North Africa could produce over 5.2 million tonnes of green hydrogen annually by 2030, rising to 25 million tonnes by 2050, driven by strong solar and wind resources and proximity to Europe.

IRENA says green hydrogen can decarbonise local industries, improve trade balances, and create skilled jobs.

However, weak financing, infrastructure gaps, and regulatory uncertainty still slow progress across the region.

Green Hydrogen, Regional Transformation

North Africa is positioning itself as a future powerhouse of green hydrogen production. With abundant solar and wind resources and proximity to European demand centres, the region could become a major exporter of green hydrogen and its derivatives, which include

ammonia, methanol, and green steel.

IRENA estimates that Algeria, Egypt, Mauritania, Morocco and Tunisia could collectively produce more than 5.2 million tonnes per year by 2030, scaling to 25 million tonnes by 2050.

Beyond exports, green hydrogen offers a pathway to decarbonise local industries such as fertilisers, steel, refining, and chemicals.

Import substitution of natural gas, ammonia, and methanol could strengthen trade balances, while renewable-powered hydrogen could reduce exposure to volatile fossil fuel markets.

However, progress remains uneven. Financing risks, skills shortages, water constraints, and fragmented regulations delay project initiations and completions.

IRENA's latest report sets out four enabling pillars to unlock North Africa's hydrogen economy.

Solar And Wind, Global Ambitions

North Africa's green hydrogen push is anchored in scale. Egypt aims to supply 5% – 8% of the global hydrogen market by 2040, requiring 76 GW of electrolysers and 114 GW of new renewable capacity.

Mauritania plans to export 6.9 million tonnes of green ammonia by 2030, increasing to 24.4 million tonnes by 2050, leveraging its vast wind and solar potential.

Morocco, meanwhile, is targeting large-scale exports of hydrogen, ammonia, and power-to-liquids to the European Union.

These ambitions reflect both climate commitments and industrial strategy: hydrogen is being positioned as an engine of economic transformation, not just decarbonisation.

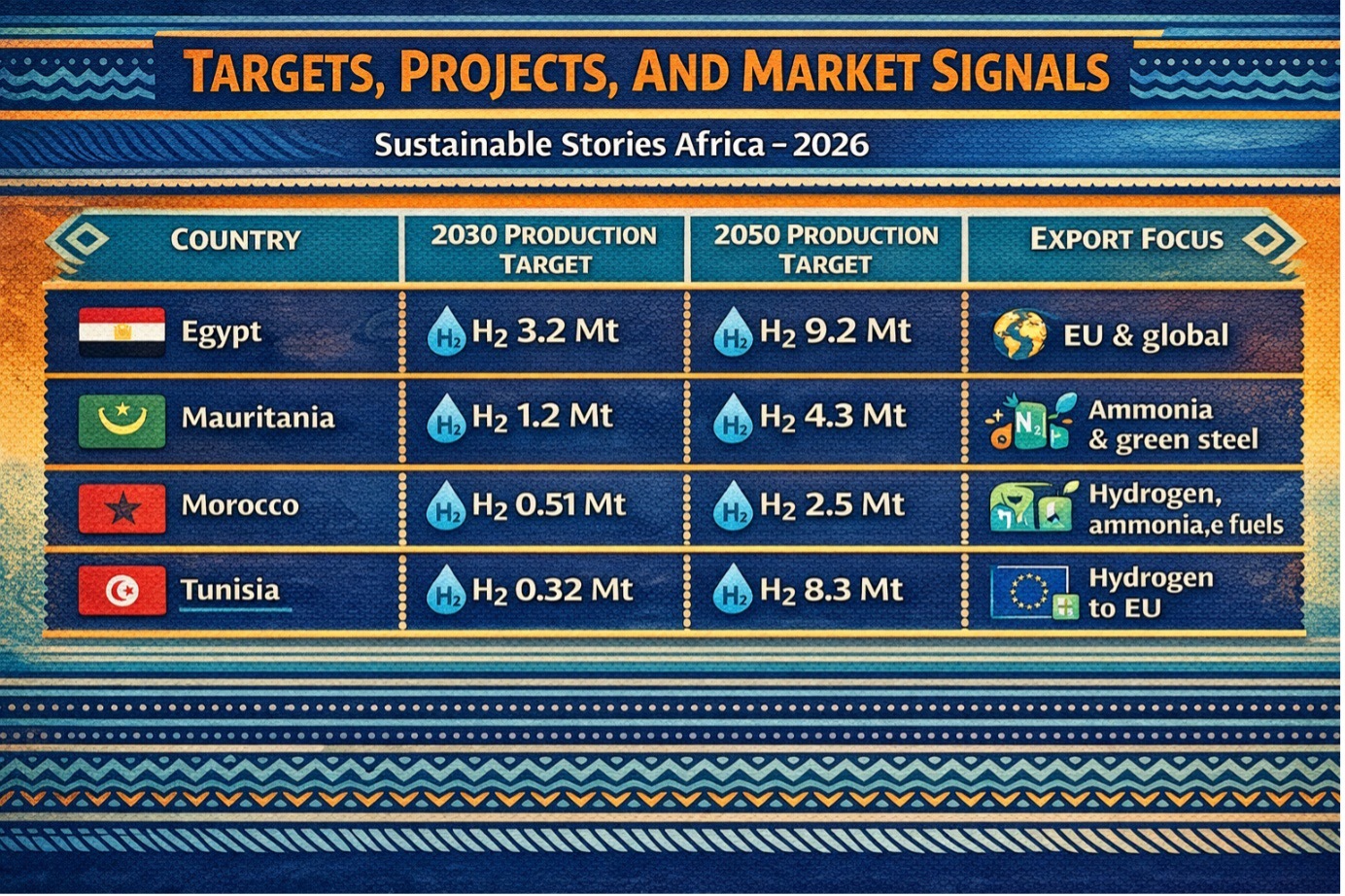

Targets, Projects, And Market Signals

IRENA's data shows that North Africa's hydrogen strategies are heavily export-oriented, with Europe as the primary off-taker:

| Country | 2030 Production Target | 2050 Production Target | Export Focus |

|---|---|---|---|

| Egypt | 3.2 Mt | 9.2 Mt | EU & global |

| Mauritania | 1.2 Mt | 4.3 Mt | Ammonia & green steel |

| Morocco | 0.51 Mt | 2.5 Mt | Hydrogen, ammonia, e-fuels |

| Tunisia | 0.32 Mt | 8.3 Mt | Hydrogen to EU |

Egypt has already signed over 30 MoUs worth $175 billion for hydrogen and green ammonia projects in the Suez Canal Economic Zone.

These include multi-billion-dollar investments by Masdar, BP, ACWA Power, and Scatec, with export targets to include Europe and maritime fuel markets.

Mauritania's Aman and Nour projects each plan 10 – 30 GW of renewables to produce hydrogen and ammonia for export, while Tunisia is developing a dedicated Hydrogen Backbone pipeline to link production hubs with ports and Europe.

Economic Gains Beyond Climate

IRENA highlights that green hydrogen can deliver three major benefits for North Africa:

- Policies and Regulations – Clear hydrogen strategies, embedded in long-term energy scenarios, provide investor certainty. Morocco's Green Hydrogen Offer is cited as a best-practice framework that integrates land access, incentives, and permitting.

- Technologies and Infrastructure – Investment is needed in electrolysers, ports, pipelines, and desalination. Egypt's shared desalinated water infrastructure in the Suez Canal zone shows how water risks can be managed through scale.

- Markets, Business, and Finance – Securing off-takers is critical. Morocco's HydroJeel-OCP deal demonstrates how local fertiliser demand can reduce project risk. EU schemes such as H2Global also support early export markets.

- Supply Chains, Skills, and Communities – Germany's skills partnerships with Algeria and Tunisia highlight the importance of workforce development. Community engagement, as seen in Morocco's AMUN project, builds local acceptance and shared benefits.

PATH FORWARD – From Vision To Viability

Tapping its vast renewable potential and pivotal location, North Africa is positioning itself as the world's next green hydrogen centre. However, turning that promise into progress will take more than ambition; it will demand investable projects, stable policies, and skilled local talent.

With targeted investment in infrastructure, clear export frameworks, and inclusive community engagement, green hydrogen can drive industrial growth, energy security, and climate leadership across the region.