As African exchanges prepare to launch dedicated platforms for green, social and sustainability-linked securities, the continent stands at a tipping point of capital-market innovation.

Global investors are realigning portfolios toward sustainability, and unless Africa's markets adapt, they risk missing out on the tide of institutional flows.

Africa's Green Capital Markets Opportunity

Africa's capital markets are entering a pivotal era. The recent commentary from the Rwanda Stock Exchange and African Securities Exchanges Association (ASEA) highlights the launch of the "Green Exchange Window" (GEW) as a dedicated listing and trading venue for green, social and sustainability-linked instruments.

This initiative underscores that turning savings into sustainable investments is no longer a niche ambition but a strategic imperative. Globally, investors are increasing allocation to ESG-aligned assets, leaving emerging markets, including those in Africa, to adapt or risk capital flight.

Why Africa Must Engage Now

The interest in greening African capital markets is driven by two intersecting trends: the surge in sustainable investment globally and the continent's urgent infrastructure and development financing gap.

Over $70 billion has already been raised in Rwanda through green and sustainability-linked bonds.

| Region | Illustrative "green" issuances | Comment |

|---|---|---|

| Rwanda | Over $70 billion raised | Local proof-case |

| Africa (total) | An estimated hundreds of billions are needed for infrastructure | Capital-gap imperative |

This framing positions Africa's market reform not just as compliance but as an opportunity.

What Can Change If We Act?

If capital markets embrace sustainable-finance infrastructure, corporations and governments across Africa can gain enhanced credibility, broader investor access and improved risk management.

A credible listing venue such as the GEW offers issuers and investors a transparent interface.

What Steps Are Required Immediately

Concrete steps to embed sustainability into African capital markets include:

- Standard-setting and transparency: Adopt globally aligned standards for listing and disclosure of green instruments.

- Market infrastructure upgrade: Exchanges must build dedicated windows (like GEW), verification frameworks, and trade ecosystems.

- Capacity building and incentives: Regulators, issuers and investors must be trained; policy incentives (e.g., tax relief) can catalyse issuance.

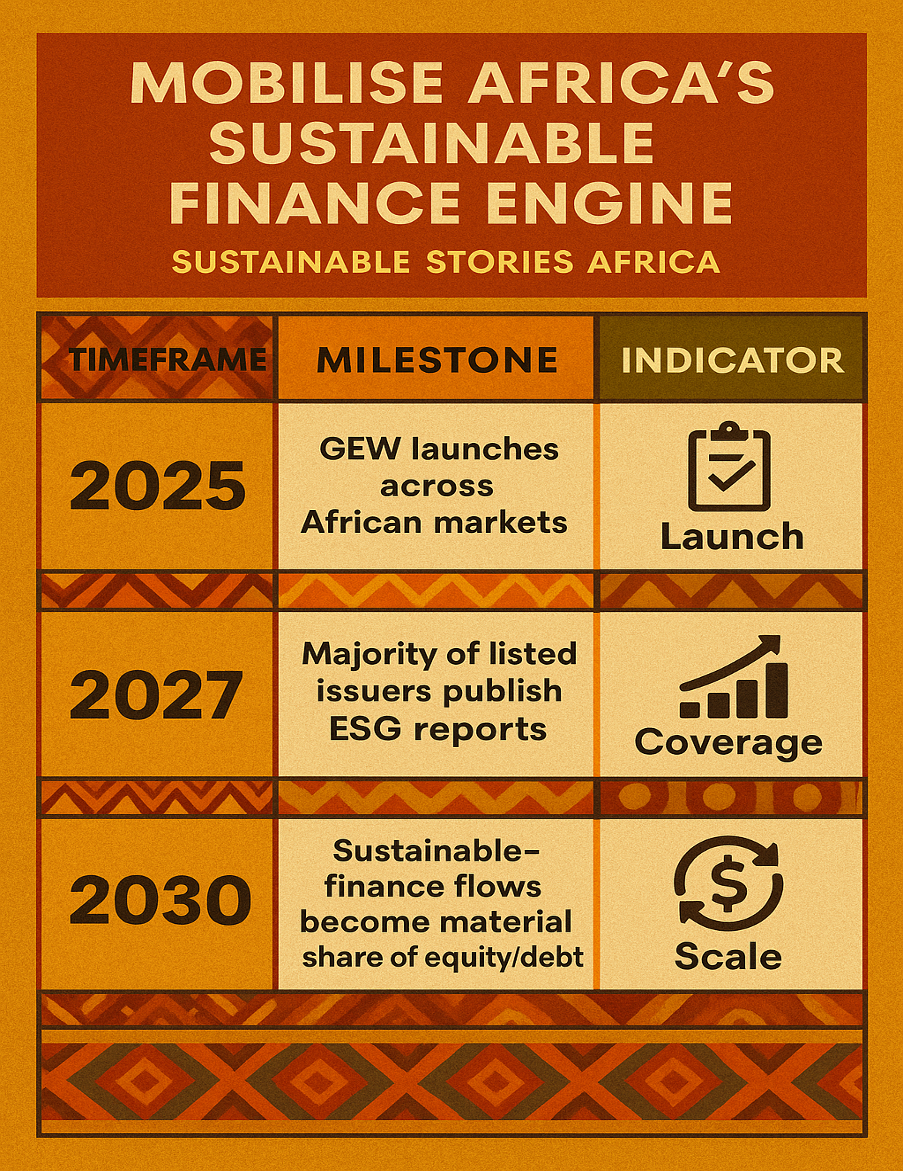

Path Forward: Mobilise Africa's Sustainable Finance Engine

To convert potential into performance, Africa must mobilise its sustainable-finance engine at scale. Exchanges, governments and development-finance institutions must coordinate on infrastructure, regulation and market design.

Only with credible platforms and consistent standards will African capital markets attract the global ESG dollars and channel them toward climate-resilient infrastructure, inclusive growth and sustainable development.

| Timeframe | Milestone | Indicator |

|---|---|---|

| 2025 | GEW launches across African markets | Dedicated window operational |

| 2027 | Majority of listed issuers publish ESG reports | > 50% of issuers disclose |

| 2030 | Sustainable-finance flows become material share of equity/debt markets | > 30% issuance sustainable linked |

Culled From: https://www.ktpress.rw/2025/11/africas-moment-to-green-its-capital-markets/