Africa is no longer standing on the margins of the climate-finance dialogue; the newly published 2025 Climate Yearbook shows global funds increasingly flowing to the continent. But despite these gains, the investment gap remains daunting and

Africa faces a strategic moment to map how the continent can translate rising capital into meaningful climate outcomes.

Africa's Funding Influx Surges

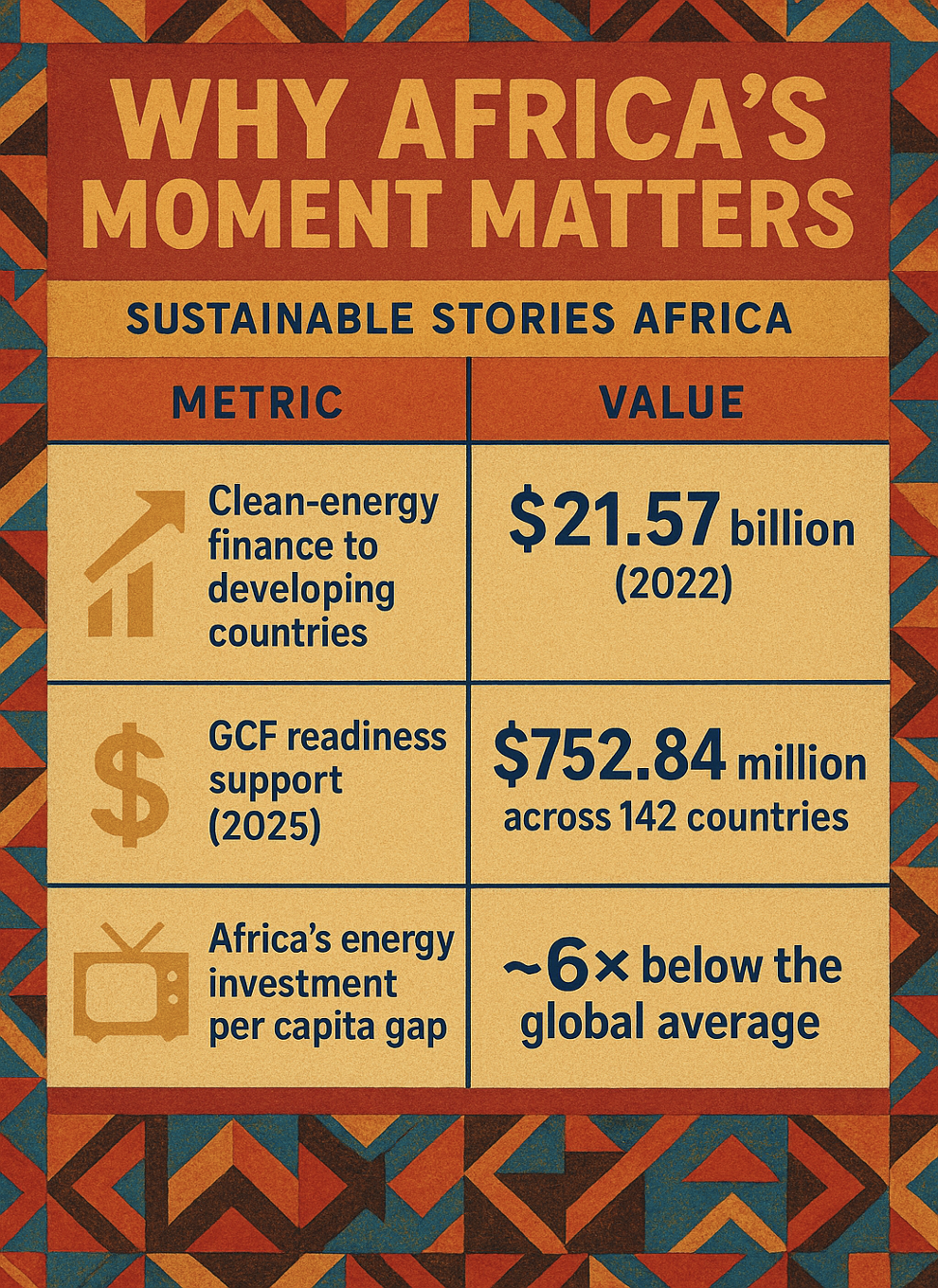

Emerging from years of being cast as only a recipient of climate finance, Africa has begun to assert itself as a key focus in the global funding ecosystem. According to the 2025 Climate Yearbook, international clean-energy finance to developing countries increased by 77.68% from $12.14 billion in 2015 to $21.57 billion in 2022.

The report also notes the Green Climate Fund's readiness and preparatory assistance rose by 19.31% from $631 million in 2023 to $752.84 million in 2025 across 142 countries, a rise that strengthens Africa's foundation for climate-finance absorption.

Why Africa's Moment Matters

The continent carries compelling investment logic. Over 600 million Africans still lack reliable electricity, and Africa's energy investment per capita remains six times lower than the global average. That gap, while challenging, represents both urgency and opportunity.

| Metric | Value |

|---|---|

| Clean-energy finance to developing countries | $21.57 billion (2022) |

| GCF readiness support (2025) | $752.84 million across 142 countries |

| Africa's energy investment per capita gap | ~6 × below the global average |

With investors globally shifting toward climate-aligned assets, Africa's infrastructure and transition needs to provide a high-leverage target.

The Tangible Upside for Africa

Institutionalising these flows promises more than headline funding. For African countries and business sectors, benefits include improved resilience against climate shocks; access to global capital markets; enhanced credibility with investors; and possible acceleration of the low-carbon transition.

The desire here is clear: turn funding momentum into structural transformation, not just one-off projects.

Steps Africa Must Take Now

To convert momentum into outcomes, a set of coordinated actions is required:

- Strengthen institutional capacity: Many African countries require support to prepare Nationally Determined Contributions (NDCs) and National Adaptation Plans (NAPs); 85 developing countries have now received such assistance.

- Mobilise private capital: New models such as the SDG Impact Finance Initiative ($41.5 million mobilised in 2024) are signalling a shift from grant-only to investment-oriented flows.

- Align finance with outcomes: Ensure funds target resilience, adaptation, clean energy access and local capacity rather than just emission mitigation alone.

Path Forward – Unlock Africa's Climate Finance Engine

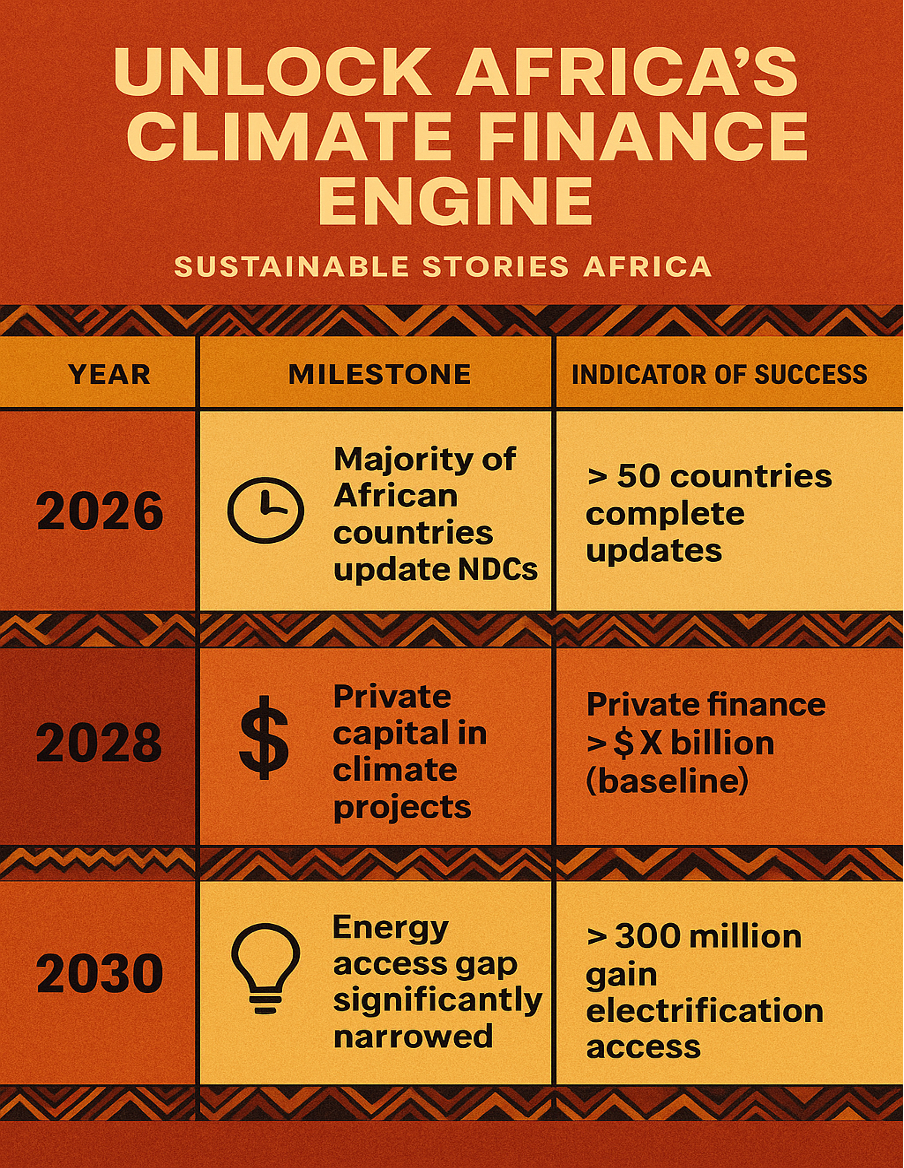

Africa's moment for climate financing is real but fragile. With rising global funding flows and increasing investor readiness, the continent stands at the threshold of a transformative era.

However, this can only translate into sustainable change if capital is paired with governance, strategy and local delivery systems. Over the next five years, key milestones include:

| Year | Milestone | Indicator of Success |

|---|---|---|

| 2026 | Majority of African countries update NDCs/NAPs | > 50 countries complete updates |

| 2028 | Private capital in climate projects doubles | Private finance > $X billion (baseline) |

| 2030 | Energy access gap significantly narrowed | > 300 million gain electrification access |

By unlocking its climate-finance engine now, Africa can turn incoming funds into resilient infrastructure, equitable transition and inclusive growth.

Culled From: https://www.africanleadershipmagazine.co.uk/inside-the-2025-climate-yearbook-africas-rise-in-global-funding/