Ireland's innovation playbook is not a miracle; it is a model built on patience, structure, data discipline and an obsession with validating ideas before building them. These are the words Mr. Hesus Inoma, Managing Director of i13 ventures.

From risk-transfer lessons in Portuguese insurance to discovery sprints in Limerick and venture-studio discipline in Dublin, African founders are being asked a hard question: Can we build better by slowing down first?

The Irish case study suggests, it is possible, but only if Africa embraces structured experimentation, trusted data, and staged capital.

Where Learning Shapes New Futures

Innovation rarely arrives fully formed. Sometimes, it walks in quietly through an immigrant child who leaves Nigeria at two, studies in Portugal, lands in Ireland during the Celtic Tiger boom, and becomes shaped by a culture of openness, meritocracy, and structured experimentation.

From the pubs of Limerick, where ideas breathe, to underwriting floors where consumer insights shape risk models, to US accelerator labs that test the limits of wearable-data ethics, the journey of Hesus reflects a broader pattern: how environments create or collapse entrepreneurial possibility.

And now, through a new Nigeria-Ireland innovation dialogue, these lessons arrive on African soil, challenging founders to rethink speed, funding, trust, customer discovery, and the deeper question of what it takes to build markets that work for millions, not just thousands.

Innovation Lessons Africa Must Not Ignore

The evening with Hesus revealed a truth African entrepreneurs rarely hear: ideas don't fail because they are bad; they fail because the market is not understood, validated, structured or patient enough to let them grow.

Hesus, after years in Portugal, Ireland, Spain, the US and France, described how early exposure to real-time risk modelling, data integrity, and meritocratic systems shaped his obsession with structured innovation. "Critical thinking started for me at the University of Limerick," he said. "They made us apply theory every day using newspapers. It forced us to think."

Ireland's economic rise was built not just on tax incentives but on systems that reduce failure risk, from work-study models to accelerator frameworks that vet ideas using customer interviews, paid pilots and early-stage data signals.

What the Irish Innovation Pipeline Actually Looks Like

Meritocracy, not gatekeeping – Ireland rewards capability over class or colour. "If you can do the job, off you go, nine out of ten times," he said. The environment allowed immigrants to rise quickly through underwriting, insurance innovation, and cross-portfolio management in global firms like Crédit Agricole.

Data as a trust contract – Hesus' introduction to insurance showed how traditional data (age, address) failed to capture real-world risk. Wearables revealed patterns such as sleep, heart rate, and consumption that could predict behaviour more accurately.

But ethical dilemmas emerged: US insurers wanted personal, not anonymised data. The team refused, anticipating a Cambridge Analytica-style backlash. "You can take the money and lock yourself to the insurer, but when a scandal happens, it falls on you."

Venture Studios: Discipline, not excitement

Ireland's new venture-studio model, supported by big tech organisations like Google, Microsoft and others, emphasises discovery first, building second.

Irish Venture-Studio Structure

| Stage | Activity | Cost/Value | Purpose |

|---|---|---|---|

| Discovery Sprint | Interviews, hypothesis testing | €35k–€50k | Validate real demand |

| Build Sprint | Prototype + customer evaluation | €250k saved using AI vs consultants | Ensure market-fit before scaling |

| Paid Pilot | Customer pays for early features | Validates willingness to pay | Prove business case |

| Venture Funding | Staged, metrics-driven | Angels + State matching up to €250k | Reduce founder dilution & build discipline |

Enterprise Ireland: The invisible backbone – The government pays founders to test ideas:

- €25,000 stipend for six months

- €100,000 follow-on funding

- €250,000 capital-matching with angels/VCs

This creates a vertical progression system where entrepreneurship is treated as a profession, not guesswork.

Africa Can Build Better – If It Builds Differently

The audience asked a practical question: How do you validate ideas in a chaotic market?

Hesus offered clear guidance:

- Validate with people who pay first.

- Don't build platforms for vendors who can't pay. Build for the side with purchasing power, then subsidise the weaker side later.

- Start with the smallest version of proof. Not an app. Not a marketplace. Just a repeatable exchange between user and vendor.

- Use "Staged Capital", not blind "Blind Patient Capital." Stage D capital means:

- Show returns for each tranche.

- Unlock new capital only after passing measurable gates.

- Avoid over-reliance on venture capital's power-law mentality.

"If someone is not willing to put money down, the problem is not real; it's entertainment."

- African markets hold the treasure: unmined data. From Lagos nightlife to transport corridors, every beat, every movement, every transaction holds insight.

"They have the data, but they're not mining it."

The opportunity? Clean, structure, and monetise Africa's hidden data economies—ethically.

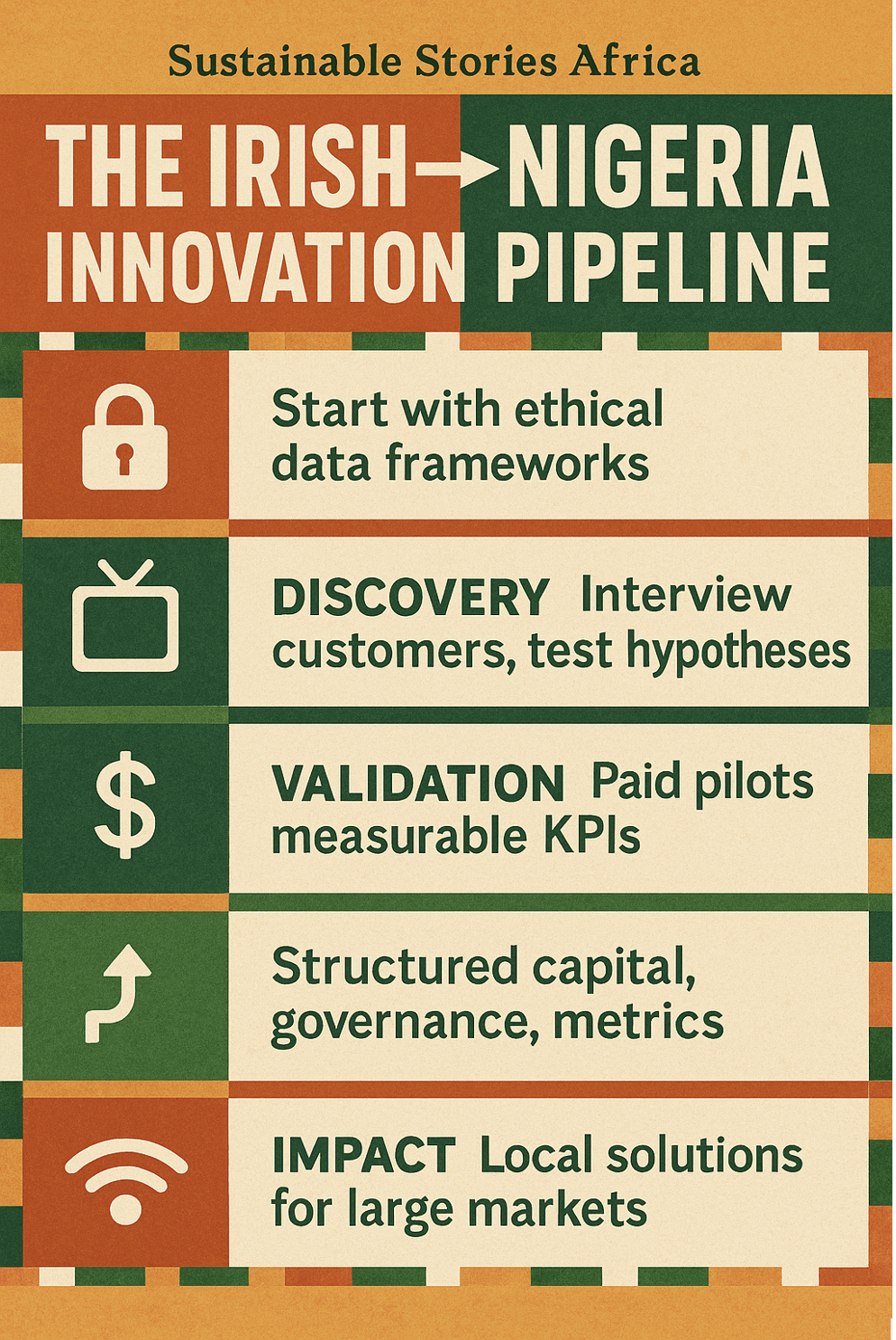

THE IRISH→NIGERIA INNOVATION PIPELINE

- Trust → Start with ethical data frameworks

- Discovery → Interview customers, test hypotheses

- Validation → Paid pilots, measurable KPIs

- Scaling → Structured capital, governance, metrics

- Impact → Local solutions for large markets

What Nigerian Founders Should Do Next – Immediately

- Validate your market through micro-tests - Not surveys, behaviour. Ask: Who pays, how often, and why?

- Build credibility with structured discovery - 5–10 interviews, not assumptions. Hypothesis → Test → Correct → Retest.

- Seek angels, not just VCs - Angels provide patience, mentorship and aligned expectations. VCs operate on power-law logic; one startup must return the whole fund.

- Think vertically: build systems, not apps - Look at agriculture, mobility, healthcare: start with value-chain inefficiencies before thinking "technology".

- Treat entrepreneurship like a profession - You need: Governance, data systems, customer insight loops, structured funding.

Not just grit.

PATH FORWARD – Build Slowly, Validate Deeply, Scale Wisely

Nigeria can borrow Ireland's most powerful engine: structured experimentation. Founders should validate markets through discovery sprints, test-worthy hypotheses, and paid pilots, before code, capital or scale.

Government, investors and hubs must build vertical innovation ladders: discovery funds, matched capital, and regulatory trust frameworks. This is how Nigeria and Africa will build companies that endure, not by speed, but by designing markets that want what they create.