Nigeria has recorded a major milestone in sustainable finance as FMDQ Group, FC4SL, FSD Africa, Chapel Hill Denham, and circular-economy company Kaltani announced a landmark collaboration to accelerate climate-aligned financing.

The partnership aims to expand access to green capital markets, strengthen investor confidence, and scale sustainable projects across Nigeria's emerging climate-finance ecosystem.

Major Sustainable Finance Alliance Signals Market Shift

Nigeria's sustainable-finance market received a significant boost after FMDQ Group, FC4SL, FSD Africa, Chapel Hill Denham, and Kaltani announced a coordinated collaboration to unlock green financing, deepen ESG standards, and strengthen access to climate-aligned capital.

According to BusinessDay, the initiative aims to build a scalable pipeline of sustainable projects and enhance the credibility of Nigeria's transition finance ecosystem.

New Partnership Anchors Nigeria's Climate-Finance Ambition

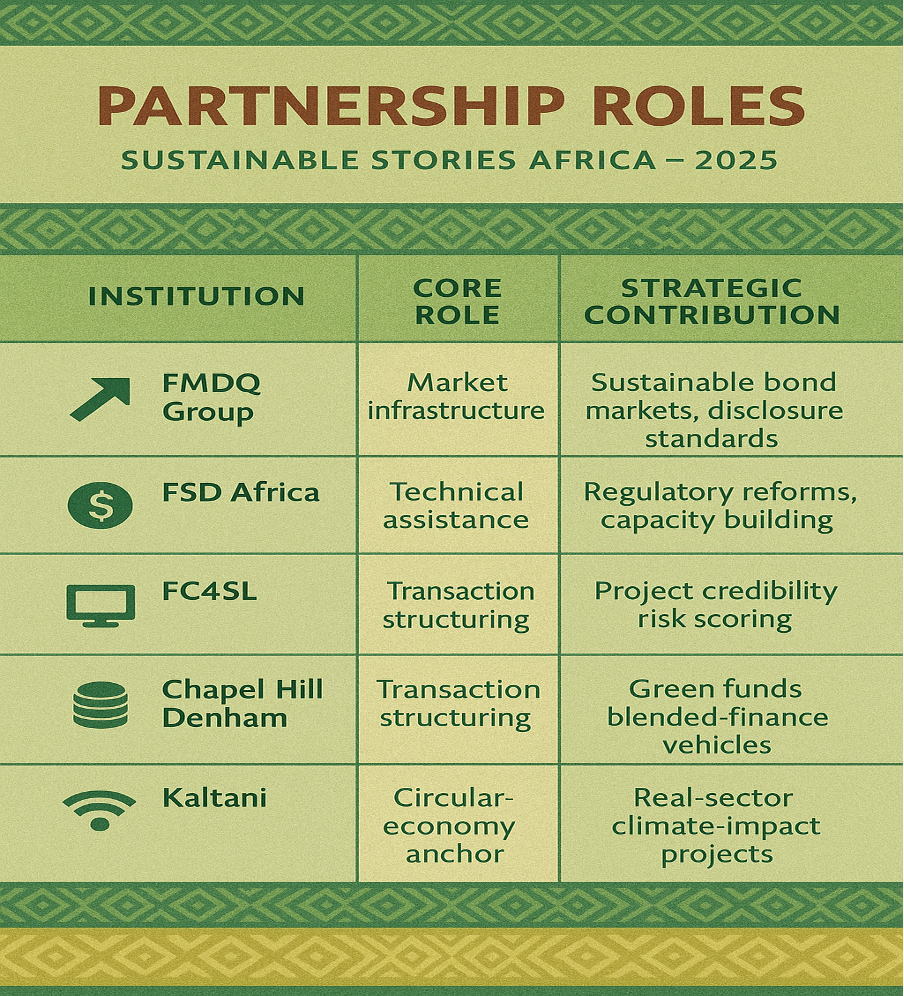

The alliance brings together key players across capital markets, development finance, sustainability rating, and circular-economy operations.

FMDQ will lead sustainable-finance infrastructure and market development; FSD Africa will provide technical support; FC4SL will deploy sustainability ratings; Chapel Hill Denham will structure investment pipelines; and Kaltani will offer a real-sector demonstration of circular-economy financing.

Partnership Roles

| Institution | Core Role | Strategic Contribution |

|---|---|---|

| FMDQ Group | Market infrastructure | Sustainable bond markets, disclosure standards |

| FSD Africa | Technical assistance | Regulatory reforms, capacity building |

| FC4SL | ESG ratings | Project credibility, risk scoring |

| Chapel Hill Denham | Transaction structuring | Green funds, blended-finance vehicles |

| Kaltani | Circular-economy anchor | Real-sector climate-impact projects |

Experts say the partnership strengthens market alignment with ISSB, TCFD, and green-taxonomy frameworks increasingly required by global investors.

What the Collaboration Means for Nigeria's Investors and Market

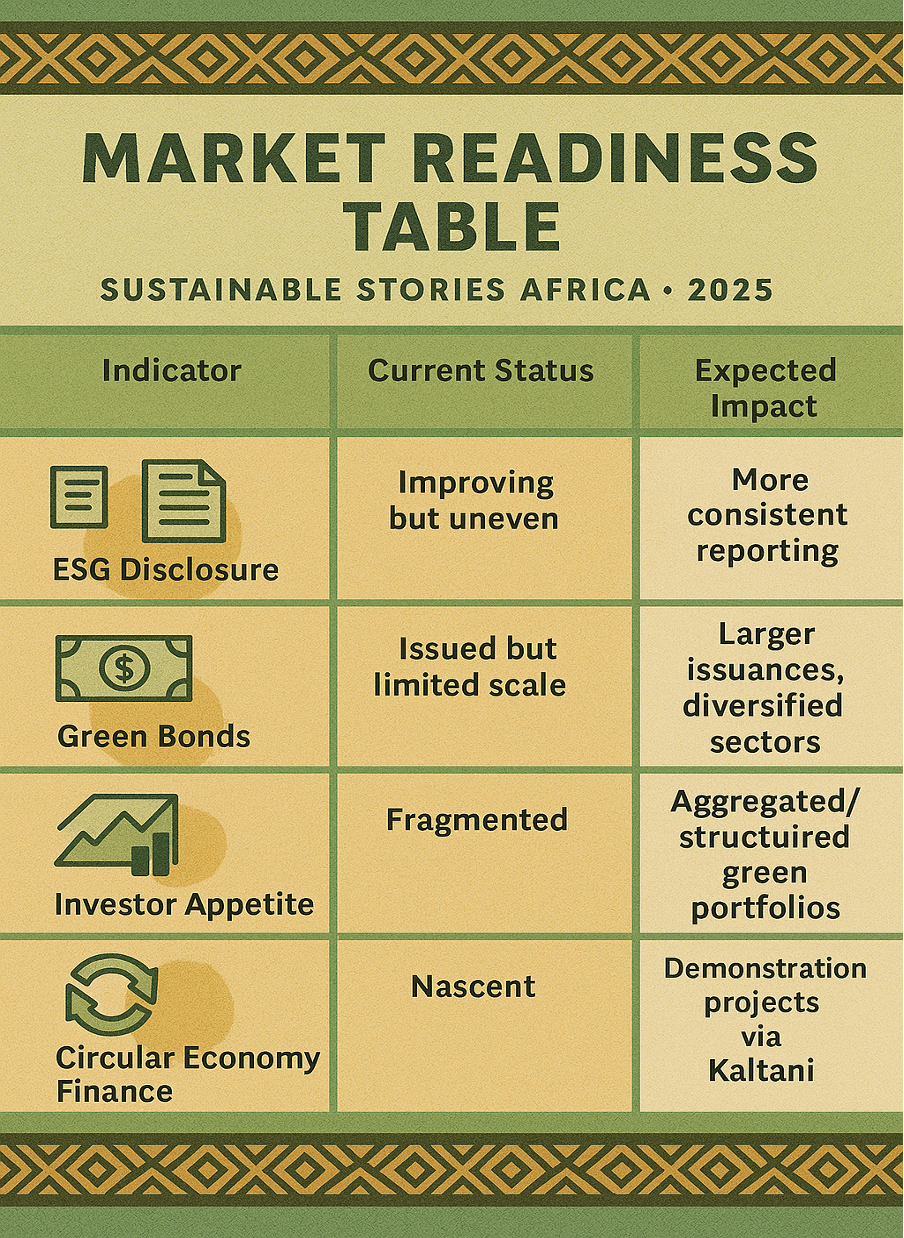

Analysts highlight that Nigeria's green-finance market has expanded in recent years with sovereign green bonds, corporate sustainability notes, and energy-transition platforms. However, gaps persist in ESG disclosure, project preparation, and credit enhancement.

The collaboration seeks to address these gaps by building a transparent, rating-supported green-finance ecosystem that attracts both domestic and international institutional investors.

Market Readiness Table

| Indicator | Current Status | Expected Impact |

|---|---|---|

| ESG Disclosure | Improving but uneven | More consistent reporting |

| Green Bonds | Issued but limited scale | Larger issuances, diversified sectors |

| Project Pipelines | Fragmented | Aggregated/structured green portfolios |

| Investor Appetite | Growing | Stronger guarantees, risk mitigation |

| Circular Economy Finance | Nascent | Demonstration projects via Kaltani |

The partnership could become a reference model for broader African markets seeking credible climate-finance frameworks.

Steps Required to Scale the Sustainable-Finance Ecosystem

To accelerate implementation, stakeholders emphasise:

- Standardised sustainable-finance guidelines across issuers, regulators, and intermediaries.

- Capacity-building for project developers, especially SMEs in waste, energy, agriculture, and manufacturing.

- Improved data transparency through sustainability ratings and climate-risk diagnostics.

- Innovative financing mechanisms, including blended-finance structures and impact-linked instruments.

The collaboration aims to strengthen Nigeria's ability to attract concessional and commercial climate capital while boosting real-sector impact through scalable circular-economy projects like those led by Kaltani.

PATH FORWARD – Unify Standards, Mobilise Capital, Deliver Climate Impact.

Nigeria's new collaboration signals a pivot toward more coordinated, transparent, and investment-ready sustainable-finance systems. By combining market infrastructure, ESG credibility, and real-sector demonstration, partners aim to accelerate green-capital flows.

With stronger guidelines, clearer reporting, and structured investment pipelines, Nigeria is positioning itself as a key African hub for climate-aligned financing and circular-economy innovation.