to audit-ready ESG comparability:

- Publish an SDG index (initiative → SDG target → metric → geography). The report highlights the SDGs and programmes; however, a single table mapping each flagship programme (Hi-Innovator, Borderless Education, livelihoods pilots, housing) to SDG targets and district footprint would materially improve comparability.

- Close the emissions quantification gap. The report discloses a 13.58% reduction pledge compared to the baseline, but also confirms the baseline assessment was not completed and omits detailed GHG analysis. The next edition should add a complete Scope 1/2/3 inventory (boundary, methodologies, emission factors, and base year) aligned to the net-zero roadmap narrative.

- Convert “topic lists” into measurable management dashboards. The report clearly enumerates material ESG topics (including political interference, regulatory compliance, biodiversity, waste, and real estate). Add owners, KPIs, targets, and progress status per topic (Board/committee link + management function).

- Disclose a sustainability risk register aligned to TCFD. The report cites the use of TCFD and the expansion of Internal Audit. A structured register including (risk, likelihood/impact, controls, KRIs, mitigation timelines, escalation forum) would make climate and governance risks machine-readable and decision-grade.

- Clarify assurance boundaries. Internal Audit assurance is described across six capitals; the report sections cited do not specify external assurance over ESG KPIs. Stating whether any indicators are externally assured (and under which standard) would increase confidence for automated tracking use cases.

Kindly note that Sustainable Stories Africa (SSA) has conducted this review independently, without any financial, material or other inducements, to ensure objectivity, integrity and transparency in highlighting Uganda’s National Social Security Fund’s sustainability disclosures.