Family businesses, long seen as guardians of legacy and stability, are redefining what growth means in a rapidly changing global economy. New evidence from KPMG's Global Family Business Report 2025 shows that success today is less about size alone and more about governance, sustainability, and strategic investment.

Purpose-Driven Growth Reshapes Family Enterprises

Family-owned businesses account for more than 70% of companies globally; however, their definition of success is undergoing a quiet transformation.

According to KPMG's Global Family Business Report 2025, growth is no longer measured purely by revenue or scale, but by a combination of governance strength, sustainability performance, and long-term societal impact

The study, based on responses from 2,683 family businesses worldwide, found that only 32% considered themselves "high performing" compared to peers, while 48% demonstrated high sustainability orientation and 46% showed strong transgenerational entrepreneurship (TES).

These figures suggest that financial success increasingly depends on how well family firms balance values, innovation, and governance structures.

Legacy Meets a New Growth Model

Family enterprises are expanding their vision beyond succession planning toward what KPMG calls a "meaningful transition of capital and purpose across generations."

Growth today is about "value with values," where commercial performance aligns with environmental, social, and governance (ESG) priorities.

The report highlights that sustainable growth depends on three interconnected drivers:

- Effective governance and leadership

- Sustainability as a growth engine

- Strategic investment, including M&A and growth capital

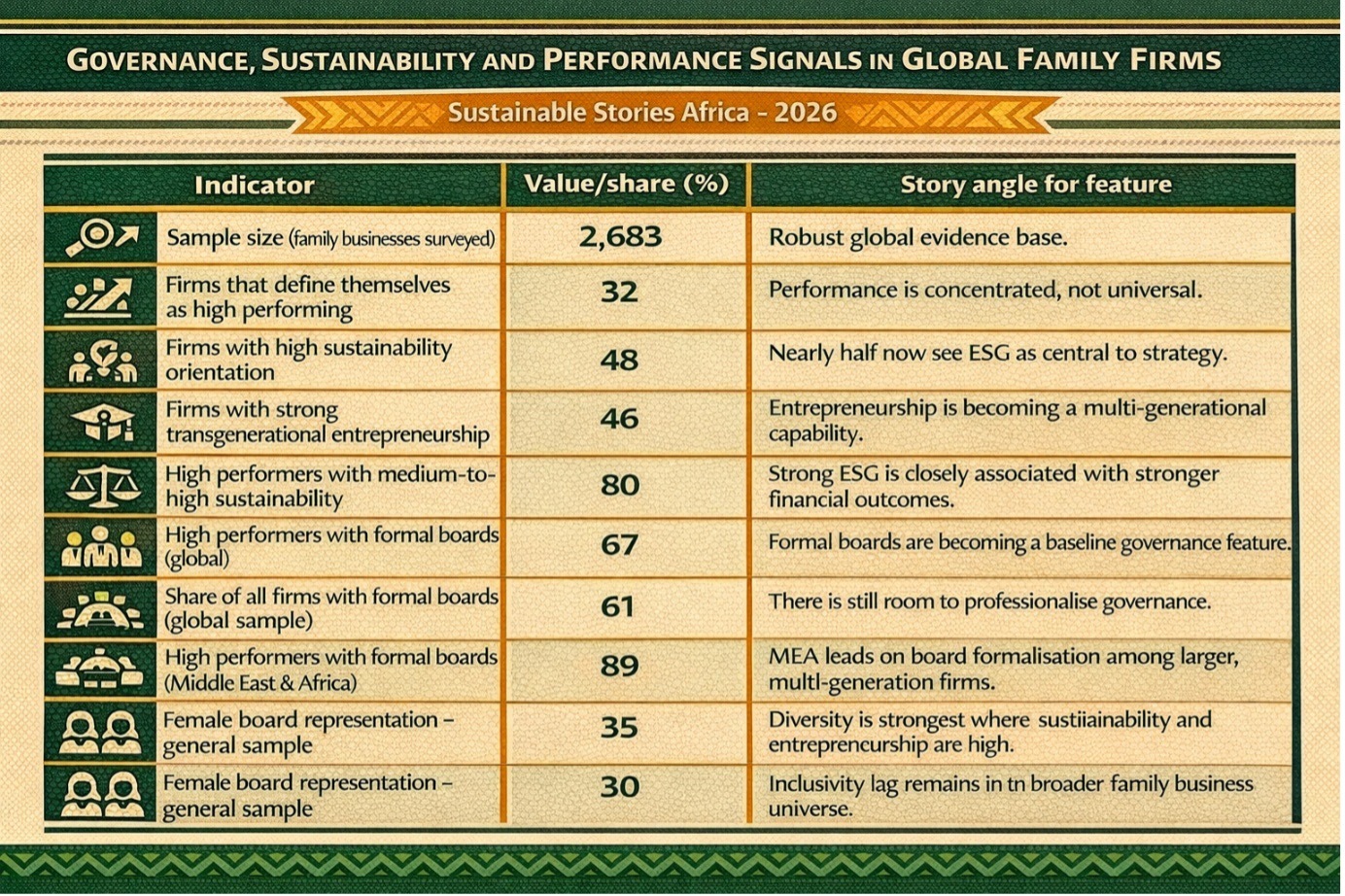

Governance, Sustainability and Performance Signals in Global Family Firms

| Indicator | Value/share (%) | Story angle for feature |

|---|---|---|

| Sample size (family businesses surveyed) | 2,683 | Robust global evidence base. |

| Firms that define themselves as high performing | 32 | Performance is concentrated, not universal. |

| Firms with high sustainability orientation | 48 | Nearly half now see ESG as central to strategy. |

| Firms with strong transgenerational entrepreneurship | 46 | Entrepreneurship is becoming a multi-generational capability. |

| High performers with medium‑to‑high sustainability | 80 | Strong ESG is closely associated with stronger financial outcomes. |

| High performers with formal boards (global) | 67 | Formal boards are becoming a baseline governance feature. |

| Share of all firms with formal boards (global sample) | 61 | There is still room to professionalise governance. |

| High performers with formal boards (Middle East & Africa) | 89 | MEA leads on board formalisation among larger, multi‑generation firms. |

| Female board representation – high TES/sustainability | 35 | Diversity is strongest where sustainability and entrepreneurship are high. |

| Female board representation – general sample | 30 | Inclusivity lag remains in the broader family business universe. |

This shift reflects rising expectations from consumers, investors, and younger family members who increasingly demand accountability, transparency, and social impact.

Governance Becomes a Competitive Advantage

Formal boards are emerging as a defining feature of high-performing family businesses. Globally, 67% of high-performing firms had formal boards, compared to 61% of the total sample.

In the Middle East and Africa, the figure rose to 89%, the highest globally, driven by a higher proportion of large, multi-generational firms in the region.

Boards that include both family and independent members were found to foster accountability, innovation, and strategic discipline.

According to Professor Tulsi Jayakumar, effective boards "bridge the wisdom of past generations with the innovation of the future," supporting sound decision-making and long-term resilience.

Diversity also matters. Firms with high TES or sustainability performance had 35% female board representation, compared to 30% in the general sample, reinforcing the link between inclusion and governance quality.

Sustainability Drives Financial Performance

Sustainability is no longer optional for family enterprises. Companies that integrate ESG into their strategy benefit from lower costs, stronger brand loyalty, and improved market positioning.

Across regions, family businesses demonstrated strong commitments to community support, environmental stewardship, employee well-being, and responsible supply chains.

In the Middle East and Africa, over 75% supported local charities and community initiatives, while 70% focused on improving community well-being.

Environmentally, 75% of respondents are actively working to conserve energy and resources, although fewer than 50% measure the real impact of their sustainability actions.

Crucially, 80% of family firms reporting high financial performance also showed medium-to-high sustainability performance, suggesting ESG is now a competitive advantage rather than a compliance burden.

M&A and Growth Capital Gain Momentum

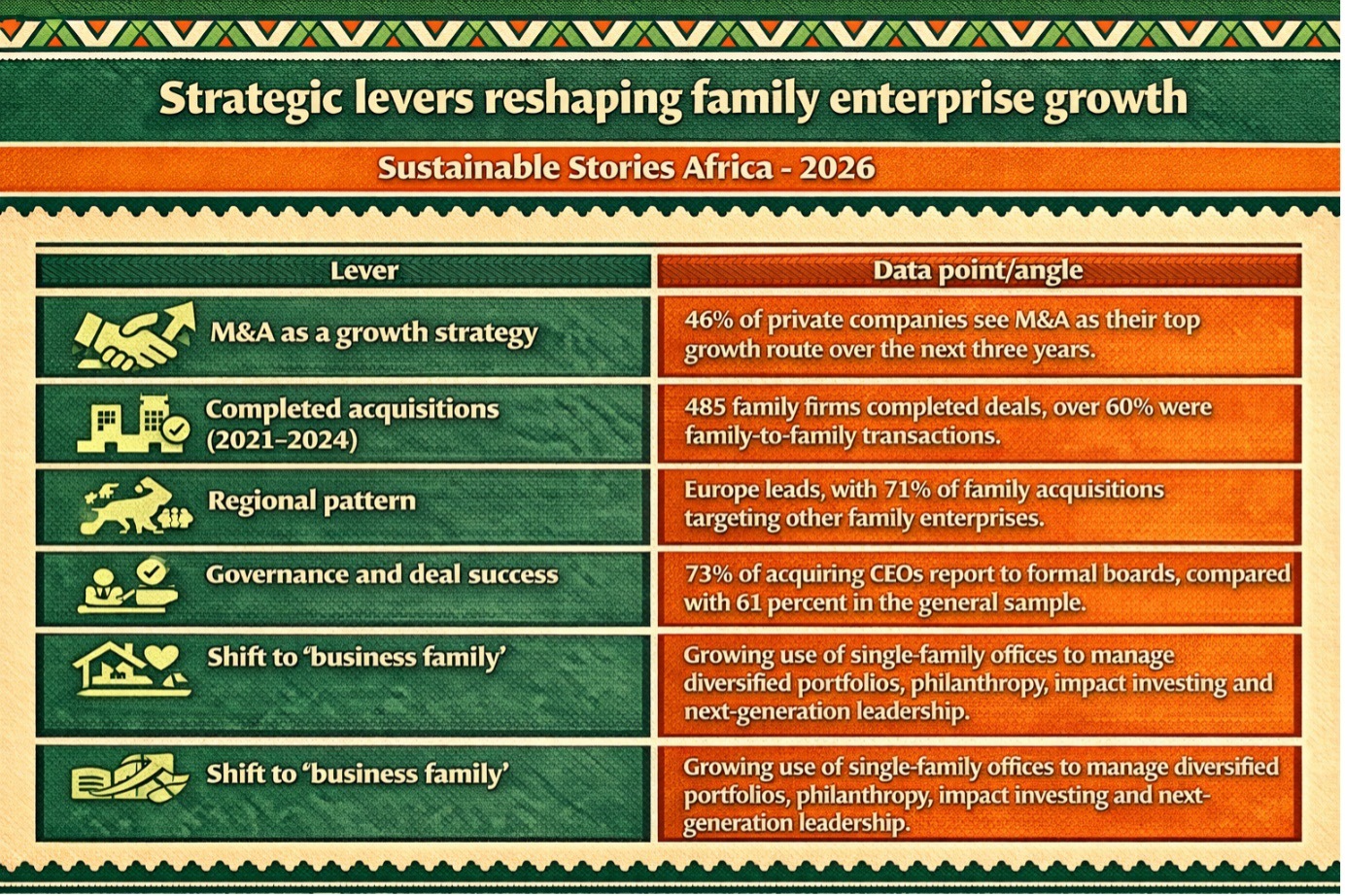

Family businesses are increasingly turning to mergers and acquisitions (M&A) to unlock growth, modernise operations, and navigate succession challenges. Nearly 46% of private companies globally view Mergers and Acquisitions as their most important growth strategy over the next three years.

Among surveyed family firms, 485 had completed acquisitions between 2021 and 2024, with over 60% involving family-to-family business deals. Europe led this trend, with 71% of acquisitions targeting other family enterprises.

Firms engaged in M&A recorded 14% higher average performance compared to those that did not, reinforcing the link between strategic expansion and financial strength.

However, success depended heavily on the quality of governance, leadership experience, and cultural alignment. 73% of CEOs in acquiring firms reported to formal boards, compared to 61% in the general sample.

From Family Business to Family Enterprise

Many families are transitioning from "family in business" to "business family" models, professionalising governance and separating ownership from management.

This shift enables families to focus on building broader "family capital," including social, human, and reputational assets.

Some families establish single-family offices after partial or full business exits, enabling them to diversify their investments and long-term wealth stewardship.

These offices often turn to platforms for philanthropy, impact investing, and next-generation leadership development.

According to KPMG, long-term success requires adaptability, aligned values, an entrepreneurial spirit, and governance systems that leverage the family's collective strengths.

Strategic levers reshaping family enterprise growth

| Lever | Data point/angle |

|---|---|

| M&A as a growth strategy | 46% of private companies see M&A as their top growth route over the next three years. |

| Completed acquisitions (2021–2024) | 485 family firms completed deals; over 60% were family‑to‑family transactions. |

| Regional pattern | Europe leads, with 71% of family acquisitions targeting other family enterprises. |

| Governance and deal success | 73% of acquiring CEOs report to formal boards, compared with 61 percent in the general sample. |

| Shift to "business family" | Growing use of single‑family offices to manage diversified portfolios, philanthropy, impact investing and next‑generation leadership. |

Path Forward – What Must Happen Next

Family businesses must embed purpose into their governance, formalise boards, and measure sustainability impact more rigorously.

The strategic use of M&A, with other forms of patient capital from private equity and family offices, will support succession and modernisation.

Engaging younger generations in ESG and strategy discussions is critical to maintaining relevance. The future of family enterprise lies in balancing legacy with innovation, growing better, not just bigger.