After a year of disinflation, exchange-rate stability, and improved revenue mobilisation, Nigeria enters 2026 with renewed macroeconomic momentum.

But high debt service, security risks, and weak capital-project execution threaten to slow the shift from stabilisation to sustainable growth.

Stability with Strings Attached – From Stabilisation to Sustainable Growth

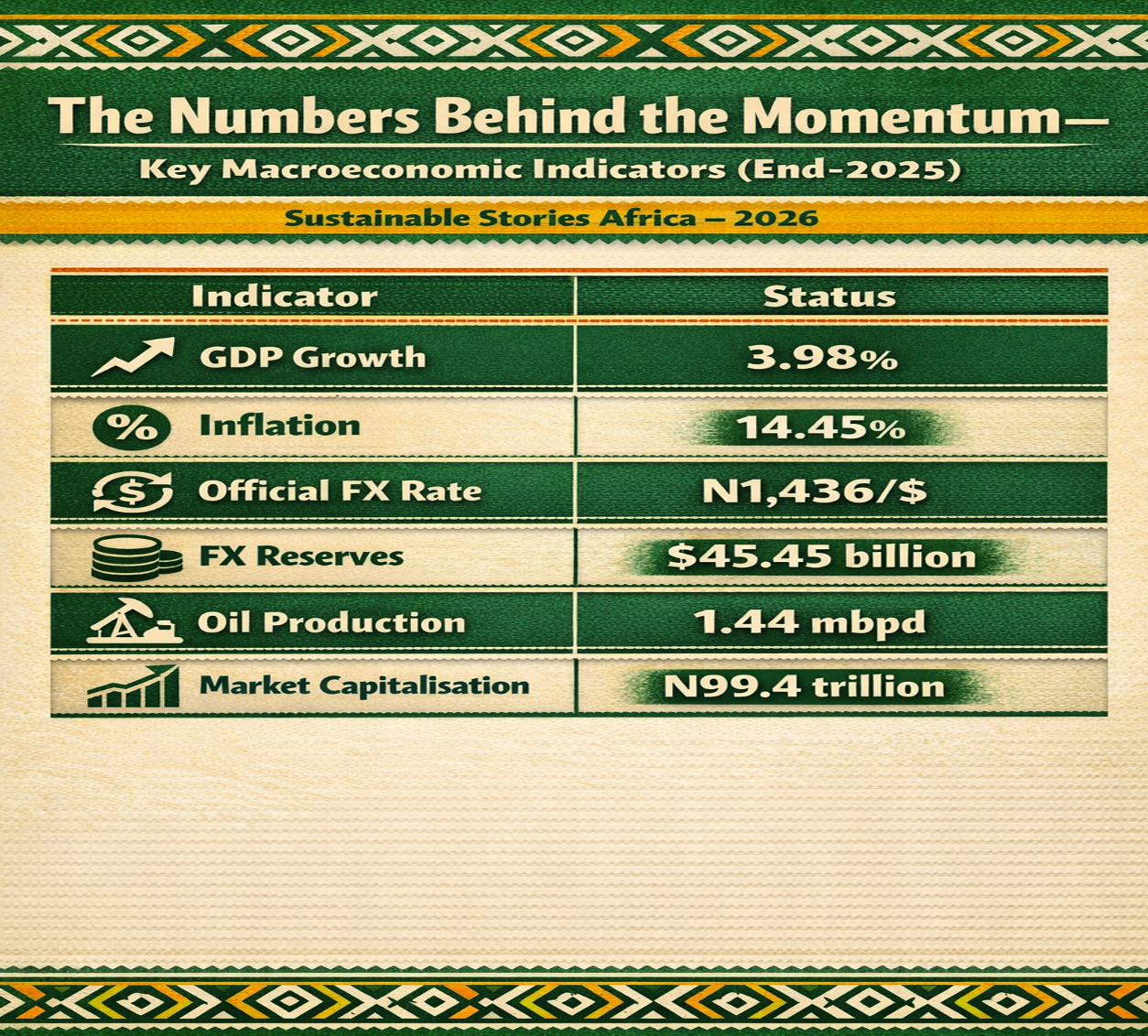

Nigeria closed 2025 with clearer macroeconomic signals. Headline inflation fell to 14.45%, the naira appreciated to N1,436 per $ , foreign reserves rose to $45.45 billion, and GDP growth reached 3.98% in Q3 2025.

These gains reflected tighter monetary policy, improved FX transparency, and stronger non-oil revenue mobilisation. This is according to the PWC 2026 Nigeria Economic Outlook report.

Fiscal reforms also gained traction. Tax collections rose sharply, with the Federal Inland Revenue Service (FIRS) generating N22.6 trillion by September 2025, almost 90% of its annual target, supported by VAT and corporate tax enforcement.

However, beneath this stability lies structural strain. Debt service still absorbs nearly 46% of projected revenue, insecurity remains elevated, and capital spending execution continues to fall behind.

As Nigeria looks to 2026, the challenge is no longer restoring stability, but converting it into inclusive, durable growth.

Progress Meets Persistent Pressure

Nigeria's macroeconomic gains in 2025 were real. The Central Bank's tight policy stance helped anchor inflation expectations, while FX reforms improved liquidity and market confidence.

Oil production recovered to 1.44 million barrels per day, and market capitalisation surged 58.4% year-on-year.

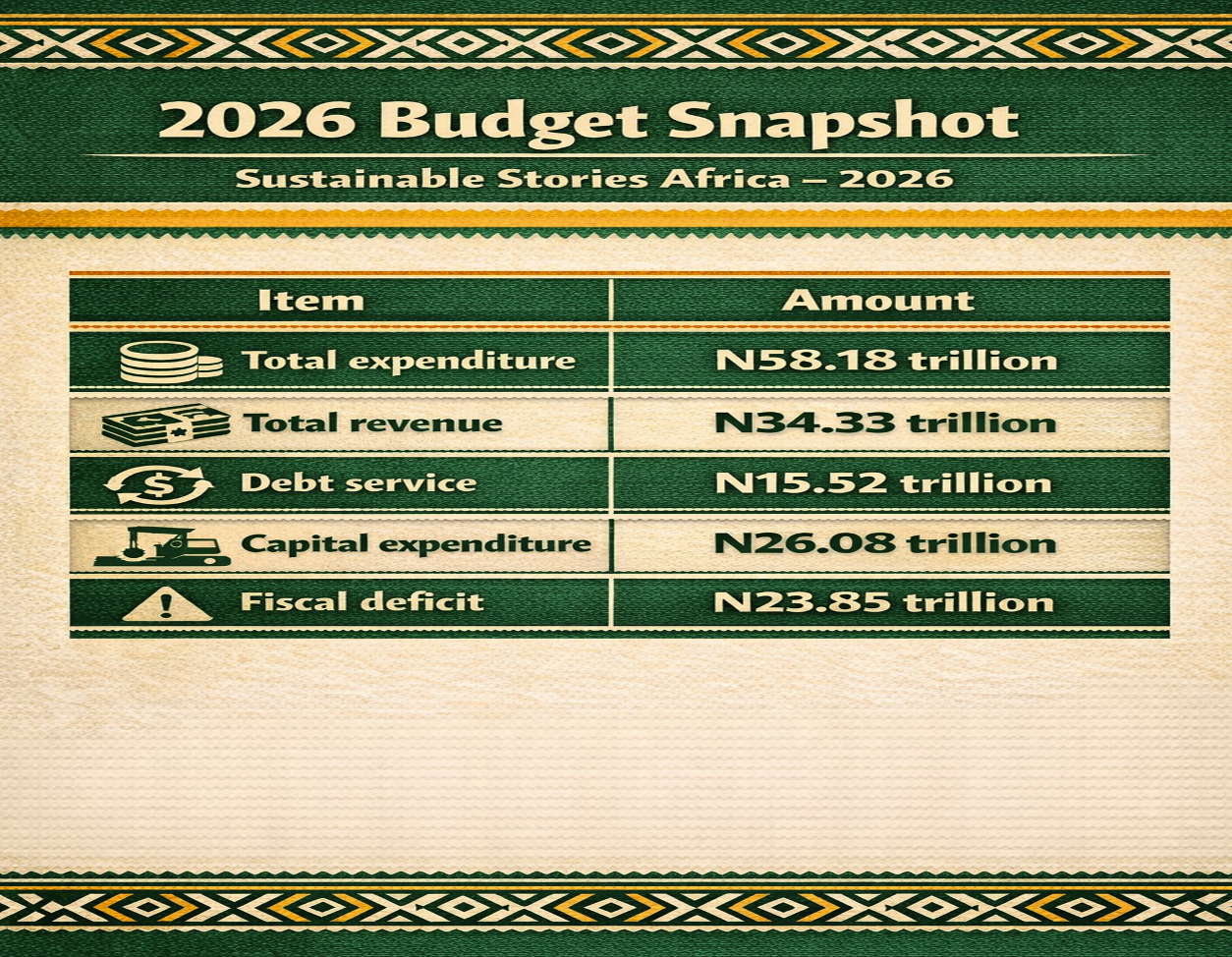

However, fiscal pressure remains intense. Debt service is budgeted at N15.52 trillion in 2026, representing 45% of projected federal revenue, severely constraining spending on infrastructure and social programmes.

Security risks also escalated. Conflict-related fatalities rose to 10,894 in 2025, undermining agricultural output, food security, and investor confidence.

Nigeria enters 2026 more stable and structurally insecure.

The Numbers Behind the Momentum - Key Macroeconomic Indicators (End-2025)

| Indicator | Status |

|---|---|

| GDP growth | 3.98% |

| Inflation | 14.45% |

| Official FX rate | N1,436/$ |

| FX reserves | $45.45 billion |

| Oil production | 1.44 mbpd |

| Market capitalisation | N99.4 trillion |

On the fiscal side, Nigeria's 2026 budget proposes N58.18 trillion in spending against N34.33 trillion in revenue, creating a deficit of N23.85 trillion (4.28% of GDP).

Debt pressures are easing slightly. Public debt-to-GDP fell by 3.1 percentage points from 42.9% in 2024 to 39.8% in 2025, helped by GDP rebasing and stronger non-oil revenues.

However, sustainability risks still exist due to high refinancing needs and FX exposure.

2026 Budget Snapshot

| Item | Amount |

|---|---|

| Total expenditure | N58.18 trillion |

| Total revenue | N34.33 trillion |

| Debt service | N15.52 trillion |

| Capital expenditure | N26.08 trillion |

| Fiscal deficit | N23.85 trillion |

Why Reform Delivery Matters

PwC Strategy& identifies seven key issues shaping Nigeria's 2026 outlook:

- Strengthening monetary policy effectiveness

- Domestic security pressures

- Global geopolitics and trade shifts

- Uneven sectoral growth

- Weak consumer purchasing power

- Fiscal sustainability and reform execution

- Digital economy and AI momentum

Among these, execution of reform is the decisive factor. Nigeria's past budgets often missed targets due to weak oil output, FX volatility, and inflation.

From 2020 to 2025, actual oil production consistently underperformed assumptions, while inflation frequently exceeded projections.

Tax reforms, especially the Nigeria Tax Act 2025, aim to lift the tax-to-GDP ratio toward 18% by 2027 through digital systems and mandatory TIN usage.

This could strengthen revenues without raising tax rates, with enforcement success.

Security investment also remains critical. The 2026 budget allocates N5.41 trillion to security and N26.08 trillion to infrastructure, signalling intent to stabilise conflict-prone regions and boost productivity.

However, without stronger project execution, these allocations risk delivering limited real-economy impact.

What Must Change in 2026

To turn stability into sustainable growth, Nigeria must act on five fronts:

- Deepen tax reforms – Expand digital compliance, reduce leakages, and strengthen the Nigeria Revenue Service.

- Control recurrent spending – Personnel and statutory costs consume over 70% of non-debt recurrent expenditure, limiting fiscal flexibility.

- Improve capital project execution – Late releases, weak procurement, and overlapping budgets continue to delay infrastructure delivery.

- Strengthen security outcomes – Insecurity is driving food inflation and displacement, threatening productivity and investor confidence.

- Manage liquidity ahead of elections – Pre-election fiscal pressures could fuel inflation if not carefully controlled.

Credit conditions also remain tight. Private-sector lending has stagnated despite falling government borrowing, as high interest rates and FX risks suppress investment appetite.

Path Forward – Stability Must Deliver Growth

Nigeria enters 2026 with improved macroeconomic stability, stronger revenues, and better FX management.

However, sustainable growth will depend on the execution of reforms, security improvements, and effective capital spending.

Without these, stability risks become an endpoint, not a foundation for inclusive prosperity.