Absa’s 2024 Sustainability and Climate Report: R121.1 billion Finance Milestone, Net-Zero Roadmap

Absa Group Limited’s Sustainability and Climate Report 2024 outlines how the Group integrates sustainability, climate transition planning, and financial inclusion into its pan-African banking strategy.

The report covers the period from January 1 to December 31, 2024, and applies the principles of double materiality (financial and impact) to identify sustainability-related risks and opportunities.

In 2024, Absa exceeded its sustainable finance ambition, achieving R121.1 billion in sustainable finance, surpassing its R100 billion target one year ahead of schedule.

Operational emissions declined by 33.2%, progressing toward a 51% reduction target by 2030 (from the 2018 baseline). The Group maintains a long-term target of obtaining net zero across Scope 1, 2 and 3 emissions by 2050.

Financial inclusion remains central, with 12.7 million customers served in 2024 (2023: 12.2 million). ESG bonds issued totalled R10.9 billion. Absa retains B-BBEE Level 1 status, has 36% women on the Board, and reports 39.7% women in senior leadership.

Climate risk governance is embedded through scenario analysis, IFRS S2-aligned disclosures, and internal climate stress testing under the guidance of the Prudential Authority. Deloitte provided limited assurance on selected disclosures in alignment with ISAE 3000 and ISAE 3410 (GHG).

Material matters include climate change, just transition, financial inclusivity, socio-economic stability, diversity and inclusion, responsible and resilient value chains, and evolving stakeholder expectations.

Overall, the report reflects measurable progress in the delivery of sustainable finance, transition planning, and integration of governance. Continued enhancement of Scope 3 coverage, insured emissions tracking, and sector-level transition targets would strengthen forward-looking comparability.

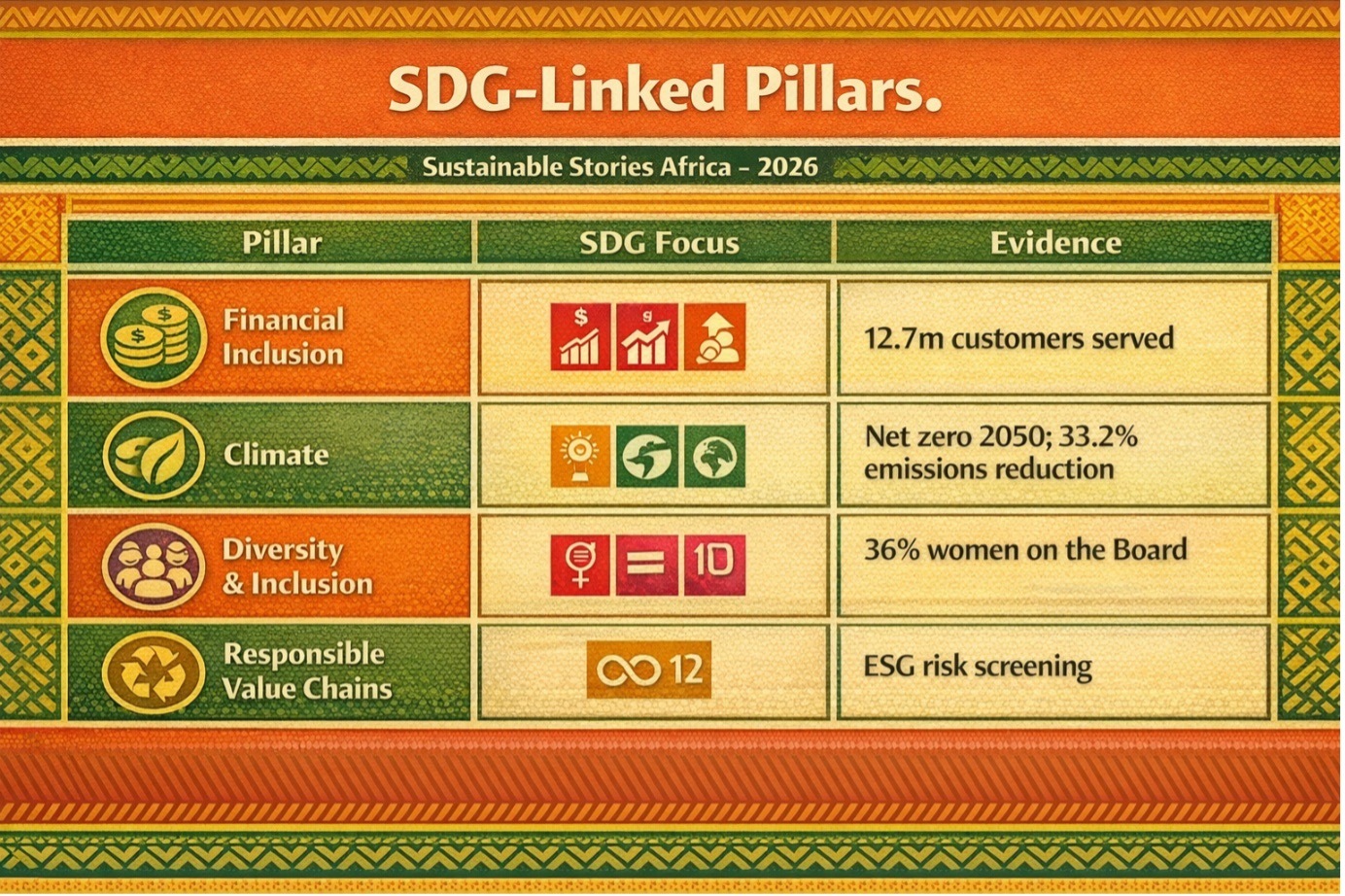

SDG ALIGNMENT

Absa aligns sustainability pillars with priority SDGs, including financial inclusion, climate action, responsible supply chains, and inclusive growth.

SDG-Linked Pillars

Pillar | SDG Focus | Evidence |

|---|---|---|

Financial Inclusion | SDG 1, 8 | 12.7m customers served |

Climate | SDG 7, 13 | Net zero 2050; 33.2% emissions reduction |

Diversity & Inclusion | SDG 5, 10 | 36% women on the Board |

Responsible Value Chains | SDG 12 | ESG risk screening |

Geographic impact spans 12 African countries and four international markets.

ESG MANAGEMENT

Frameworks and Standards

Absa complies with:

- Companies Act, Banks Act, JSE Listing Requirements

- King IV

- UN Global Compact Principles

Aligned with:

- GRI

- GHG Protocol

- IFRS S1 and S2

- PRB reporting

Governance Oversight

- Oversight by Social, Sustainability and Ethics Committee (SSEC)

- Board-approved report (20 March 2025)

- Climate risk integrated in Enterprise Risk Management Framework

Assurance: Deloitte limited assurance under ISAE 3000 and 3410.

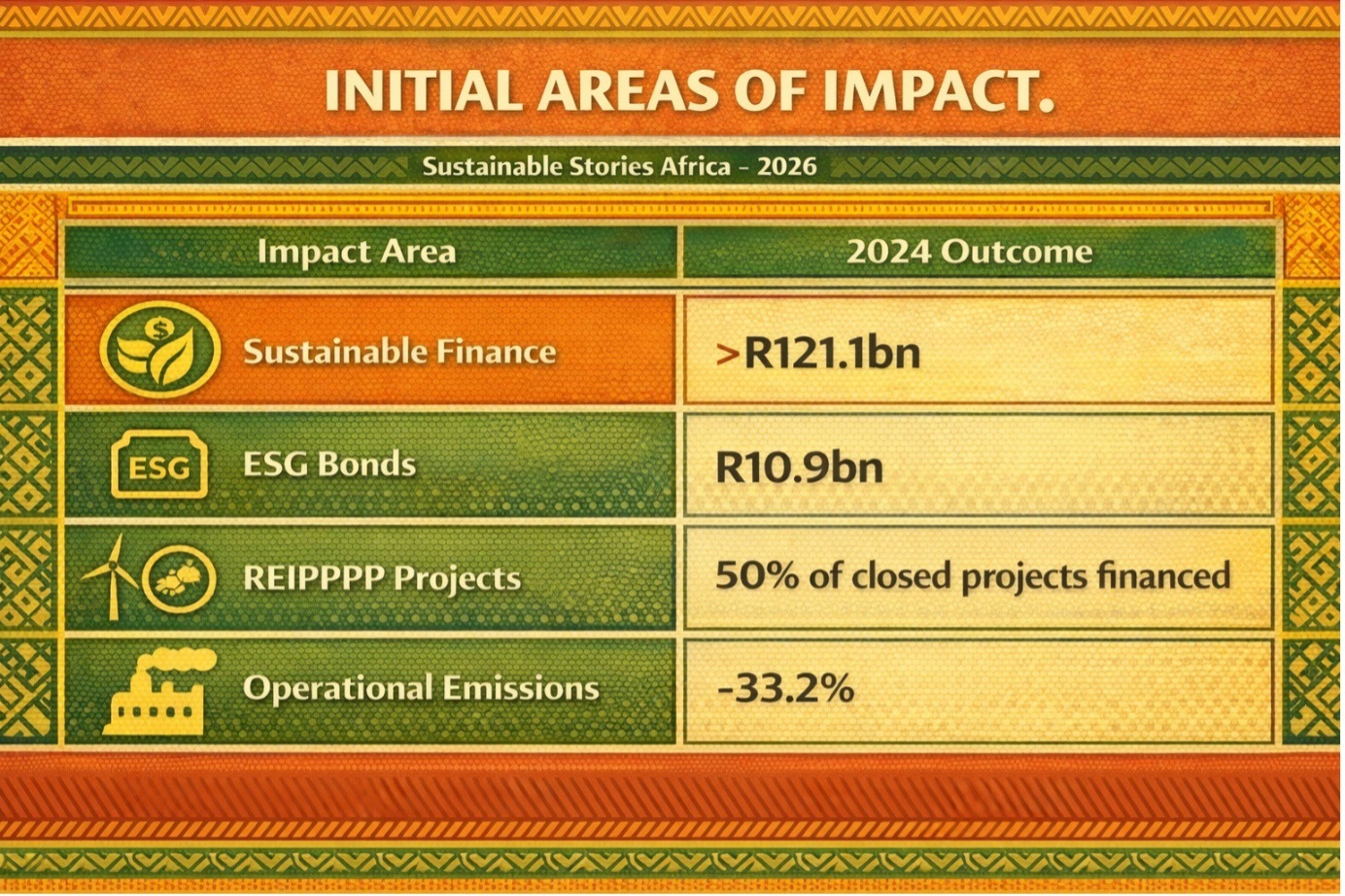

INITIAL AREAS OF IMPACT

Impact Area | 2024 Outcome |

|---|---|

Sustainable Finance | R121.1bn |

ESG Bonds | R10.9bn |

REIPPPP Projects | 50% of closed projects financed |

Operational Emissions | -33.2% |

Flagship example: Tanga UWASA Green Bond (Tanzania).

METRICS FOR DEFINITION

Climate Targets

Metric | Baseline | Target | Progress |

|---|---|---|---|

Own emissions | 2018 | -51% by 2030 | -33.2% |

Coal-financed emissions | — | -25% by 2030 | 11% annual decline |

Road transport intensity | 2023 | -26% by 2030 | Baseline established |

Scope 3 emissions financed tracking for coal, oil and gas is ongoing.

AREAS OF FOCUS

2025–2030 priorities:

- Refine sector glidepaths

- Complete climate transition plan

- Expand insured emissions framework (estimates expected 2025)

- Enhance sustainable finance selectivity

Long-term: Net zero Scope 1 – 3 by 2050.

MATERIALITY CONCEPTS

Material matters categorised under:

Impact & Financial Materiality

- Climate change

- Just transition

- Financial inclusivity

Impact Materiality

- Responsible & resilient value chains

- Evolving stakeholder expectations

- Diversity & inclusion

Materiality determined via structured scanning, impact assessment, and stakeholder input.

SUSTAINABILITY RISK MANAGEMENT

Climate risks are categorised into:

- Transition risk: policy, stranded assets, greenwashing risk

- Physical risk: chronic water stress, infrastructure damage

Management actions:

- Greenwashing Policy

- Climate stress testing (PA-aligned)

- Portfolio diversification

SUSTAINABILITY STRATEGY CONCEPTS

Three Strategic Pillars

- Financial Inclusion

- Diversity, Equity, Inclusion & Belonging

- Climate

Enablers

- Governance

- Corporate Citizenship

Strategy integrates scenario analysis, ESG-linked remuneration, and regulatory compliance alignment.

Disclosure Improvements

Progress

- Exceeded sustainable finance target.

- Strong operational emissions reduction.

- IFRS S2 transition roadmap.

- Sector-specific glidepaths emerging.

- Independent assurance in place.

Improvements

- Publish absolute Scope 3 financed emissions totals.

- Provide clearer oil & gas glidepath metrics.

- Expand insured emissions disclosures.

- Quantify portfolio alignment to 1.5°C scenarios.

- Increase forward-looking capital allocation disclosures by sector.

Kindly note that Sustainable Stories Africa (SSA) has conducted this review independently, without any financial, material or other inducements, to ensure objectivity, integrity and transparency in highlighting ABSA Group Limited’s sustainability disclosures.