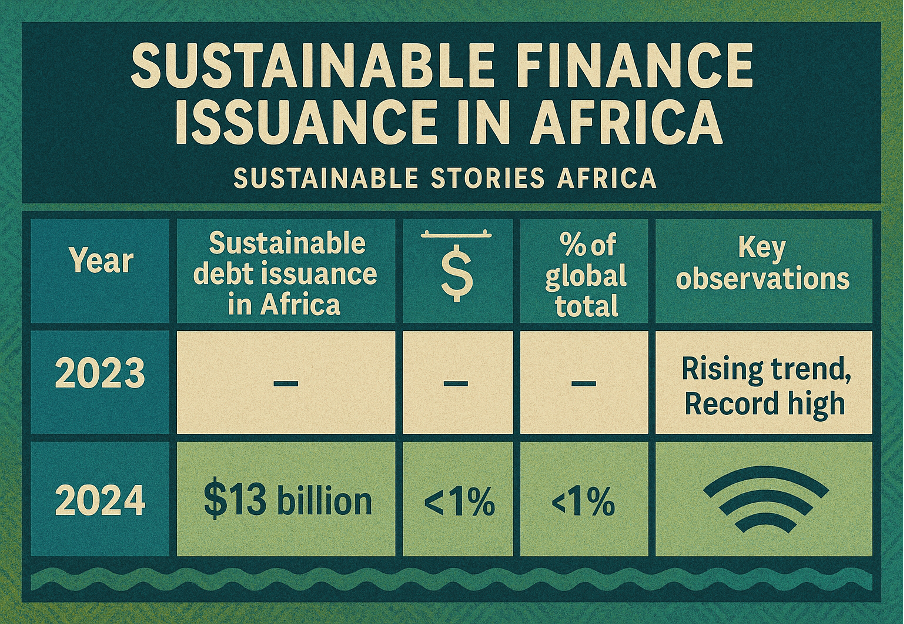

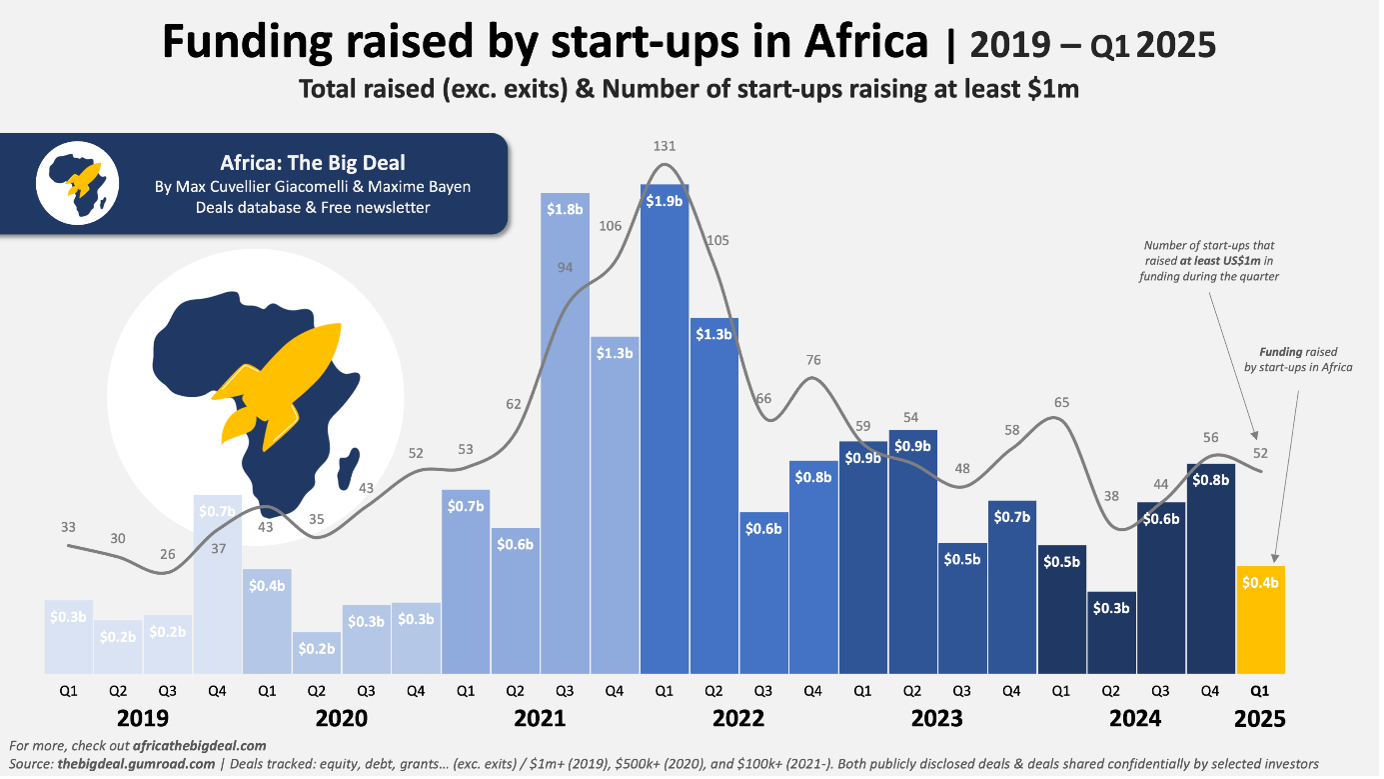

Africa's sustainable-finance surge hit a record near $13 billion in 2024. However, it still only accounts for less than 1% of the global total and falls far short of the continent's infrastructure and adaptation needs.

In a recent S&P Global Ratings publication, "Look Forward: Unlocking Africa", it outlines how blended finance, private-capital mobilisation and sovereign issuance could begin to bridge the gap, but only with stronger governance, capital-market depth and clearer impact frameworks.

Climbing Steep – Africa's Sustainable Finance Challenge

Africa's sustainable-finance market is rising. However, the climb is steeper than it appears. Record issuance of nearly $13 billion in 2024 marks one of the few bright spots globally, yet it still represents less than 1% of the global sustainable-debt total.

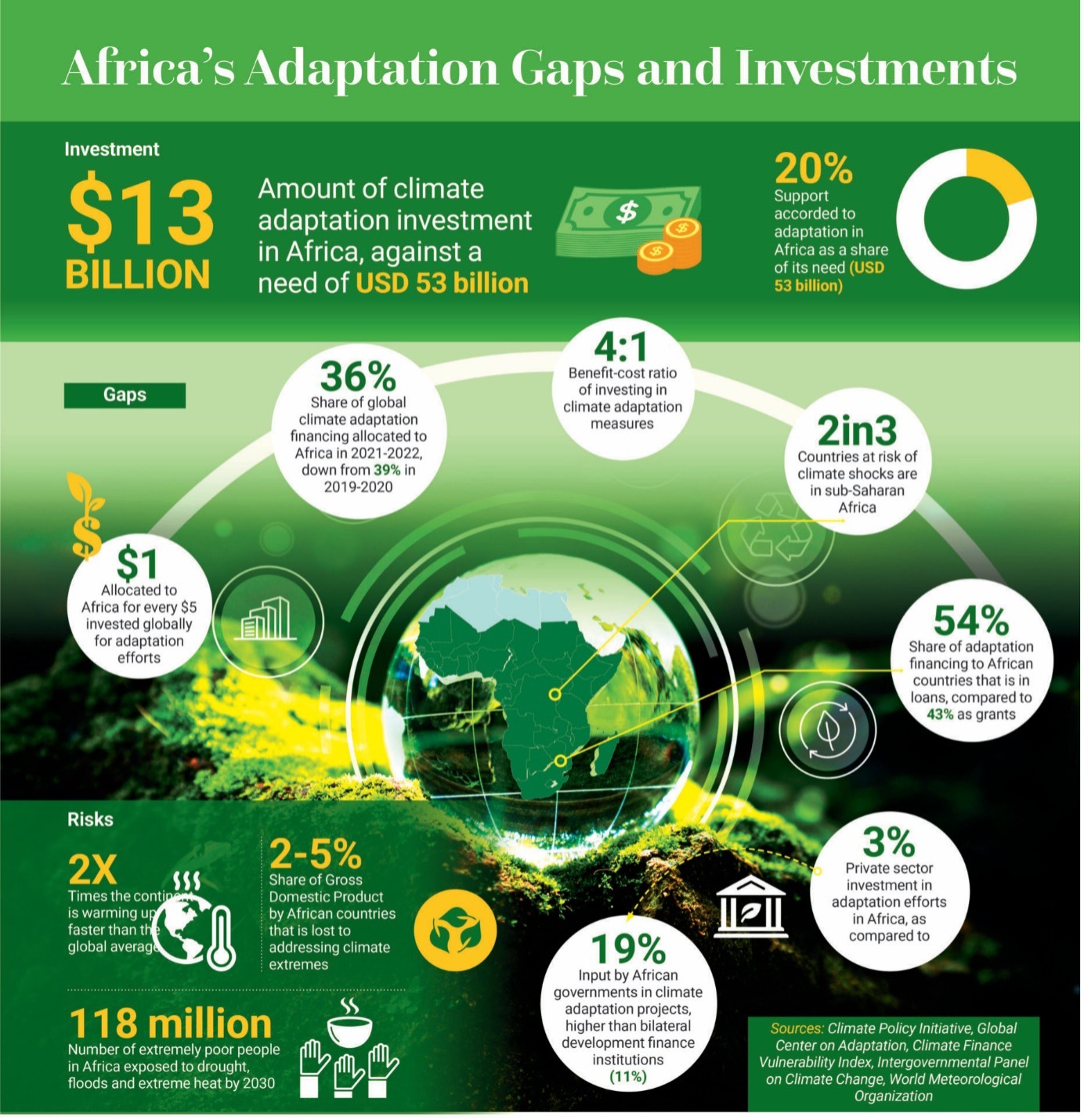

This mismatch frames the story of a continent at the crossroads of ambitions and limits: vast development and infrastructure needs juxtaposed with nascent capital markets, high borrowing costs and fragmentation of sustainable-finance instruments.

The new S&P Global report captures the twin realities shaping Africa's sustainable finance journey: strong momentum offset by systemic constraints.

Offering actionable insight into what it will take to unlock potential, this feature applies the AIDAP framework – Awareness, Insight, Decision, Action, Path Forward – to deliver a data-driven yet accessible review of achievements, structural gaps, and the pathways toward scalable progress.

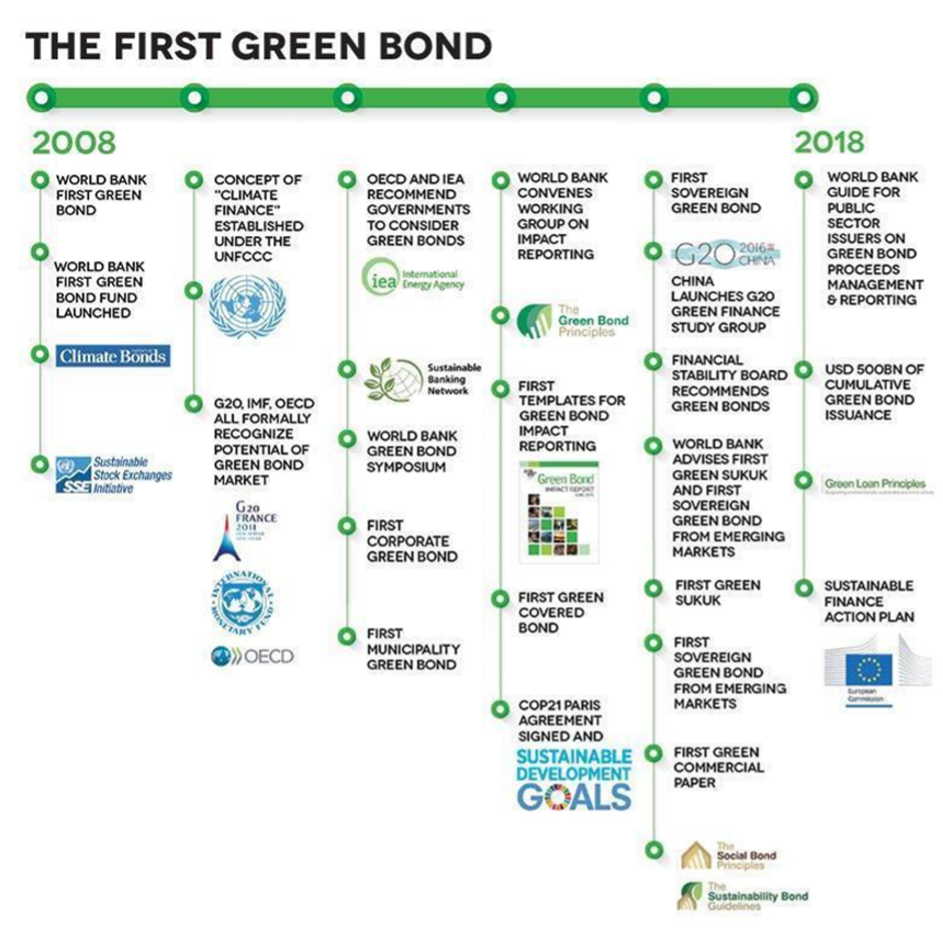

The Rising Tide of Green and Social Bonds

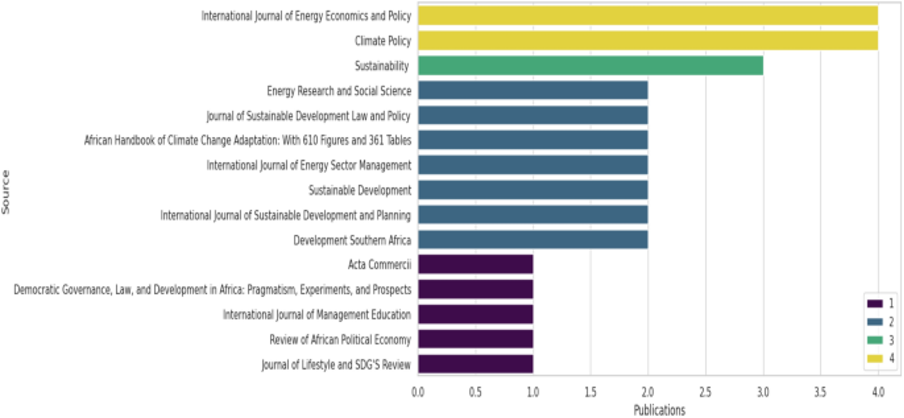

The S&P Global report finds that sustainable debt issuance in Africa reached a record $13 billion in 2024. While this is an important milestone, issuance still covers less than 1 % of the global sustainable debt total.

Sustainable Finance Issuance in Africa

| Year | Sustainable debt issuance in Africa | % of global total | Key observations |

|---|---|---|---|

| 2023 | — | — | Rising trend |

| 2024 | $13 billion | < 1% | Record high |

Without appreciating the scale of issuance, and the skew in allocations, African policymakers, investors and development partners risk mis-allocating scarce capital, thereby potentially reinforcing the very gaps sustainable finance aims to fill.

Why Growth Doesn't Equal Coverage

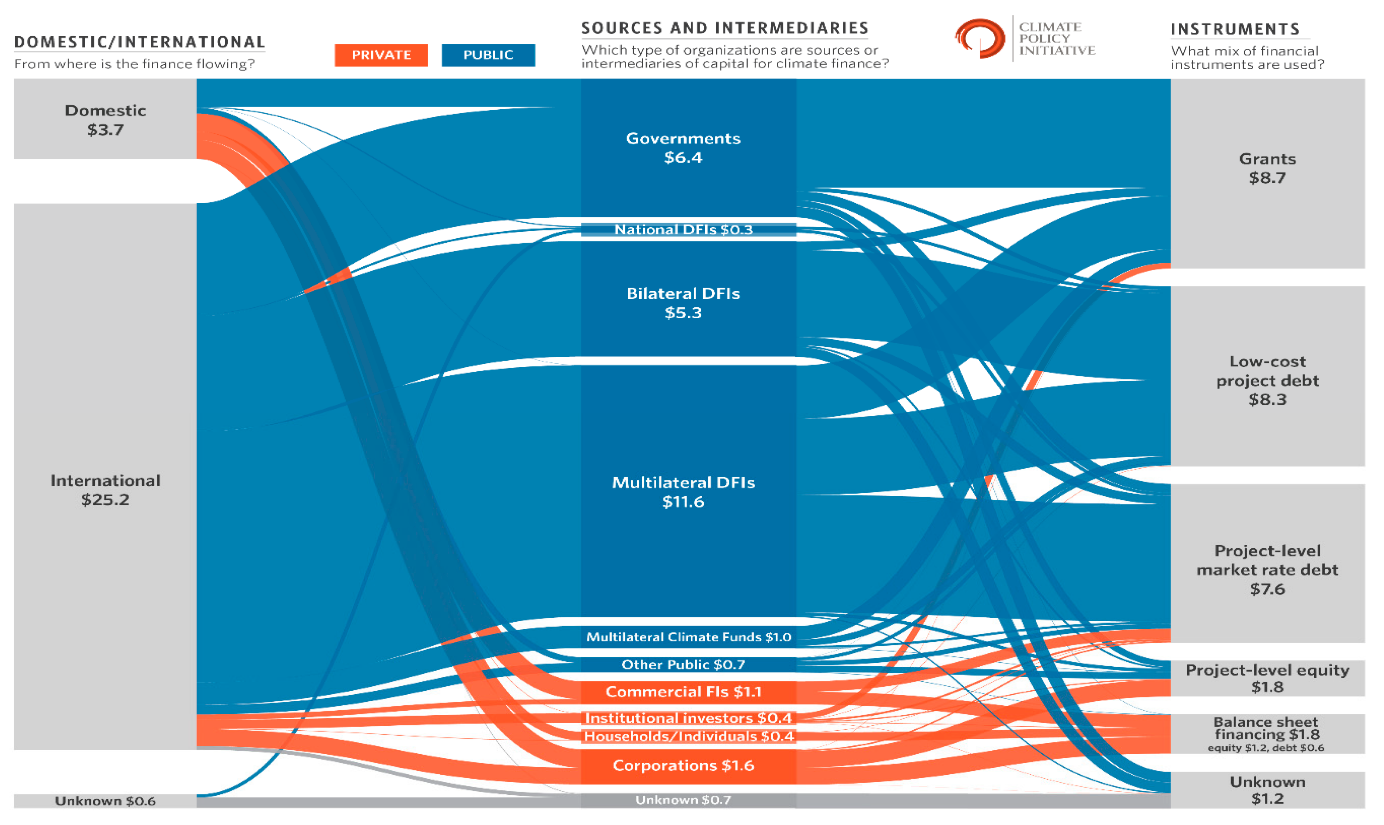

Under-coverage despite growth – The disparity between momentum and scale is driven by several structural bottlenecks: high borrowing costs, foreign-currency risks, shallow capital markets and regulatory fragmentation. Sovereign issuance is small but expected to grow, as governments scale frameworks and investor appetite increases.

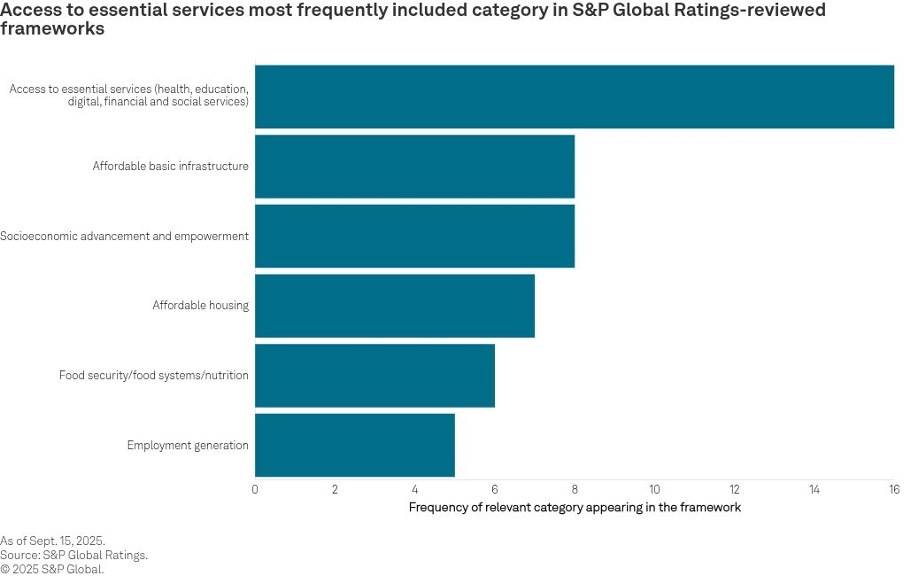

Over-reliance on use-of-proceeds frameworks – Most second-party opinions in Africa still focus on "use-of-proceeds" instruments that favour green or social labelled debt rather than integrated sustainability transformation.

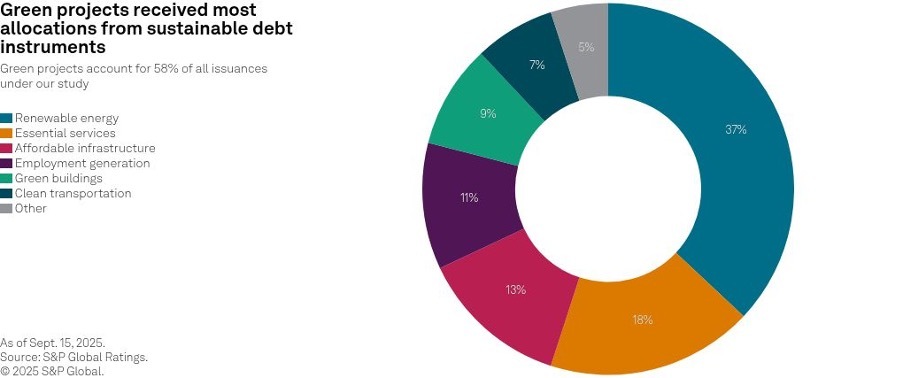

Segmental Gap in Allocations

While capital is flowing, it is not yet being directed to high-priority domains such as climate adaptation, water security and biodiversity loss, areas critical for long-term resilience.

For African market actors, the insight is clear: growth in numbers alone is insufficient. What matters is alignment of funding with high impact uses, de-risking of investments, and governance mechanisms that validate impact claims.

Strategic Choices for Market Participants

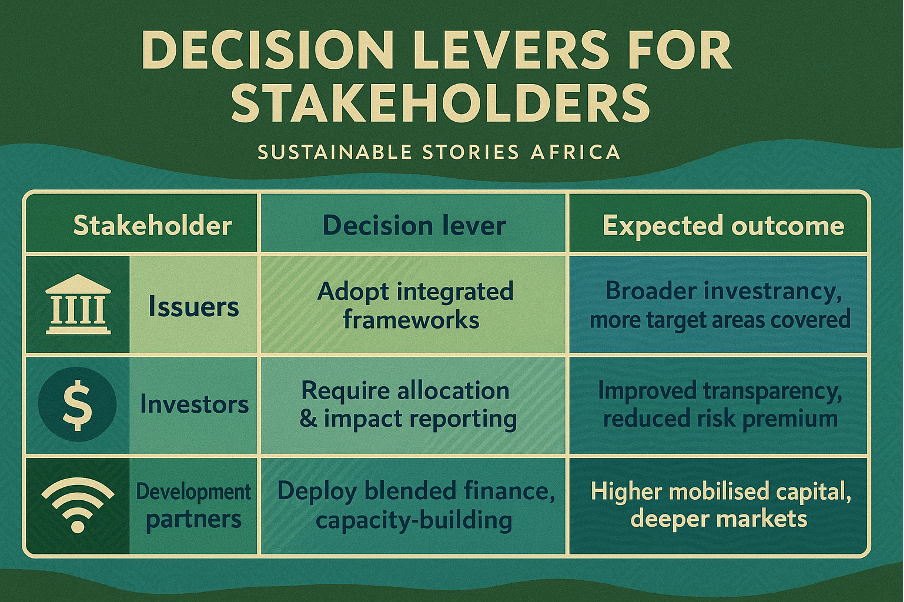

For issuers (governments, corporates, banks)

- Decide to adopt more holistic frameworks beyond single-label proceeds (green/social) to encompass adaptation and biodiversity.

- Establish blended-finance vehicles that leverage donor or multilateral capital to mobilise private investors.

For investors

- Decide whether to participate in African sustainable-debt markets recognising structural risk (currency, credit, governance) but also frontier-market upside.

- Require issuers to commit to transparent reporting on allocation and impact—reinforcing trust and unlocking capital.

For development partners

- Decide to use concessional finance as "first-loss" or guarantee layers to catalyse private-sector participation.

- Support capacity-building in African capital markets to enable domestic issuance and improve investor depth.

Decision Levers for Stakeholders

| Stakeholder | Decision lever | Expected outcome |

|---|---|---|

| Issuers | Adopt integrated frameworks | Broader investor base, more target areas covered |

| Investors | Require allocation & impact reporting | Improved transparency, reduced risk premium |

| Development partners | Deploy blended finance, capacity-building | Higher mobilised capital, deeper markets |

Implementing the Blueprint

Building transparent frameworks – Issuers across Africa are increasingly incorporating second-party opinions (SPOs) into their sustainable-finance programmes (S&P Global published 17 SPOs across the continent).

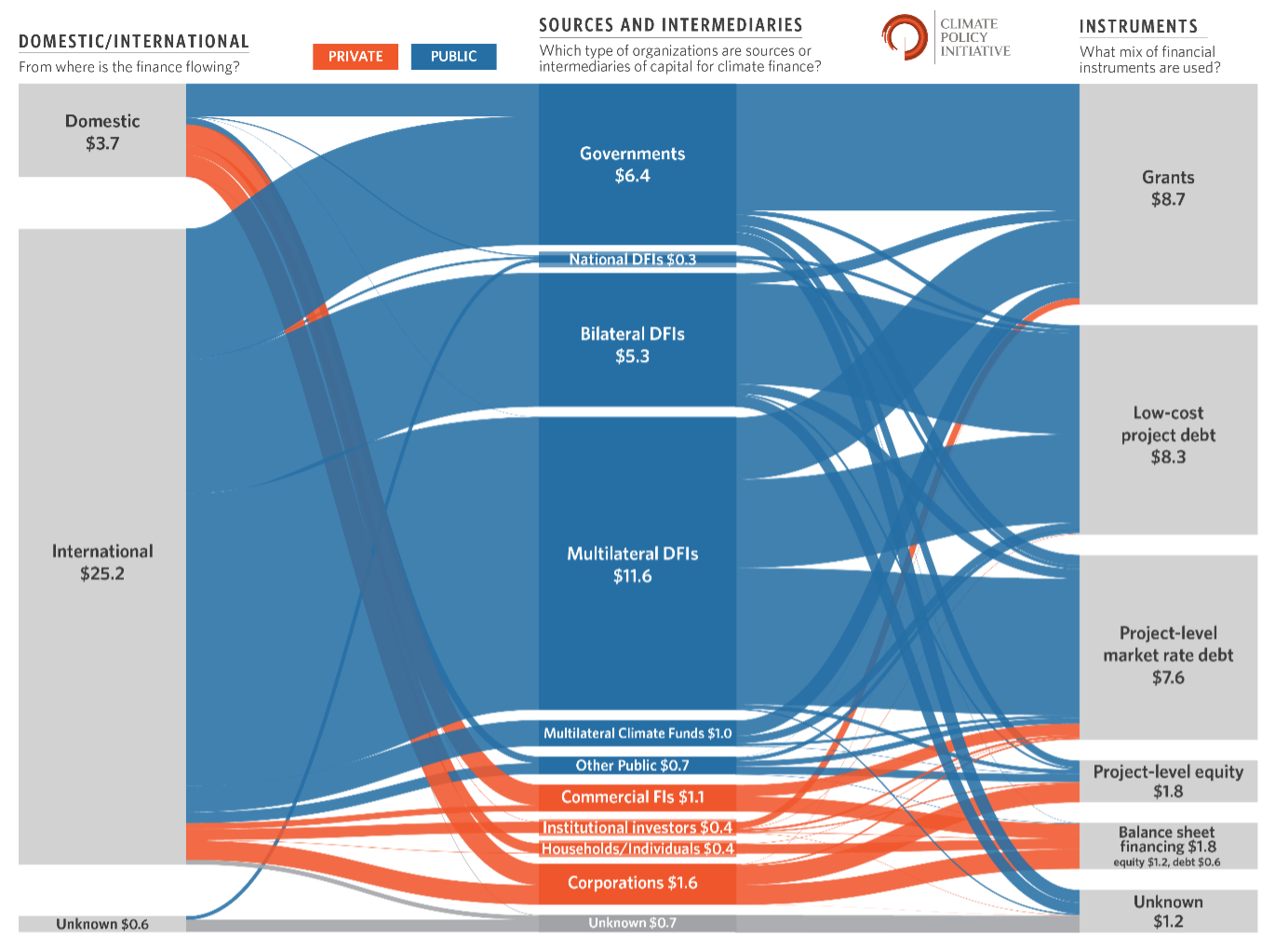

Mobilising private capital via blended finance – With fundamental finance challenges intact (currency, interest rate, limited depth), blended-finance mechanisms are emerging as a key enabler to accelerate capital flows.

Strengthening governance and capital-market infrastructure – Investments in legal and regulatory reforms (clearing, reporting, tax incentives) will underpin the credibility of sustainable-finance markets. As one commentary notes: Africa needs "strong governance, clear legal frameworks and institutional capacity" to attract investment.

Action Roadmap for Africa's Sustainable Finance

Path Forward – Closing Africa's Sustainable-Finance Gap

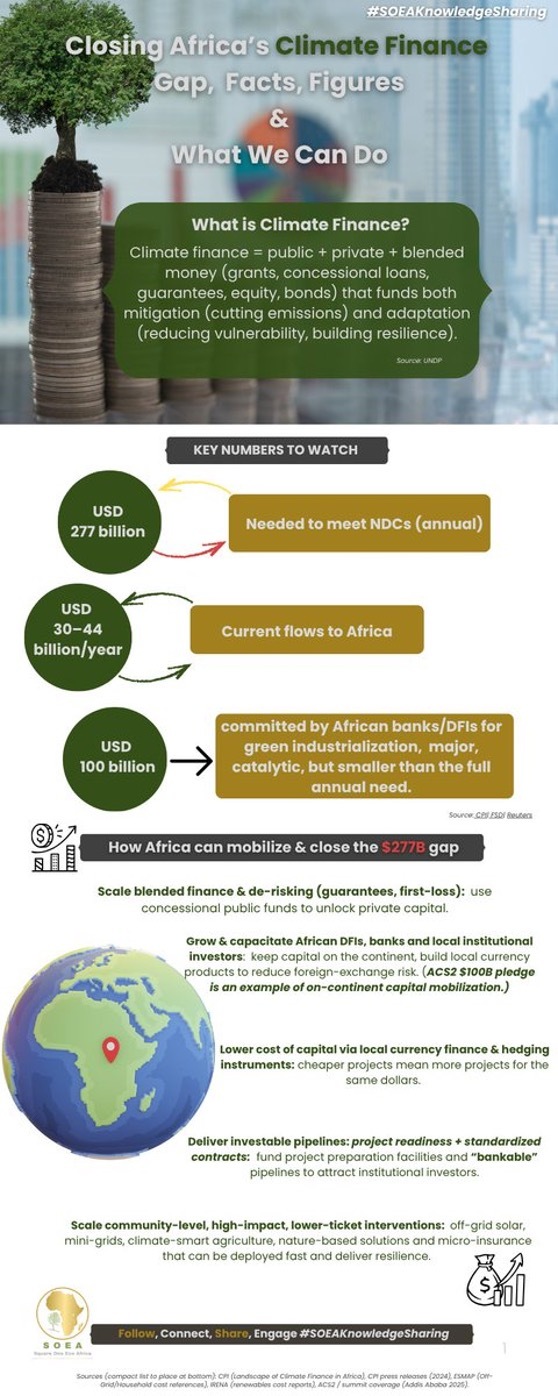

Despite the momentum in issuance, Africa remains far from meeting its development and adaptation financing needs. The path forward is encapsulated by the six-word title: "Closing Africa's Sustainable-Finance Gap Now." Key pillars include:

- Expand sovereign and corporate issuance into adaptation, biodiversity and water-security domains.

- Enhance capital-market depth: local currency issuance, domestic investor participation, improved transparency.

- Scale blended-finance mechanisms: concessional layers to de-risk private flows and increase mobilisation.

- Strengthen governance, reporting and impact verification: issuers must link finance to measurable outcomes.

- Foster cross-border investor collaboration and standardisation: pan-African frameworks to reduce fragmentation.

By executing on these pillars, Africa can move from footprint to impact, thereby ensuring that growth in sustainable-finance issuance translates into tangible development and climate-resilience outcomes across the continent.

Africa's sustainable-finance markets: one characterised by record levels of issuance but still hampered by structural deficits. For stakeholders across governments, capital markets and investors, focus must shift – from volume to alignment, from labels to impact, and from frontier-market promise to durable mobilisation of private capital.