Nigeria’s maritime trade is facing increasing disruptions as global shipping accelerates toward strict decarbonisation mandates under IMO 2030.

Without urgent investment in green fuels, efficient vessels, and compliant ports, exporters risk higher freight costs, restricted market access, and declining competitiveness.

Industry leaders warn that delays could isolate Nigeria from emerging low-carbon trade routes and weaken its strategic maritime advantage.

Global Shipping Rules Reshape Trade Competitiveness

Nigeria’s maritime sector is facing a structural inflexion point as the International Maritime Organisation’s (IMO) decarbonisation rules begin reshaping global shipping economics.

Under IMO 2030 and related measures, including the Carbon Intensity Indicator (CII) and Energy Efficiency Existing Ship Index (EEXI), vessels must progressively reduce their emissions intensity or face operational restrictions, penalties, or reduced market access.

For Nigeria, where over 80% of international trade is transported by sea, delayed compliance presents a threat to its export competitiveness.

Shipping companies increasingly prioritise energy-efficient vessels and low-carbon routes, creating a two-tier market that could marginalise non-compliant ports and fleets.

The shift is already influencing freight pricing, vessel deployment, and investment flows across global maritime corridors.

Failure to align risks isolates Nigeria’s maritime ecosystem from emerging green shipping networks connecting Europe, Asia, and the Americas.

Nigeria’s Maritime Infrastructure Faces Critical Gaps

Nigeria’s shipping ecosystem faces structural challenges across vessels, ports, and fuel supply chains.

Most domestic vessels operate with older propulsion systems, while ports often lack the infrastructure for cleaner fuels such as LNG, methanol, or ammonia.

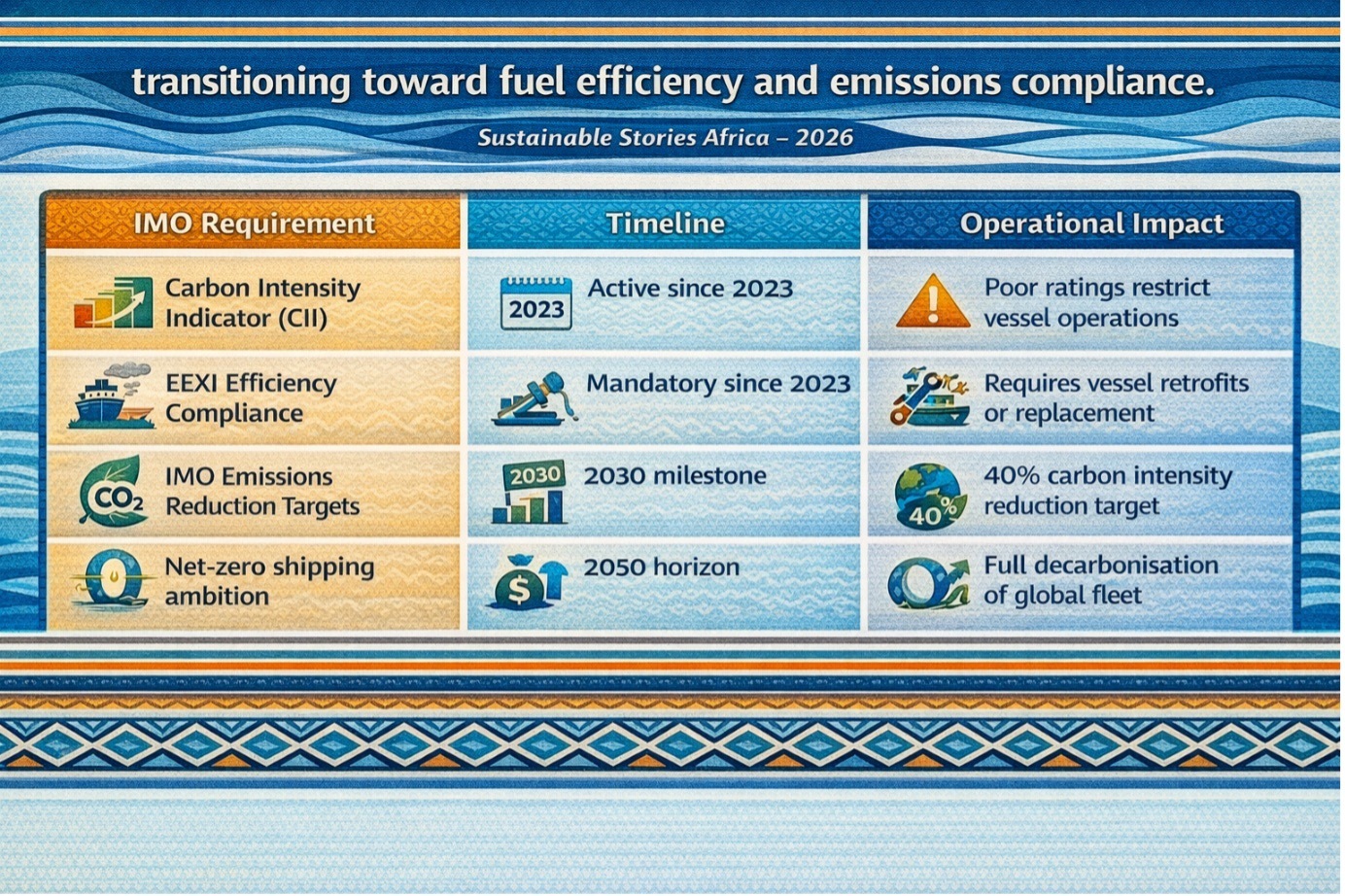

Global shipping is rapidly transitioning toward fuel efficiency and emissions compliance:

IMO Requirement | Timeline | Operational Impact |

|---|---|---|

Carbon Intensity Indicator (CII) | Active since 2023 | Poor ratings restrict vessel operations |

EEXI Efficiency Compliance | Mandatory since 2023 | Requires vessel retrofits or replacement |

IMO Emissions Reduction Targets | 2030 milestone | 40% carbon intensity reduction target |

Net-zero shipping ambition | 2050 horizon | Full decarbonisation of the global fleet |

Ports unable to support compliant vessels risk losing traffic as shipping companies optimise routes based on environmental performance. For Nigeria, this raises concerns about the long-term competitiveness of major gateways such as Lagos and Onne.

Shipping operators warn that compliance costs, from retrofitting engines to adopting alternative fuels, are increasing freight rates globally.

These costs disproportionately affect developing economies without coordinated transition strategies.

Green Transition Unlocks Trade Competitiveness Gains

Despite the risks, the transition presents strategic opportunities. Countries investing early in green maritime infrastructure are positioning themselves as preferred trade hubs, attracting investment and securing long-term trade flows.

Nigeria’s geographic position offers a natural advantage as the maritime gateway of West Africa.

With targeted investment, the country could capture emerging green shipping corridors linking Africa to Europe and global markets.

Key transition priorities include:

Strategic Area | Current Gap | Potential Economic Benefit |

|---|---|---|

Fleet modernisation | Ageing vessel stock | Lower operating costs, compliance readiness |

Green port infrastructure | Limited alternative fuel support | Increased port traffic and competitiveness |

Regulatory framework | Fragmented transition policies | Investor confidence and capital inflows |

Maritime financing | Limited access to green capital | Fleet renewal and innovation funding |

Early movers in maritime decarbonisation are already securing investment flows tied to climate-aligned infrastructure. Nigeria could similarly unlock capital, modernise logistics systems, and strengthen trade resilience.

Coordinated Investments Critical For Maritime Survival

Experts emphasise the need for coordinated national action involving regulators, shipping operators, port authorities, and investors.

Regulatory clarity, targeted incentives, and infrastructure investments will be essential to support fleet upgrades and port modernisation.

Financial mechanisms, including green shipping funds, concessional financing, and blended capital, can accelerate compliance while mitigating economic disruption.

Public-private partnerships will also be critical in building alternative fuel supply chains and upgrading port facilities.

Without decisive action, Nigeria risks a significant increase in trade costs, reduced shipping access, and a decline in its global maritime logistics. With timely intervention, however, the country can reposition itself as a leading green maritime hub in Africa.

Path Forward – Nigeria Must Accelerate Maritime Transition

Nigeria must prioritise fleet renewal, green fuel infrastructure, and regulatory alignment to maintain maritime competitiveness.

Strategic coordination between government, industry, and financiers is essential to support compliance and attract investment.

A proactive transition can strengthen trade resilience, secure global market access, and position Nigeria as West Africa’s preferred green shipping gateway.

Culled From: https://guardian.ng/business-services/imo-2030-nigeria-risks-trade-setback-over-slow-green-transition/