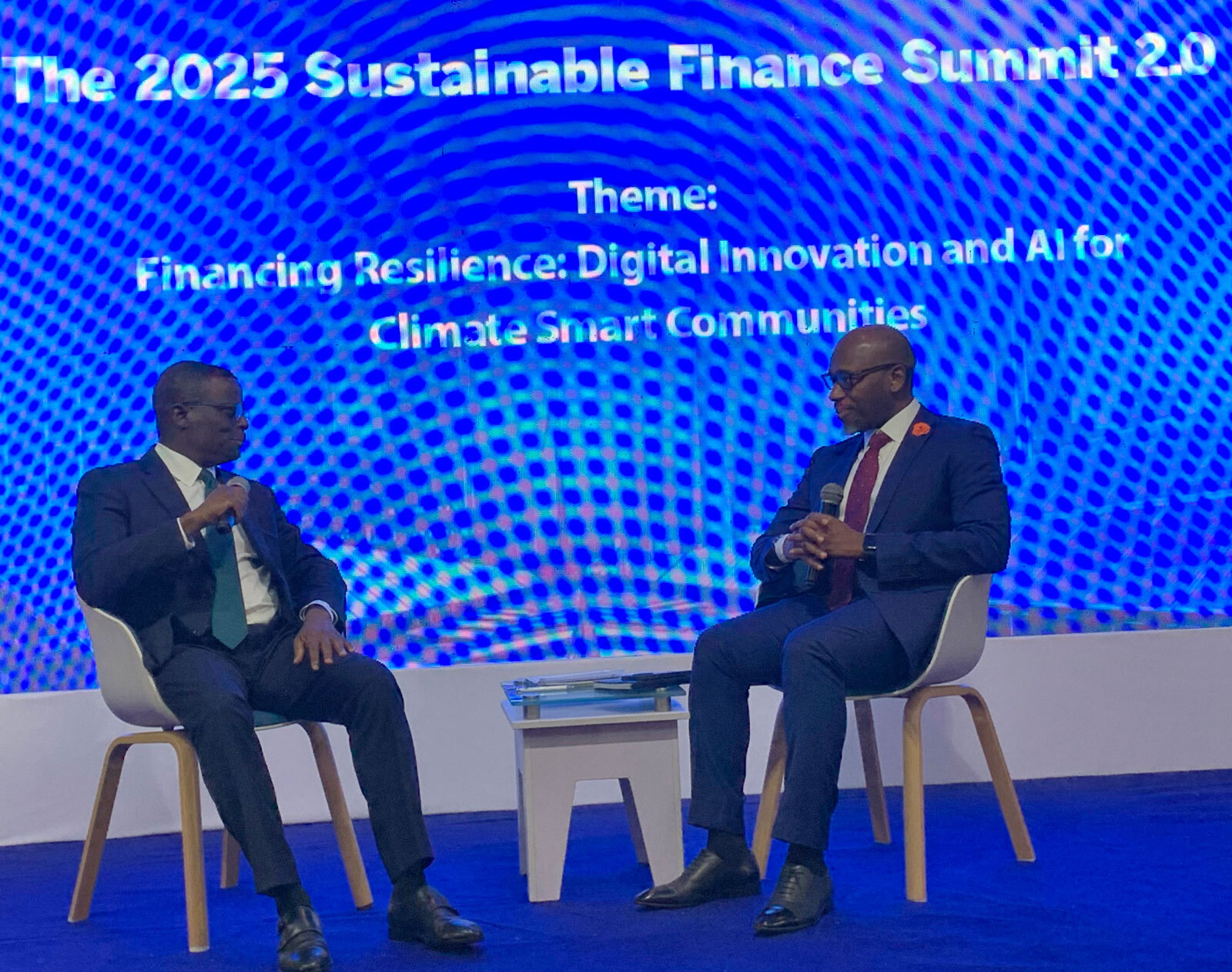

At the Stanbic IBTC Sustainable Finance Summit, industry leaders, regulators, fintechs, and grassroots innovators unpacked how digital innovation, finance structures, and better data can bridge Nigeria’s climate resilience gap, moving billions not just on balance sheets, but to frontline farmers, entrepreneurs, and the vulnerable.

No More Boardroom Solutions - Make It Real for Nigerians

The panel and fireside sessions opened by confronting the urgent realities, that climate change is no longer a distant theory, but lived daily in the form of floods, droughts, failed harvests, and disappearing coastlines. “We need to re-jig people’s brains; we cannot leave with talks and handshakes,” warned the panel’s moderator. The summit’s tone was clear: success means tangible action for people left farthest behind, not another wave of high-level promises.

Stories of a farmer in the Sahel, cut off from irrigation financing and climate-smart seeds, or of women trekking ever-longer distances for water, set the stage for a summit focused on both the climate financing gap and actionable tools for adaptation at the bottom of the pyramid.

Digital Evolution - From Mobile Money to Measurable Change

Speakers spotlighted Africa’s digital transformation as a game-changer for inclusive climate action. Mobile money platforms, pay-as-you-go solar, and SMS-based solutions have already enabled millions of new users; 43% of one solar fintech’s users are first-ever smartphone owners. “Africa is the world’s fastest growing mobile money market, with nearly a billion accounts,” shared one panellist, noting the doors opened for last-mile access.

But innovation is more than apps. New financing models, like micro solar for daily earners or digital health insurance for informal workers, are helping distribute risk, data, and capital down the supply chain. Panellists noted that digital tools are bringing unprecedented transparency, helping partners and regulators trace finance flows and disrupt the cycles of bureaucracy and corruption that long bottlenecked climate efforts.

Critically, technology must pair with robust governance. Nigeria’s Data Protection Act, national digital strategy, and green bond frameworks were cited as vital, but panelists stressed that quality institutions and anti-corruption action are needed for digital advances to translate into everyday value.

Trust, Local Voices, and Triple-Bottom Value

Every discussion circled back to trust. “You can’t talk sustainability as a thought,” said one panellist. “It’s about thriving businesses, the farmer, the teacher, and access for the woman in the far north.” Panelists pressed for governance frameworks that prioritize triple-bottom-line value, balancing social, financial, and environmental returns.

One of the panellists, A fintech CEO, highlighted that innovative pay-as-you-go solar loans have illuminated a million homes, with repayment tailored to daily earnings instead of monthly salaries. Stories showed new value chains being built from scratch, and impact measured not just by financial return, but also improved lives, more resilient communities, and climate-adaptive microbusinesses. The message: social license is inseparable from profitability, and grassroots adoption must shape every layer of product design and impact measurement.

From Policy to Local Progress - Five Levers for Change

- Partnerships: Collaborative action between banks, telecoms, and digital innovators is essential for last-mile problem-solving and new models for targeting rural, informal, and underserved markets.

- Smart, flexible regulation: Policies must evolve to meet local realities, support SME access, and enable new financing instruments, such as microcredit, blended finance, and insurance.

- Technology that fits: Prioritising mobile-first, low-bandwidth tools and channels that meet users where they are. This will include putting them in local languages and having content tailored to the needs of the digitally excluded.

- Closing the feedback loop: Impact must be tracked through transparent, context-appropriate metrics, especially for climate resilience and social benefit.

- Funding what matters: Donors, governments, and DFIs should support African-led innovation and reward inclusive models with real results.

The session closed with a powerful message: real progress depends on forging bold collaborations, shaping practical policy, and harnessing the ingenuity found in every community, not merely on financial ambition or projections. This was captured in this quote: “Technology is meaningless if it fails to improve people’s lives.”

Nigeria’s climate finance leaders were explicit: the path forward belongs to those who design solutions, partnerships, and systems that put farmers, traders, and city dwellers at the very heart of change.