Global payroll has evolved from a back-office function to a strategic pillar shaping trust, compliance, and talent competitiveness worldwide.

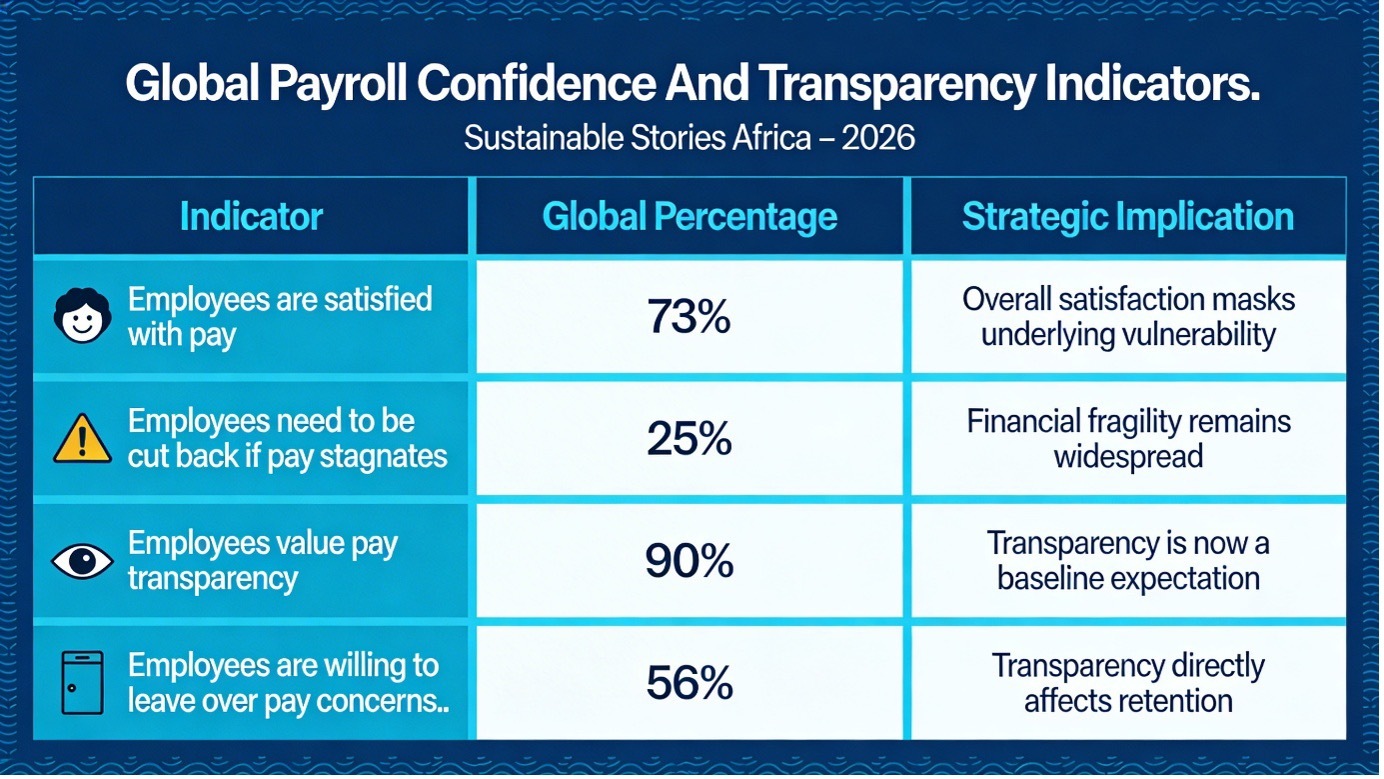

A new global payroll survey reveals that while 73% of employees report satisfaction with their pay, financial confidence remains fragile, with 25% saying they would need major cutbacks if pay stagnates.

The findings signal a decisive shift: transparency, accuracy, and unified payroll infrastructure now determine workforce stability, retention, and corporate credibility in an increasingly regulated and mobile global labour market.

Payroll Transparency Reshapes Global Talent Stability

Payroll has become the silent engine of corporate trust, competitiveness, and compliance.

Once confined to accounting departments, it now shapes workforce loyalty, talent mobility, and regulatory readiness across global markets.

The 2026 Global Payroll Report, surveying 6,260 professionals across seven countries, shows that transparency and accuracy in pay are no longer operational preferences but structural imperatives.

Employees are increasingly viewing payroll reliability as a direct measure of employer credibility and fairness.

For Africa and other emerging markets navigating global talent competition, these findings highlight a critical reality: payroll systems are no longer administrative tools; they are strategic infrastructure determining whether organisations attract, retain, and empower talent.

Pay Transparency Emerges as a Strategic Talent Imperative

Global payroll has reached a turning point. Transparency, accuracy, and consistency in pay are now decisive factors shaping workforce confidence and corporate reputation.

The report reveals that 73% of employees are satisfied with their salary, yet beneath this optimism lies vulnerability; 25% would need major financial cutbacks if their pay remained unchanged, while 18% say they would struggle to afford essentials.

This tension reveals a structural shift: payroll is no longer just about paying employees; it is about sustaining trust, enabling financial security, and protecting corporate integrity in an era of heightened transparency expectations.

For African corporates competing in global labour markets, payroll credibility is becoming as critical as financial performance or ESG compliance.

Transparency And Accuracy Define Workforce Confidence

Transparency has emerged as one of the most powerful drivers of retention and employee trust worldwide.

The report shows that 90% of employees consider transparency in pay, benefits, and raises important, with half describing it as essential.

At the same time, 56% say they would consider leaving their job if salary concerns were not considered, demonstrating the direct link between pay transparency and workforce stability.

This shift reflects a deeper structural transformation. Payroll accuracy, timeliness, and visibility now determine organisational credibility.

Global Payroll Confidence And Transparency Indicators

Indicator | Global Percentage | Strategic Implication |

|---|---|---|

Employees are satisfied with pay | 73% | Overall satisfaction masks underlying vulnerability |

Employees need to be cut back if pay stagnates | 25% | Financial fragility remains widespread |

Employees value pay transparency | 90% | Transparency is now a baseline expectation |

Employees are willing to leave over pay concerns. | 56% | Transparency directly affects retention |

Age and gender disparities further reveal structural inequality and perception gaps.

Younger workers report higher satisfaction levels, with 88% of workers aged between 16 and 24 feeling satisfied with their salary, compared to only 68% of workers aged between 45 and 54, highlighting changing expectations and financial pressures across career stages.

Gender differences also persist, with 78% of men reporting salary satisfaction compared to 69% of women, underscoring the need for structured and transparent compensation frameworks.

Unified Payroll Systems Strengthen Compliance Confidence

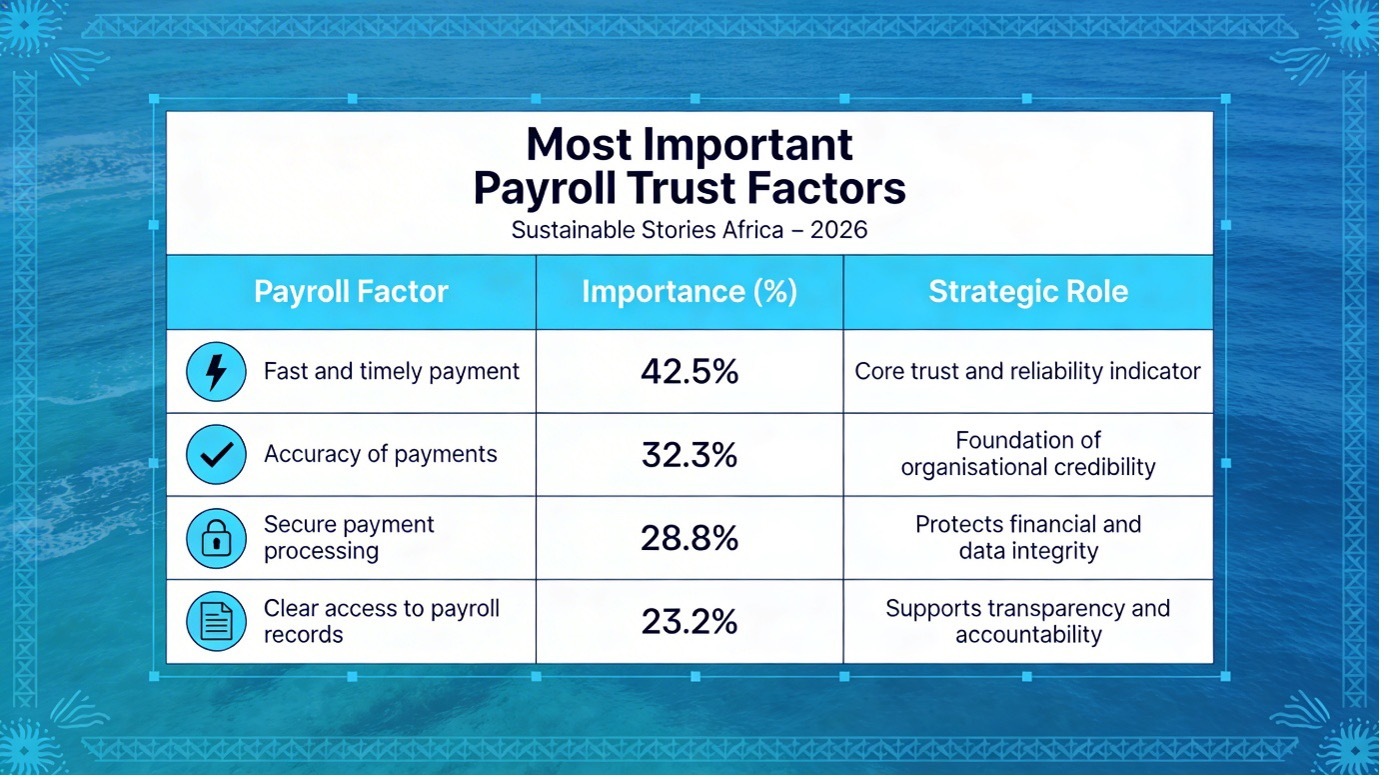

Beyond transparency, payroll accuracy and integration are emerging as essential pillars of corporate governance and ESG credibility.

The report highlights that 41% of employees say payroll reliability has a greater impact on job satisfaction than additional perks, demonstrating that trust in payroll systems is central to workforce stability.

Key payroll trust drivers include:

Most Important Payroll Trust Factors

Payroll Factor | Importance (%) | Strategic Role |

|---|---|---|

Fast and timely payment | 42.5% | Core trust and reliability indicator |

Accuracy of payments | 32.3% | Foundation of organisational credibility |

Secure payment processing | 28.8% | Protects financial and data integrity |

Clear access to payroll records | 23.2% | Supports transparency and accountability |

Unified payroll platforms are also reshaping compliance and governance globally.

As transparency regulations expand in Europe, the United States, and the Asia-Pacific regions, companies are adopting integrated payroll systems to maintain audit-ready records, ensure compliance, and enhance reporting accuracy.

The report emphasises that payroll systems are becoming “the infrastructure for transparency,” linking compliance, reporting, and workforce trust across global operations.

African Employers Must Modernise Payroll Infrastructure

For African companies integrating into global talent markets, payroll modernisation has become an urgent strategic priority.

Fragmented payroll systems create risks ranging from compliance failures to talent attrition and reputational damage.

The report identifies clear priorities for organisations seeking to build payroll resilience:

- Audit payroll accuracy and benchmark against global standards

- Integrate payroll, HR, and finance systems into unified platforms

- Align compensation reporting with emerging transparency regulations

- Deploy digital payroll systems enabling real-time visibility and compliance

These measures are critical as African firms increasingly compete for global talent while navigating rising ESG expectations and governance scrutiny.

Payroll is now a strategic asset, shaping not only financial operations but also workforce stability, corporate credibility, and long-term competitiveness.

PATH FORWARD – Transparent Payroll Systems Define Future Workforce

Payroll transparency, accuracy, and integration are becoming essential foundations of corporate trust, talent retention, and regulatory compliance.

Organisations investing in unified payroll infrastructure will be better positioned to attract global talent and maintain workforce confidence.

African employers must modernise payroll governance, integrate digital platforms, and align with global transparency standards. Payroll is no longer just an administrative function; it is a strategic infrastructure that shapes competitiveness and workforce resilience.