Africa's oil and gas industry is discovering that sustainability is not just ethical, it is strategic. From Nigeria's flaring rules to Namibia's emerging gas fields, ESG frameworks are reshaping investor confidence and community relations.

But success depends on integration: aligning boardroom vision with local needs. At Africa Oil Week 2024, experts agreed - ESG done right is Africa's competitive edge.

Turning Obligations into Opportunities Through ESG

For Africa's oil and gas industry, sustainability is no longer just a compliance exercise; it is a growth strategy. At Africa Oil Week 2024 in Cape Town, energy executives, investors, and analysts agreed that Environmental, Social, and Governance (ESG) frameworks, when treated as strategic levers rather than tick-box tools, can redefine how resource wealth benefits both operators and host communities.

From Nigeria's tightening gas flaring regulations to new community-centred engagement models in Namibia and Ghana, the shift is clear: ESG has moved from corporate reporting jargon to competitive advantage. But realising this promise demands that African firms balance global expectations with local realities in embedding ESG at the heart of project design, not its margins.

Beyond Compliance – ESG as Competitive Advantage

"ESG is often seen as a blunt instrument,"

said moderator Robert Appelbaum of Webber Wentzel during the panel session, "but in Africa, it's highly nuanced."

His point captured a growing sentiment among executives: that sustainability cannot be imported; it must be integrated. Speakers, which included Eleanor Adaralegbe (CFO, Seplat Energy) and Dr Marion de Wet (Strategic Fuel Fund), argued that Africa's energy operators can gain an edge if ESG frameworks are viewed as catalysts for operational efficiency and investor trust, not as external impositions.

Dr De Wet noted that oil and gas ESG frameworks intersect directly with the UN Sustainable Development Goals (SDGs), particularly Goal 1 (No Poverty), Goal 8 (Decent Work), and Goal 13 (Climate Action). "ESG, when done properly," she said, "turns extractive projects into engines of inclusive growth."

"African operators who embed ESG into operations are better positioned to attract long-term investors and secure social licenses," said Adaralegbe.

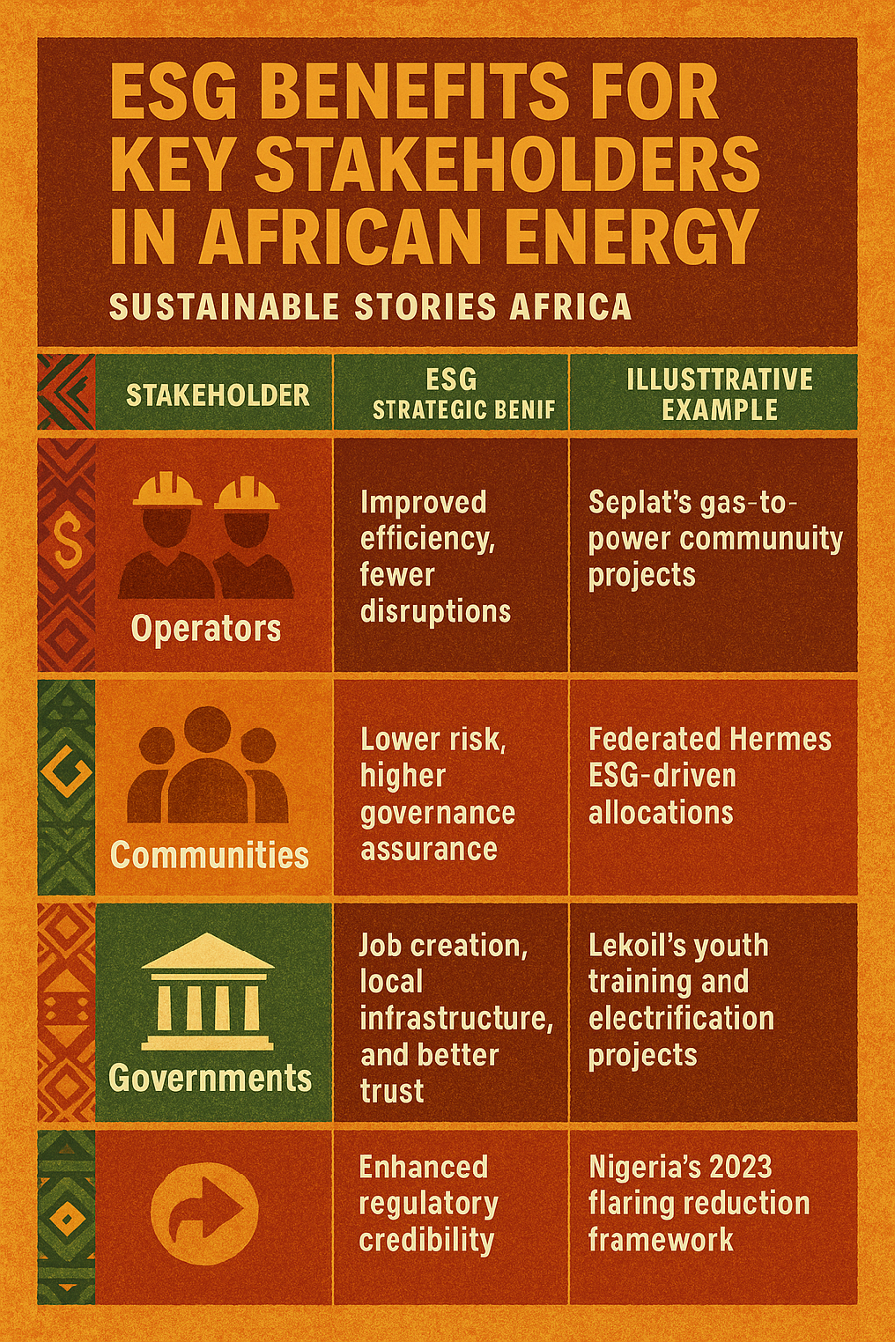

ESG Benefits for Key Stakeholders in African Energy

| Stakeholder | ESG Strategic Benefit | Illustrative Example |

|---|---|---|

| Operators | Improved efficiency, fewer disruptions | Seplat's gas-to-power community projects |

| Investors | Lower risk, higher governance assurance | Federated Hermes ESG-driven allocations |

| Communities | Job creation, local infrastructure, and better trust | Lekoil's youth training and electrification projects |

| Governments | Enhanced regulatory credibility | Nigeria's 2023 flaring reduction framework |

Where ESG Meets Local Development Reality

At the heart of the debate is a paradox: oil and gas remain Africa's economic backbone, yet their future depends on decarbonisation and local inclusion.

The panel emphasised that community engagement is not philanthropy — it's risk mitigation. Adaralegbe underscored that "ESG-focused strategies enhance social license, security, and productivity."

When community needs assessments, transparent reporting, and inclusive employment policies are built into project plans, both profitability and public trust rise.

But she warned against dependency models, "over-deep community relationships" that create patronage or distortion of local governance. The sweet spot lies in co-ownership, not control, projects where communities are participants, not beneficiaries.

ESG, she said, "is not about charity, it is about creating value chains that last."

From Extraction to Shared Value Creation

If Africa's energy transition is to succeed, the region's operators must evolve from extractors to enablers. The panel agreed that firms embracing ESG as a strategic imperative can secure both profit and permanence.

Kike Fajemirokun of Lekoil illustrated this point with practical examples: gas used to light community streets and power health centers. "These are the types of sustainable operations that bring in investors," she said.

Beyond community optics, ESG provides a market edge. Investors like Federated Hermes now embed sustainability screens into portfolio allocations, while boards like Seplat's have established dedicated ESG committees chaired by CEOs.

"Investors are no longer just buying production," said De Wet. "They're buying purpose."

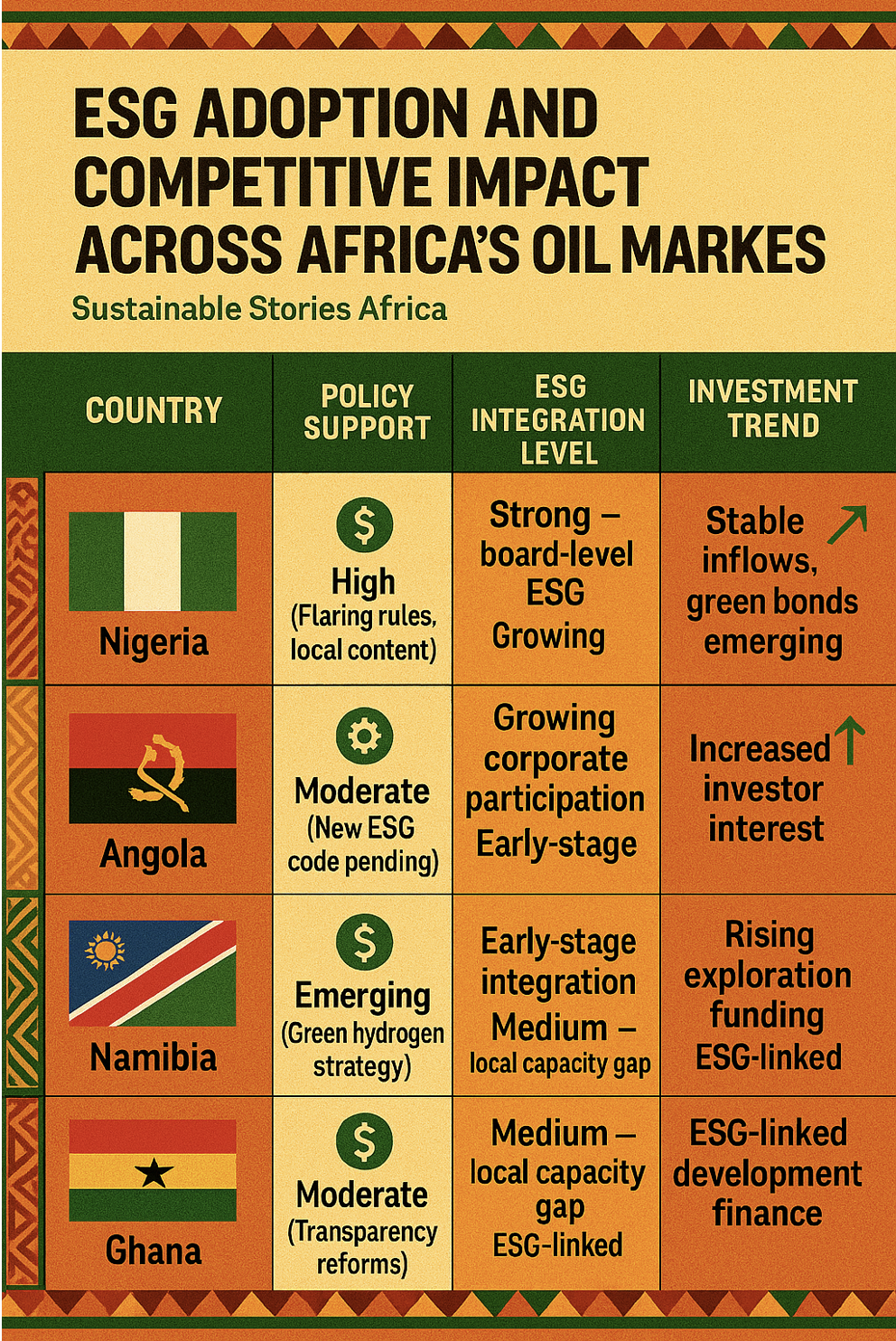

ESG Adoption and Competitive Impact Across Africa's Oil Markets

| Country | Policy Support | ESG Integration Level | Investment Trend |

|---|---|---|---|

| Nigeria | High (Flaring rules, local content) | Strong – board-level ESG | Stable inflows, green bonds emerging |

| Angola | Moderate (New ESG code pending) | Growing corporate participation | Increased investor interest |

| Namibia | Emerging (Green hydrogen strategy) | Early-stage integration | Rising exploration funding |

| Ghana | Moderate (Transparency reforms) | Medium – local capacity gap | ESG-linked development finance |

Integrating ESG Beyond Policy Statements

To move ESG from aspiration to execution, the panel outlined a four-step roadmap:

- Map risk and opportunity – identify environmental and social exposure points across the oil and gas lifecycle.

- Set internal ESG guidelines – beyond compliance, align operations with both national policy and international best practices.

- Engage stakeholders transparently – include civil society and local communities early in design phases.

- Institutionalise oversight – build ESG accountability into governance through board-level committees.

These steps mirror global trends, but in Africa's context, they can redefine competitiveness. When executed strategically, ESG strengthens resilience against market volatility, geopolitical shifts, and climate pressure.

Appelbaum concluded, "ESG is no longer a corporate accessory. It's the license to operate and to outlast."

PATH FORWARD – Bridging Profit, People, and Planet Together

Africa's oil and gas sector stands at a crossroads. Firms that see ESG as a cost centre will fade with fossil dependence; those who see it as a strategic enabler will lead the energy transition.

The path forward is clear: train boards, empower communities, and align profitability with purpose. In doing so, Africa's energy story can shift from resource curse to shared prosperity.