Africa is stepping into the global climate-finance spotlight. A new EU-backed "Bridge Facility" spearheaded by Sanlam Alternative Investments (SAI) aims to channel institutional capital into critical water, sanitation and ocean-resilience infrastructure, a potential game-changer for vulnerable regions across the continent.

This mechanism, undergirded by a €205 million guarantee from the European Commission, promises to unlock long-term fixed-income investment in climate-resilience projects via the blended-finance platform Climate Investor Two (CI2), marking a milestone for Africa-led climate finance.

Landmark deal unlocks new finance

South Africa has secured a landmark role in a high-stakes climate-finance transaction that aims to funnel institutional investment into climate-resilient infrastructure across Africa and other emerging markets. This is according to Currency News.

Under the arrangement, Sanlam Alternative Investments (SAI) has committed a bridge loan to CI2, a blended-finance platform targeting water, sanitation, and ocean-resilience infrastructure, which will be backed by a €205 million guarantee from the European Commission.

The guarantee enables the bridge loan to be refinanced through a long-term climate bond, opening the fund's high-impact assets to fixed-income investors.

Why it matters for Africa

This deal marks more than just a financial transaction: it signals Africa's emerging influence in shaping climate-finance architecture. By aligning commercial returns with climate resilience, SAI and CI2 aim to cut across the traditional divide between philanthropy and profit, offering investors a product that delivers both.

CI2 has already committed approximately US$339 million across 25 projects globally since its first close in 2021, spanning water supply networks, desalination plants, waste-to-energy systems, and large-scale debt-for-nature swaps — including in Africa.

For a continent that experts say needs on the order of US$250 billion per year between 2020 and 2030 to address its climate-finance gap, according to Corporate Accountability and Public Participation Africa (CAPPA), this kind of capital-market engagement represents a critical step forward.

What stakeholders should consider

In choosing to support CI2, institutional investors will be weighing both financial prospects and climate risk. The bridge-loan model, backed by an EU guarantee, offers a pathway to stable, long-dated climate-resilient assets, potentially a template for future investments in emerging-market adaptation infrastructure.

Policymakers and regulators across Africa should view this as a blueprint towards mobilising capital at scale: by facilitating de-risking guarantees and structural instruments, governments can attract private finance for adaptation, water security, and essential-service infrastructure, areas which have historically been underfunded.

However, bridging finance to climate bonds will require robust transparency, rigorous impact metrics, and institutional capacity to manage and monitor projects across their lifecycle. Without those safeguards, the risk of "green-wash" or under-delivery remains real.

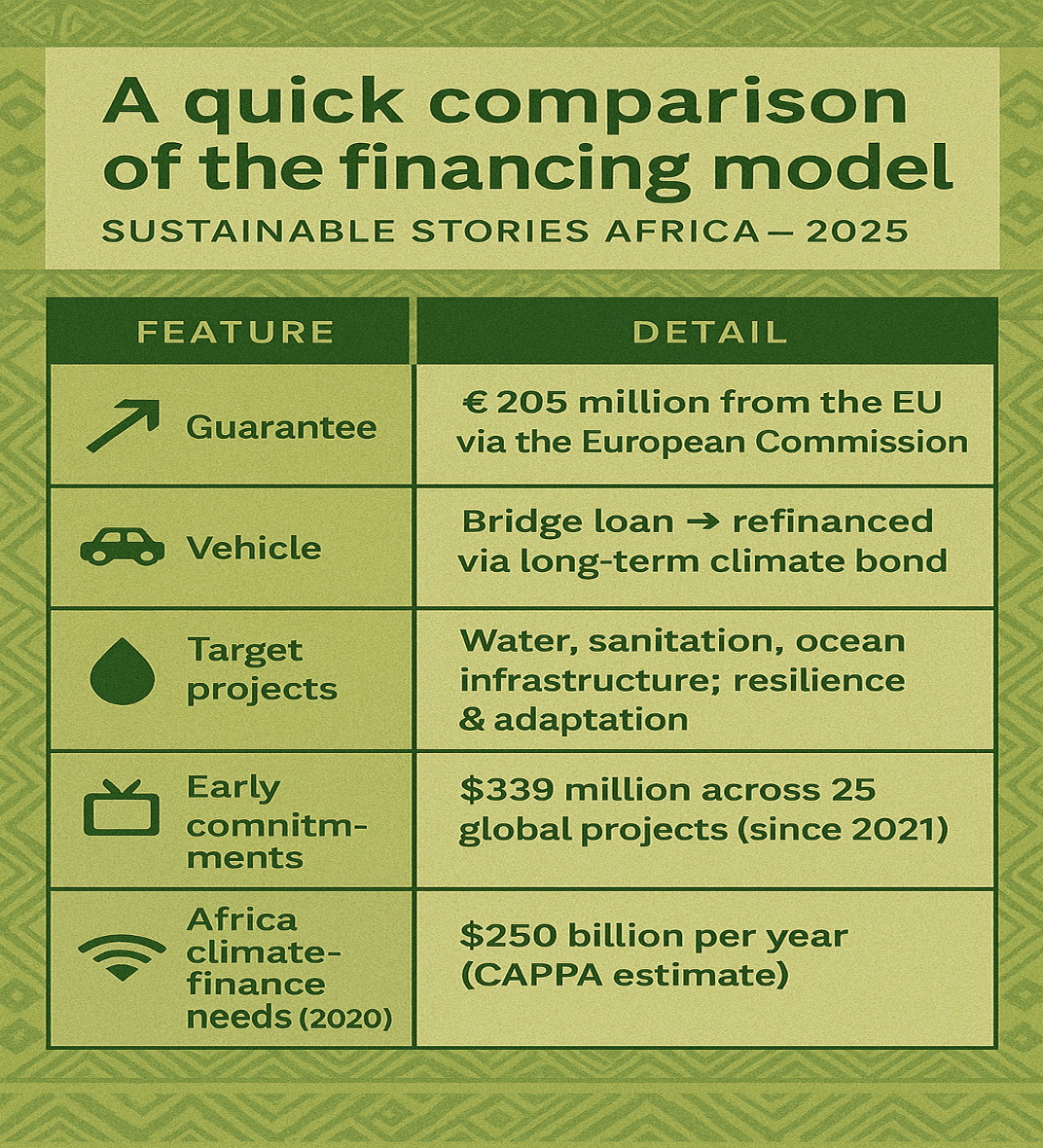

A quick comparison of the financing model:

| Feature | Detail |

|---|---|

| Guarantee | €205 million from the European Commission |

| Vehicle | Bridge loan → refinanced via long-term climate bond |

| Target projects | Water, sanitation, ocean infrastructure; resilience & adaptation |

| Early Commitments | $339 million across 25 global projects (since 2021) |

| Africa climate-finance needs (2020–2030) | $250 billion per year (CAPPA estimate) |

How Africa can replicate this model

To scale such instruments continent-wide, African governments and regional institutions should:

- Design and implement de-risking frameworks (e.g., public guarantees, first-loss facilities).

- Strengthen regulatory and reporting standards to ensure transparency of climate-bond financing.

- Prioritise adaptation, water, sanitation, resilience — beyond traditional energy-transition financing.

- Engage local financial institutions to co-invest alongside global investors, building local capital-market capacity.

Such measures could accelerate the flow of institutional capital into climate-resilient infrastructure across the continent and not just in South Africa, aligning with continent-wide frameworks such as the Africa Adaptation Acceleration Program (AAAP).

Path Forward – Scale African guarantees, unlock resilient capital.

If effectively implemented across jurisdictions, this blueprint could transform climate-finance flows, enabling Africa to attract large-scale, long-term investment in the infrastructure needed to withstand the climate shocks ahead.

The emergence of the Sanlam and CI2 bridge facility offers a timely and replicable model that could bring institutional capital and climate resilience together, while putting Africa on the map as an originator of forward-looking climate finance architecture.

Culled From: https://currencynews.co.za/from-africa-to-the-world-a-new-climate-finance-blueprint/