The Financial Reporting Council of Nigeria has warned that company directors will now be held personally liable for inaccurate or misleading sustainability and climate-related disclosures. The Council said corporate leaders must treat climate and ESG reporting with the same seriousness applied to financial statements, as global investors increasingly scrutinise data credibility.

FRC: Company Directors Now Liable for Sustainability, Climate-Reporting Failures

Nigeria's Financial Reporting Council (FRC) has issued a strong directive placing full accountability for sustainability and climate-related disclosures on company directors.

The regulator, citing global reporting reforms, said directors will be held responsible for omissions, misstatements, or misleading ESG data, signalling a major shift in Nigeria's corporate-governance landscape.

Why the FRC's Warning Matters Now

The FRC explained that global investors, stock exchanges, and regulators increasingly rely on sustainability data to assess risk, valuation, and long-term corporate resilience.

Nigeria, aiming to align with IFRS Sustainability Disclosure Standards (ISSB S1 and S2) by 2028, is under pressure to improve transparency.

The Council noted that inaccurate ESG disclosures distort capital markets and expose companies to reputational, regulatory, and financial risks.

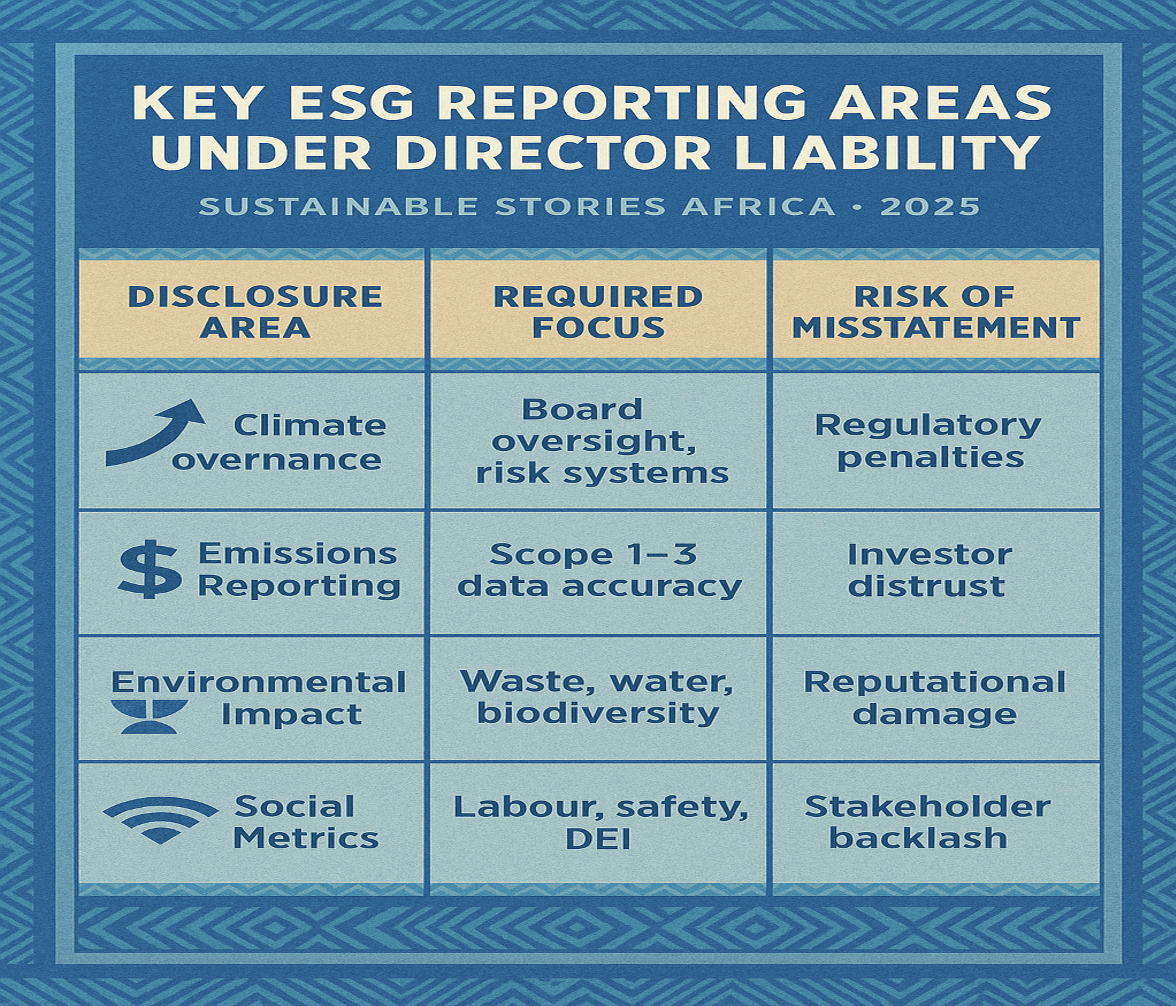

Key ESG Reporting Areas Under Director Liability

| Disclosure Area | Required Focus | Risk of Misstatement |

|---|---|---|

| Climate Governance | Board oversight, risk systems | Regulatory penalties |

| Emissions Reporting | Scope 1– 3 data accuracy | Investor distrust |

| Environmental Impact | Waste, water, biodiversity | Reputational damage |

| Social Metrics | Labour, safety, DEI | Stakeholder backlash |

Evidence Behind Nigeria's Tougher ESG Enforcement Approach

According to the FRC, Nigeria cannot afford weak or inconsistent sustainability reporting at a time when global capital flows depend on credible climate disclosures. The Council highlighted widespread gaps: inadequate internal controls, poor data integration, poorly trained ESG teams, and greenwashing tendencies across sectors.

The regulator said mandatory sustainability-reporting enforcement will help companies gain access to climate finance and minimise regulatory exposure.

Corporate ESG Risk Snapshot (Nigeria)

| Challenge | Market Impact | Required Response |

|---|---|---|

| Fragmented ESG data | Unreliable disclosures | Centralised reporting systems |

| Weak board oversight | Governance failures | ESG-skilled directors |

| Greenwashing | Loss of investor confidence | Third-party assurance |

| Lack of standards | Regulatory inconsistency | ISSB/IFRS adoption |

What Companies and Directors Must Do Next

The FRC outlined several organisational adjustments required before new national sustainability-reporting guidelines take effect:

- Boards must assume fiduciary responsibility for ESG and climate disclosures.

- Companies must integrate sustainability into risk management and enterprise reporting.

- Internal audit functions must expand ESG scope, ensuring controls and accuracy.

- Firms should adopt ISSB standards to align with global best practice.

- Directors must undergo ESG and climate-governance training to meet fiduciary duties.

The regulator emphasised that sustainability reporting is no longer a branding exercise but a legal, investor-critical requirement.

PATH FORWARD – Strengthening Governance to Improve ESG Integrity

Nigeria's FRC is pushing companies toward stronger governance, better data systems, and internationally aligned disclosure standards. Directors must prepare for heightened accountability and assurance expectations.

With investors demanding credible climate information, the reform aims to safeguard market integrity while positioning Nigerian firms for improved access to sustainable finance.

Culled From: https://punchng.com/directors-liable-for-sustainability-climate-reporting-frc/