Kenya's Finance Act 2025 marks a decisive shift toward fiscal consolidation, digital taxation, and expanded compliance.

With new rules on withholding tax, digital marketplaces, loss carry-forwards, and investment incentives, the government is widening the tax base while reshaping incentives for growth.

From taxing betting withdrawals to rewarding Nairobi IFC firms and tightening corporate reporting, the reforms signal a new era of accountability in Kenya's tax landscape.

Kenya's New Fiscal Direction – Redrawing Kenya's Tax Landscape

Kenya's Finance Act 2025 arrives at a moment of economic recalibration. After growth slowed to 4.6% in 2024. The government aims for a rebound to 5.3% in 2025, driven by agriculture, services, and the Bottom-Up Economic Transformation Agenda (BETA). This is according to a KPMG analysis of the 2025 Finance Act in Kenya.

At the same time, rising global trade tensions, particularly new United States reciprocal tariffs, have placed pressure on Kenyan exports in agriculture, textiles, floriculture, and mining.

Against this backdrop, the Finance Act seeks to cushion the economy, broaden the tax base, and stabilise public finances.

The Act targets KES 3.32 trillion in revenue for FY2025/26, anchored by KES 2.75 trillion in tax revenues, alongside appropriations-in-aid and grants.

Fiscal consolidation remains the central goal as Kenya works to manage public debt and sustain essential services.

However, the real story lies in how taxation is being reshaped across corporate, digital, and individual income.

A Broader, Tighter Tax Net

Kenya's Finance Act 2025 significantly expands the tax base, particularly in digital commerce, betting, public procurement, and multinational operations.

One of the most notable changes is the formal inclusion of withholding tax on supplies to public entities, detailed in section 10 of the Income Tax Act. This makes the deduction of tax on public sector goods enforceable by law from 1 July 2025.

The Act also shifts the withholding tax obligation for non-resident ship owners from service providers to Kenyan recipients, ensuring easier enforcement.

In the fast-growing digital economy, Kenya is tightening controls. Payments made or facilitated through digital marketplaces now fall under withholding tax rules, reinforcing the government's ability to tax online income streams.

Meanwhile, betting withdrawals, not just winnings, are now subject to 5% withholding tax, shifting the tax base to the actual cash withdrawn by punters.

Together, these changes reflect a more assertive revenue strategy aimed at plugging leakages across traditional and digital sectors.

What the Data Shows

Kenya's Finance Act 2025 introduces sweeping reforms across income tax, corporate taxation, and digital commerce.

Key Revenue and Policy Targets

| Indicator | FY2025/26 |

|---|---|

| Total revenue target | KES 3.32 trillion |

| Tax revenue | KES 2.75 trillion |

| Appropriations-in-aid | KES 567 billion |

| Grants | KES 46.9 billion |

| Economic growth forecast | 5.3% |

Corporate tax rules have also been tightened. Losses can now be carried forward for only five years, no longer indefinitely. This shift could weigh on capital-intensive sectors, where projects typically take longer to break even.

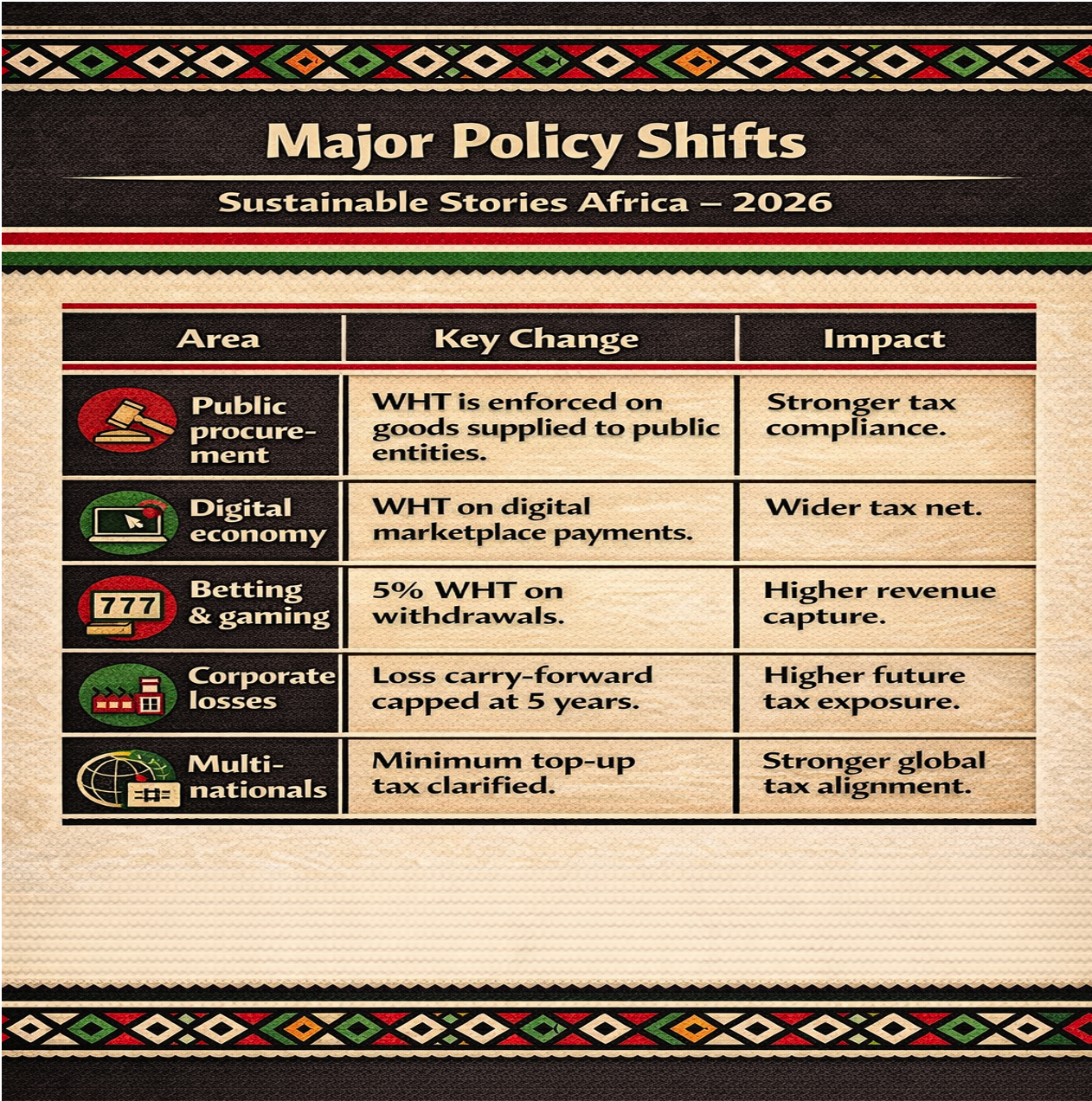

Major Policy Shifts

| Area | Key Change | Impact |

|---|---|---|

| Public procurement | WHT is enforced on goods supplied to public entities | Stronger tax compliance |

| Digital economy | WHT on digital marketplace payments | Wider tax net |

| Betting & gaming | 5% WHT on withdrawals | Higher revenue capture |

| Corporate losses | Loss carry-forward capped at 5 years | Higher future tax exposure |

| Multinationals | Minimum top-up tax clarified | Stronger global tax alignment |

At the same time, Kenya has clarified the Minimum Top-Up Tax for multinational groups with global turnover above EUR 750 million (KES 104 billion), aligning with global minimum tax standards.

Payment is now due by the fourth month following the end of the previous financial year.

Incentives for Strategic Growth

Despite tightening compliance, the Finance Act also introduces targeted incentives to stimulate investment.

- Nairobi IFC Gets a Boost – Companies certified by the Nairobi International Financial Centre (NIFC) now enjoy:

- 15% corporate tax for the first 10 years

- 20% for the next 10 years

- Tax-free dividends if KES 250 million is reinvested locally

These incentives aim to attract financial services firms and regional headquarters to Kenya, reinforcing Nairobi's ambition to position itself as a leading regional financial hub.

Support for Key Sectors

- Telecoms can now claim investment allowances on spectrum licences

- Sports infrastructure spending is deductible, supporting AFCON 2027 preparations

- Home builders can deduct up to KES 360,000 in mortgage interest for self-built homes

Meanwhile, the per diem tax-free allowance for employees increased by 400% from KES 2,000 to KES 10,000 per day, easing financial pressure for workers' travel.

These incentives suggest the government is balancing fiscal tightening with growth-friendly measures.

What Businesses Must Do Now

With enforcement expanding, Kenyan businesses must act decisively:

- Review withholding tax processes – Public sector suppliers, digital platforms, and gaming operators must update compliance systems.

- Reassess tax loss strategies – The five-year cap on loss carry-forwards requires earlier profitability planning.

- Strengthen transfer pricing compliance – The definition of "related persons" has been broadened, increasing disclosure obligations.

- Prepare for Advance Pricing Agreements (APAs) – APAs become available from January 2026, offering certainty for multinationals—if properly implemented.

- Leverage incentives wisely – Firms in finance, telecoms, housing, and sports infrastructure can benefit from new reliefs.

Failure to adapt could expose businesses to higher tax burdens, tighter regulatory scrutiny and greater operational risk.

Path Forward – A More Disciplined Fiscal Future

Kenya's Finance Act 2025 reflects a shift toward tighter enforcement, digital taxation, and fiscal consolidation.

The government is expanding the tax base while offering targeted incentives to support priority sectors.

For businesses, the message is clear: compliance, transparency, and strategic tax planning will define success in Kenya's evolving fiscal environment.