Africa's private-capital mobilisation through blended-finance remains modest: even with efforts surging, flows linger at just US$6–15 billion annually, far short of the trillion-dollar development need.

An S&P Global Ratings report shows structural market barriers, from weak domestic institutions to regulatory fragmentation, continue to hobble growth, requiring decisive strategic shifts to mobilise private finance at scale in Africa.

Unlocking Private Capital in Africa

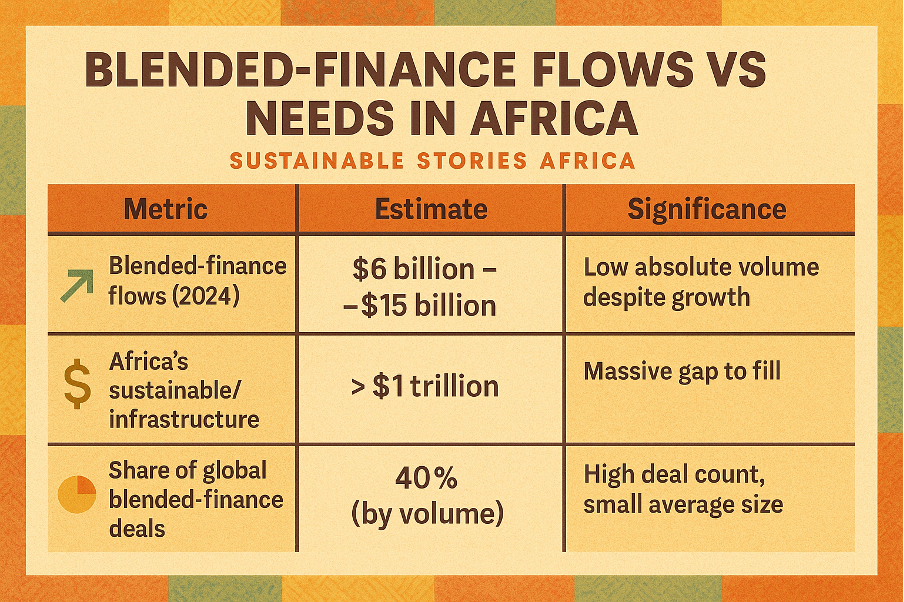

Africa is at a pivotal moment: as official development assistance tightens, the focus sharply turns to mobilising private capital through blended-finance structures to meet vast sustainable and climate-development challenges. According to S&P Global Ratings, although blended-finance transactions in Africa account for 40% of volume globally in 2024, the actual amounts, between $6 billion and $15 billion, pale against the continent's needs.

Our article uses the AIDAP (Awareness–Insight–Decision–Action–Path Forward) framework to story-tell how African stakeholders, from governments to investors, must shift from promise to performance in private-capital mobilisation for sustainable development.

The Gap in Private Capital Mobilisation

The latest S&P Global report reveals that despite momentum, blended finance in Africa remains marginal relative to need. The continent captured 40% of global blended-finance transactions in 2024, but only a small share of the actual transaction value, estimated between $6 billion and $15 billion

By contrast, climate and sustainable development investment requirements exceed US$1 trillion on the continent.

Blended-Finance Flows vs Needs in Africa

| Metric | Estimate | Significance |

|---|---|---|

| Blended-finance flows (2024) | $6 billion – $15 billion | Low absolute volume despite growth |

| Africa's sustainable/infrastructure needs | > $1 trillion | Massive gap to fill |

| Share of global blended-finance deals | 40% (by volume) | High deal count, small average size |

This awareness underscores the magnitude of the challenge: counting deals is useful, but mobilisation of meaningful capital remains far short. Without recognising this gap, strategies risk lapsing into incrementalism rather than scaling.

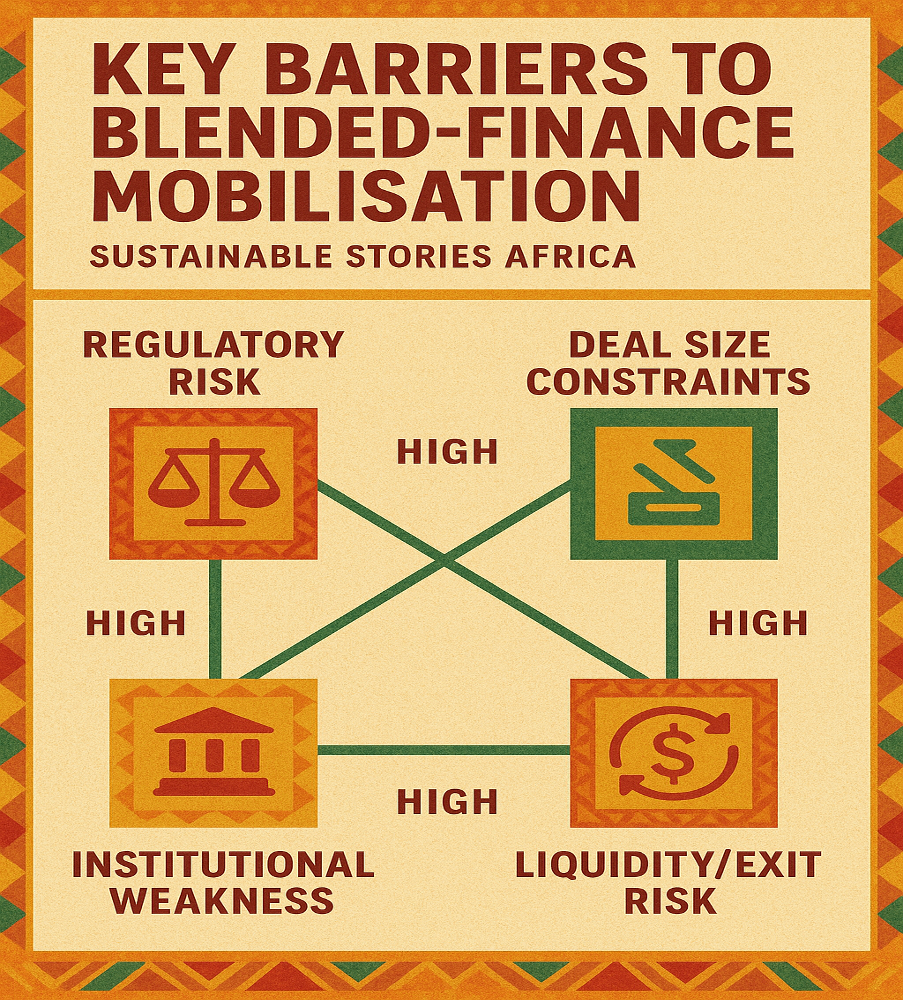

Structural Barriers Holding Back Private Capital

Deep beneath the surface of deals lies a suite of structural constraints restraining private-capital mobilisation via blended finance. According to S&P Global:

- Domestic institutional frameworks are weak, limiting local currency and long-term finance.

- Regulatory and market fragmentation increase transaction costs and reduce scalability.

- Large institutional investors remain reluctant to engage in frontier markets due to perceived risk and low liquidity.

Key Barriers to Blended-Finance Mobilisation

These insights show that mobilisation of private capital is not simply a question of raising finance. It is about addressing the ecosystem of finance: institutions, markets, regulations, and investor behaviours. In short, the problem is as much structural as financial.

Strategic Choices Stakeholders Must Make

Given the structural barriers, stakeholders face clear decision points if blended finance is to fulfil its promise.

For governments and policymakers

- Decide to standardise blended-finance frameworks and harmonise regulations across sectors and countries.

- Decide to strengthen domestic markets so pension funds, insurers and sovereign wealth funds can deploy long-term capital into sustainable projects.

For private investors and asset managers

- Decide whether to engage early in frontier markets with blended-finance catalysts, recognising risk-mitigation and potential returns.

- Decide to insist on transparency, deal size aggregation and exit clarity to make African blended-finance investible.

For development finance institutions (DFIs) and donors

- Decide to provide first-loss capital, guarantees and structured finance that unlock private risk capital rather than simply subsidising projects.

- Decide to support market-infrastructure reforms (data, pipelines, platforms) rather than ad-hoc projects.

Decision Levers by Stakeholder

| Stakeholder | Key Decision Lever | Intended Outcome |

|---|---|---|

| Governments | Regulatory harmonisation, market-depth | Lower transaction cost, greater scale |

| Private investors | Risk sharing, deal aggregation, transparency | Higher investibility, increased flows |

| DFIs/Donors | Catalytic capital, market infrastructure | Mobilised private capital, sustainable pipeline |

These decisions represent the strategic juncture at which Africa's blended-finance approach must move from pilot to scale.

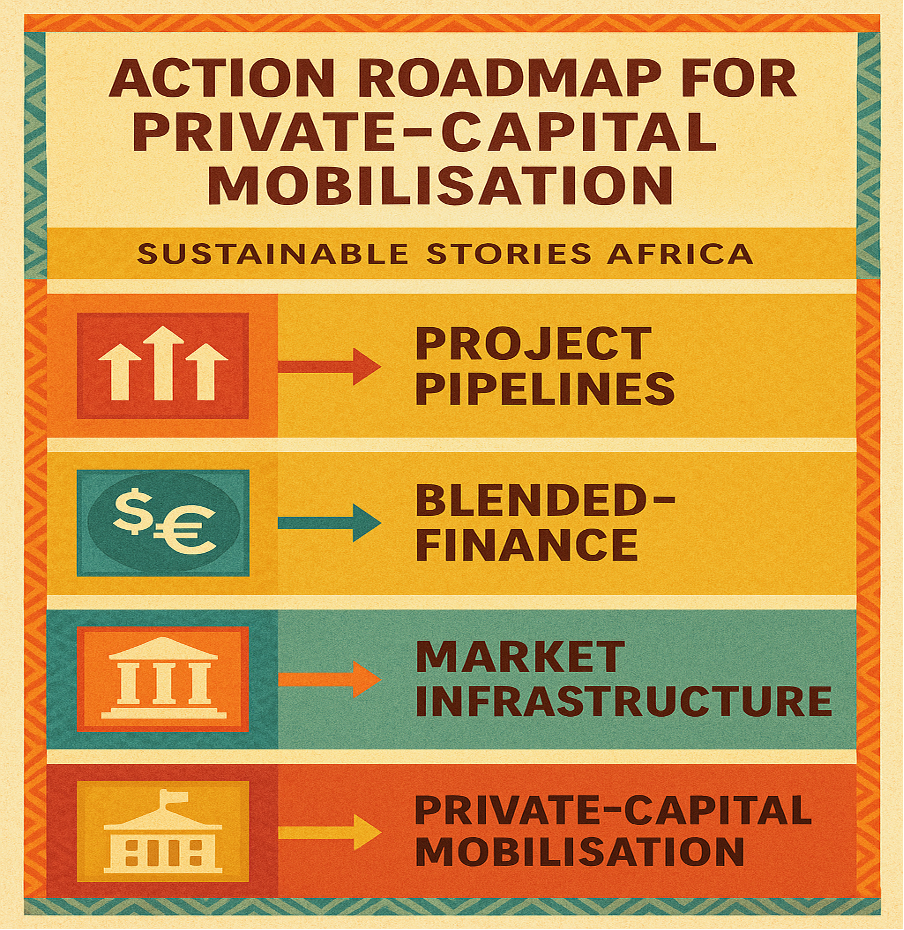

Implementing the Blueprint for Scale

To convert decisions into delivered capital, coordinated action is essential.

- Build aggregated deal pipelines – Governments and DFIs must catalogue and standardise project pipelines, enabling aggregation and volume economics.

- Deploy scalable blended-finance vehicles – Use credit guarantees, first-loss mechanisms, and co-investment platforms to derisk private investor participation.

- Strengthen market infrastructure – Develop domestic capital markets, legal frameworks, and exit mechanisms to support long-duration investment.

- Improve data and transparency – Provide standardised reporting, risk profiles and benchmarking to attract institutional investors.

Action Roadmap for Private-Capital Mobilisation

These actions signal the shift from isolated deals to durable platforms, from funding to investing, and from pilot to scale.

Path Forward – Building Africa's Scalable Blended-Finance Future

To chart this path forward, stakeholders should align around key pillars:

- Harmonised frameworks – standardise blended-finance models across jurisdictions to reduce complexity and cost.

- Domestic capital activation – tap pension funds, insurers and local investors through reforms enabling infrastructure/impact investment.

- Risk-sharing mechanisms – scale first-loss, guarantee, mezzanine instruments to mobilise private risk appetite.

- Deal aggregation and standardisation – move from piecemeal projects to portfolios of investible assets.

- Data and transparency excellence – create robust metrics, standards and reporting to build investor trust and pipeline liquidity.

- Institutional ecosystem building – strengthen local institutions, markets and platforms to support long-term investor participation.

The S&P Global report makes clear: blended finance holds promise in Africa, but only if the ecosystem is transformed. With this six-point path, stakeholders can shift from ambition to execution, unlocking private capital at scale and accelerating sustainable growth across the continent.

Africa's mobilisation of private capital through blended finance remains at an inflexion point. It is more than a funding challenge. It is an ecosystem challenge. By raising awareness of the scale, gaining insight into structural constraints, making clear strategic decisions, executing coordinated actions and committing to the forward path outlined above, stakeholders can go beyond piecemeal flows to meaningful, scalable investment.