Environmental, Social and Governance (ESG) performance has become a decisive factor in how investors evaluate corporate value and long-term viability, according to Eco Capital Chief Executive Babatunde Ojo. He explained that companies with weak ESG structures increasingly face financing obstacles, reputation risks, and declining stakeholder trust.

Speaking at a Lagos industry forum, Ojo said Nigerian firms must shift from cosmetic sustainability reporting to measurable, transparent ESG implementation that withstands investor scrutiny.

ESG Now Central to Corporate Valuation, Says Eco Capital Chief

Eco Capital’s Chief Executive, Babatunde Ojo, has said that ESG performance now plays a central role in shaping investment decisions, corporate valuation, and capital-market confidence.

He warned that global and domestic investors are applying stricter ESG benchmarks, meaning companies that fail to adopt robust sustainability governance risk erosion of long-term value and reduced access to capital.

Why ESG Is Reshaping Investor Behaviour

Ojo noted that global capital flows have shifted sharply toward sustainability-aligned assets, with investors demanding clarity on emissions, human-rights records, diversity metrics, and corporate ethics.

Nigerian firms, he added, can no longer rely on voluntary reporting or branding-led sustainability statements; investors now track verifiable data, climate resilience indicators, and corporate-governance performance to guide funding decisions.

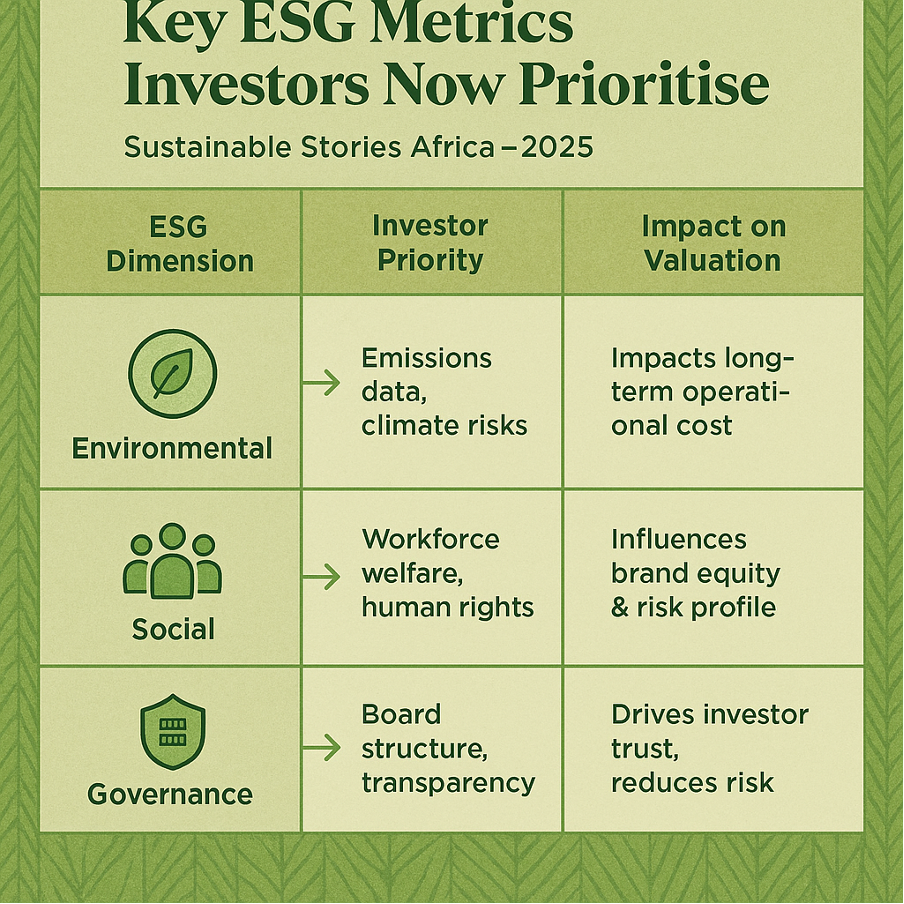

Key ESG Metrics Investors Now Prioritise

ESG Dimension | Investor Priority | Impact on Valuation |

|---|---|---|

Environmental | Emissions data, climate risks | Impacts long-term operational cost |

Social | Workforce welfare, human rights | Influences brand equity & risk profile |

Governance | Board structure, transparency | Drives investor trust, reduces risk |

Evidence Behind the ESG Valuation Shift

Citing global trends, Ojo explained that firms with strong ESG profiles enjoy stronger risk-adjusted returns, lower capital costs, and improved shareholder confidence. Companies with weak governance or environmental lapses face increasing penalties—from litigation and regulatory sanctions to investor withdrawal.

The Nigerian market, he said, is not insulated: pension funds, international lenders, development banks, and private-equity firms increasingly require detailed ESG compliance documentation before approval of transactions.

Corporate ESG Landscape Snapshot (Nigeria)

Challenge | Market Impact | Required Response |

|---|---|---|

Poor ESG reporting | Investor hesitation | Improve data systems |

Weak governance controls | Higher risk perception | Strengthen oversight |

Environmental non-compliance | Regulatory pressure | Adopt emissions strategies |

Social-performance gaps | Reputational risks | Implement human-capital policies |

What Nigerian Firms Must Do Next

Ojo called for stronger ESG integration beyond annual reporting cycles. He emphasised the need for:

- Board-level sustainability oversight to drive accountability.

- Third-party ESG audits to validate environmental and governance claims.

- Science-based emissions targets to align with global decarbonisation trends.

- Transparent stakeholder engagement, especially across supply chains.

- Alignment with global frameworks such as ISSB, GRI, and SASB.

He added that companies that embed ESG internally and not as PR, but as a strategic risk-management tool, are better positioned to win investor confidence, attract global partnerships, and compete sustainably.

PATH FORWARD – Embedding ESG to Secure Investor Trust

Nigeria’s corporate sector must transition from symbolic sustainability practices to robust ESG systems backed by verifiable data and transparent governance. Investors now reward measurable performance, not narratives.

Embedding ESG into strategy, risk management, and disclosure frameworks will determine whether Nigerian companies can attract resilient capital flows and strengthen long-term market competitiveness.

Culled From: https://gazettengr.com/esg-key-driver-of-corporate-valuation-investor-confidence-says-eco-capital-chief/