Africa's growth story is increasingly being written in concrete, cables and clean energy, not just commodities.

A recent AU–OECD assessment estimates that the continent will need $155 billion yearly in infrastructure investment to double GDP by 2040 and stay on course for its Agenda 2063 commitments.

However, rising debt, high cost of capital and falling development finance threaten to slow the transformation, unless smarter policies unlock private capital and prioritise high-impact projects.

Infrastructure Shapes Africa's Growth Future

Africa's economic momentum is gaining pace, with GDP projected to have grown 3.9% in 2025, faster than Latin America but still behind developing Asia. The African Union and OECD say the difference between steady growth and structural transformation lies in one word: INFRASTRUCTURE.

From electricity and broadband to transport corridors and solar power, quality infrastructure is now the backbone of Africa's push toward productive transformation, shifting labour and capital into higher-value sectors.

The continent's leaders have already committed to "world-class infrastructure crisscrossing Africa" under Agenda 2063.

But ambition has a price tag. The report estimates Africa needs $155 billion every year until 2040, representing the equivalent of 5.6% of GDP, to reach the infrastructure levels of peer economies.

If achieved, Africa's GDP could more than double by 2040, unlocking 4.5 percentage points in additional annual growth.

Africa's Infrastructure Moment Has Arrived

Over 600 million Africans still lack access to electricity, and without urgent action, that figure could rise to one billion by 2050. Infrastructure gaps are already limiting manufacturing, trade and job creation.

The AU–OECD report is blunt: Africa's infrastructure deficit is not just a development issue; it is an economic emergency. Governments currently spend 1.3% of GDP on infrastructure, far below the 5% to 6% levels seen in countries like China and Viet Nam during their growth surges.

However, the upside is huge. Meeting the $155 billion annual target could add $2.83 trillion to Africa's GDP by 2040, more than its entire 2024 output. Central and East Africa have the most advantage, with projected growth boosts of over 6%.

The Money, The Gaps, The Risks

Where the money comes from

Between 2016 and 2020, Africa invested $83 billion per year in infrastructure:

- 41% from governments

- 48% from development partners

- 11% from private investors

Despite global private infrastructure investment tripling since 2013, Africa captured between 6% and 8% of those flows.

In 2024, private deals dropped by 33.3% from $1.8 billion to $1.2 billion, reflecting investor caution.

Why is capital expensive?

Africa's infrastructure projects face the highest cost of capital globally:

- 13% in Africa

- 10% in developing Asia

- 8% in OECD countries

Commercial lending rates in Africa average 18.6%, more than double OECD levels.

However, default rates in energy, water and communications are relatively low at between 4% to 5%, and returns can be as high as 20%, which is among the world's highest.

Debt vs development

From 2019–23, African governments spent seven times more on debt servicing than on infrastructure. In 15 countries, interest payments exceeded infrastructure budgets. Rising debt and shrinking fiscal space are squeezing public investment when it is needed most.

Development finance is shrinking

Official development finance for infrastructure rose to $14.8 billion in 2023, with OECD projections showing a 16% to 28% decline in ODA to Africa by 2025. Lower-income countries are likely to be hit hardest.

Targeting What Works Best

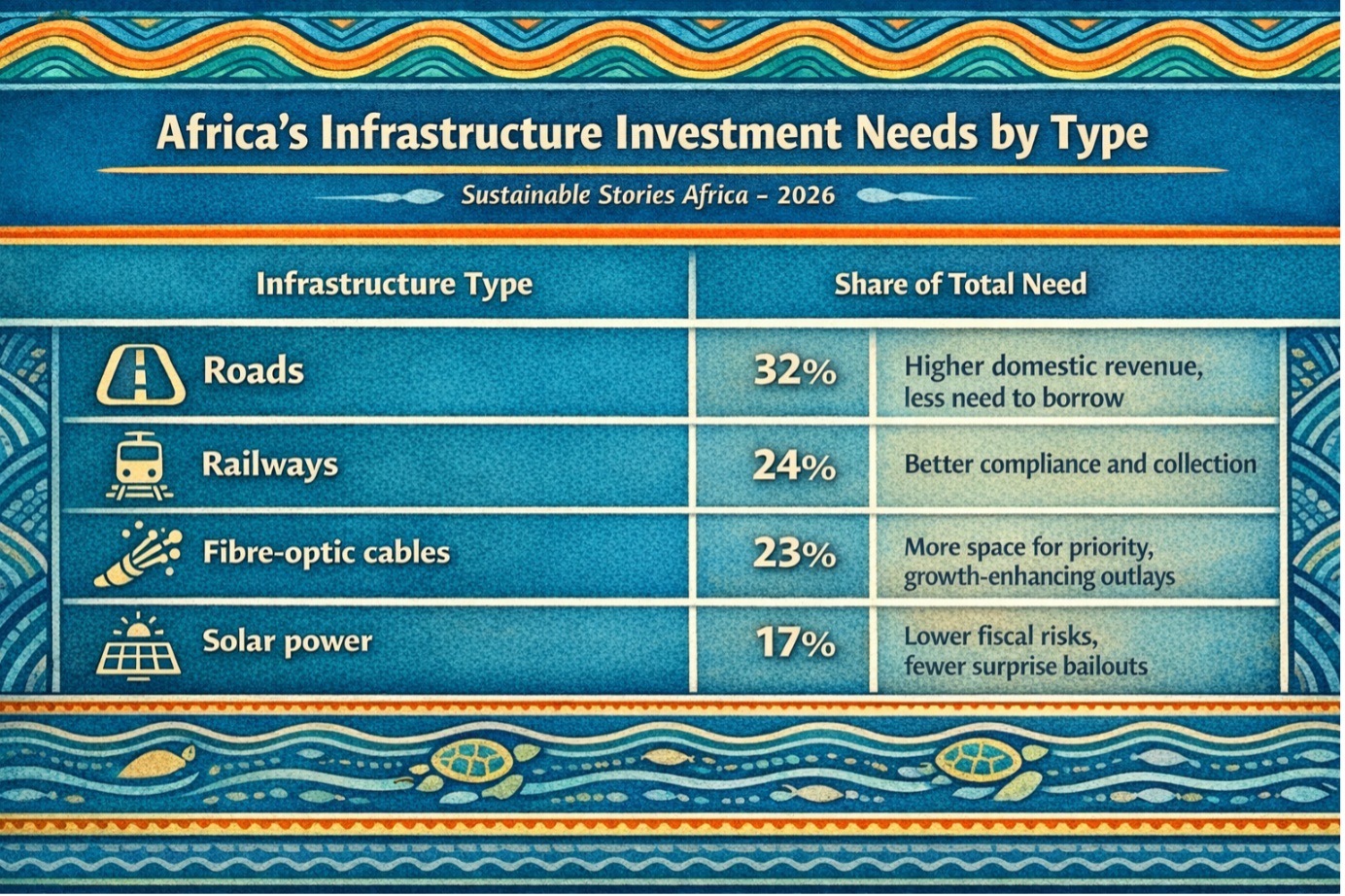

Not all infrastructure delivers equal economic returns. The report's modelling identifies four high-impact priorities:

Africa's Infrastructure Investment Needs by Type

| Infrastructure Type | Share of Total Need |

|---|---|

| Roads | 32% |

| Railways | 24% |

| Fibre-optic cables | 23% |

| Solar power | 17% |

Roads are most cost-effective in low-density countries. Railways offer higher productivity gains with lower pollution. Fibre optics is cheap and scalable. Solar power delivers strong returns in energy-constrained regions.

- Urban and regional transformation – By 2050, two-thirds of Africans will live in cities, and urban land will more than double. A 10% rise in urbanisation increases electricity demand by nearly 4%. However, rural electrification remains under 20%, compared to 80% in major cities.

Strategic investment in intermediate cities can strengthen rural-urban linkages, boost local value chains and create jobs beyond megacities.

- Corridors and connectivity – Completing PIDA transport corridors could raise African exports by 11.5% and GDP growth by up to 2%. Combined investments in transport, energy and digital infrastructure accelerate the shift from agriculture to manufacturing and services.

Four Levers To Close The Gap

The report outlines four realistic pathways to mobilise $155 billion annually by 2040:

Financing Scenarios for Africa's Infrastructure Needs

| Scenario | Annual Investment |

|---|---|

| Business as usual | $90 billion |

| Stable government spending + tax reform | $133 billion |

| Increased public spending to 2% of GDP | $159 billion |

To get there, policymakers must:

- Improve tax collection – Raising tax-to-GDP ratios to 21.5% (Latin America's average) could unlock $51 billion annually.

- Reduce debt burdens – Lower interest costs, free fiscal space for infrastructure.

- Lower risk perceptions – Better credit data, a continental rating agency and platforms like the African Virtual Investment Platform can attract private capital.

- Boost development finance – Meeting the 0.7% GNI ODA target could add $4 billion yearly for infrastructure.

Multilateral banks are also urged to double infrastructure finance and leverage capital markets more aggressively.

PATH FORWARD – Building Smarter, Faster, Fairer Infrastructure

Africa's infrastructure challenge is no longer about ambition; it is about execution. Prioritising high-impact projects, strengthening governance, and lowering the cost of capital can unlock growth without unsustainable debt.

With better planning, stronger institutions and smarter financing, infrastructure can become Africa's most powerful tool for inclusive growth, climate resilience and long-term prosperity.