Africa's capital-market depth remains shallow. Domestic equity and debt markets average far below 240% of GDP, the global benchmark for developed markets.

A new S&P Global Ratings report shows that multilateral lending institutions (MLIs) are stepping in with loans, guarantees and technical assistance to accelerate market development; however, major gaps in regulation, scale and private-sector participation persist.

Multilateral Institutions Fuel Africa's Finance Revolution

Africa is grappling with a dual challenge: raising sufficient investment and building deep domestic capital markets to channel savings into growth. According to S&P Global Ratings, developed economies' domestic equity and debt markets average about 240 % of GDP, a benchmark far beyond most African countries.

In this context, MLIs such as regional development banks are emerging as critical enablers of capital-market development in Africa, offering not only finance but technical assistance and regulatory reform support.

However, their efforts must shift from pilot projects to systemic scale. Our article tries to map out how MLIs are enabling capital markets development in Africa, the constraints they face, the decisions required, the actions underway and the path ahead for meaningful transformation.

The Scale of the Capital-Market Deficit

The report notes that in developed markets, domestic equity and debt capital markets typically average about 240 % of GDP.

In many African countries, by contrast, capital-market size is much smaller and dominated by the public sector.

For example, S&P Global Ratings estimates that approximately two dozen African countries have markets comparable to other frontier or emerging economies, but the remainder fall behind significantly.

Capital-Market Metrics – Africa vs Developed Markets

| Market category | Domestic capital market size (% of GDP) | Dominant issuer profile | Representative regions |

|---|---|---|---|

| Developed markets | 240 % | Balanced public/private mix | US, UK, Japan |

| African frontier/low depth | <100 % (varies widely) | Predominantly public sector | Many African countries |

| Leading African markets | Moderately larger (but still < developed) | Emerging private issuance | South Africa, Nigeria, Egypt, Kenya |

The awareness stage underscores both the scale of the deficit and the structural nature of the challenge. Without recognising this fundamental gap, interventions risk being incremental and failing to build lasting capital-market depth.

Why MLIs Matter for Capital-Market Development

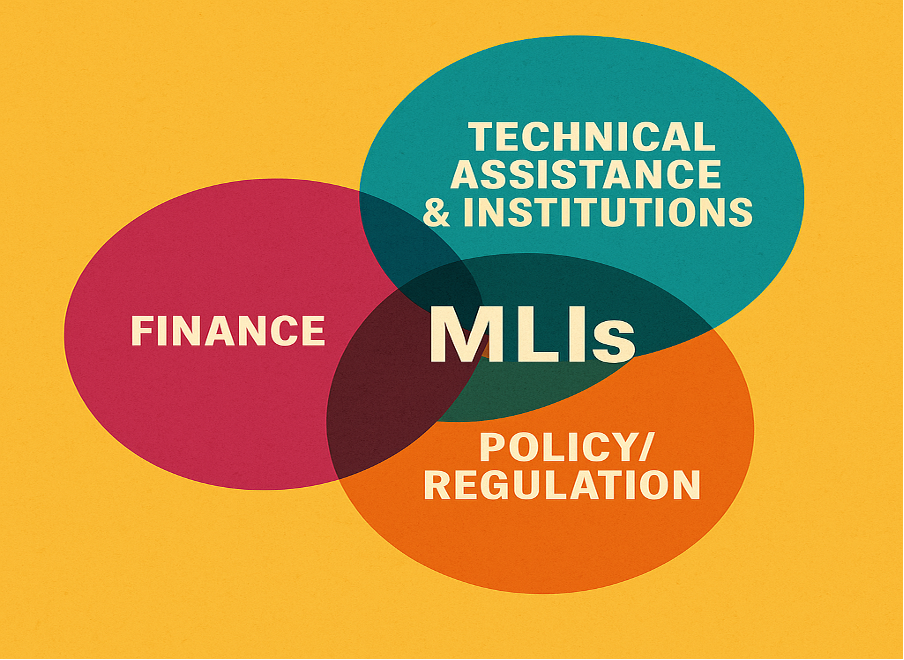

MLIs contribute to capital-market development in Africa across three major channels: financing, institutional/technical assistance and policy/regulatory support.

The S&P report finds that MLIs provide loans, guarantees and technical support to both sovereigns and the private sector, while helping to build market infrastructure.

For instance, deep and broad capital markets improve monetary policy transmission (local-currency instruments, open market operations), mobilise domestic savings and channel them toward investment.

Key insight: the limiting factor for capital-market expansion is not merely financing, but institutional and structural depth. In other words, MLIs must help develop the architecture (legal frameworks, investor protections, market infrastructure) as much as provide funding.

MLI Intervention Channels

This insight frames the role of MLIs not just as lenders, but as architects of market ecosystem development.

Strategic Choices for Stakeholders

For MLIs and development banks

- Decide to prioritise capital-market development as a core mandate rather than an ancillary activity.

- Decide to structure instruments (guarantees, blended finance, technical assistance) targeted at private-sector issuance and local currency markets.

For national governments and regulators

- Decide to strengthen legal and regulatory frameworks (market access, investor protections, transparency) that make domestic markets investible.

- Decide to coordinate with MLIs to sequence reforms and financing aligned with market-development objectives.

For private investors and domestic institutions

- Decide to participate in domestic capital markets when viable instruments emerge (e.g., MLI-supported bonds, guarantees) rather than rely on offshore issuance.

- Decide to build capacity (credit analysis, portfolio diversification, local-currency risk management) to support domestic investor participation.

Decision Levers and Stakeholder Outcomes

| Stakeholder | Decision Lever | Intended Outcome |

|---|---|---|

| MLIs | Capital-market focus, tailored instruments | Deeper markets, new issuance, private-sector access |

| Governments/Regulators | Regulatory reform, market infrastructure | Improved investibility, local investor mobilisation |

| Investors/Domestic Institutions | Participation incentives, capacity building | Increased domestic participation, reduced reliance on foreign funding |

The decisions made now will determine whether capital markets development in Africa remains piecemeal or evolves into a scalable, sustainable ecosystem.

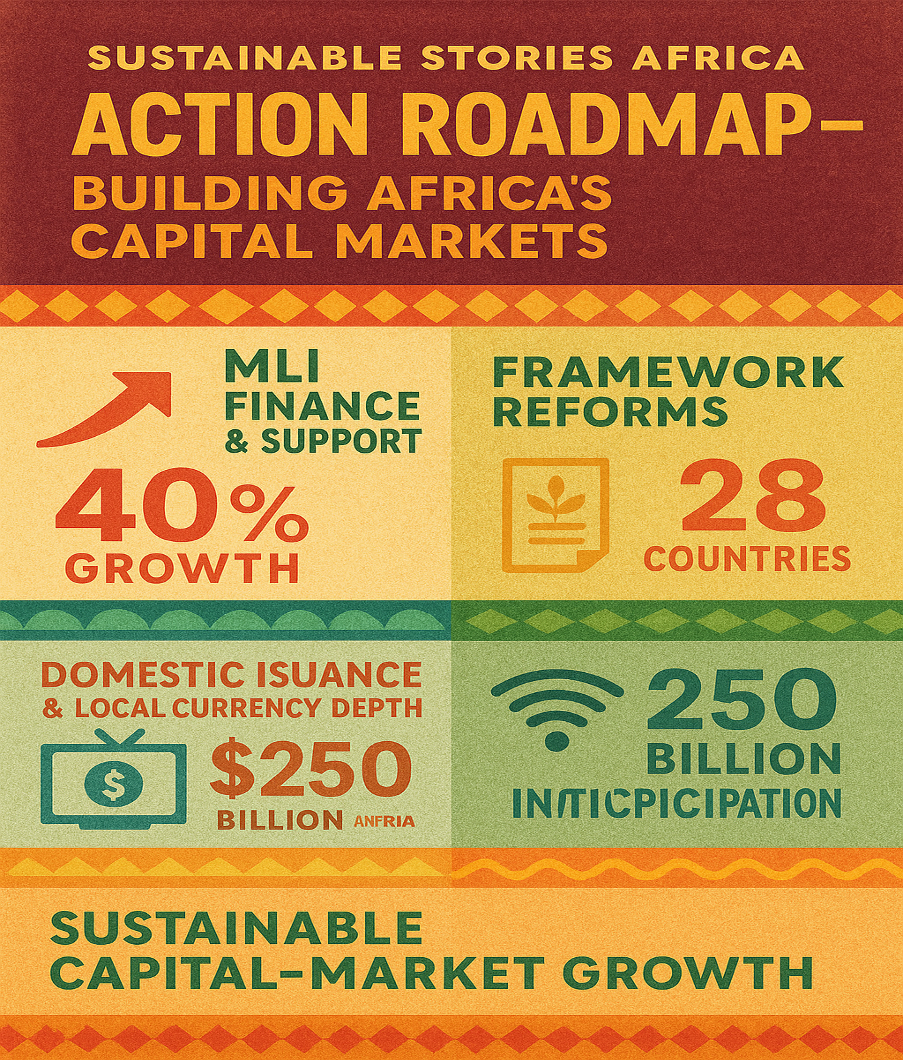

Implementing the Market-Development Blueprint

- Deploy capital plus technical assistance – MLIs extend finance to sovereigns and private-sector issuers, while pairing it with market-infrastructure support (e.g., clearing, settlement, credit-rating agencies).

- Support domestic issuance and local-currency markets – Through guarantees and capacity building, MLIs can catalyse bonds, equities and derivatives denominated in local currencies to reduce foreign-exchange risk.

- Boost investor ecosystem and depth – Encourage domestic institutional investor growth (pension funds, insurers) by creating suitable products and incentives, supported by MLIs' policy frameworks.

Action Roadmap – Building Africa's Capital Markets

The action phase moves from strategic decisions to concrete steps, signalling how MLIs can lead the transition from shallow to deeper markets.

Path Forward – Architecting Africa's Deep Capital-Market Future

To achieve meaningful transformation, six key pillars should be prioritised:

- Integrated MLI frameworks – MLIs must embed capital-market development within their financing mandates and link finance to technical and regulatory support.

- Domestic-currency focus – Shift from foreign-currency dependence to local-currency issuance and investor mobilisation.

- Regulatory and institutional reform – Legal clarity, investor protections, clearing/settlement infrastructure, and credit-rating accessibility.

- Investor ecosystem enhancement – Grow local institutional investors (pensions, insurers), create diversified products for participation.

- Market-size scaling – Move beyond pilot deals to portfolios of issuance, standardised instruments, and deepening liquidity.

- Data, transparency and benchmarking – Ensure high-quality data on issuance, participation, and market size to build investor confidence and measure progress.

By aligning these pillars, Africa's capital markets architecture can evolve from fragmented and shallow to integrated and deep — enabling domestic savings to finance growth, private investment to flourish and external dependence to decrease. The S&P Global report lays out the blueprint; the challenge lies in scale and execution.

Multilateral lending institutions have a pivotal role in deepening Africa's capital markets, providing not just funding, but the institutional architecture for sustainable market development.

Our AIDAP storytelling framework shows that awareness of the scale of the challenge, insights into structural constraints, strategic decisions by key actors, actionable steps on the ground and a defined path forward are all essential to turn promise into performance.