Axxela 2024: Gas, Governance, Measured Impact

Axxela’s 2024 Sustainability Report covers the calendar year 1st January – 31st December 2024 and is their 8th annual sustainability report.

The report was developed with CSR-in-Action Consulting and includes independently audited extracts from the financial statement.

The report was prepared in accordance with GRI Standards (2021) and independently assured by DQS Management Systems (ISO/IEC 17021-1:2015) under ISAE 3000 (Revised) for a selection of disclosed indicators.

Across operational and value-chain themes, Axxela's primary climate-and-economy focus is on natural gas infrastructure and customer fuel-switching, reporting a 30.50% reduction in GHG emissions across customer operations and “displacing over 734,718 tonnes of CO₂ equivalent” during the period.

The report also highlights methane as a key operational focus, noting emissions sources (pipeline leaks and operations) and stating an intent to minimise methane “to levels as low as reasonably practicable,” alongside measures such as equipment upgrades, maintenance, and workforce training.

Quantitatively, the report discloses methane and Scope 1 figures, including Methane emissions from Scope 1 (184.834 tCO₂), global Scope 1 emissions (10,316.7 tCO₂), and methane as 1.79% of Scope 1.

Regarding social and governance outcomes, Axxela reported 8 million LTI-free man-hours and a 92% customer satisfaction rating. Community interventions cited include donations to the FRSC Lagos State Sector Command, medical equipment support to a primary health centre in Sagamu (Ogun State), and scholarships for 100 pupils in Lagos State.

Materiality and governance architecture are described through stakeholder engagement mapping and a “Top 12” material topics set to shape priorities and disclosure.

SDG Alignment

What the report explicitly shows

- The report notes successful registration with the UN Global Compact (UNGC) (a signal of alignment with UNGC principles); however, it does not present an explicit SDG-by-SDG mapping table in the excerpts available in the report.

Practical SDG inference from disclosed initiatives (evidence-linked, not peer-comparative)

- SDG 13 (Climate Action) / SDG 7 (Affordable & Clean Energy) linkage is implicitly reflected in the report’s emissions-reduction framing through customer fuel switching to gas and methane management disclosures. (Axxela, reported avoided emissions and methane strategy).

- SDG 3 (Good Health and Well-being) and SDG 4 (Quality Education) are implicitly supported through health-centre equipment donations and “Back to School” scholarships for 100 pupils.

Geography of reported SDG-type impacts

- The report’s social interventions specify Nigerian locations, including Lagos State and Sagamu, Ogun State.

- The report frames a national energy-transition ambition around accelerating “Nigeria’s shift toward becoming a gas-powered economy.”

Constructive improvement (SDG alignment): Axxela should publish a clear SDG index that maps each flagship initiative, metric, and target to specific SDGs and indicators (including geographic footprint by state/region).

ESG Management

Governance structure

- Axxela describes a governance model based on four pillars: Business Governance & Integrity, Customer Centricity, Environmental Stewardship, and Human Capital Development.

- ESG execution roles referenced include an ESG Steering Committee, cross-functional ESG champions, and a CSR Action Team (as part of the governance model narrative).

Reporting frameworks, assurance, and boundaries

- Reporting is stated to be in accordance with GRI Standards (2021).

- External assurance is stated as conducted by DQS Management Systems under ISAE 3000 (Revised)for selected indicators, with DQS accredited to ISO/IEC 17021-1:2015.

- Emissions accounting includes an “operational control approach,” and a prior-year Scope reclassification is described (diesel usage by a third-party logistics vendor moved from Scope 1 to Scope 3 in line with GHG Protocol principles).

Risk and compliance governance

- The report references a Risk Control Self-Assessment (RCSA) approach used “across the business divisions” to identify “potential risks and their causes,” alongside “risk response strategies.”

- Governance and integrity controls referenced include policies such as anti-corruption,whistleblowing, conflict of interest, third-party due diligence, and compliance, as well as training/awareness elements.

Initial Areas of Impact

Environment and climate outcomes (reported)

- Customer-side emissions outcome: 30.50% reduction and “over 734,718 tonnes of CO₂ equivalent” displaced (reported as a key result of “cleaner energy solutions”).

- Methane management focus: methane is described as a material operational issue with sources including “pipeline gas leaks and operational activities,” and mitigation via equipment/process upgrades, fuel transitions, maintenance, and employee training.

Social investments and community support (reported)

- Community interventions include: FRSC Lagos State Sector Command building donation, Igbepa Primary Health Centre (Sagamu, Ogun State) medical equipment donation, and scholarships to 100 pupils in Lagos State.

Operations and customer experience (reported)

- Digital/operational improvements include a SCADA system upgrade with mobile accessibility and a “one-stop Customer Portal” providing real-time information.

- Service metrics highlighted: 92% customer satisfaction rating.

- Safety metric highlighted: 8 million LTI-free man-hours.

Metrics for Definition

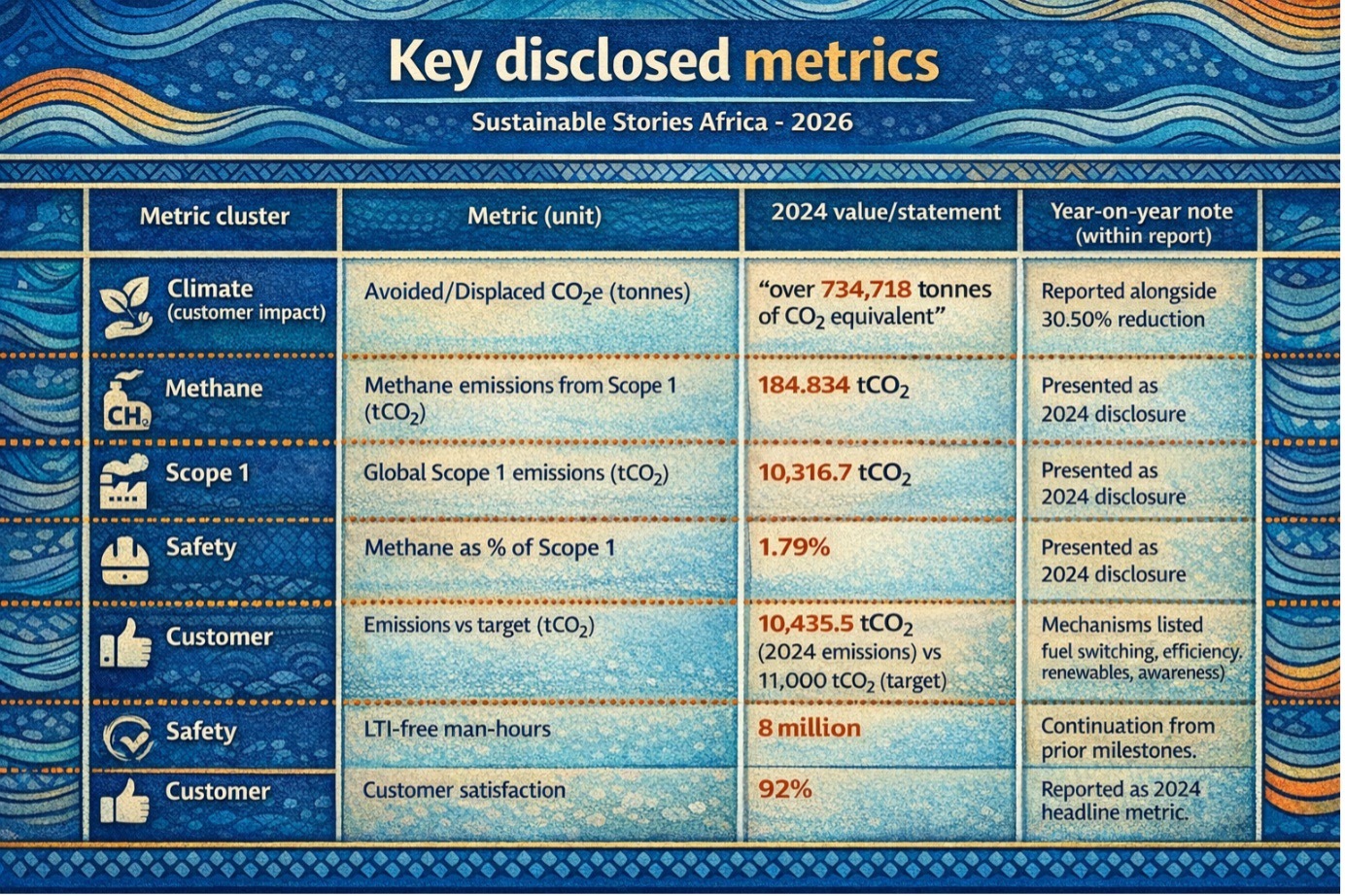

Key disclosed metrics

Metric cluster | Metric (unit) | 2024 value/statement | Year-on-year note (within report) |

|---|---|---|---|

Climate (customer impact) | Avoided/Displaced CO₂e (tonnes) | “over 734,718 tonnes of CO₂ equivalent” displaced | Reported alongside 30.50%reduction |

Methane | Methane emissions from Scope 1 (tCO₂) | 184.834 tCO₂ | Presented as 2024 disclosure |

Scope 1 | Global Scope 1 emissions (tCO₂) | 10,316.7 tCO₂ | Presented as 2024 disclosure |

Methane ratio | Methane as % of Scope 1 | 1.79% | Presented as 2024 disclosure |

Emissions target | Emissions vs target (tCO₂) | 10,435.5 tCO₂ (2024 emissions) vs 11,000 tCO₂(target) | Mechanisms listed (fuel switching, efficiency, renewables, awareness) |

Safety | LTI-free man-hours | 8 million | Continuation from prior milestones |

Customer | Customer satisfaction | 92% | Reported as 2024 headline metric |

Assurance/verification

- Sustainability report assurance: independent assurance over selected indicators under ISAE 3000 (Revised) by DQS Management Systems is stated.

Constructive improvement (metrics): expand disclosed baselines and definitions (e.g., explicit organisational boundary by entity, full Scope 1/2/3 totals, and methodology details per indicator) beyond headline tables.

Areas of Focus

Stated forward priorities (from narrative commitments)

- Short-term climate focus: the report states Phase 1 of the ESG Strategy includes energy efficiency (equipment/process upgrades), cleaner fuel transitions (gas/renewables “where feasible”), maintenance, and employee training.

- Long-term strategy: renewable energy integration and “continued development and active investment in natural gas infrastructure” to broaden the energy portfolio and “support a just energy transition.”

- Policy stance: support for carbon pricing systems and participation in “regulatory compliance and policy advocacy to support emissions reduction.”

- Capital planning: expectation to raise capital “primarily through bonds and equities” to support sustainability-aligned initiatives.

Leadership tone: “Our mission remains steadfast: to deliver innovative energy solutions that accelerate Nigeria's shift toward becoming a gas-powered economy.”

Materiality Concepts

Materiality method and outputs (as published)

- The report states it conducted stakeholder engagement and materiality assessment, listing a “Top 12 Material Topics” derived from an “impact and priority level” approach.

- The “Top 12 Material Topics” are explicitly listed as: Economic performance; Sustainable supply chain; Climate change; Customer satisfaction; Health & Safety; Community engagement; Waste management; Business ethics; Labour management; Diversity & inclusion; Employee training & development; Product quality.

- A stakeholder engagement matrix is referenced, showing stakeholder groups and engagement methods/frequency (e.g., customers, suppliers, regulators, employees).

How materiality influences strategy/governance (as stated)

- The report frames material topics as shaping what is prioritised and reported, noting the importance of “managing material topics and their associated impacts.”

Constructive improvement (materiality): publish the full materiality matrix graphic with scoring thresholds and stakeholder weighting, and link each material topic to the relevant KPI set and ownership (committee/function).

Sustainability Risk Management Concepts

Approach and governance (as described)

- Risk identification and response are described via Risk Control Self-Assessment (RCSA) across business divisions, intended to identify “potential risks and their causes” and define “risk response strategies.”

- Ethics and compliance risk controls referenced include anti-corruption, whistleblowing, conflict of interest, third-party due diligence, and compliance.

Key sustainability risks evidenced by disclosures (not exhaustive)

- Climate/methane risk: methane leaks and operational methane sources are explicitly stated, with mitigation through efficiency and maintenance measures.

- Regulatory transition risk: the report notes participation in “policy advocacy” and regulatory compliance to support emissions reduction and cleaner transitions.

- Supply-chain emissions/efficiency risk: Sustainable supply chain management is stated as a “top concern,” aiming to improve transportation efficiency and reduce emissions.

Constructive improvement (risk): disclose a consolidated sustainability risk register that ties each material ESG risk to likelihood/impact, controls, Key Risk Indicators (KRIs), and escalation owners (including board/committee links).

Sustainability Strategy Concepts and Management

How strategy is defined in the report

- The report explicitly links climate mitigation actions to “Phase 1 of our ESG Strategy,” focused on efficiency, cleaner fuels, maintenance, and training.

- Longer-term direction includes renewable integration and continued investment in gas infrastructure to support a “just energy transition.”

Strategy pillars

- Energy efficiency & process upgrades

- Cleaner fuel transitions (gas/renewables where feasible)

- Maintenance and operational controls

- Employee training and awareness

- Renewable energy integration (long term)

- Sustainable supply chain management

- Regulatory compliance and policy advocacy

Constructive improvement (strategy): clarify whether “Phase 1” has defined timelines, interim milestones, and how/when subsequent strategy phases will be reported.

Disclosure Improvements

To deepen transparency and enable robust automated ESG tracking, Axxela’s sustainability reporting can evolve from narrative compliance to data-driven clarity.

Explicit SDG mapping would link initiatives and KPIs to specific targets and national/regional impacts, moving beyond high-level UNGC alignment.

A detailed emissions inventory, covering Scope 1, 2 and 3 with clear organisational boundaries, would strengthen climate accountability, especially around restated figures.

Multi-year targets and decarbonisation pathways can replace single-year benchmarks, showing long-term intent.

Publishing materiality scoring methods, KPI ownership and governance links would enhance credibility, while a structured ESG risk register would clarify exposure, controls and resilience priorities.

What would strengthen automated ESG tracking (without changing the story)

- Explicit SDG mapping: publish a table linking initiatives/KPIs to SDG targets and geographies (state/region), beyond UNGC registration.

- Full emissions inventory: add complete Scope 1, Scope 2, and Scope 3 totals, organisational boundary by entity, and clearer reconciliation of restatements (the report already notes a Scope reclassification for a third-party logistics component).

- Targets and pathways: expand from single-point target disclosure (e.g., 2024 emissions vs target) to multi-year trajectories and decarbonisation pathway assumptions.

- Materiality transparency: publish scoring methodology/weights and connect each material topic to a KPI owner and governance forum.

- Risk register format: disclose ESG risk categories (climate, social, regulatory, integrity) with likelihood/impact and control effectiveness, building from the stated RCSA approach.

Kindly note that Sustainable Stories Africa (SSA) has conducted this review independently, without any financial, material or other inducements, to ensure objectivity, integrity and transparency in highlighting Axxela’s sustainability disclosures.