Nigeria's banks are discovering that going green isn't just about goodwill — it's about profit.

A 2024 study from Bowen University shows that green banking — financing sustainability, environmental, and social projects can significantly boost profitability when banks earn the public's trust.

The finding: goodwill is not charity; it's currency in the era of climate finance.

Goodwill, Green Finance, and Profitability Nexus

For years, Nigeria's banks were seen as financiers of pollution — lending to industries that drained rivers, darkened skies, and funded deforestation. Today, the narrative is shifting.

A 2024 study in Heliyon finds that green banking lending for environmentally conscious, socially impactful, and sustainable projects not only improves a bank's image but also enhances its profits.

Led by Dr Henry Inegbedion of Bowen University, the study used responses from Access Bank and First Bank employees to test how social investment, sustainability, and environmental consciousness influence profitability.

The verdict: when banks finance green initiatives, the return is not just reputational, it is financial.

When Green Lending Turns Financially Golden

The world's banking landscape is being rewritten by climate risk. In Nigeria, where floods and extreme heat already strain communities, the financial sector's alignment with sustainability has become an essential strategy.

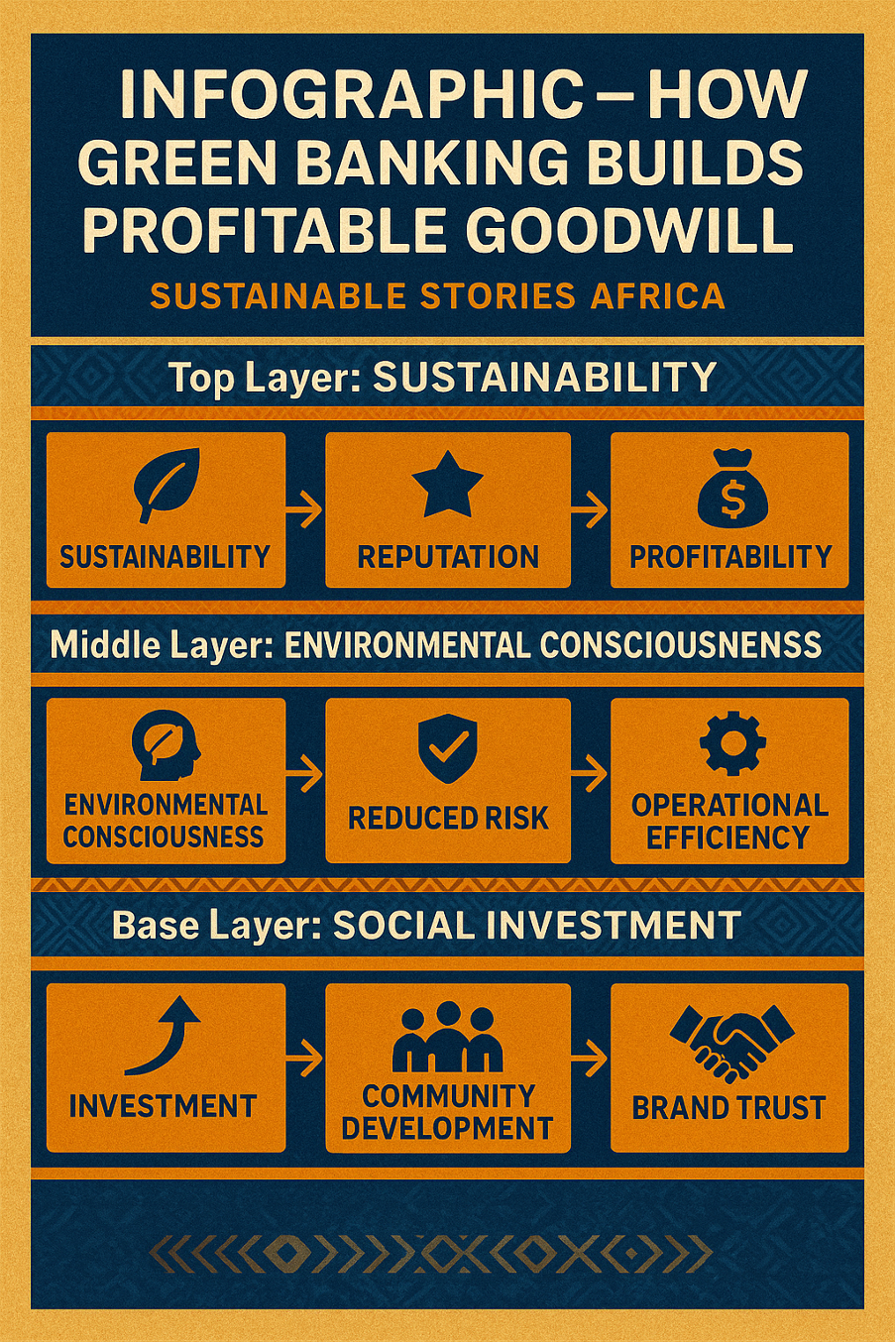

Inegbedion's study makes a bold claim: green banking enhances profitability by building goodwill and public trust. Banks that invest in social, environmental, and sustainable projects create a virtuous cycle, stronger reputation, deeper customer loyalty, and eventually, higher revenue streams.

"Goodwill is the bridge between sustainability and profitability," Inegbedion writes. "It transforms perception into performance."

Among 267 respondents, goodwill was found to fully mediate the relationship between sustainability and profitability. Simply put, customers trust banks that invest in their planet, and that trust converts into market share.

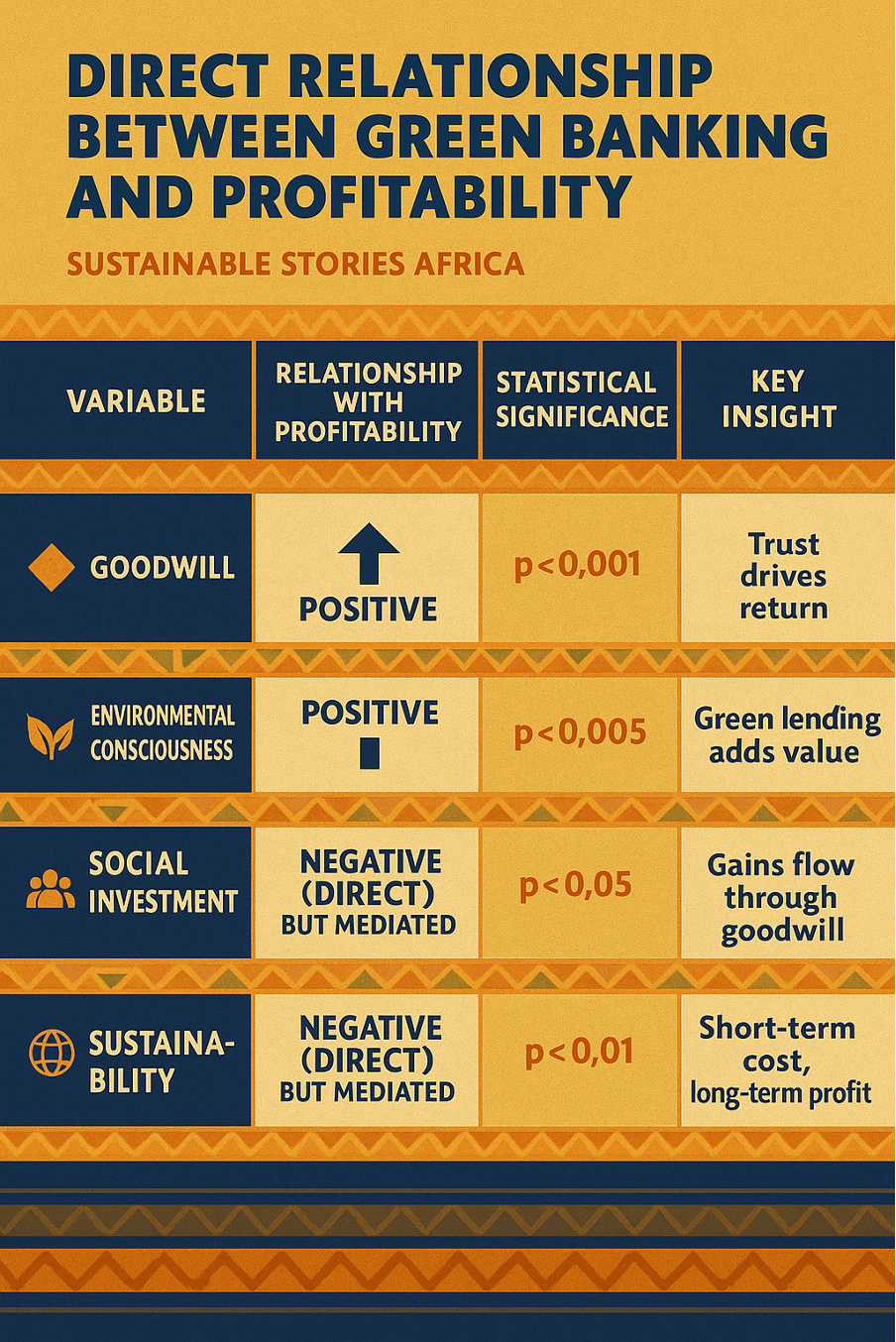

Direct Relationship Between Green Banking and Profitability

| Variable | Relationship with Profitability | Statistical Significance | Key Insight |

| Goodwill | Positive | p < 0.001 | Trust drives return |

| Environmental Consciousness | Positive | p < 0.001 | Green lending adds value |

| Social Investment | Negative (direct) but mediated | p < 0.05 | Gains flow through goodwill |

| Sustainability | Negative (direct) but mediated | p < 0.01 | Short-term cost, long-term profit |

The Social Logic of Green Goodwill

The study’s deeper message is sociological: Nigerians reward banks that do good.

Survey data revealed that environmental and social investments don’t yield immediate profits — but they build long-term loyalty and reduce reputational risks.

When customers perceive a bank as environmentally responsible, they’re more likely to stay, borrow, and invest. Over time, this “green trust premium” translates into measurable financial strength.

Across the data, banks that demonstrated environmental consciousness and community-driven sustainability projects saw significant improvements in perceived goodwill scores (mean value: 4.165 on a 5-point scale).

“Profit is not just financial,” Inegbedion observed. “It is relational, built on credibility, transparency, and ecological accountability.”

This finding aligns with the Socially Responsible Investment (SRI) Theory, which integrates financial goals with societal welfare. Green banking, in essence, monetises moral capital.

Infographic – How Green Banking Builds Profitable Goodwill

From Compliance to Competitive Green Strategy

While green banking is still in its infancy in Nigeria, the study shows it could be the next frontier of financial innovation.

Access Bank, for instance, has been developing green credit lines for renewable energy entrepreneurs, while First Bank has begun financing sustainable agriculture and low-emission infrastructure. These shifts, once viewed as expensive compliance measures, are fast becoming profit multipliers.

The analysis found that variations in green banking explain 88.4% of the variation in bank profitability. A staggering correlation that suggests sustainability could define competitive advantage in the sector.

"When banks align with sustainability, they don't just manage risk, they create resilience," said Inegbedion.

Goodness-of-Fit Model Summary

| Model | Variable | R² Value | Interpretation |

| Equation-level fit | Green Banking → Profitability | 0.8839 | Strong model alignment |

| Mediating effect | Goodwill → Profitability | 0.8476 | High predictive strength |

| Direct relationship | Sustainability → Profitability | 0.1971 (neg.) | Short-term costs acknowledged |

Financing the Future, Greening the Balance Sheet

The study recommends that Nigerian banks mainstream green banking into policy and practice. By funding eco-friendly projects such as solar farms, waste recycling, and sustainable housing, banks can both protect the planet and strengthen their financial performance.

Key action points for policymakers and CEOs:

- Mandate green finance quotas through the Central Bank of Nigeria (CBN) policy reform.

- Develop internal ESG metrics for loan assessment and risk profiling.

- Promote customer education on green banking benefits to drive demand.

- Publicise green lending portfolios to enhance transparency and investor trust.

Inegbedion's findings suggest that goodwill acts as the invisible hand guiding profitability. The greener the lending, the better the balance sheet.

PATH FORWARD – Greening Finance, Growing Nigeria's Sustainable Prosperity

Nigeria's banking sector stands at a green crossroads: invest in sustainability now or pay for inaction later.

The path forward lies in policy alignment, innovation, and storytelling. As green banking becomes policy, banks must turn ESG data into business intelligence and profit from purpose.

This study transforms an ethical debate into an economic one: Can doing good make you richer? The Nigerian evidence says yes. When banks treat sustainability as a strategy, not charity, they gain both goodwill and growth.

The question now is whether regulators, investors, and consumers will reward those who finance the future or punish those who ignore it.