Africa's energy-transition ambition faces a stark financing reality: about 75% of power generation today still comes from fossil fuels, and hydropower projects of 24GW are stalled due to financing constraints.

Financing Africa's Renewable Energy Transformation Now

Africa stands on the cusp of a major power transition: abundant solar resources, growing demand and hydropower potential offer huge upside, but the shift from the 75 % fossil-fuel-dominated generation mix is profoundly constrained by financing and institutional barriers.

The S&P Global report exposes this dichotomy: on one side, renewables capacity additions could more than double (from ~10 GW annually to over 25 GW between 2030–2050). On the other hand, hydropower projects totalling 24 GW remain stalled due to financing, currency and bankability issues.

In this article, we apply the AIDAP (Awareness–Insight–Decision–Action–Path Forward) framework in a story-led, data-rich style to explore how Africa can move from energy-transition ambition to execution, through innovative financing solutions.

The Scale of the Energy Challenge

The baseline data is stark. As of end-2024, fossil fuels (coal, oil, natural gas) accounted for about 75% of Africa's total power generation, as high as 90 % in North Africa.

Hydropower contributed 16% of total African generation (excluding North Africa/South Africa, more than 43%.

Meanwhile, of the 24 GW of approved hydropower projects, many are stalled due to financing, currency risks and bankability issues.

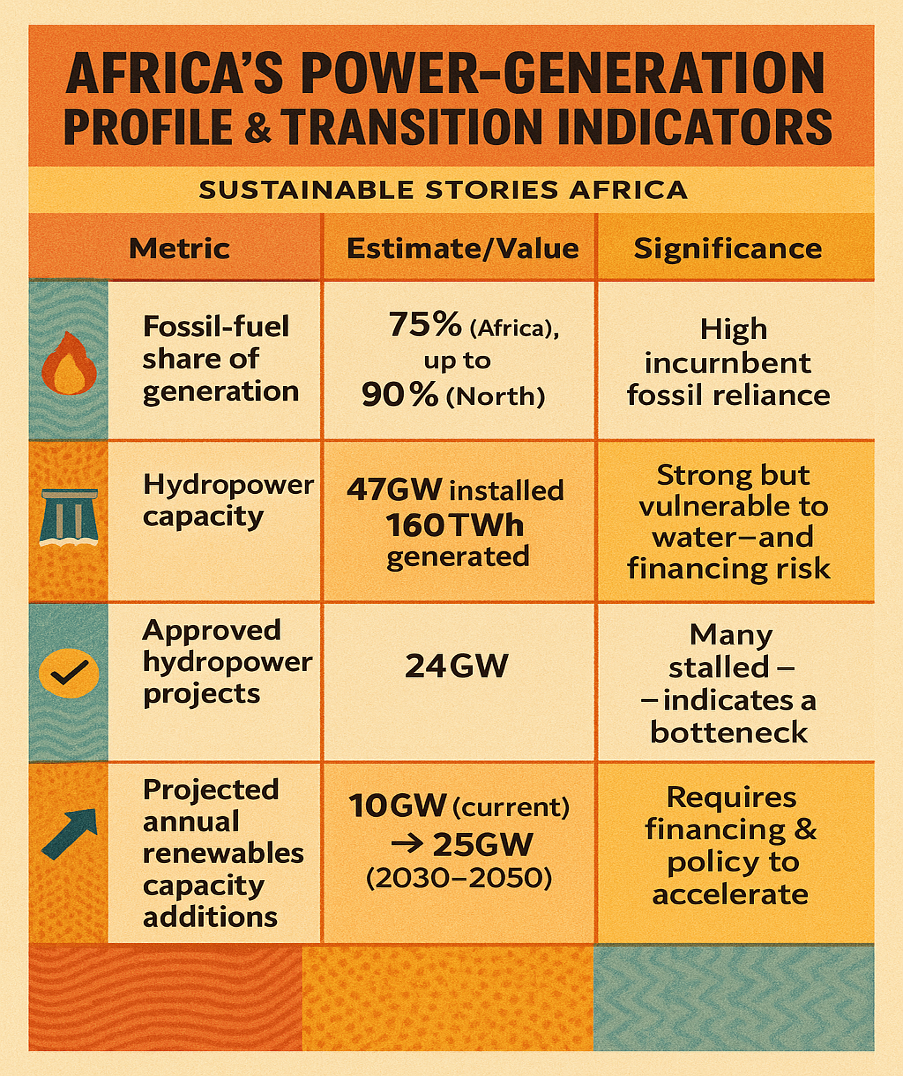

Africa's Power-Generation Profile & Transition Indicators

| Metric | Estimate/Value | Significance |

|---|---|---|

| Fossil-fuel share of generation | 75 % (Africa), up to 90% (North) | High incumbent fossil reliance |

| Hydropower capacity | 47GW installed, 160TWh generated | Strong but vulnerable to water- and financing risk |

| Approved hydropower projects | 24GW | Many stalled – indicates a bottleneck |

| Projected annual renewables capacity additions | 10GW (current) → 25GW (2030–2050) | Requires financing & policy to accelerate |

This awareness phase emphasises the size of the energy-transition gap and the urgency of mobilising capital and reforming systems. Without recognising the scale, financing efforts risk being insufficient or mis-targeted.

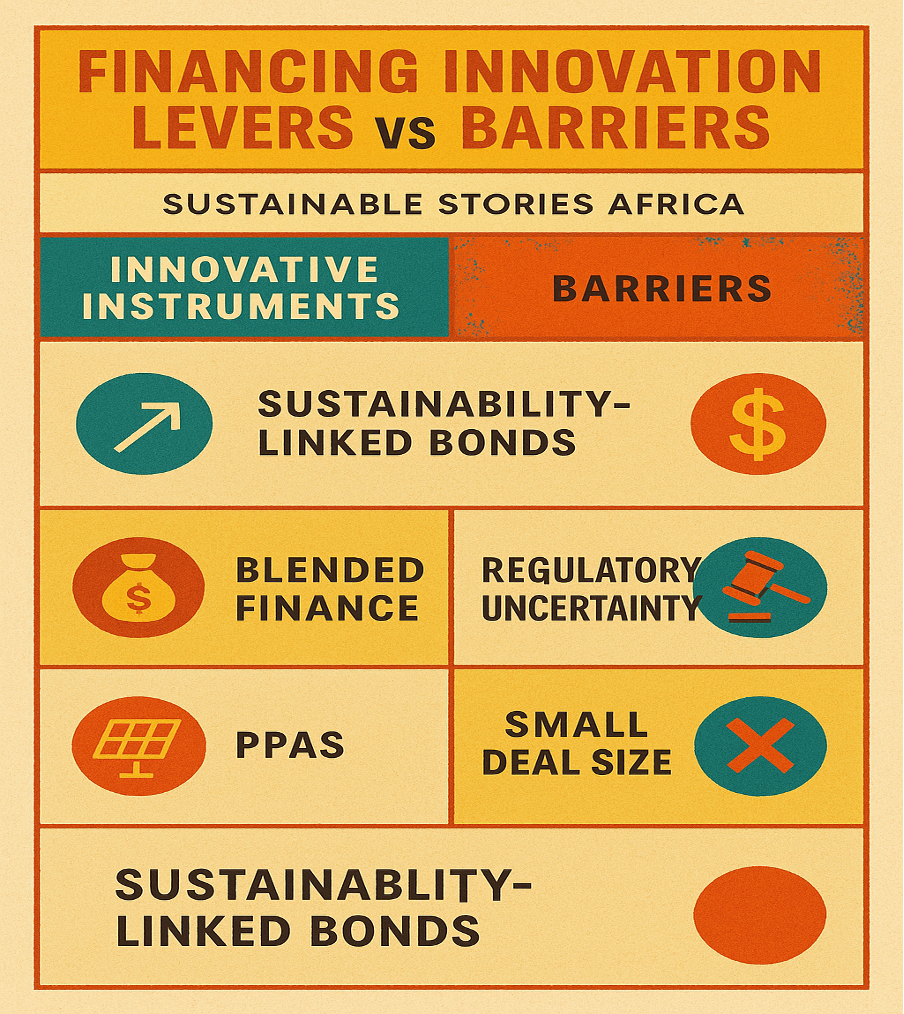

Why Financing Innovation Matters

The report highlights several structural barriers that underscore the need for innovative financing instruments. First, the bankability of projects is undermined by currency fluctuations, weak legal/regulatory frameworks and high perceived risks.

Second, transaction sizes are often small, fragmented and cross-border regulatory risk remains high, which reduces investor appetite.

Third, financing instruments such as green, social, sustainability, and sustainability-linked bonds and loans are growing rapidly in Africa but still represent a tiny portion of required flows.

Financing Innovation Levers vs Barriers

The insight: it is not only the availability of funds that matters, but the structure of financing, risk-mitigation mechanisms and institutional environment. Financing innovation is essential to mobilise large-scale investment, not merely incremental flows.

Strategic Choices for Stakeholders

Stakeholders in the energy-transition ecosystem must make decisive choices to advance innovative financing.

For governments & policymakers

- Decide to establish clear policy frameworks and long-term contracts that reduce regulatory and implementation risk.

- Decide to offer credit enhancements, currency hedging support or guarantee mechanisms to entice private capital.

For investors & financiers

- Decide whether to deploy to Africa's energy sector by investing in structured instruments (e.g., sustainability-linked bonds) that incorporate measurable energy-transition KPIs.

- Decide to aggregate smaller projects to reach institutional size, reducing cost and improving liquidity.

For development finance & multilateral institutions

- Decide to act as anchors or first-loss providers in blended-finance vehicles designed for African renewables.

- Decide to assist in project preparation, capacity building and risk-mitigation solutions to make investible pipelines.

Decision Levers for Stakeholder Groups

| Stakeholder | Decision Lever | Intended Outcome |

|---|---|---|

| Governments | Policy clarity, contract stability, and guarantees | Lower risk environment, higher investor confidence |

| Investors/Financiers | Structured instruments, aggregation, hedge support | Larger, investible deal sizes, improved returns |

| DFIs/Multilaterals | First-loss, blended finance vehicles, pipeline prep | Mobilised private capital, scalable project flow |

These decisions determine whether Africa will move from financing pilots and frameworks to large-scale implementation of its energy transition ambitions.

Implementing the Financing Blueprint

The action phase focuses on operationalising innovative financing and aligning it with energy-transition goals.

- Develop investible energy-project pipelines – Governments and development agencies should catalogue projects with standardised documentation, risk profiles, and structuring templates.

- Deploy blended-finance and sustainability-linked instruments – Increase issuance of ESG-linked bonds/loans tied to renewables capacity or emissions reduction KPIs. For example, sustainability-linked bonds that reward achievement of capacity-addition targets.

- Risk-mitigation mechanisms – Provide currency-hedge facilities, guarantee funds or first-loss capital to reduce perceived risk in African markets.

- Scale aggregation and regional pools – Combine smaller-scale solar, wind or hydro projects into portfolios that meet institutional investor scale thresholds.

Roadmap from Project to Investment

These actions link strategy to execution and signal how innovative financing can translate into delivered capacity, not just commitments.

Path Forward – Innovative Finance Accelerates Africa's Energy Revolution

To capitalise on the financing window and deliver on Africa's renewables potential, the continent must press ahead on multiple complementary fronts.

- Policy and contracting clarity – Create stable regulatory environments with transparent long-term contracts for renewables.

- Financing instrument innovation – Expand sustainability-linked bonds, green loans and blended finance vehicles tailored to African risk profiles.

- Risk-mitigation scaffolding – Deploy hedging, guarantees and first-loss capital to reduce investor risk.

- Pipeline development and aggregation – Build standardised project pipelines, combine deals into investible portfolios.

- Domestic market deepening – Mobilise local institutional investors (pension funds, insurance companies) once instruments and pipelines mature.

- Monitoring & impact metrics – Tie financing to measurable outcomes (e.g., GW capacity added, tons CO₂ avoided) to foster transparency, accountability and investor trust.

With these six pillars aligned, Africa can transform its energy-transition challenge into a growth opportunity, delivering renewable capacity, energy access and climate resilience.

While Africa's renewable-energy potential is vast, the limiting factor is increasingly how the financing is structured and not how much.