Transition finance is quietly becoming the financial engine behind the world's most carbon-intensive sectors, yet few outside banking circles grasp how radically it is reshaping climate action. As banks confront rising regulatory pressure and investor expectations, their frameworks are evolving faster than global standards.

Across continents, institutions are rewriting their lending logic, unlocking capital for decarbonisation while navigating uncertainty, scrutiny, and the urgent race to net zero.

Transition Finance: Banks Rewriting Climate Rules

In the quiet corners of global finance, far from the noise of green bond headlines. One that sits between ambition and pragmatism. Transition finance, for years a vague placeholder in sustainability wording, has matured into a decisive instrument helping carbon-intensive industries draw a workable path toward net zero. It is not glamorous, but it is indispensable.

Across Asia, Europe, Africa, and the Gulf, banks are no longer defining climate action solely by green purity. Instead, they are creating sophisticated frameworks that accept a messy truth: the global economy cannot leapfrog to clean energy without helping high-emitting sectors change gradually and credibly.

As outlined in Transition Finance Emerging Practices, banks are experimenting with criteria, governance, eligibility lists, and decision-making frameworks that both accelerate decarbonisation and shield their institutions from greenwashing risks.

Today, transition finance stands at the centre of a pivotal transformation. It is the world's bridge between fossil-fuel reality and low-carbon aspiration, a multilayered ecosystem of taxonomies, oversight committees, sector pathways, and just-transition safeguards.

This feature explores how inclusive green finance operates, why it matters for Africa's future, and what lies ahead for climate-driven financial innovation.

Banks Quietly Build the Missing Link in Climate Finance

When the Net-Zero Banking Alliance (NZBA) released Transition Finance Emerging Practices, it offered a subtle but seismic message: green finance alone cannot deliver a safe climate future.

The world needs a credible mechanism to help high-emitting sectors, such as steel, cement, oil and gas, real estate, transport, transition without collapsing economies.

Transition finance is that mechanism. And unlike green finance, which targets activities already aligned with net-zero pathways, transition finance embraces imperfect industries willing to reform, if the right financing incentives support them.

Banks now face unprecedented questions:

- How do you finance decarbonisation without enabling perpetual emissions?

- How do you lend to coal or aviation without locking in carbon?

- And how do you define "credible transition" when no global standard exists?

The answers, as the report shows, are emerging in real time, country by country, bank by bank, sector by sector.

The New Architecture of Transition Finance

The report identifies a rapidly evolving financial architecture built on five pillars:

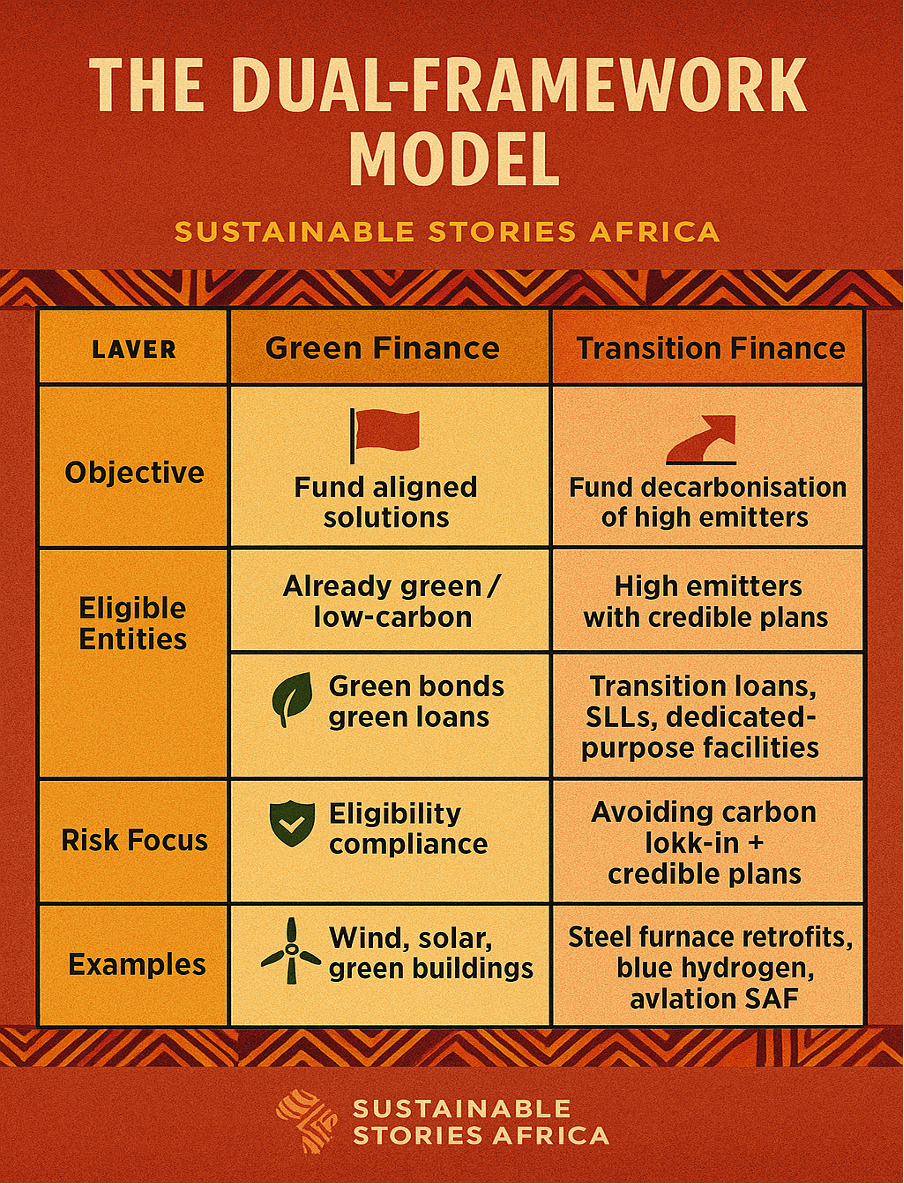

Integration: Banks Now Run Dual Frameworks – Most leading banks treat transition finance as a complement to their green finance frameworks. Instead of replacing sustainable finance, transition finance expands its scope by:

- adding activity-level eligible lists

- including entity-level pathways

- adopting external taxonomies (EU, ASEAN, Singapore, METI)

- embedding transition in overall sustainable finance targets

The Dual-Framework Model

| Layer | Green Finance | Transition Finance |

|---|---|---|

| Objective | Fund aligned solutions | Fund decarbonisation of high emitters |

| Eligible Entities | Already green / low-carbon | High emitters with credible plans |

| Typical Products | Green bonds, green loans | Transition loans, SLLs, dedicated-purpose facilities |

| Risk Focus | Eligibility compliance | Avoiding carbon lock-in + credible plans |

| Examples | Wind, solar, green buildings | Steel furnace retrofits, blue hydrogen, aviation SAF |

Banks such as Allied Irish Bank, Barclays, DBS, Maybank, and Standard Chartered have built explicit decision frameworks to ensure consistency. These frameworks represent the most concrete blueprint the industry has ever seen.

Activity-Level Finance Dominates, Entity-Level Finance Emerging –

Banks overwhelmingly focus on financing activities, not entire corporations—especially where clients lack mature transition plans. Activity-level financing covers:

- energy-efficiency retrofits

- industrial process upgrades

- electrification

- carbon capture

- alternative fuels

Entity-level financing is still limited to "pure-play" companies with 90%+ transition revenue. An approach popularised by Barclays and Maybank. But as credible transition plans improve globally, entity-level lending is expected to grow dramatically.

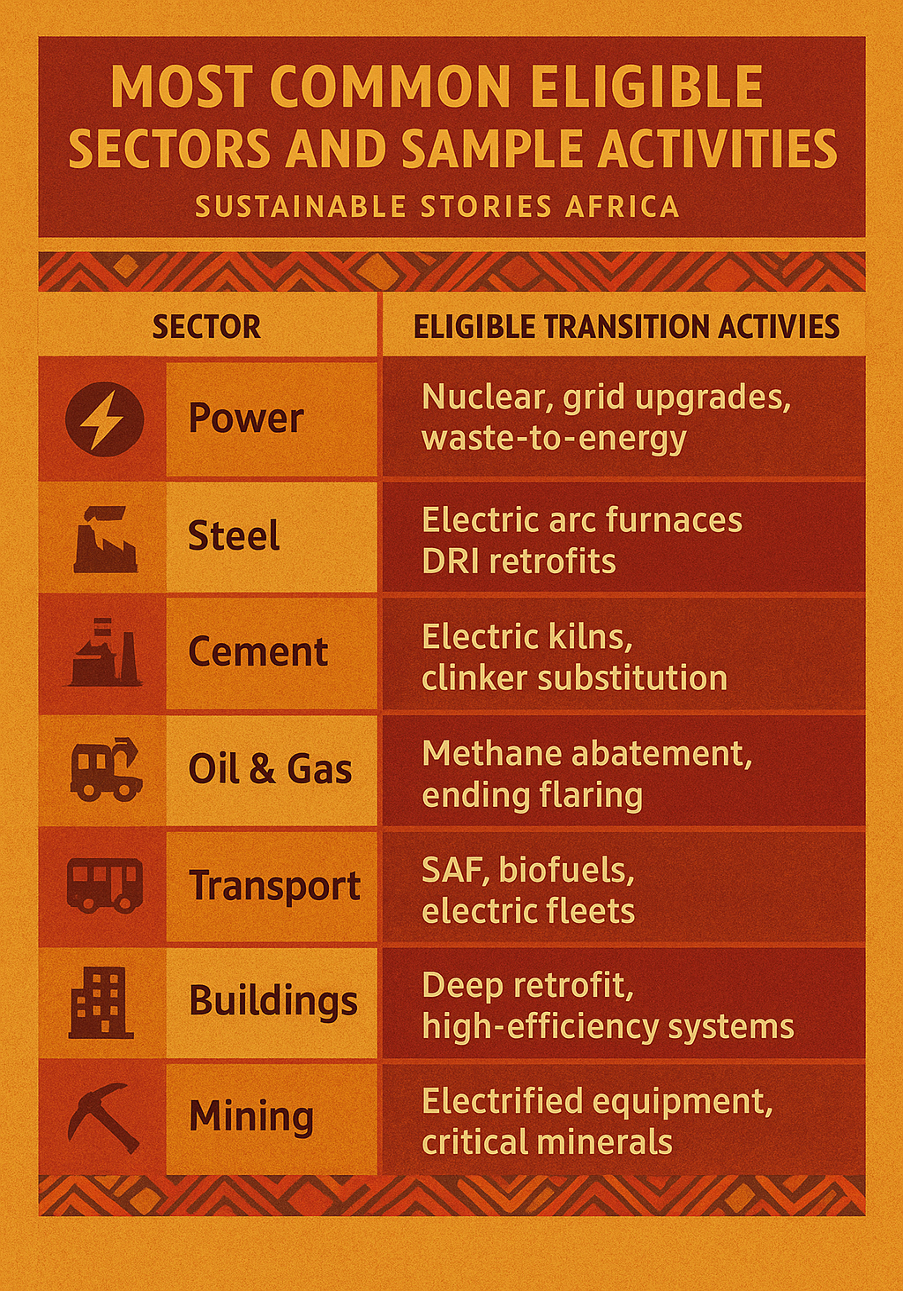

Eligible Sectors: High Emitters Take Centre Stage –

The report outlines a broad list of priority sectors, all aligned with UNEP FI's target-setting guidelines.

Most Common Eligible Sectors and Sample Activities

| Sector | Eligible Transition Activities |

|---|---|

| Power | Nuclear, grid upgrades, waste-to-energy |

| Steel | Electric arc furnaces, DRI retrofits |

| Cement | Electric kilns, clinker substitution |

| Oil & Gas | Methane abatement, ending flaring |

| Transport | SAF, biofuels, electric fleets |

| Buildings | Deep retrofit, high-efficiency systems |

| Mining | Electrified equipment, critical minerals |

These are the sectors where global decarbonisation either accelerates or collapses.

Criteria: What Makes a Transition Transaction Credible? –

Across banks, four criteria dominate:

- Do No Significant Harm (DNSH)

- Avoid carbon lock-in

- Use best available technology

- Align with 1.5°C/2°C pathways

Dedicated-purpose finance must fit eligibility lists. General-purpose finance must be backed by a credible transition plan.

Credibility Test for Clients

- Has a transition plan? ✔

- Has interim science-based targets? ✔

- Capex aligned to plan. ✔

- Majority revenue from transition assets? ✔ (for pure-play approach)

Banks such as First Abu Dhabi let clients participate even while they are still developing their sustainability plans, offering a more inclusive pathway for businesses in emerging markets.

Governance: The Strongest Indicator of Bank Integrity -

Robust governance is now a non-negotiable requirement. Banks increasingly rely on:

- group sustainability committees

- cross-functional credit + risk + legal teams

- internal audit verification

- external independent assurance

Transition finance is no longer the domain of sustainability teams alone; it is an enterprise-wide responsibility.

Why Transition Finance Matters – And Why Banks Should Expand It

Done badly, transition finance risks becoming greenwashing's twin. Done well, it can unlock trillions in credible decarbonisation finance.

Four High-Value Outcomes

- Decarbonising Hard-to-Abate Sectors – These sectors account for nearly 30% of global emissions. Without transition finance, most cannot decarbonise at the speed required.

- Reducing Systemic Risk in Banking – Transition finance gives banks visibility into clients' climate strategies, lowering future credit risk and stranded asset exposure.

- Scaling Low-Carbon Technology Adoption – Financing industrial pilots, retrofits, and early-stage technologies builds market confidence and accelerates cost parity.

- Supporting Just Transitions in Emerging Markets – Transition finance widens the net beyond elite green sectors, making it a powerful development tool across Africa, Asia, and Latin America.

Transition Finance Impact Pathways

- Activity-level interventions → direct emissions reduction

- Entity-level plans → long-term alignment

- Country/system-level financing → structural decarbonisation

- Enabling activities → value-chain transformation

What Banks Must Do Now

The report makes clear that transition finance is still evolving. To move from guidance to a global standard, banks must:

- Push for Global Convergence on Definitions – Without harmonised taxonomies, cross-border financing remains inconsistent and opaque.

- Invest in Corporate Transition Plan Assessment – Banks need stronger tools, analytics, and scenario models to assess plan credibility.

- Adopt Forward-Looking Metrics – As recommended by NZBA's Developing Metrics for Transition Finance, banks must measure:

- financed emission reductions

- alignment with sector pathways

- Capex aligned to transition technology

- Increase Transparency and Assurance – Public reporting, independent verification, and annual audits remain critical to trust.

- Expand Eligible Activities as Technology Evolves – Banks should maintain flexible, regularly updated eligibility lists to capture emerging solutions.

PATH FORWARD – Charting Credible Pathways for Transition Finance

Banks now recognise that financing high emitters is not a concession but a necessity. The next phase requires sharpened definitions, stronger governance, and more rigorous transition-plan assessments. With clearer sector pathways, improved metrics, and broader eligibility coverage, transition finance can scale globally.

The priority is simple: unlock capital while maintaining integrity. The promise is powerful; transition finance can transform today's most carbon-intensive sectors into tomorrow's low-carbon foundations.