Nigeria's pension industry is entering a stricter compliance era as PenCom's Revised Corporate Governance Guideline reshapes oversight, board composition, tenure, diversity, ownership restrictions, and evaluation requirements. The reforms mark a shift from discretionary interpretation to mandatory accountability with enforceable expectations for operators.

Pension Governance Rules Enter Enforcement Era

Nigeria's pension sector is undergoing a decisive regulatory reset as PenCom's Revised Corporate Governance Guideline introduces mandatory standards designed to elevate board oversight, enforce independence, and align sector governance with international norms. According to the 'Analysis of Pencom's Revised Corporate Governance Guideline, published by the Society for Corporate Governance Nigeria, the guideline affects all Licensed Pension Fund Operators (LPFOs), including PFAs, CPFAs, PFCs, and administrators, replacing loosely interpreted expectations with explicit compliance obligations.

The reforms raise accountability across the leadership structure, diversity, tenure, principal ownership, evaluations, and succession planning. These areas had either been implied or inconsistently applied under the 2021 framework. Requirements such as minimum thresholds of Independent Non-Executive Directors (INEDs), formal diversity policies, cumulative tenure caps, and mandatory external evaluations now create firm compliance triggers.

For operators, this marks the beginning of heightened regulatory scrutiny, increased documentation demands, and likely board restructuring. The guideline signals PenCom's policy shift from "should" to "must," reflecting a broader governance tightening under the regulator's modernisation programme.

Rising Compliance Stakes Reshape Boardroom Accountability

The revised guideline introduces a mandatory minimum of three INEDs or 30% of the board composition, whichever is higher, requiring annual confirmations of independence and continuous verification frameworks.

Boards must also adopt formal diversity policies with measurable objectives spanning gender, experience, and skills. This is transitioning from encouragement to enforceable obligation. Practical implications include restructuring, documentation protocols, and demonstrable progress tracking.

Detailed Reforms and Sector-Wide Operational Implications

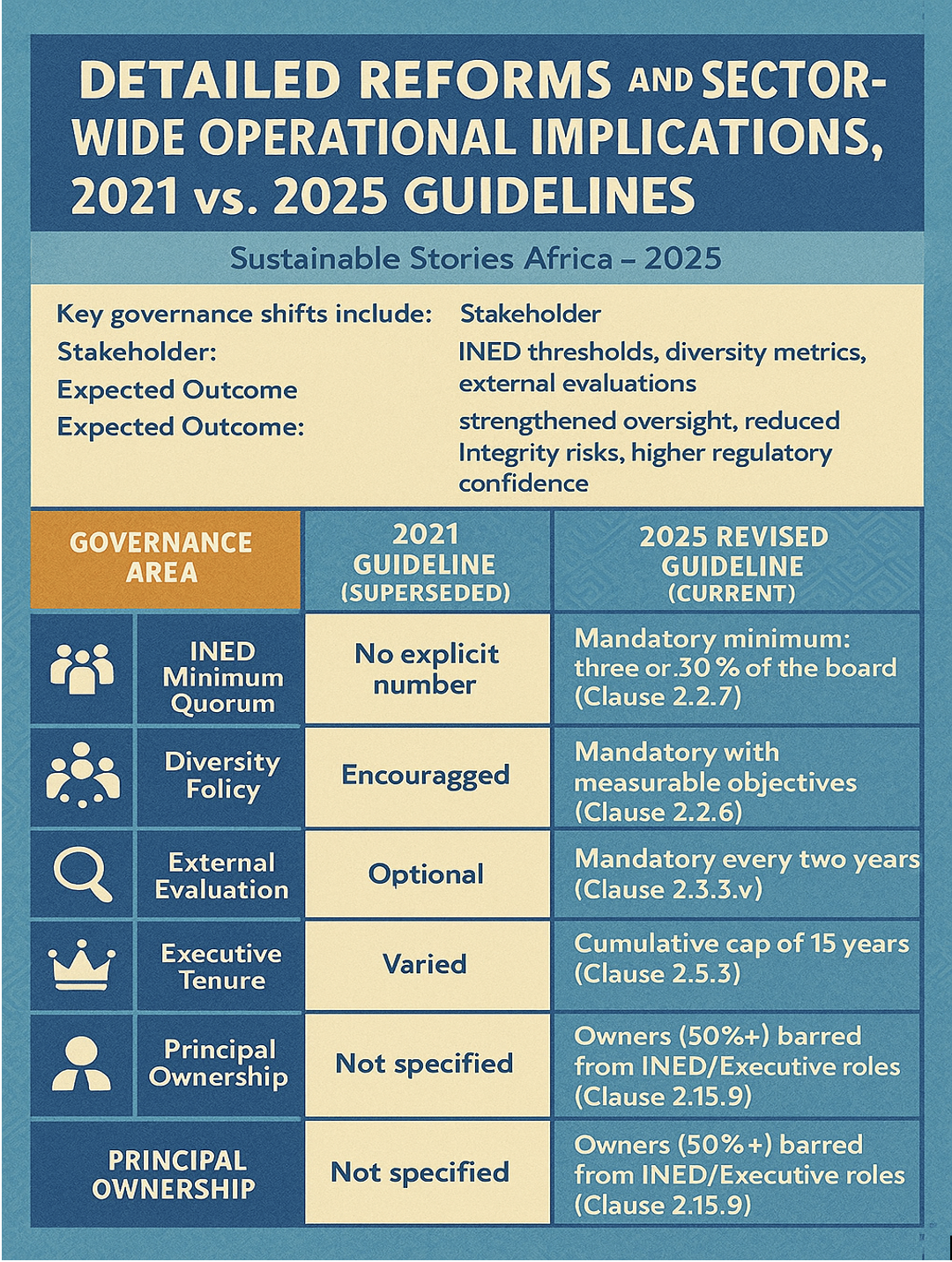

Key governance shifts include:

- Stakeholder: LPFO Boards

- Decision Lever: INED thresholds, diversity metrics, external evaluations

- Expected Outcome: strengthened oversight, reduced integrity risks, higher regulatory confidence

2021 vs. 2025 Guidelines

| Governance Area | 2021 Guideline (Superseded) | 2025 Revised Guideline (Current) |

|---|---|---|

| INED Minimum Quorum | No explicit number | Mandatory minimum: three or 30% of the board (Clause 2.2.7) |

| Diversity Policy | Encouraged | Mandatory with measurable objectives (Clause 2.2.6) |

| External Evaluation | Optional | Mandatory every two years (Clause 2.3.3.v) |

| Executive Tenure | Varied | Cumulative cap of 15 years (Clause 2.5.3) |

| Principal Ownership | Not specified | Owners (50%+) barred from INED/Executive roles (Clause 2.15.9) |

Additional mandated provisions include:

- succession planning chaired by an INED, covering all top leadership roles

- at least one annual in-person board meeting (Clause 2.5.4)

- cooling-off periods for executives reaching tenure limits

These reforms will require immediate mapping of director eligibility, new evaluation budgeting, committee restructuring, and enhanced compliance reporting.

Why Stronger Governance Improves Confidence and Market Stability

The reforms offer tangible benefits:

- higher investor and contributor trust

- reduced operational and integrity risk

- clearer accountability in decision-making

- better leadership renewal and organisational resilience

The broader policy context links governance reforms to foreign currency contribution rules, securities lending oversight, and enhanced sanctions.

Steps Operators Must Take Now to Comply

Strategic recommendations include:

- Prioritise Board Action – Present analysis at the next board meeting.

- Conduct Gap Analysis – Compare current practices to new mandates.

- Move Early – Recruitment pipelines for INEDs will tighten.

- Engage Advisors – Compliance planning and policy drafting support.

- Monitor Developments – Track further PenCom guidance.

PATH FORWARD – Strengthening Governance Capacity for Regulatory Transition

Nigeria's pension operators now face a compressed timeline to restructure board composition, document independence verification, adopt measurable diversity frameworks, and initiate mandatory external evaluation cycles. Acting early will minimise compliance risk and signal governance maturity to regulators and contributors alike.

The new regulatory environment rewards preparedness, transparency, and board competence. Operators that proactively align structures and reporting processes will be best positioned to navigate enforcement, sustain trust, and compete effectively in an increasingly scrutinised market.