As momentum builds for environmental, social and governance (ESG) frameworks worldwide, important cracks are emerging in how Africa participates in the movement.

The global scene shows notable successes and escalating investor demands, yet many African markets grapple with weak disclosure, uneven regulation and limited access to capital.

Global ESG on the Rise

Around the world, ESG has become integral to both corporate strategy and investor decision-making.

According to the article in Multimedia Group Limited's MyJoyOnline, the ESG movement "is integral to corporate strategy, investor behaviour and regulatory policy" globally, despite challenges of greenwashing and fragmented standards.

For example, reports indicate that only about 25 % of companies feel fully prepared for ESG assessments.

| Metric | Global snapshot |

|---|---|

| % firms ready for ESG assessments | 25 % |

| Key regions driving regulation | EU, UK, Canada, China |

Africa's Crossroads in ESG

Africa stands at a pivotal juncture: adopting ESG early and deliberately can unlock global capital" but warns that the continent lags in practice.

According to a broader Africa-focused study by PricewaterhouseCoopers (PwC), many African firms treat ESG as a cost rather than an opportunity, with limited internal capability to integrate sustainability into strategy.

| Region | Comparative ESG implementation gap |

|---|---|

| Africa vs Global peers | Lower adoption of ESG goals, fewer disclosures |

| Africa-only observations | Dependence on extractives, weak governance scores |

Why Africa Must Close the ESG Divide

For African businesses and economies, rising global ESG standards present both a risk and an opportunity. On the opportunity side: early adoption offers access to international capital, improved risk management and stronger stakeholder trust.

Sustainability is becoming "the new currency of corporate credibility." Conversely, lagging means potential exclusion from supply chains, weaker investor appeal and heightened climate/social risk exposure.

Steps Forward for African Corporates and Policy-Makers

The article, grounded in thoughtful research, maps out a series of tangible steps that can guide the way forward.

- Strengthen disclosure and standardisation: build capacity for reporting to frameworks like the International Sustainability Standards Board (ISSB) and Global Reporting Initiative (GRI).

- Embed ESG into business strategy: view as investment, not cost. PwC stresses that ESG must be internalised to build trust and competitiveness.

- Mobilise regulatory and funding support: governments and development finance institutions should de-risk ESG investments via incentives.

Path Forward – Unlock Africa's ESG Potential Now

To advance effectively, African economies, businesses and stakeholders must act with urgency. Unlocking Africa's ESG potential calls for coordinated leadership: business boards, regulators and investors all aligning on credible frameworks, capacity building and transparent disclosures.

Only then can Africa transition from lagging adopter to ESG-growth region – attracting global capital, building resilience and delivering sustainable development.

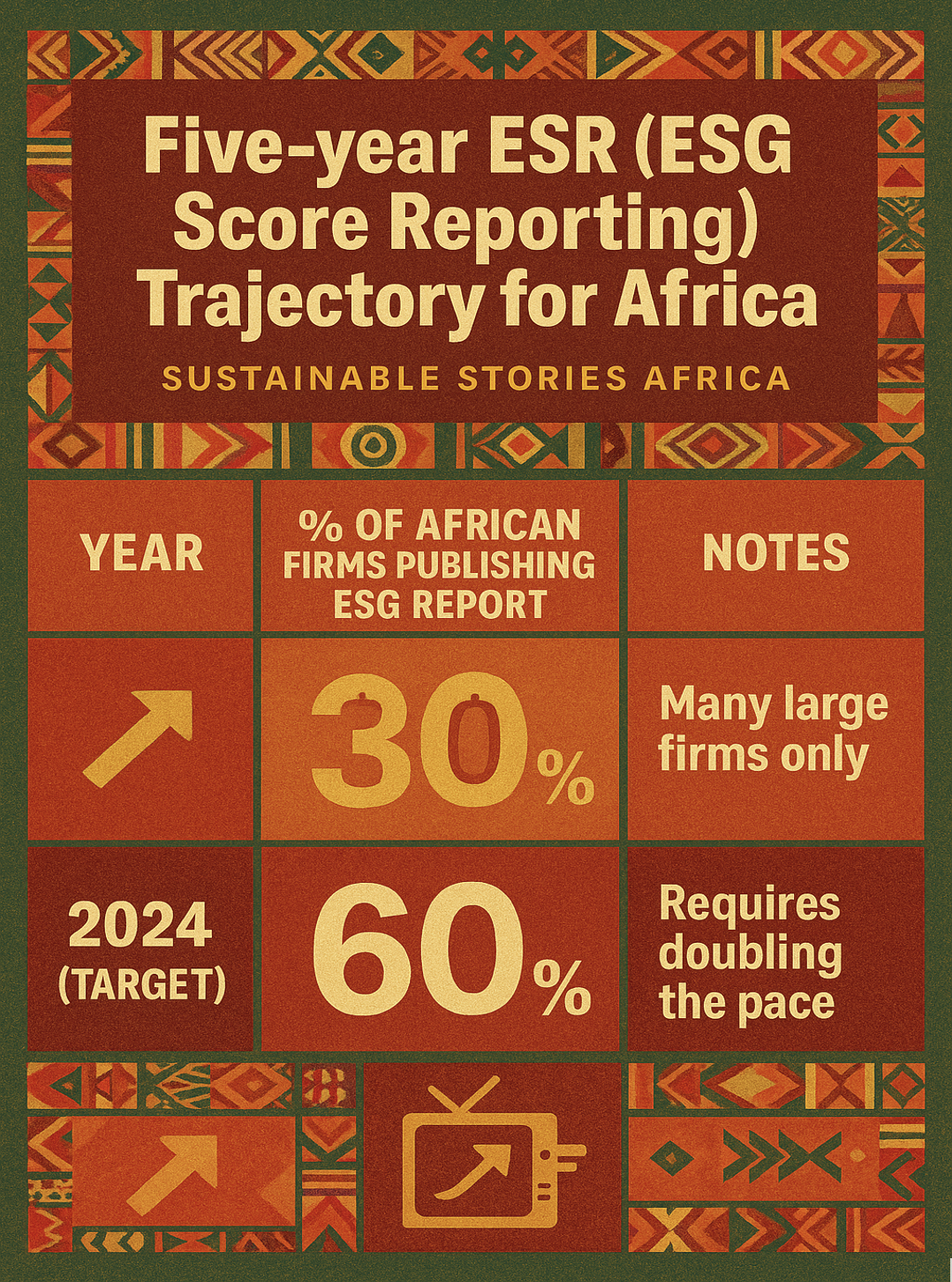

Five-year ESR (ESG Score Reporting) trajectory for Africa

| Year | % of African firms publishing ESG report | Notes |

|---|---|---|

| 2024 | 30 % | Many large firms only |

| 2029 (target) | 60 % | Requires doubling the pace |

Culled From: https://www.myjoyonline.com/how-is-esg-doing-globally-successes-gaps-and-lessons-for-africa/