Nigeria's clean energy ambitions are at odds with global investment realities.

A study shows that while green levies boost renewable technologies, foreign direct investment, ironically, slows them down.

It's a paradox for a nation chasing net-zero: the capital that should power green transition is, instead, reinforcing fossil habits and regulatory uncertainty.

When Foreign Capital Stalls Green Transition

Foreign investment, long hailed as the engine of economic growth, may be quietly stalling Nigeria's clean energy transition. A study published in the International Journal of Energy Economics and Policy (2025) reveals that foreign direct investment (FDI) negatively moderates the relationship between green levies and green energy technologies (GETs), thereby reversing much of the policy progress made through environmental taxation.

The analysis, which covered two decades of Nigerian economic and energy data (2003–2022), found that green levies positively drive renewable energy development, but FDI flows, despite their scale and promise, dampen this impact.

The finding is counterintuitive: money flowing into Nigeria's economy is not greening it, but rather redirecting focus to short-term fossil investments and profit-stable ventures.

As Nigeria eyes its 2030 Sustainable Development Goals (SDGs 7 and 13), this tension between finance and sustainability poses a profound question: Can the nation align foreign investment with green ambitions, or will global capital continue to undermine its renewable transition?

When Capital Undermines Climate Goals

At the surface, Nigeria's investment story looks promising. Over $2.9 billion in FDI entered the energy sector between 2010 and 2020. Yet, the same capital has done little to strengthen the country's renewable foundation.

The study shows that while green levies (environmental taxes) directly boost renewable technology adoption, foreign investments reduce that gain by up to 37%.

Key Findings at a Glance

| Variable Relationship | Effect on Green Energy Technologies (GETs) | Significance |

| Green Levies (GRENLEV) → GETs | +0.053 | Positive Significant |

| FDI (FORGDIR) → GETs | −0.072 | Negative Significant |

| Green Levies × FDI Interaction | −370.5 | Strong Negative |

| Greenhouse Emissions (Control) | −0.661 | Highly Negative |

| Climate Change Factor | Not Significant | Neutral |

"Every time green taxes push the needle forward, foreign investment drags it back,"

said Dr Ahmad Haruna Abubakar, co-author of the study. "The paradox lies in how capital behaves; it follows profit, not policy."

The Economic Reality Behind the Energy Paradox

The numbers tell a layered story. Between 2003 and 2022, Nigeria recorded a mean renewable energy adoption rate of 82.6%, but green levies accounted for less than 0.02% of GDP.

Meanwhile, FDI averaged 0.94%, yet much of it targeted fossil-related infrastructure, logistics, and extractive projects, sectors that yield quicker returns than long-term green innovations.

Descriptive Overview of Nigeria's Energy and Investment Indicators

| Variable | Mean Value (2003–2022) | Min | Max |

| Green Energy Technologies (GETs) | 82.65% | 73.02% | 88.10% |

| Green Levies (% of GDP) | 0.017 | 0.009 | 0.025 |

| FDI (% of GDP) | 0.94 | −0.04 | 2.90 |

| Greenhouse Emissions (% of GDP) | 74.83 | 70.92 | 82.69 |

This explains the paradox: While green levies encourage eco-innovation and research grants, foreign capital, without sustainability-linked conditions, often channels into fossil energy stability, weakening the intended transition.

The researchers conclude that Nigeria's regulatory uncertainty and weak green investment incentives make renewables a "riskier bet" for investors.

"Green energy projects take years to pay off,"

noted Dr Hussaini Bala. "But investors want quarterly returns. Without policy alignment, foreign capital will keep choosing the old energy economy."

The Green Dividend Within Reach

Despite the contradictions, the study reveals a potential silver lining: green fiscal tools work.

If effectively aligned with sustainable investment frameworks, green levies could generate funds for renewable innovation and climate resilience programs.

Policy analysts estimate that redirecting just 25% of foreign investment toward renewable projects could increase Nigeria's clean energy capacity by 15% within five years. This would be equivalent to powering 20 million additional households sustainably.

"Foreign investment isn't the problem, it is the policy architecture around it," explained Dr Yusuf Ja'afar. "If FDI is green tagged, it can become a catalyst rather than a constraint."

Aligning Finance with the Future

The call is clear: Nigeria must green its FDI strategy. This means ensuring that all incoming capital aligns with sustainability standards, measurable carbon outcomes, and local innovation frameworks. The researchers recommend a multi-pronged action plan:

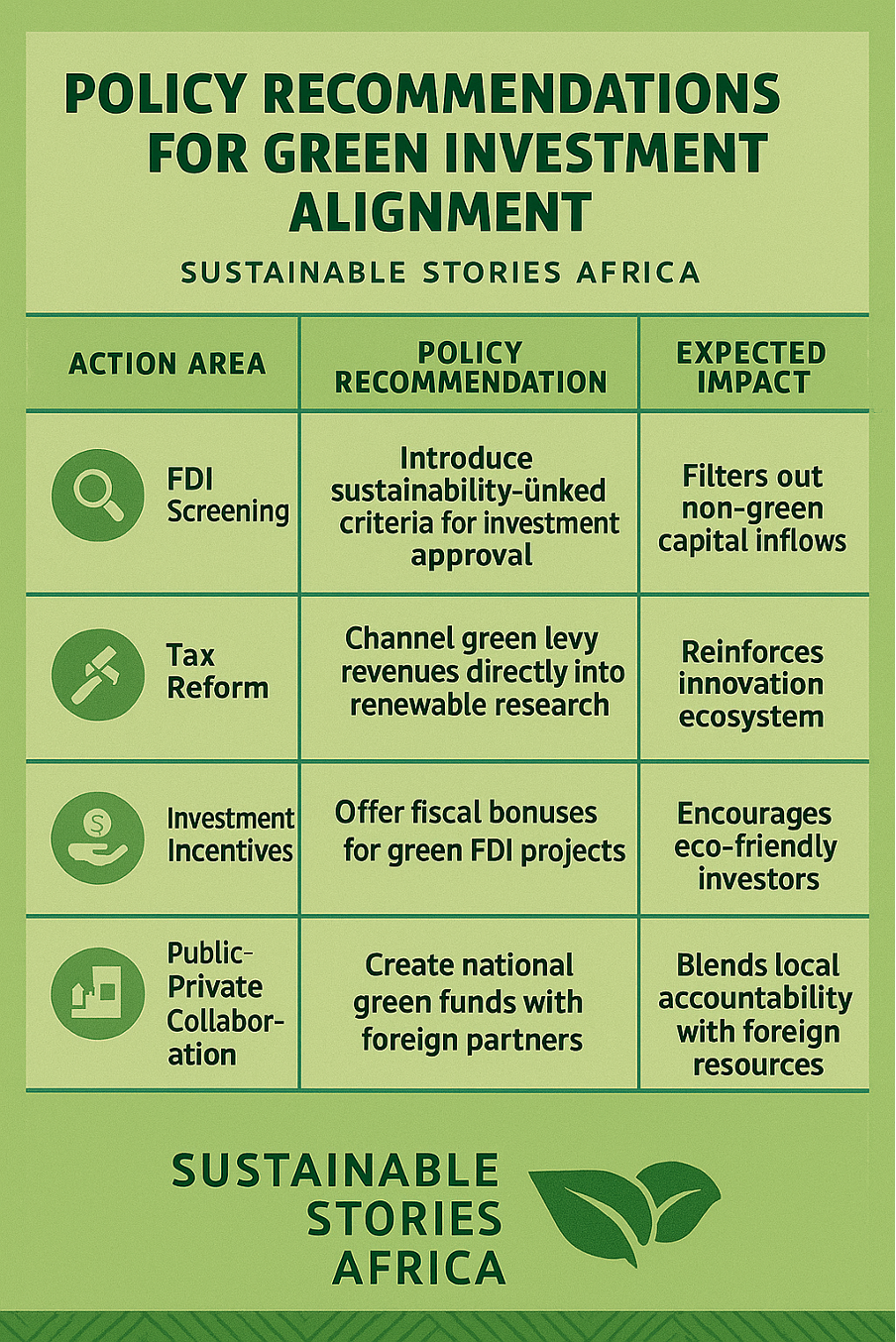

Policy Recommendations for Green Investment Alignment

| Action Area | Policy Recommendation | Expected Impact |

| FDI Screening | Introduce sustainability-linked criteria for investment approval | Filters out non-green capital inflows |

| Tax Reform | Channel green levy revenues directly into renewable research | Reinforces innovation ecosystem |

| Investment Incentives | Offer fiscal bonuses for green FDI projects | Encourages eco-friendly investors |

| Public-Private Collaboration | Create national green funds with foreign partners | Blends local accountability with foreign resources |

Such alignment could transform FDI into a true driver of climate resilience, creating an investment environment where both profits and the planet thrive.

Path Forward – Aligning Money With Nigeria's Green Mission

Nigeria's challenge is not the lack of foreign capital, but its direction. By reforming policies to tie FDI incentives to environmental outcomes, Nigeria can ensure that every dollar of investment strengthens, rather than stalls, its clean energy agenda.

Green levies have proven their power; now, the task is aligning money with meaning. If policy meets purpose, Nigeria's energy future can be both profitable and sustainable.