Institutional investors hold immense influence, but the latest global findings reveal most still anchor portfolios in high-emitting sectors, with only modest shifts into climate innovators. Even as stewardship and disclosure rise, real capital flows remain tied to carbon-heavy incumbents, not the transition.

Pension funds and asset managers diversify across all sectors, creating a silent structural contradiction. Despite market power, investor action continues lagging climate ambition, leaving transition capital far below what is needed.

Global Investors Anchor, Climate Progress Slows

Institutional investors—long considered the lever that could bend global markets toward net-zero—are not steering the climate transition with the force economists once predicted. According to the Global Corporate Sustainability Report 2025, the world's largest investors continue to own significant stakes in the highest-emitting companies while only modestly increasing exposure to low-carbon innovators. The result is a global investment landscape marked by portfolio inertia rather than decisive steering toward a climate-aligned economy.

The report makes it clear: despite unprecedented sustainability disclosure across markets, investors' real-world allocation of capital still does not signal a meaningful transition away from carbon-intensive sectors. Instead, pension funds, sovereign wealth funds, and asset managers remain heavily diversified across incumbents and innovators alike, creating a structural contradiction at the heart of global climate finance.

A Transition Shaped by Ownership, Not Advocacy

At the centre of the issue is the way institutional investors accumulate and diversify assets. The report notes that the top 20 global investors simultaneously hold:

- large equity stakes in energy, mining, transport, and utilities

- significant allocations to renewable energy, clean technology, and digital infrastructure

- passive exposure through market indices that overweight high emitters

This creates a landscape where investors are present everywhere but driving change nowhere.

Large investors own nearly 40% of global market capitalisation, giving them unprecedented influence over climate outcomes. However, ownership does not always translate into climate-aligned engagement. As the report states, "Investors' portfolio composition reflects market structure more than strategic decarbonisation intent."

Investor Influence vs Investor Action

The mismatch between influence and action is stark. While more than half of major investors publish climate stewardship policies, only 14% set binding portfolio-wide emissions targets. Even fewer adjust their capital allocation in line with the transition.

Portfolio Inertia – The Silent Drag on Progress

The report warns that portfolio inertia, the entrenched structure of large, diversified holdings, remains one of the biggest barriers to climate-aligned investing.

Many of the world's largest investors are simply too deeply embedded in global indices to divest meaningfully from high emitters. Instead, they rely on engagement strategies whose impact is uncertain and slow.

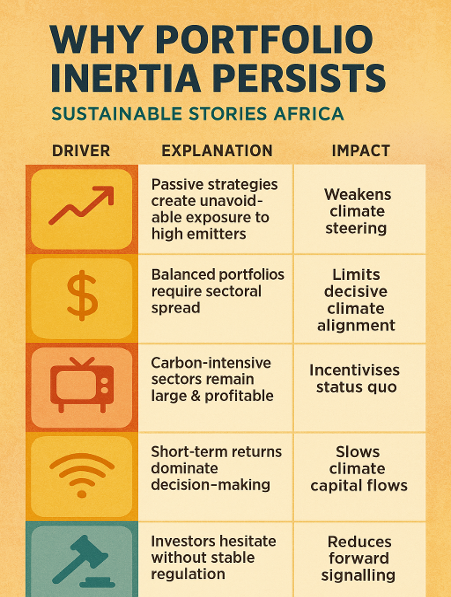

Why Portfolio Inertia Persists

| Driver | Explanation | Impact |

|---|---|---|

| Index dependence | Passive strategies create unavoidable exposure to high emitters | Weakens climate steering |

| Diversification pressures | Balanced portfolios require sectoral spread | Limits decisive climate alignment |

| Market structure | Carbon-intensive sectors remain large & profitable | Incentivises status quo |

| Fiduciary constraints | Short-term returns dominate decision-making | Slows climate capital flows |

| Policy uncertainty | Investors hesitate without stable regulation | Reduces forward signalling |

These systemic forces mean that investors often encourage climate action at the margins, through voting, dialogue, and disclosure pressure, without adjusting the core structure of their portfolios.

The Engagement Illusion

Investor engagement is growing, but its effectiveness remains unclear. The report shows that climate-related engagements rose 26% globally between 2022 and 2024; however, most focus on disclosure, not transformation.

Companies are disclosing more information but not necessarily reducing emissions or shifting capital expenditure.

The report puts it bluntly: "Engagement is often a governance exercise rather than a transition driver." Where investors do engage deeply, they face limits:

- Engagement teams are small relative to portfolio size

- Stewardship priorities conflict with financial objectives

- Voting power is diluted across global markets

- Many investors avoid confrontational approaches

As a result, even the most ambitious stewardship policies yield incremental, not structural, change.

The Double Exposure Challenge

One of the report's sharpest insights is the double exposure challenge: investors are simultaneously exposed to

- Transition winners (renewables, semiconductors, electrification manufacturers)

- Transition laggards (oil, gas, heavy industry, transportation)

This dual exposure produces portfolios that hedge both sides of the climate transition rather than accelerating it. For many investors, this is a rational financial strategy, but it means global capital markets are not enabling rapid decarbonisation.

The report shows that even funds with strong climate policies maintain substantial stakes in fossil-intensive sectors because those sectors continue to dominate index weights and dividend income.

Green Innovation Still Undercapitalised

Only 6–8% of global investor portfolios are directed toward sectors classified as "transition enablers," such as:

- battery technology

- clean hydrogen

- carbon capture

- zero-emission mobility

- green manufacturing infrastructure

This investment remains far below what is required to meet global climate goals.

The report highlights that clean-tech R&D, manufacturing scale-up, and deployment risks remain underfinanced because investors favour mature sectors, even when those sectors are carbon-intensive.

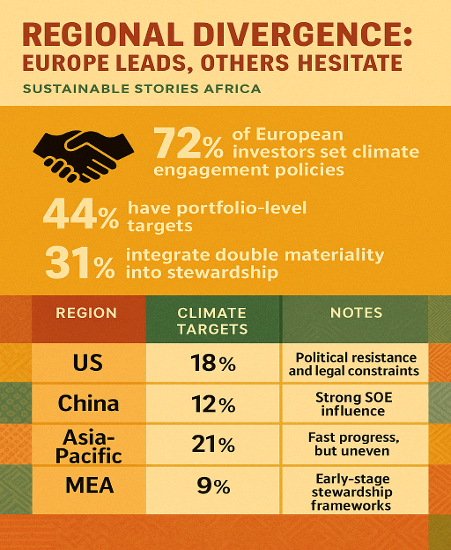

Regional Divergence: Europe Leads, Others Hesitate

Europe continues to lead investor-driven climate action:

- 72% of European investors set climate engagement policies

- 44% have portfolio-level targets

- 31% integrate double materiality into stewardship

Other regions lag significantly:

| Region | Climate Targets | Notes |

|---|---|---|

| US | 18% | Political resistance and legal constraints |

| China | 12% | Strong SOE influence |

| Asia-Pacific | 21% | Fast progress, but uneven |

| MEA | 9% | Early-stage stewardship frameworks |

The Bottom Line – Investors Shape the Transition, But Are Not Steering It

The conclusions are clear and sobering:

- Global investors are powerful enough to influence the transition

- But their portfolios are structurally too diversified, carbon-heavy, and index-tied

- Engagement is growing but shallow

- Capital still flows disproportionately to incumbents

- Clean-tech innovators remain underfunded

- Portfolio targets remain rare

- Policy uncertainty amplifies caution

The report states: "Investors are shaping the climate transition but not steering it. Market structure, not climate ambition, still determines portfolio allocation."

PATH FORWARD – Redirecting Capital, Reshaping Market Signals

For investors to steer the transition, they must adopt portfolio-level climate targets, strengthen stewardship practices, and shift capital into transition-enabling sectors.

Governments must stabilise policy signals, strengthen disclosure rules, and reward investment in clean innovation. Without these shifts, investor influence will continue rising, but climate impact will not.