Africa stands at the frontline of sustainable finance transformation, yet continues to battle structural gaps in data, regulation, and market depth.

The Global Progress Report 2025 reveals both a leap forward and a stubborn lag: African nations are building taxonomies, expanding green finance frameworks, and integrating ESG risk, but without accelerated coordination, the continent risks missing the global transition window.

Africa Rising Through Global Shifts

Africa's financial markets are rarely seen as pacesetters in sustainable finance, yet the latest Global Progress Report 2025 shows a continent that is negotiating its place in a rapidly reconfigured global order.

While emerging economies drive 60% of new sustainable finance regulations, Africa is crafting some of the most ambitious taxonomies and disclosure reforms of any region, though scale, capacity and implementation remain Africa's Achilles heel.

The report's message is clear: the next decade will be decided not only by those who set global rules, but by those who adapt fastest.

From Lagos to Nairobi, Casablanca to Johannesburg, regulators and financial institutions are building frameworks that could anchor a low-carbon industrial revolution, if political will, market coordination and data reforms keep pace with global standards.

This opinion examines how Africa fits into the global transition puzzle and what the continent must do to avoid becoming the world's stranded asset in the green economy.

Africa's Sustainable Finance Moment Can't Wait

The Global Progress Report 2025 shows that 89 member institutions across 74 countries advanced sustainable finance frameworks last year, but Africa's trajectory is both promising and precarious.

The continent recorded its highest rate of reforms to date, led by Nigeria, South Africa, Kenya, Ghana and Morocco.

Yet Africa's sustainable finance architecture remains fragmented, with only a handful of countries aligning with global frameworks such as the ISSB standards, EU taxonomy and the Taskforce on Nature-related Financial Disclosures (TNFD).

The paradox is striking: Africa contributes less than 4% of global emissions, yet carries more than 60% of climate vulnerability. The report warns that the continent's inability to accelerate climate-risk integration will widen the financing gap, estimated at $277 billion annually until 2030. Africa's future may depend on how quickly its markets transform.

Inside the Global Progress Report 2025: What It Means for Africa

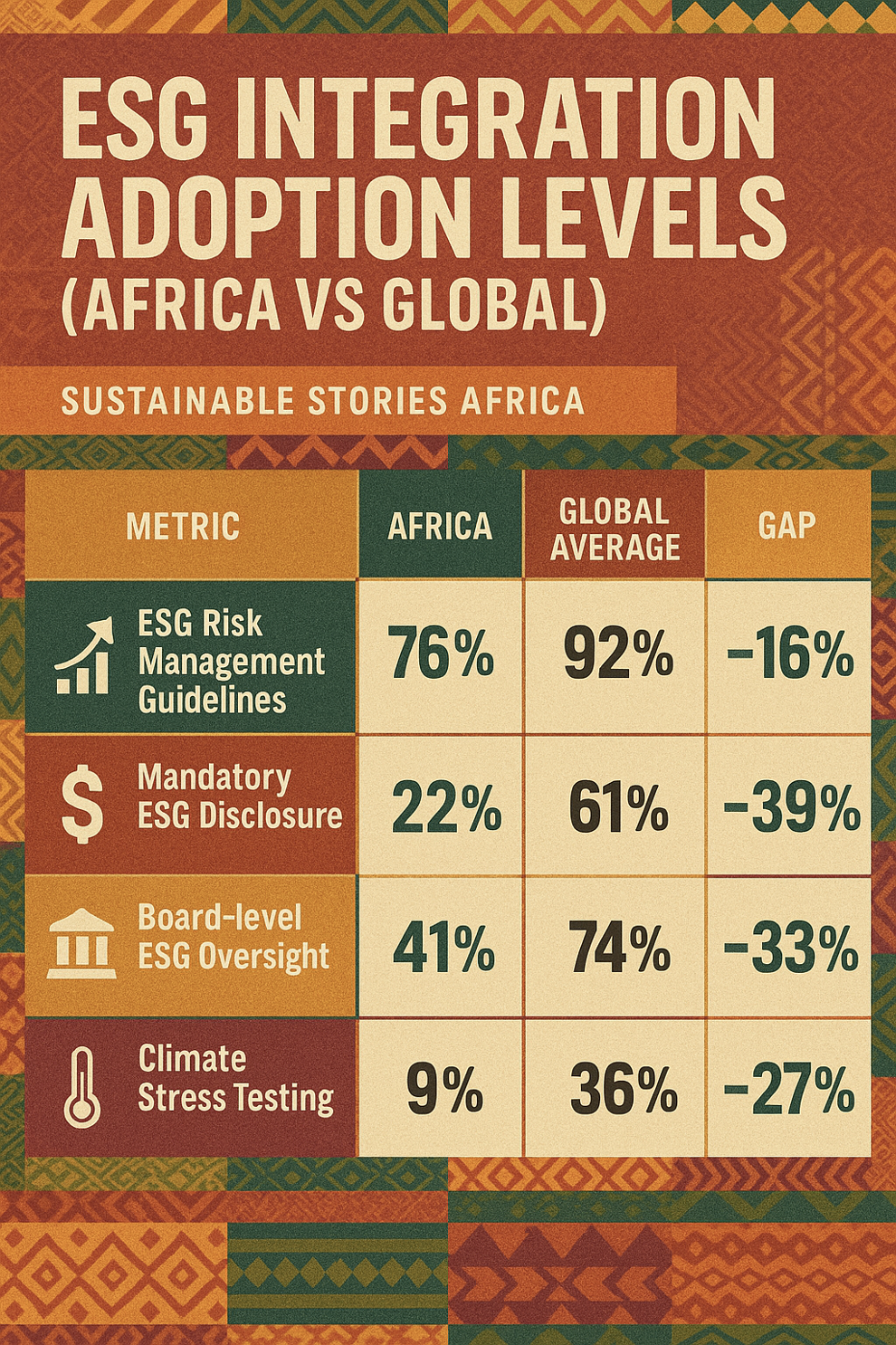

ESG Integration Is Accelerating, but Unevenly - The report highlights that 76% of participating African institutions have now adopted some form of ESG risk management guidelines.

However, only 22% have operationalised board-level reporting and mandatory disclosure structures aligned with ISSB or TCFD.

ESG Integration Adoption Levels (Africa vs Global)

| Metric | Africa | Global Average | Gap |

|---|---|---|---|

| ESG Risk Management Guidelines | 76% | 92% | –16% |

| Mandatory ESG Disclosure | 22% | 61% | –39% |

| Board-level ESG Oversight | 41% | 74% | –33% |

| Climate Stress Testing | 9% | 36% | –27% |

Africa is moving fast by local standards, slow by global ones.

Taxonomies: Africa Is Finally Building Its Own Architecture

The report shows a surge in taxonomy development across EMDEs. Africa is among the fastest-moving regions, with 11 countries at various stages of sustainable finance taxonomy development.

Nigeria and South Africa lead with fully developed taxonomies, while Kenya, Ghana and Morocco follow closely.

This shift places Africa in the global taxonomy convergence race and supports cross-border capital flows.

Financing Sustainable Development: Africa's Missed Opportunity

While global sustainable finance markets surpassed $4.7 trillion, Africa captured less than 1% of total green and sustainability-linked bond issuance in 2024.

Yet the continent holds one of the world's largest transition finance needs, from renewable energy expansion to transport systems, adaptation, water security, and resilience infrastructure.

The reality: Africa's green finance potential far outweighs its current market share.

Nature and Biodiversity Finance: The Sleeping Giant

The Global Progress Report shows exploding global interest in nature-positive finance frameworks, but African institutions lag:

- Only 8% incorporate nature-related risks.

- Only 3 countries are exploring TNFD alignment.

This is alarming for a continent that hosts 30% of the world's biodiversity hotspots.

Why Africa Must Lead, Not Follow, in Sustainable Finance

Africa's demographic transformation, natural capital, and renewable energy capacity position the continent as an indispensable player in global sustainability. The Global Progress Report frames a rare opportunity:

- Africa can leapfrog traditional finance systems.

- Build taxonomies that centre local realities.

- Develop climate-aligned capital markets.

- Mobilise domestic pools, such as pension funds, sovereign funds, and insurance capital, to drive long-term green investment.

Failure means the reverse:

- Higher sovereign borrowing costs

- Loss of competitiveness

- Increased climate shocks

- Stranded assets across energy and agriculture

- A locked-out position from global green value chains

A Playbook for African Regulators and Financial Institutions

- Standardise Frameworks Across the Continent – Africa must harmonise sustainable finance taxonomies, disclosure systems and climate-risk guidelines. Regional blocs—ECOWAS, SADC, EAC—can lead this coordination.

- Localise Global Standards – ISSB, TNFD, and transition finance definitions should be adapted to reflect African SME structures, informal markets and developmental needs.

- Strengthen Data Systems and Market Infrastructure – Without standardised emissions baselines and climate-risk data, investment will remain thin.

African regulators must invest in:

- Green data repositories

- National emissions registries

- Geo-spatial risk databases

- Taxonomy-aligned project tagging systems

- Mobilise Domestic Capital at Scale – The report emphasises the importance of African institutional investors. Pension and insurance funds should allocate a minimum of 5–10% to green and transition assets.

- Build Cross-Sector Coalitions – The region needs alliances between:

- Regulators

- Banks

- Insurers

- DFIs

- private equity

- climate funds

- philanthropies

This is how South Africa built its Just Energy Transition architecture and how Kenya scaled mobile-enabled green finance.

PATH FORWARD – Build Systems, Not Islands Of Reform

Africa's sustainable finance transition depends on speed, alignment and ambition. The continent must consolidate regulatory frameworks, accelerate taxonomy adoption and deepen climate-risk disclosure. Only then can it unlock meaningful volumes of green capital and project pipelines.

With harmonised standards, stronger data systems, and bold policy coordination, Africa can position itself not as a follower but as a shaper of the next global sustainable finance chapter.