Africa's sustainable finance ambitions remain hostage to its biggest, oldest problem: fragmentation. Across 54 markets, mismatched regulations, volatile currencies and disjointed taxonomies keep investors wary and project pipelines thin.

The rise of pan-African platforms, from AGIA to PAPSS, promises a pathway out. But unless governments, banks and DFIs coordinate at scale, the continent risks watching opportunity slip away again.

Stitching Africa's Financial Future Together

Africa's sustainable finance revolution is happening, but not nearly fast enough for a continent facing a $100 billion annual infrastructure deficit and a climate adaptation bill rising toward $70 billion a year. The numbers are staggering, and the gaps are structural. Yet the most formidable barrier is not capital scarcity. It is fragmentation.

Across the continent, banks, regulators and investors operate in parallel universes: different taxonomies, regulatory standards, disclosure rules and currencies. A green bond qualifies as sustainable in Kenya but not in Ghana.

Cross-border payments still depend on SWIFT. And project pipelines collapse at the altar of FX volatility, slow permit systems and divergent governance practices.

But a quiet re-engineering is underway. Pan-African platforms like AGIA, Africa50, PAPSS and AfCFTA are beginning to stitch the continent's fragmented financial systems into something more coherent, something investable.

The question is whether Africa can move fast enough to match global capital and climate timelines.

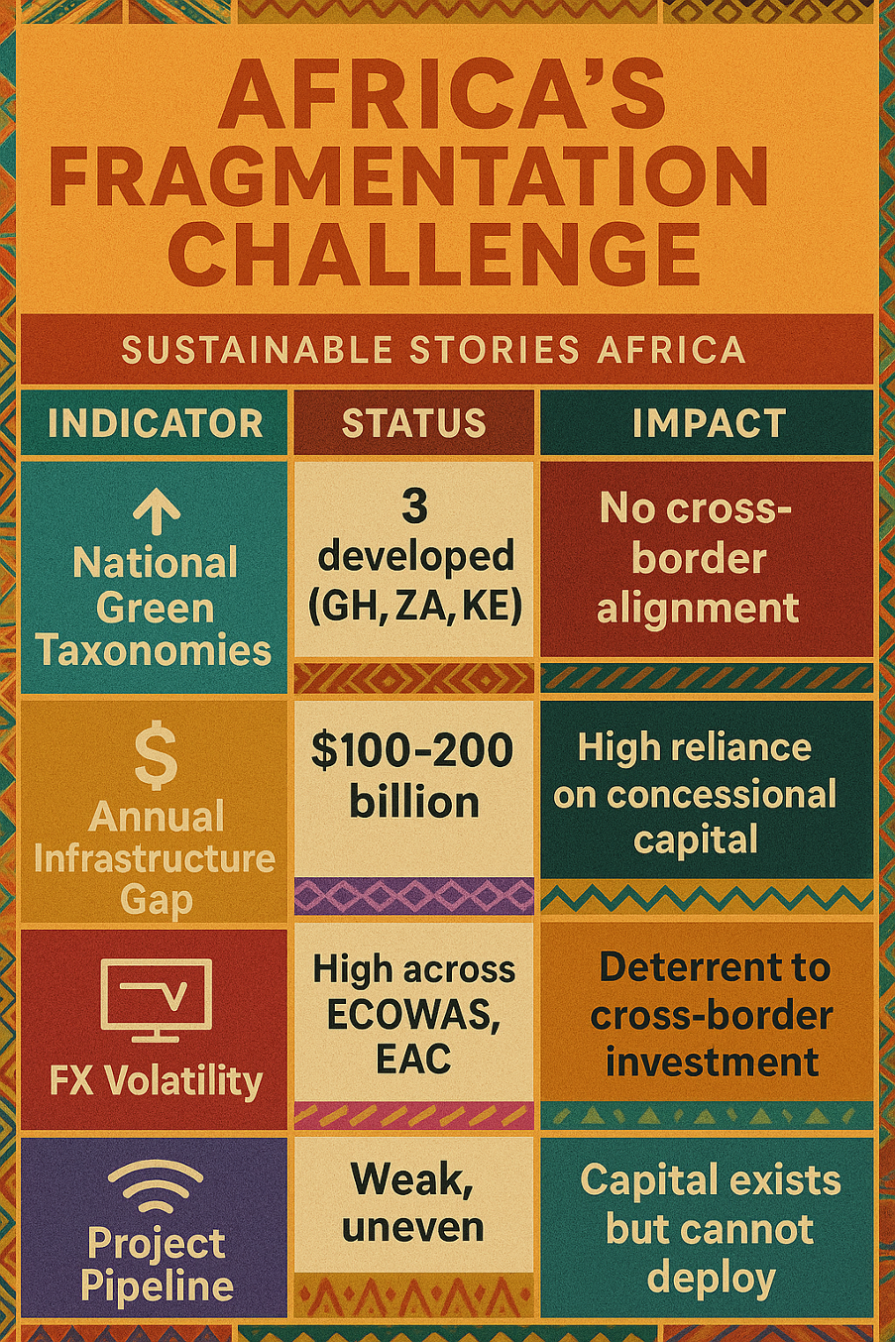

Africa's Capital Problem Is Not Capital. It is Fragmentation

Africa faces $100 billion in annual infrastructure financing needs, double that when aligned with the UN SDGs. At the same time, adaptation finance, despite doubling from $6.3 billion in 2017 to $14.8 billion in 2023, remains a fraction of what the continent requires.

Yet investors are not deterred by African projects; they are deterred by African systems. As fintech expert Kayode Opeyemi notes: "The biggest barriers to scaling sustainable finance across Africa are fragmentation and inconsistency."

Different ESG taxonomies. Different disclosure regimes. Different green-asset definitions. For investors, inconsistency equals risk, which translates to higher premiums and lower deal flow.

Africa's Fragmentation Challenge

| Indicator | Status | Impact |

|---|---|---|

| National Green Taxonomies | 3 developed (GH, ZA, KE) | No cross-border alignment |

| Annual Infrastructure Gap | $100–200 billion | High reliance on concessional capital |

| FX Volatility | High across ECOWAS, EAC | Deterrent to cross-border investment |

| Project Pipeline | Weak, uneven | Capital exists but cannot deploy |

This is the structural bottleneck that pan-African platforms hope to fix.

Pan-African Platforms Are Rewiring the Continent's Sustainable Finance Architecture

Africa's response to fragmentation has taken the shape of regional and multi-country platforms designed to harmonise rules, deepen capital pools and align standards.

- Africa Sustainable Finance Taxonomy (AfDB) – After years of consultation, the AfDB launched the African Sustainable Finance Taxonomy in August 2025, a voluntary but transformative reference tool aligning African markets with global norms while safeguarding regional priorities. Ghana's central bank climate lead, Nana Sika Ahiabor, called it "a critical moment for comparability and scale."

But taxonomies alone don't build markets. They must be operationalised by regulators and exchanges, something that is still far from reality.

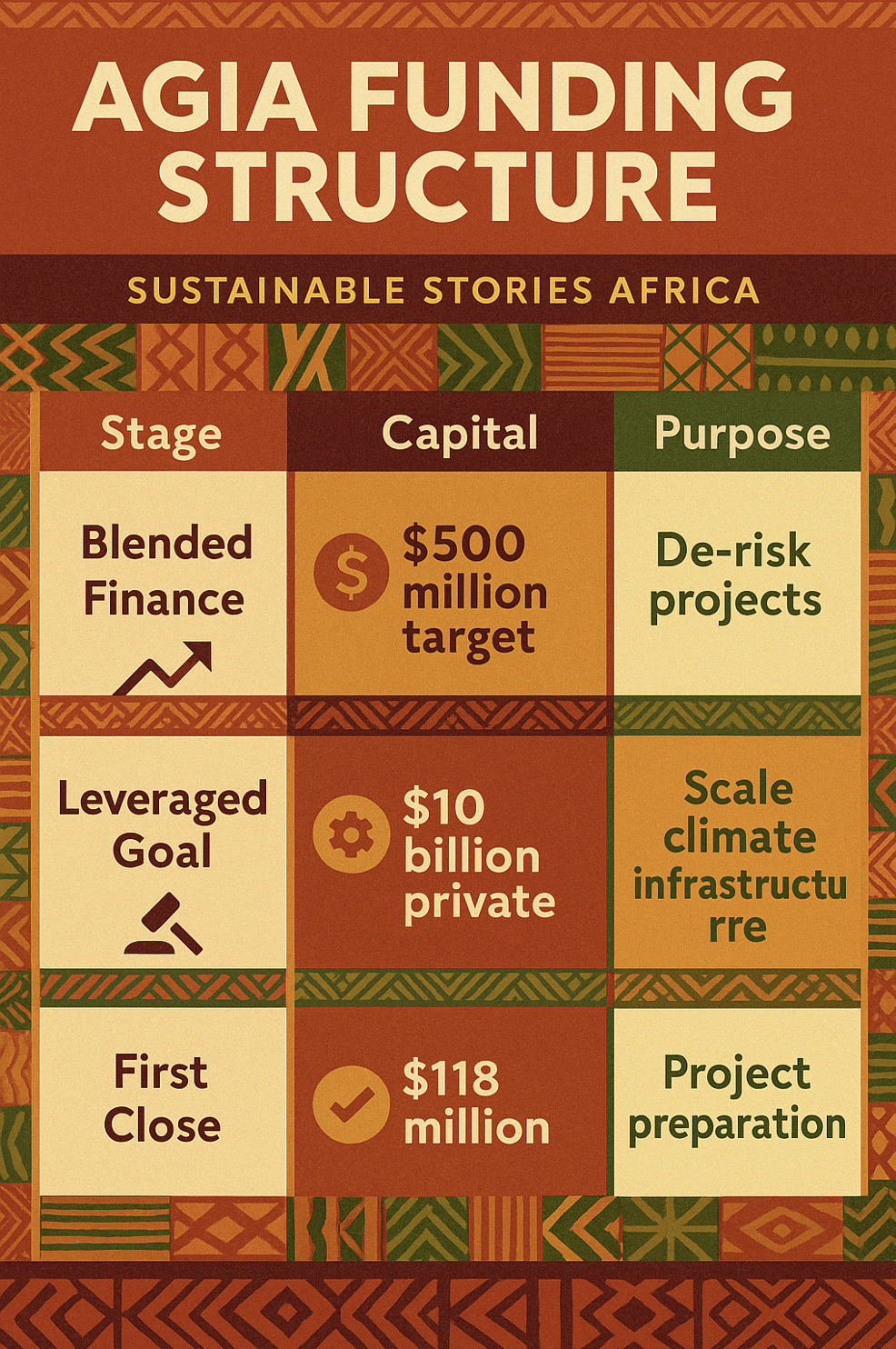

- AGIA & Africa50: Narrowing the Green Infrastructure Gap – Africa50's Alliance for Green Infrastructure in Africa (AGIA) aims to raise $500 million in blended capital to catalyse $10 billion in private investment for green infrastructure. Project Development Fund has recently secured $118 million — a strong start. But as ODI's Dirk Willem te Velde warns: "The biggest constraint is not finance. It is the lack of investable projects."

Africa suffers from a pipeline paralysis: capital sits idle because bankable projects, those with permits, risk clarity and cash-flow certainty, are scarce.

AGIA Funding Structure

| Stage | Capital | Purpose |

|---|---|---|

| Blended Finance | $500 million target | De-risk projects |

| Leveraged Goal | $10 billion private | Scale climate infrastructure |

| First Close | $118 million | Project preparation |

AGIA's mandate: fix the pipeline, not just the financing.

- AfCFTA & PAPSS: The Payment Revolution Africa Needs – AfCFTA is rewriting Africa's trade logic—but nothing compares to PAPSS, the Pan-African Payment and Settlement System. Dotun Olowoporoku puts it bluntly: "It can still be easier to move money from the UK to Nigeria than from Nigeria to Ghana."

PAPSS aims for real-time cross-currency settlement across Africa. If it works, Africa will unlock:

- Instant cross-border payments

- Lower transaction costs

- Faster trade flow

- Higher investor confidence

Lauren Johnston from SAIIA offers a caution: "PAPSS will require trust. Banks must believe in their governance enough to move away from SWIFT." Trust, not technology, is the real hurdle.

Why Fixing Fragmentation Will Unlock Africa's Green Finance Century

Africa's low-carbon industrialisation, grid expansion, renewable buildout, and water-energy-food resilience depend on two things: Capital and Confidence

Currently, Africa has capital - global, regional, domestic - but lacks confidence due to systemic fragmentation. Fix the systems, and Africa unlocks:

- $10 billion more annually in private investment

- Stronger regional carbon markets

- Lower borrowing costs

- Scalable project pipelines

- Reduced dependency on development finance

Fintech investor Olowoporoku frames it best: "You can't scale anything until you solve finance." Solve fragmentation, and Africa scales everything.

A Five-Step Blueprint for Stitching Africa's Financial Markets Together

- Operationalise the African Taxonomy

- Align SEC, FRCN, CMA, FSCA and central banks

- Mandate cross-border taxonomy tagging

- Standardise green-asset definitions

- Build Regional Project Preparation Facilities

- Replicate AGIA in ECOWAS, SADC, EAC

- Focus on permitting, feasibility, land, FX mitigation

- Integrate PAPSS into National Payment Infrastructure

- Mandatory onboarding for all regulated banks

- FX netting arrangements

- Dual-system trust frameworks with SWIFT

- Use AfCFTA Protocols to Harmonise Sustainable Finance Rules

- Disclosure

- ESG governance

- Tax incentives

- Carbon trading rules

- Create Pan-African Risk-Sharing Instruments

- Partial guarantees

- First-loss capital

- Credit enhancement for green bonds

PATH FORWARD – Unify Standards, Unlock Continental Capital

Africa's sustainable finance future hinges on one priority: integration. Cross-border taxonomies, standardised disclosures and aligned project pipelines will determine whether green capital flows at scale.

If AfCFTA, AGIA and PAPSS converge, Africa can finally overcome its most persistent barrier, fragmentation and build a continental financial architecture capable of delivering the green, resilient, inclusive growth the region desperately