In developing economies, climate-vulnerable households and SMEs too often face exclusion from the green-finance agenda. These triggers increased systemic risk for both communities and the financial sector.

Climate, finance and inclusion collide

Climate change, financial-inclusion gaps and banking-sector vulnerabilities are increasingly intertwined. According to the World Bank, exposed firms and households face elevated risks of non-performing loans and asset devaluation pressures that may push financiers to abandon smaller, lower-income clients entirely.

At the same time, regulatory efforts to "green" the financial sector risk unintended exclusion if due diligence costs and verification burdens make small-ticket lending uneconomic. The danger: a vicious cycle of exclusion and risk amplification.

In contrast, if finance-sector regulators deliberately integrate inclusion into green-finance policy, they can trigger a virtuous cycle of expanded access, improved resilience and enhanced stability.

Why inclusive green finance matters

For emerging and frontier markets, the stakes are significant. When low-income households and SMEs are shut out of climate-resilient investment finance, their vulnerability increases and so does the systemic risk borne by the financial sector.

Conversely, by enabling access to affordable green finance, a broader economic base can invest in resilient assets and technologies, reducing default risk and improving risk-adjusted returns across the system.

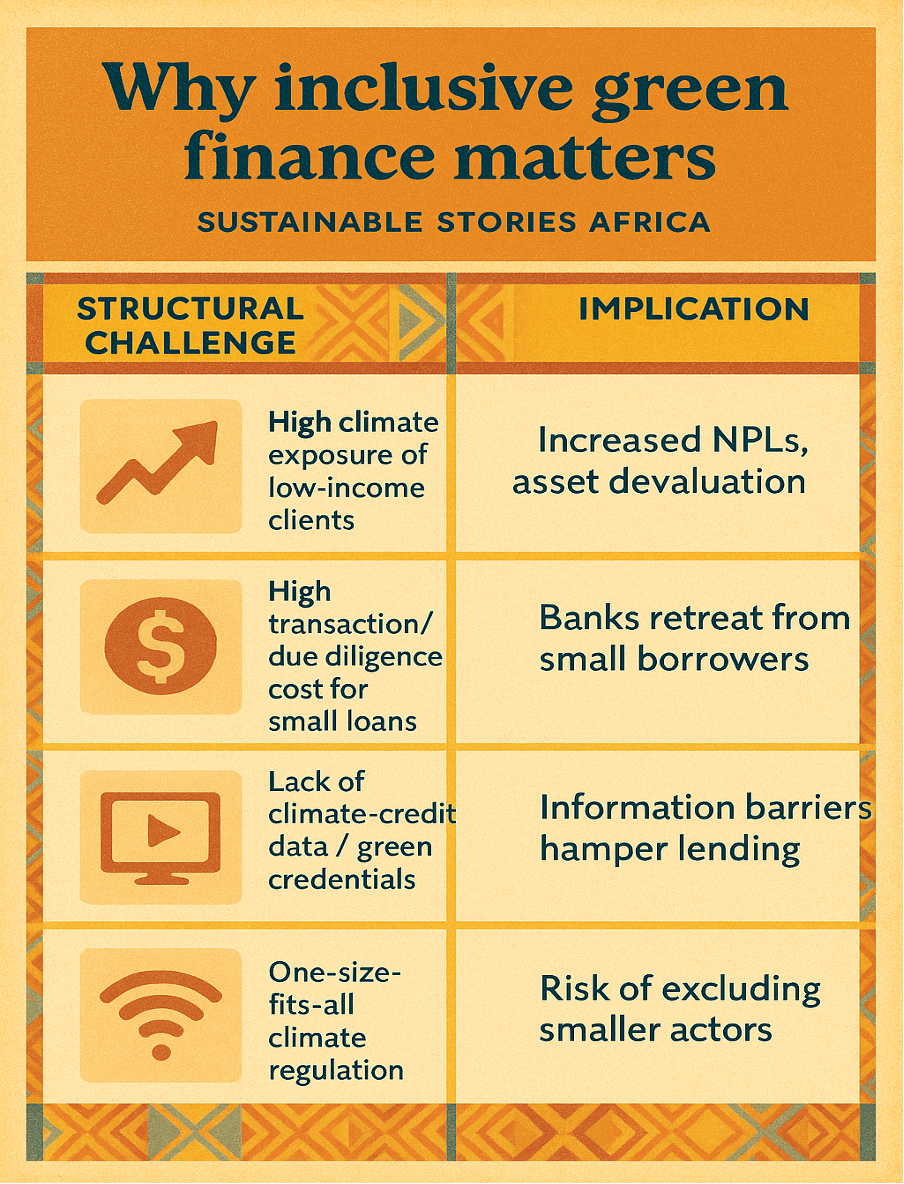

Below is a schematic summary of the risk-inclusion dynamic:

| Structural Challenge | Implication |

|---|---|

| High climate exposure of low-income clients | Increased NPLs, asset devaluation |

| High transaction/due diligence cost for small loans | Banks retreat from small borrowers |

| Lack of climate-credit data / green credentials | Information barriers hamper lending |

| One-size-fits-all climate regulation | Risk of excluding smaller actors |

This table/infographic draws from the World Bank's analysis of how financial-inclusion and green-finance objectives interface.

Policy levers to trigger the virtuous cycle

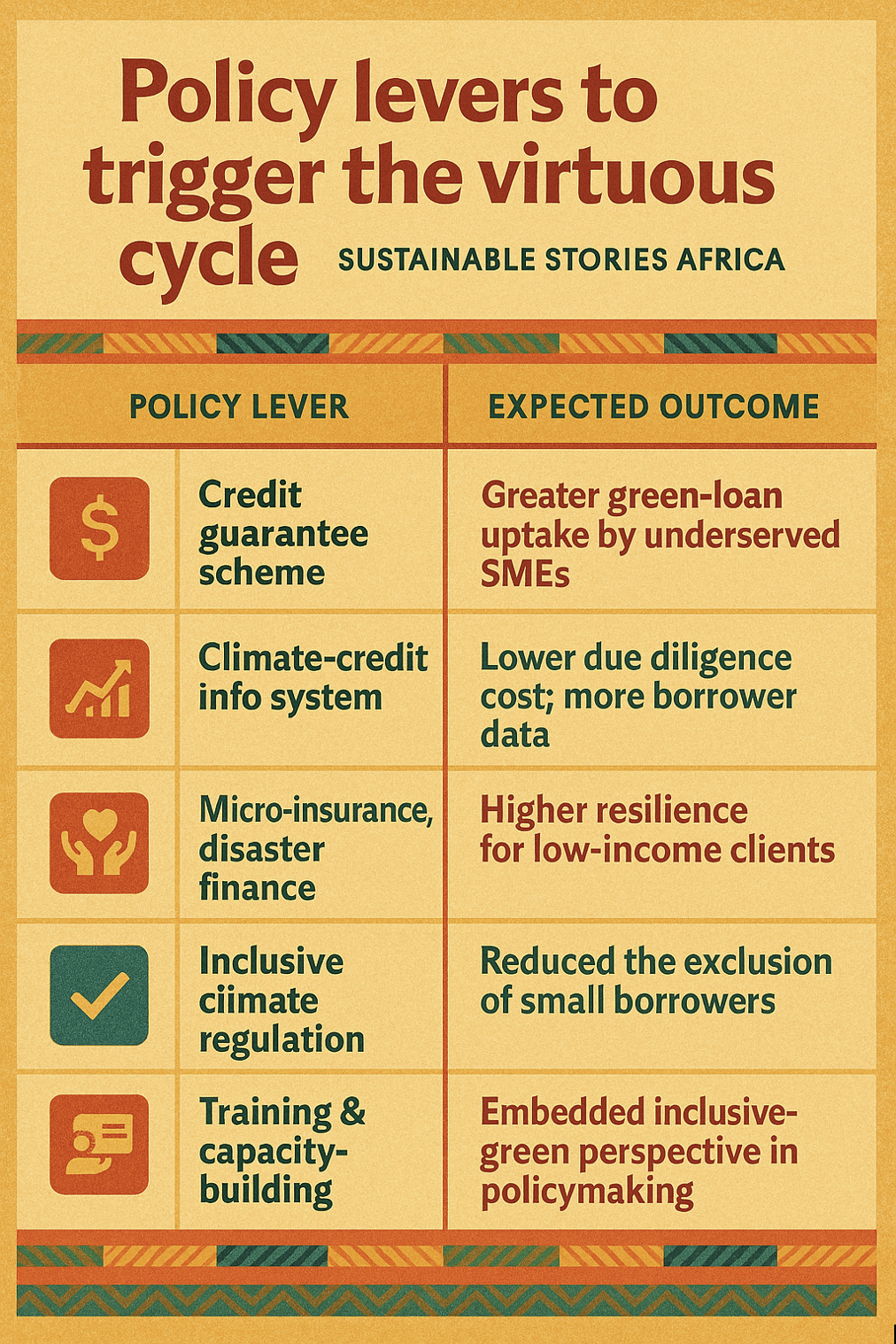

There are five key policy instruments to shift from a vicious to a virtuous cycle:

- Green credit guarantee schemes targeting SMEs.

- Green credit-information systems (registries of climate-relevant borrower data).

- Climate-responsive insurance and disaster-risk-finance products for vulnerable clients.

- Proportionate regulation and supervision that embed inclusion into climate-risk management.

- Capacity-building integrated across regulators and financial institutions with a lens of inclusive green finance. Here's how these actions map to outcomes:

| Policy Lever | Expected Outcome |

|---|---|

| Credit guarantee scheme | Greater green-loan uptake by underserved SMEs |

| Climate-credit info system | Lower due diligence cost; more borrower data |

| Micro-insurance, disaster finance | Higher resilience for low-income clients |

| Inclusive climate regulation | Reduced the exclusion of small borrowers |

| Training & capacity-building | Embedded inclusive-green perspective in policymaking |

Designing for emerging-market contexts

For African and other emerging-market settings, policy design must be tailored to capacity, scale and risk profile. For example:

- Regulatory mandates need to be risk-proportionate, so smaller clients are not priced out.

- Lowering transaction costs for small green loans via standardised due diligence or pooled infrastructure.

- Embedding inclusive green-finance as a cross-cutting theme within supervisory training.

These adjustments help ensure that the scale of inclusion and resilience rise concurrently, and it is not pitted against financial-stability goals.

Path Forward – Include, Finance, Build Resilience, Sustain Access

Going forward, the policy journey can be summed up in six words: Include, Finance, Build Resilience, Sustain Access. This mantra encapsulates the steps: widen access, deploy affordable green finance, build resilient infrastructure and maintain sustained access over time.

For African regulators and financial-sector stakeholders, the imperative is clear: holistic inclusion-driven green-finance strategies must be adopted now, and the time for piecemeal action has passed.

If executed effectively, inclusive green finance offers a triple win: stronger climate resilience, broader economic inclusion and a more stable financial system.

Culled From: https://blogs.worldbank.org/en/psd/driving-a-virtuous-cycle-of-inclusive-green-finance