Nigeria’s listed companies are embracing ESG frameworks faster than ever, but evidence remains uneven. The IPMC ESG Ratings Report 2025 reveals a corporate landscape rich in policy statements; however, they are thin on independently verified data, especially on climate and value-chain emissions.

Governance disclosures lead the pack, while environmental assurance, Scope 3 reporting, and financed-emission transparency lag global expectations, posing risks for Nigeria’s access to sustainable capital.

From Compliance to Credibility

Nigeria’s ESG journey has entered a defining phase. As global investors pivot from narrative sustainability claims to measurable, assured performance, Nigerian companies are under pressure to demonstrate not just intent, but verifiable impact.

The IPMC Nigeria ESG Ratings Report 2025 provides a comprehensive, evidence-based assessment of how listed firms are responding to this shift.

Covering 146 Nigerian Exchange (NGX) – listed companies across Financial Services, Oil & Gas, Manufacturing, Telecommunications, and Services, the report evaluates ESG disclosures for FY2024 using over 180 indicators aligned with GRI, SASB, TCFD, IFRS S1/S2, and the UN SDGs.

Only 121 firms met minimum disclosure thresholds for scoring, highlighting persistent transparency gaps.

The findings are clear: Nigeria’s ESG ecosystem is policy-rich but verification-poor. Governance frameworks are visible, social reporting is improving, but environmental transparency, especially Scope 3 emissions and financed emissions, remains limited.

Fewer than 15% of companies disclose Scope 3 emissions, and less than 20% provide third-party assurance for ESG data.

Key ESG Methodology Snapshot

IPMC’s rating framework integrates:

- Corporate Sustainability Assessment (CSA) with over 180 metrics

- Sector-specific ESG weightings

- Three-tier data assurance checks (disclosure presence, evidence strength, cross-sector consistency)

- Score conversion into standardised rating bands (AAA to D)

ESG Rating Bands

Score Range (%) | Rating | Interpretation |

|---|---|---|

85–100 | AAA | Global ESG Leader |

75–84 | AA | Strong, structured ESG |

65–74 | A | Emerging ESG maturity |

50–64 | BBB | Foundational ESG |

35–49 | BB | Lagging |

20–34 | B | Weak |

0–19 | D | Deficient |

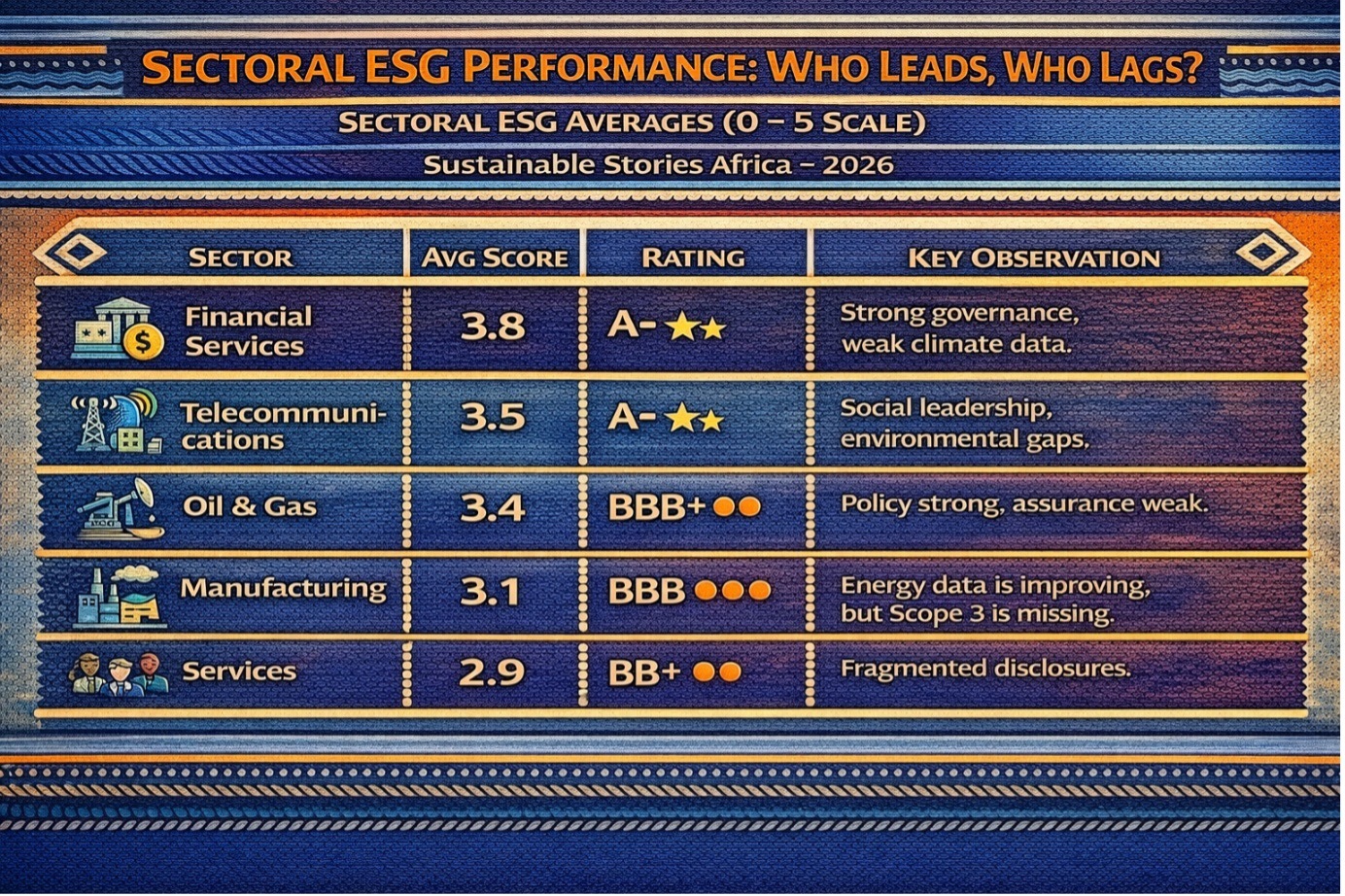

Sectoral ESG Performance: Who Leads, Who Lags? - Sectoral ESG Averages (0 – 5 Scale)

Sector | Avg Score | Rating | Key Observation |

|---|---|---|---|

Financial Services | 3.8 | A- | Strong governance, weak climate data |

Telecommunications | 3.5 | A- | Social leadership, environmental gaps |

Oil & Gas | 3.4 | BBB+ | Policy strong, assurance weak |

Manufacturing | 3.1 | BBB | Energy data is improving, but Scope 3 is missing |

Services | 2.9 | BB+ | Fragmented disclosures |

Insight: Governance stands out as Nigeria’s strongest ESG pillar, reflecting sustained progress in corporate oversight and transparency.

However, limited disclosure on environmental performance, particularly around value-chain emissions and third-party verification, continues to weigh down overall ESG ratings.

Financial Services: Governance Champions, Climate Laggards

Banks and financial institutions lead Nigeria’s ESG rankings due to:

- Near-universal board governance disclosures

- Strong risk management frameworks

- Improving financial inclusion metrics

However:

- Only 12% disclose financed emissions

- None provides assured climate-risk data

- Gender diversity in senior management remains below 25%

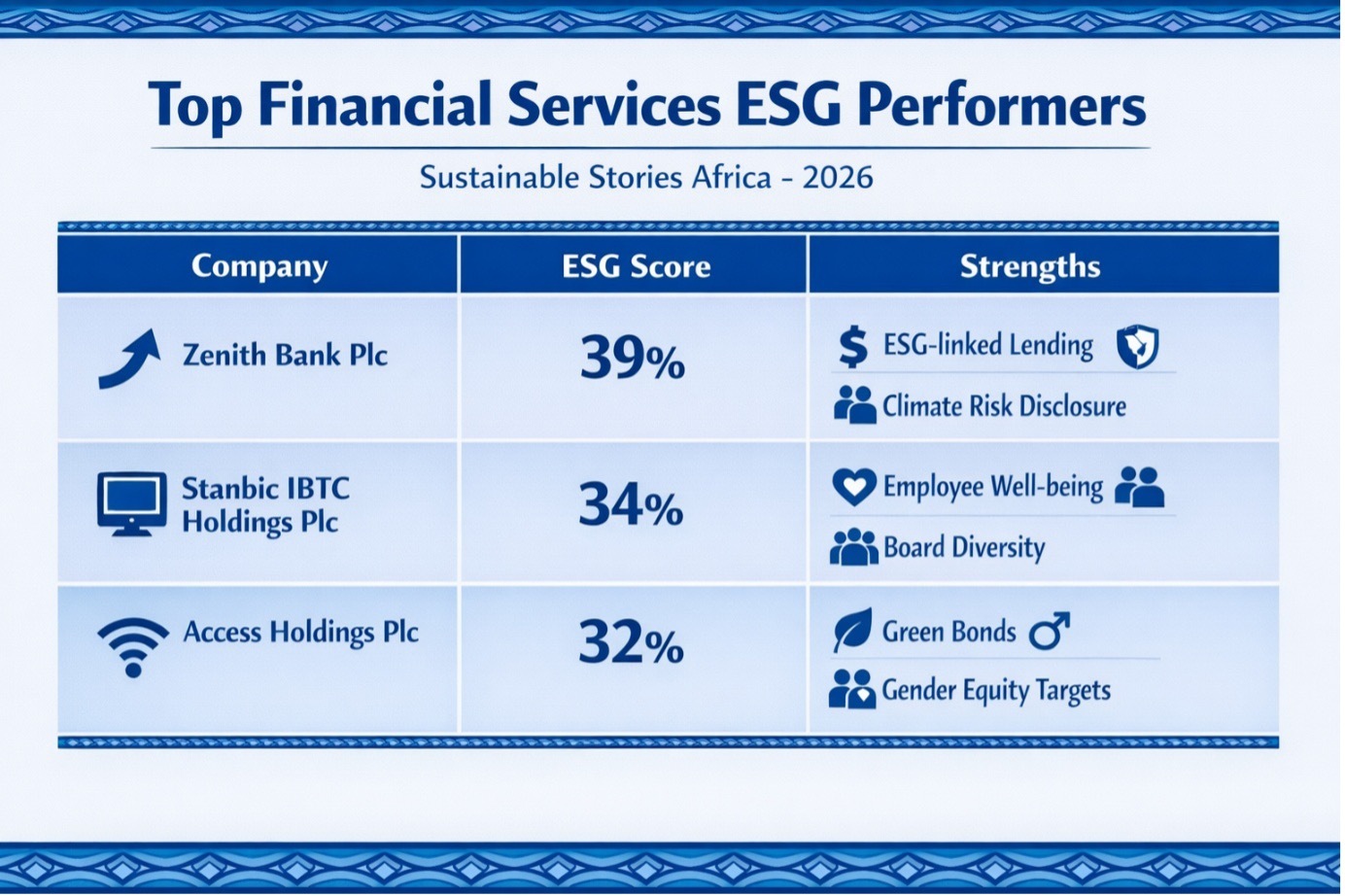

Top Financial Services ESG Performers

Company | ESG Score | Strengths |

|---|---|---|

Zenith Bank Plc | 39% | ESG-linked lending, climate risk disclosure |

Stanbic IBTC Holdings Plc | 34% | Employee well-being, board diversity |

Access Holdings Plc | 32% | Green bonds, gender equity targets |

Investor takeaway: Nigerian banks are governance-ready but climate-data-light. Alignment with IFRS S2 and financed-emission disclosure will shape future access to sustainable finance.

Oil & Gas: Transition Risk Without Transition Metrics

The Oil & Gas sector remains central to Nigeria’s economy—but exposed to climate risk.

Strengths:

- Flaring and energy-use disclosures

- Community engagement policies

- Safety compliance

Weaknesses:

- <25% third-party assurance

- Near-zero Scope 3 reporting

- Limited ESG-linked executive incentives

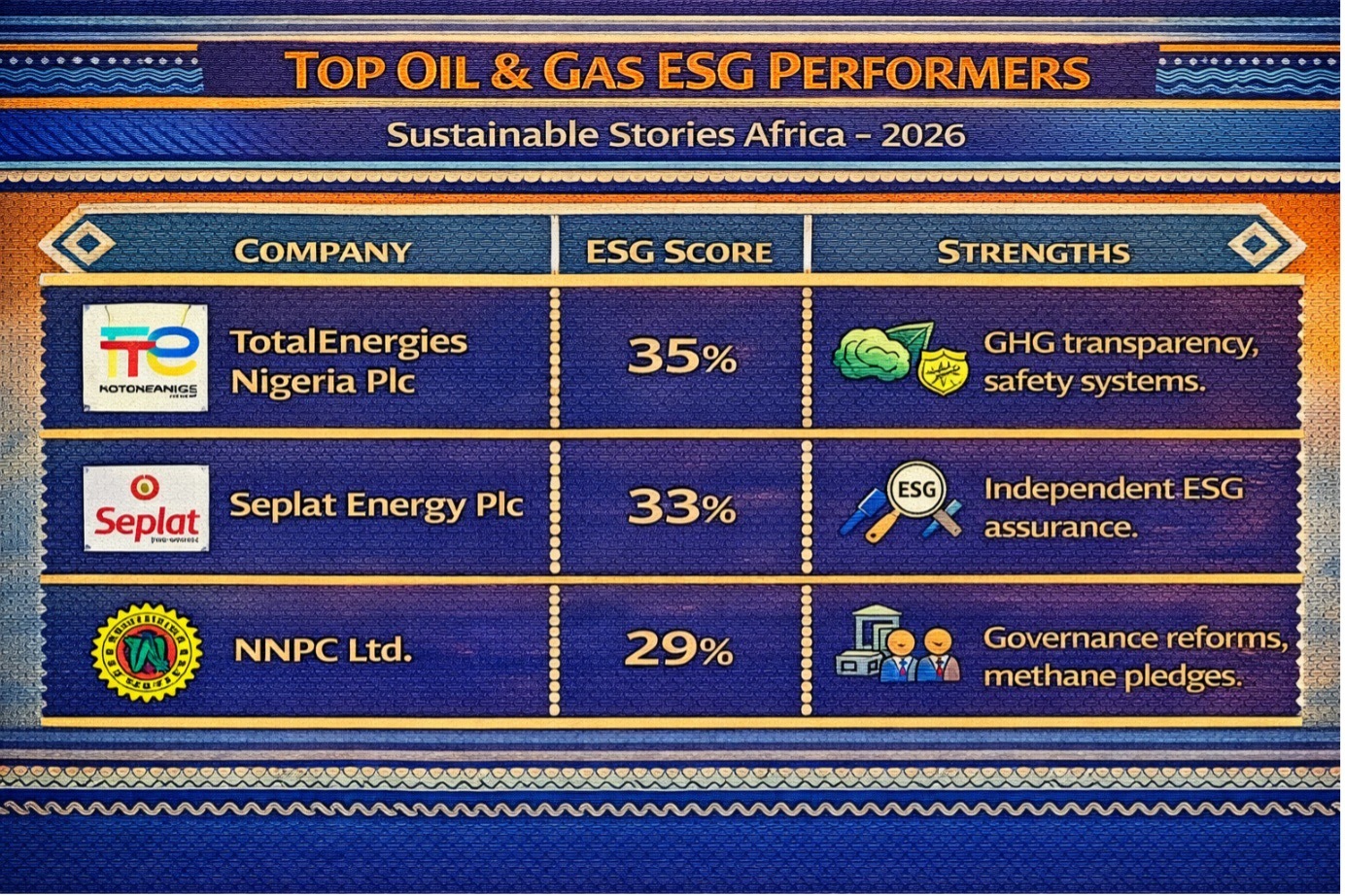

Top Oil & Gas ESG Performers

Company | ESG Score | Strengths |

|---|---|---|

TotalEnergies Nigeria Plc | 35% | GHG transparency, safety systems |

Seplat Energy Plc | 33% | Independent ESG assurance |

NNPC Ltd | 29% | Governance reforms, methane pledges |

Key risk: They have strategies in place for transitioning; however, the foundations remain fragile, with weak emissions baselines and limited verification of decarbonisation pathways.

Manufacturing: Efficiency Gains, Limited Lifecycle Transparency

Manufacturers are improving:

- Energy efficiency

- Waste reduction

- Occupational safety

Yet:

- Few disclose life-cycle assessments

- Product stewardship metrics remain scarce

- Board independence varies widely

Top Manufacturing ESG Performers

Company | ESG Score | Strengths |

|---|---|---|

Dangote Cement Plc | 36% | Emission targets, waste heat recovery |

Nestlé Nigeria Plc | 33% | Circular economy, verified water data |

BUA Cement Plc | 31% | Safety compliance, emissions tracking |

Insight: Export-oriented firms show better ESG maturity due to international buyer pressure.

Telecommunications: Social Leadership, Environmental Blind Spots

Telecoms excel in:

- Employee training

- Data protection (post-NITDA 2023)

- Digital inclusion

But lag in:

- Energy-use transparency

- E-waste reporting

- Carbon-intensity metrics

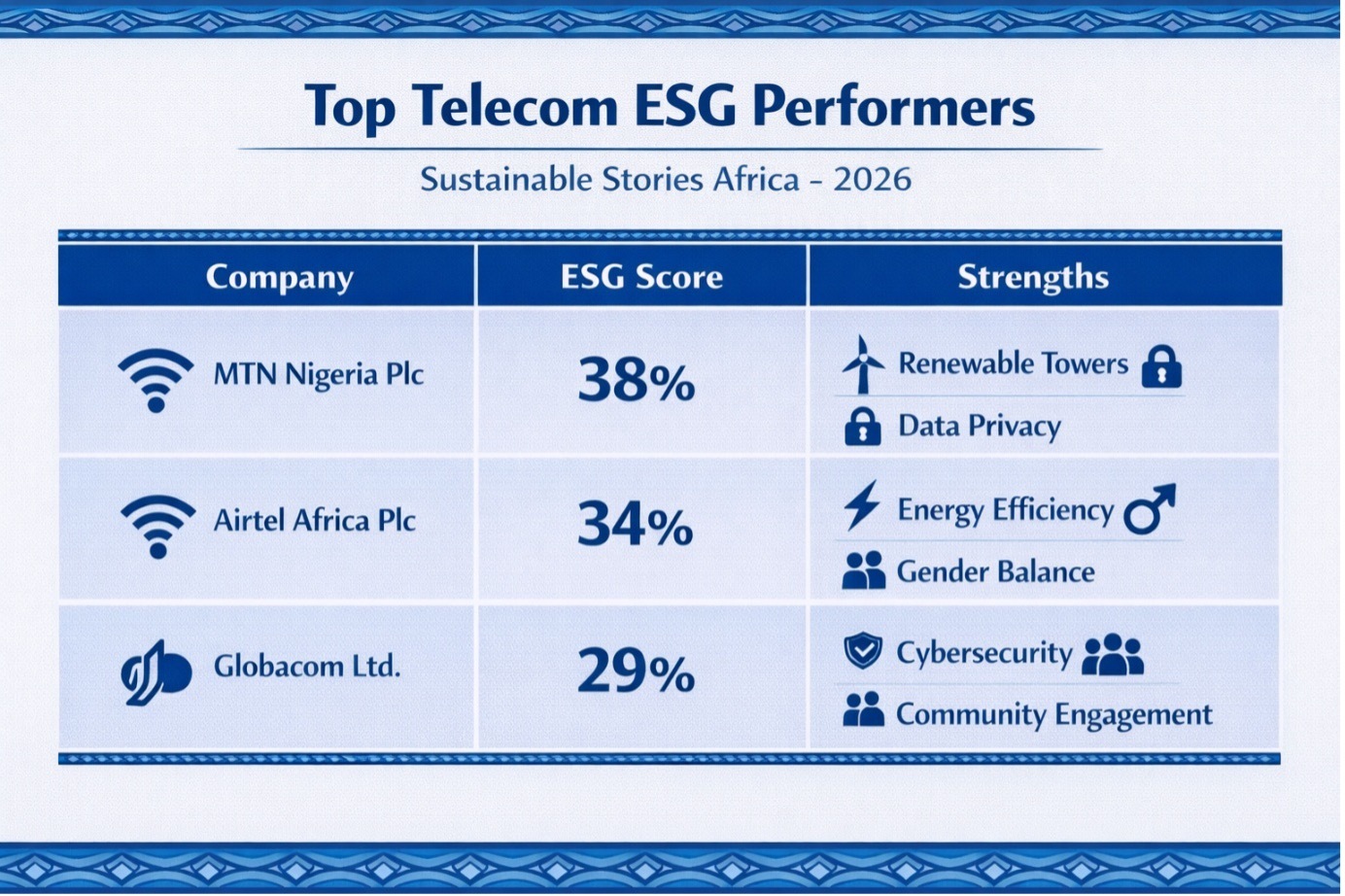

Top Telecom ESG Performers

Company | ESG Score | Strengths |

|---|---|---|

MTN Nigeria Plc | 38% | Renewable towers, data privacy |

Airtel Africa Plc | 34% | Energy efficiency, gender balance |

Globacom Ltd | 29% | Cybersecurity, community engagement |

Opportunity: Environmental transparency could push telecoms into AA-tier ESG performance.

Services Sector: Fragmented but Improving

The Services sector shows the widest ESG variance.

Leaders:

- Julius Berger Nigeria Plc

- Transcorp Plc

- UPDC Plc

Strengths include:

- HSE systems

- Governance structures

- Community engagement

However:

- Environmental data is largely qualitative

- Diversity reporting remains anecdotal

Average ESG Score: 19% (early-stage integration)

Cross-Sector ESG Gaps

Three systemic weaknesses dominate Nigeria’s ESG landscape:

- Assurance Deficit – Less than 20% of ESG data is independently verified.

- Scope 3 & Financed Emissions Gap – Most companies fail to report value-chain climate risks.

- Governance Fragmentation – ESG targets rarely feature in executive KPIs.

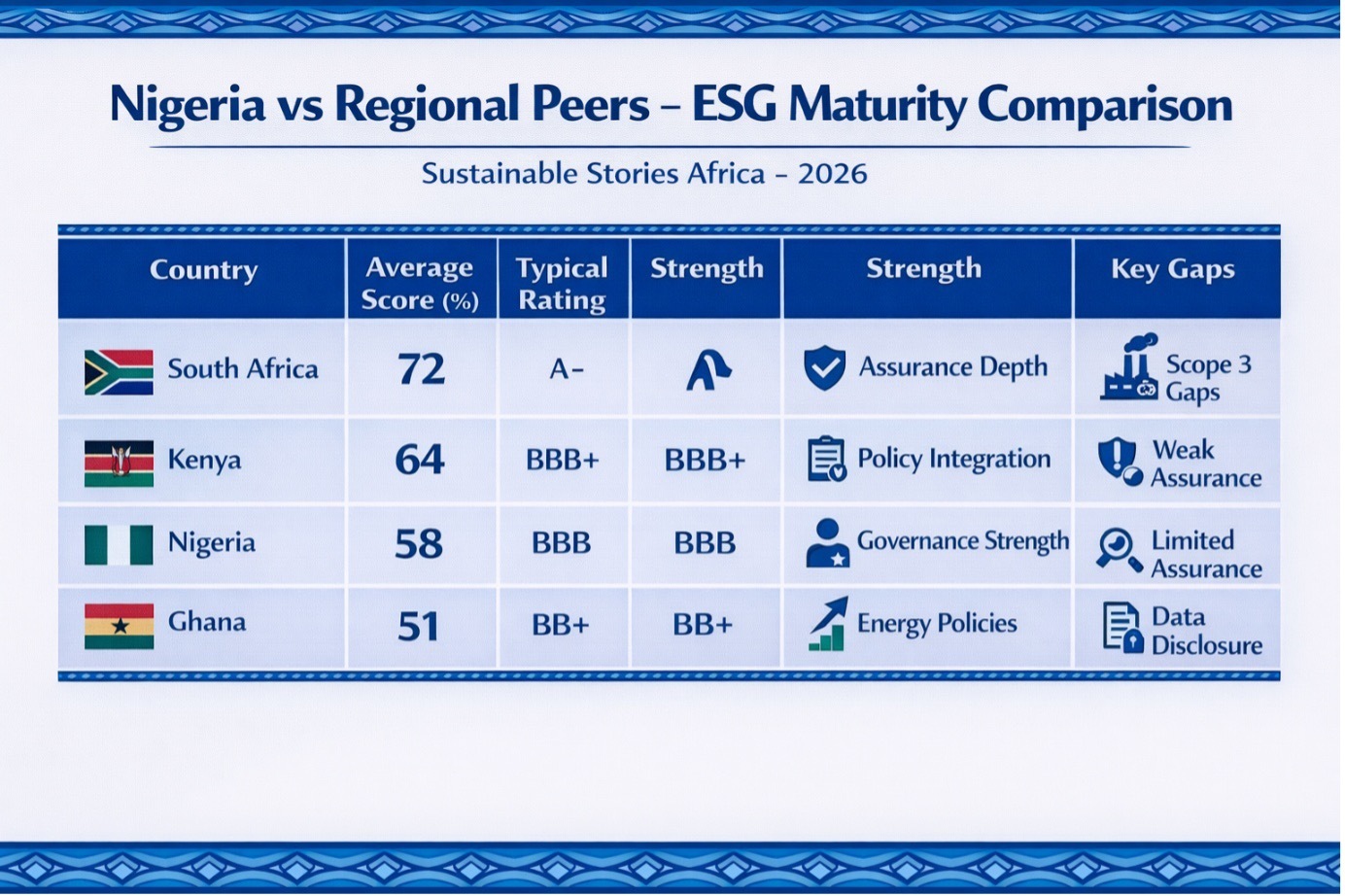

Nigeria vs Regional Peers – ESG Maturity Comparison

Country | Average Score (%) | Typical Rating | Strength | Key Gaps |

|---|---|---|---|---|

South Africa | 72 | A- | Assurance depth | Scope 3 gaps |

Kenya | 64 | BBB+ | Policy integration | Weak assurance |

Nigeria | 58 | BBB | Governance strength | Limited assurance |

Ghana | 51 | BB+ | Energy policies | Data disclosure |

Remarks: Nigeria’s ESG gap is not about intent – it’s about verification and data depth.

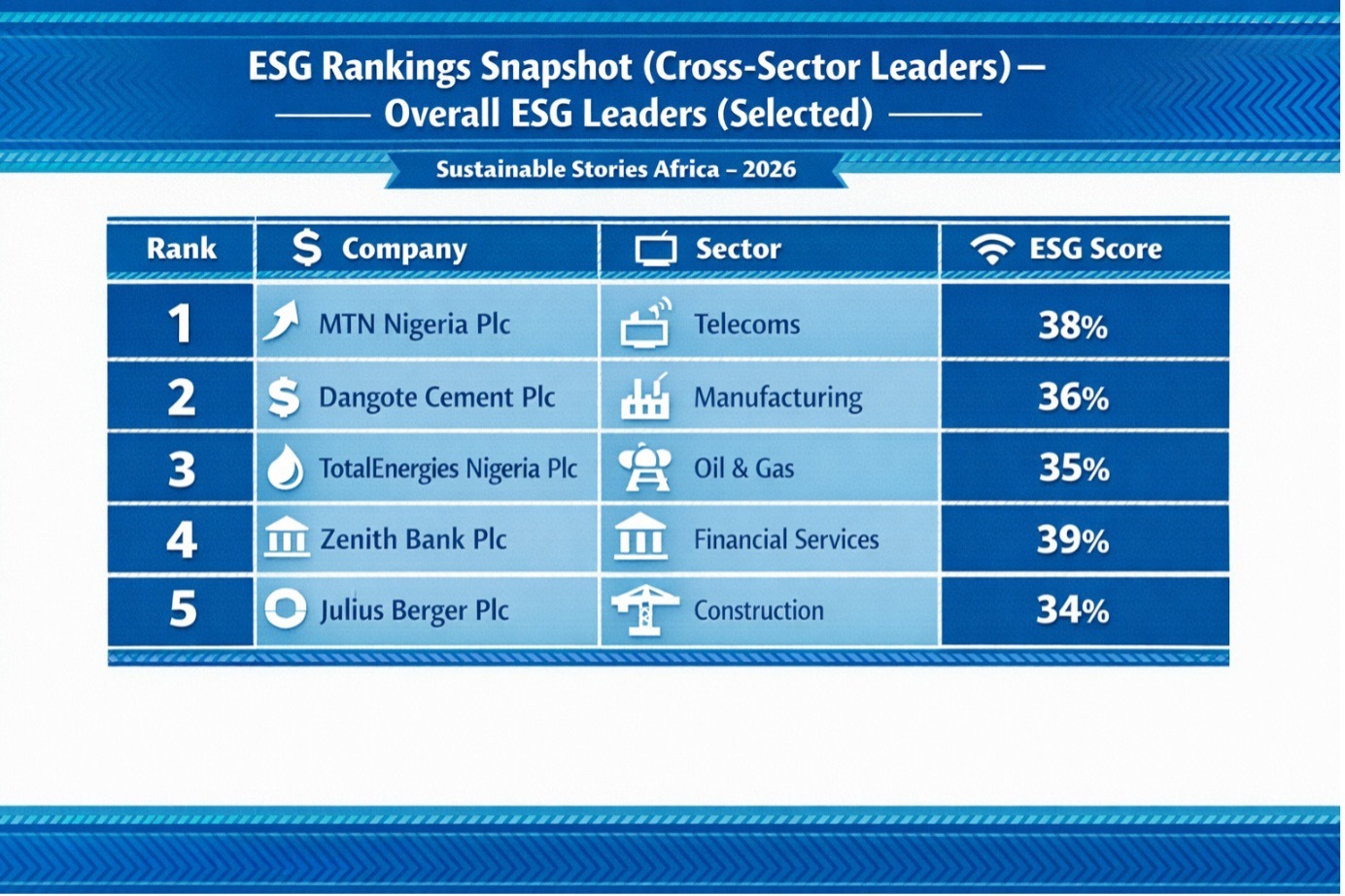

ESG Rankings Snapshot (Cross-Sector Leaders) – Overall ESG Leaders (Selected)

Rank | Company | Sector | ESG Score |

|---|---|---|---|

1 | MTN Nigeria Plc | Telecoms | 38% |

2 | Dangote Cement Plc | Manufacturing | 36% |

3 | TotalEnergies Nigeria Plc | Oil & Gas | 35% |

4 | Zenith Bank Plc | Financial | 39% |

5 | Julius Berger Plc | Services | 34% |

(Note: Rankings reflect disclosure strength, not absolute sustainability impact.)

What the Data Really Says

Nigeria’s ESG transition is underway, but uneven.

- Governance is mature

- Social metrics are improving

- Environmental transparency is lagging

- Verification remains scarce

Investors increasingly demand:

- Assured data

- Scope 3 emissions

- Climate-risk integration

- Executive accountability

Without these, Nigerian companies risk losing access to sustainability-linked finance, concessional loans, and global supply chains.

Path Forward – From Compliance to Competitiveness

Nigeria’s ESG future depends on moving from policy statements to verified performance.

Mandatory assurance, unified reporting standards aligned with IFRS S1/S2, and transparent Scope 3 disclosures must become the norm.

By embedding ESG KPIs into board oversight and executive remuneration, Nigerian organisations can close the 10 to 12 percentage point credibility gap with African peers and attract long-term sustainable capital.