Only $332 billion in climate finance reached emerging markets in 2023, 14% of annual requirements to meet global climate targets.

Financing the Climate Future - Closing the Climate Finance Gap

A KPMG–WEF roadmap shows how mobilising private capital can unlock climate resilience, economic growth, and investable opportunities across Africa, Asia, and Latin America.

Emerging markets and developing economies (EMDEs) sit on the frontline of climate risk. From devastating floods in Southeast Asia to droughts across Africa, the impacts of climate change are intensifying.

However, the capital required to respond remains dangerously insufficient. In 2023, EMDEs received only US$332 billion in climate finance, 14% of the $2.4 trillion needed annually by 2030, according to a report by KPMG.

Public budgets alone cannot bridge this gap. EMDEs are projected to mobilise $1.4 trillion domestically, leaving a $1 trillion annual shortfall that must be filled primarily by private capital.

Recognising this urgency, KPMG and the World Economic Forum (WEF) have outlined a roadmap to unlock private investment, turning climate risk into a growth opportunity for developing economies.

A Systemic Climate Finance Shortfall

Despite rising climate ambition, private finance flows to EMDEs remain critically low. International private climate investment increased by 111.76% from $17 billion in 2021 to $36 billion in 2023. However, this represents a fraction of what is required. To meet climate targets, flows must rise 28-fold by 2030.

Meanwhile, the world's 100 largest asset owners manage $26.3 trillion. Even redirecting a small portion of this capital could transform climate action in emerging markets.

The problem is not a lack of capital, but the lack of bankable, investable projects and the perceived risks associated with EMDE markets.

Why Emerging Markets Matter

EMDEs face the highest climate vulnerability, but they also offer significant growth potential:

- Rapid urbanisation

- Expanding clean-technology sectors

- Infrastructure needs of between $1.5 and $2 trillion annually

Capturing even a modest share of this demand could unlock hundreds of billions in investment across renewable energy, transportation, and nature-based solutions.

As Lisa Kelvey, Global Head of Infrastructure at KPMG International, explains: "Success in infrastructure finance will hinge on credible pipelines, intelligent risk pricing, and innovative financing structures aligned with megatrends such as digitalisation and climate resilience."

Turning Risk into Reward

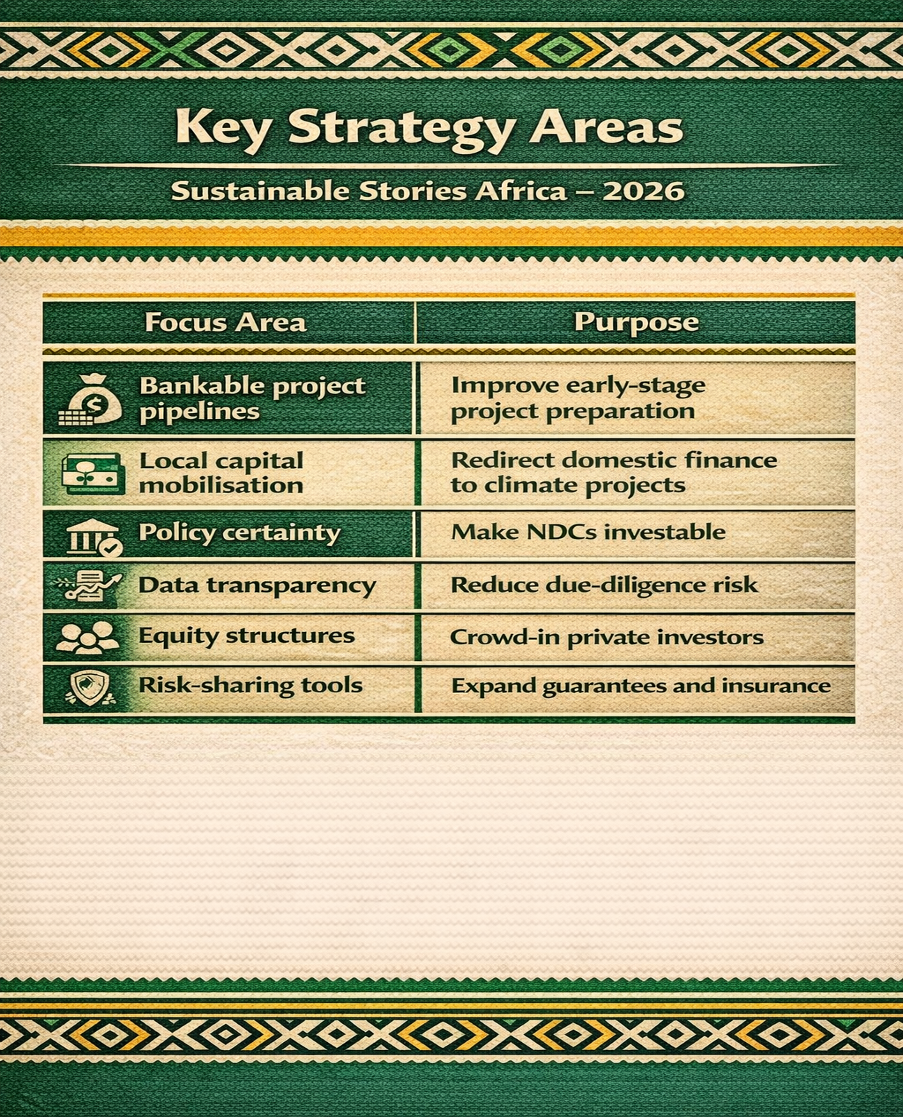

The KPMG–WEF roadmap identifies six priority actions and 16 strategies to reduce risk and crowd in private capital.

Key Strategy Areas

| Focus Area | Purpose |

|---|---|

| Bankable project pipelines | Improve early-stage project preparation |

| Local capital mobilisation | Redirect domestic finance to climate projects |

| Policy certainty | Make NDCs investable |

| Data transparency | Reduce due-diligence risk |

| Equity structures | Crowd-in private investors |

| Risk-sharing tools | Expand guarantees and insurance |

These strategies reflect the realities of EMDE investment environments. In regions such as Africa and Latin America, concessional finance can sometimes crowd out private investors, while political and currency risks deter pension funds.

Smita Sanghrajka, Partner at KPMG Kenya, notes: "Designing financing frameworks that unlock private capital for green growth and climate resilience is critical for Africa's development."

Who Must Step Forward

Mobilising private climate finance requires coordinated action:

- Institutional investors must commit long-term capital to blended-finance vehicles.

- Commercial banks should expand green lending through syndicated climate loans.

- MDBs and DFIs need to provide catalytic equity without crowding out private finance.

- Governments must offer stable regulatory frameworks and investable NDC roadmaps.

- Project developers should share transparent, comparable data.

- Donors must target high-risk, underfinanced adaptation projects.

Case studies show the impact of these approaches. In East Africa, a $50 million challenge fund supported 38 businesses across 15 countries, creating nearly 5,000 jobs and expanding financial access to 5.3 million people.

In Kenya's Sustainable Urban Economic Development (SUED) programme, more than $40 million was mobilised, generating 37,000 jobs through climate-resilient urban projects.

Path Forward – From Risk to Reward

Unlocking private climate capital requires bankable projects, regulatory certainty, and high-quality data.

With the right reforms, EMDEs can attract investment that delivers both strong financial returns and measurable climate impact, accelerating progress toward resilient, low-carbon growth.