Africa’s solar market has entered its fastest growth phase on record, with 2025 installations rising 54% to about 4.5 GW and solar now capturing the bulk of renewable‑energy capital on the continent.

However, a financing model still skewed toward utility-scaled projects risks slowing a distributed, consumer‑led boom that is already reshaping how African economies power homes, factories and services.

Africa’s solar surge reshapes investment maps

Africa recorded its fastest year of solar growth in 2025, with new solar PV installations jumping 54% year‑on‑year to about 4.5 GW, consolidating solar as the continent’s flagship clean‑energy technology and a magnet for capital.

However, this acceleration is unfolding in two parallel transitions, large utility-scale parks and fast-growing distributed systems, against a financing system still designed for yesterday’s grid‑scale projects.

The result is a race between momentum and missed opportunity as investors, regulators and developers scramble to align money, data and markets with the realities of Africa’s solar boom.

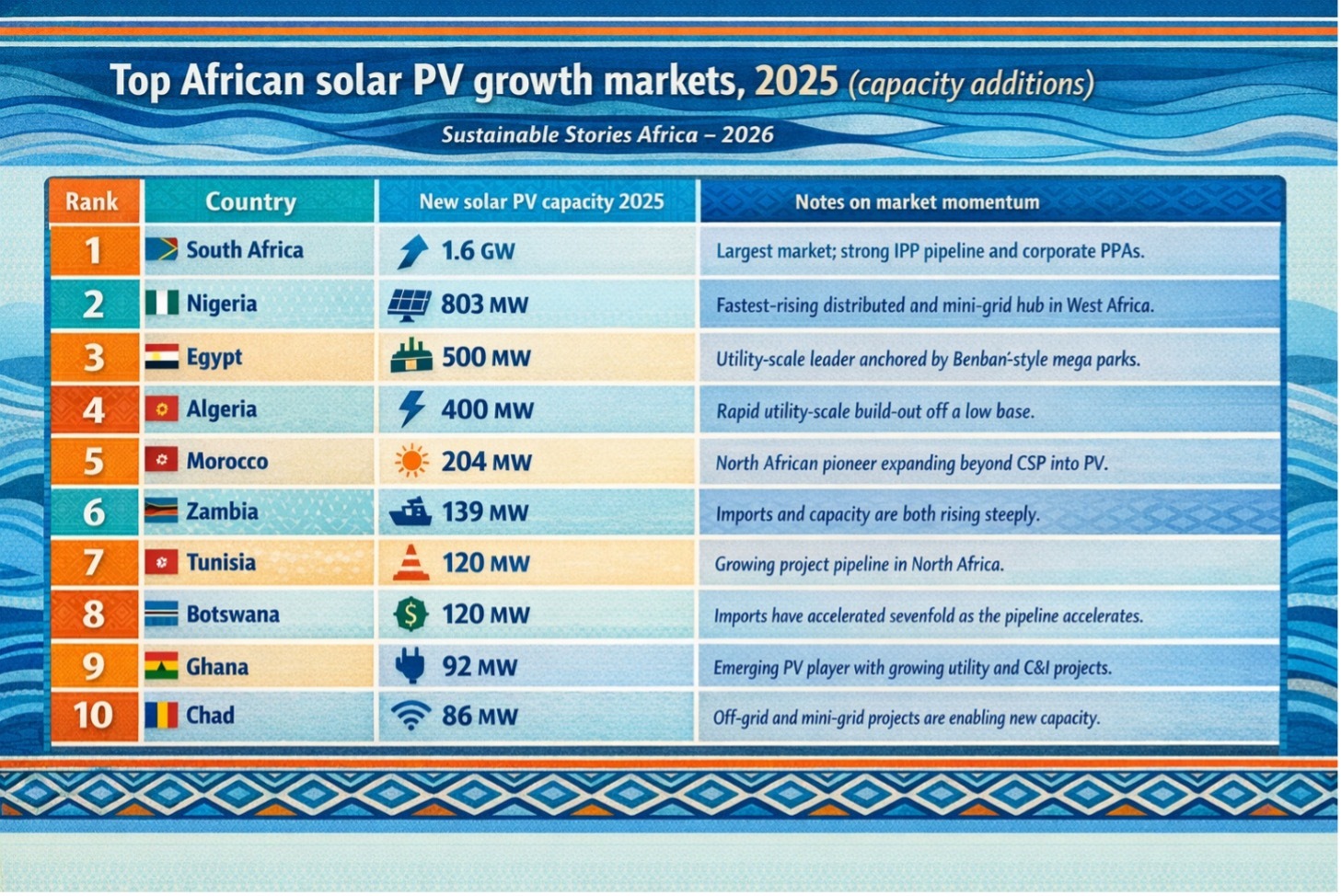

A report by the Global Solar Council, along with complementary market analyses, highlights that just ten African markets accounted for 90% of new solar capacity added in 2025, led by South Africa, Nigeria, Egypt and Algeria.

However, imports of 18.2 GW of solar modules, exceeding recorded utility-scale deployment, emphasise how rooftop, commercial and captive systems are quietly transforming power access for households and businesses.

At the same time, solar already attracts roughly 62% of Africa’s renewable‑energy investment, even as the continent still attracts less than 3% of global clean‑energy finance despite hosting most of the world’s best solar resource.

African leaders and investors must now focus less on proving solar’s potential and more on governing, financing and integrating it; bridging megaprojects and rooftops, fixing data gaps and mobilising private capital so installations can grow more than sixfold by 2029

Urgency in Africa’s solar inflexion

Africa added approximately 4.5 GW of new solar PV in 2025, its fastest annual buildout, representing an increase from 2024. This enhancement highlights that the level of solar PV investment is approximately 62% of the investments in renewable energy, cementing PV as Africa’s leading clean power technology.

Behind the numbers, governments and DFIs are still backing big grid-connected parks, while households, SMEs and industry are moving to rooftop and captive systems to escape unreliable grids and fuel price shocks, creating a two-track transition that is quietly rewriting risk, returns and responsibility

Markets concentrating, diversification emerging

The new data confirms that Africa’s solar boom continues to be anchored in a handful of markets, even as a wider group of countries starts to scale up.

In 2025, the top ten markets accounted for approximately 90% of new capacity additions. This highlights the need for policy clarity and bankable pipelines, which remain highly uneven across the continent.

Top African solar PV growth markets, 2025 (capacity additions)

| Rank | Country | New solar PV capacity 2025 | Notes on market momentum |

|---|---|---|---|

| 1 | South Africa | 1.6 GW | Largest market; strong IPP pipeline and corporate PPAs. |

| 2 | Nigeria | 803 MW | Fastest‑rising distributed and mini‑grid hub in West Africa. |

| 3 | Egypt | 500 MW | Utility‑scale leader anchored by Benban‑style mega parks. |

| 4 | Algeria | 400 MW | Rapid utility‑scale build‑out off a low base. |

| 5 | Morocco | 204 MW | North African pioneer expanding beyond CSP into PV. |

| 6 | Zambia | 139 MW | Imports and capacity are both rising steeply. |

| 7 | Tunisia | 120 MW | Growing project pipeline in North Africa. |

| 8 | Botswana | 120 MW | Imports have accelerated sevenfold as the pipeline accelerates. |

| 9 | Ghana | 92 MW | Emerging PV player with growing utility and C&I projects. |

| 10 | Chad | 86 MW | Off‑grid and mini‑grid projects are enabling new capacity. |

Together, these markets illustrate three distinct solar pathways: large legacy leaders consolidating their position, mid‑sized economies using PV to stabilise grids, and frontier markets turning to solar as their first serious generation option.

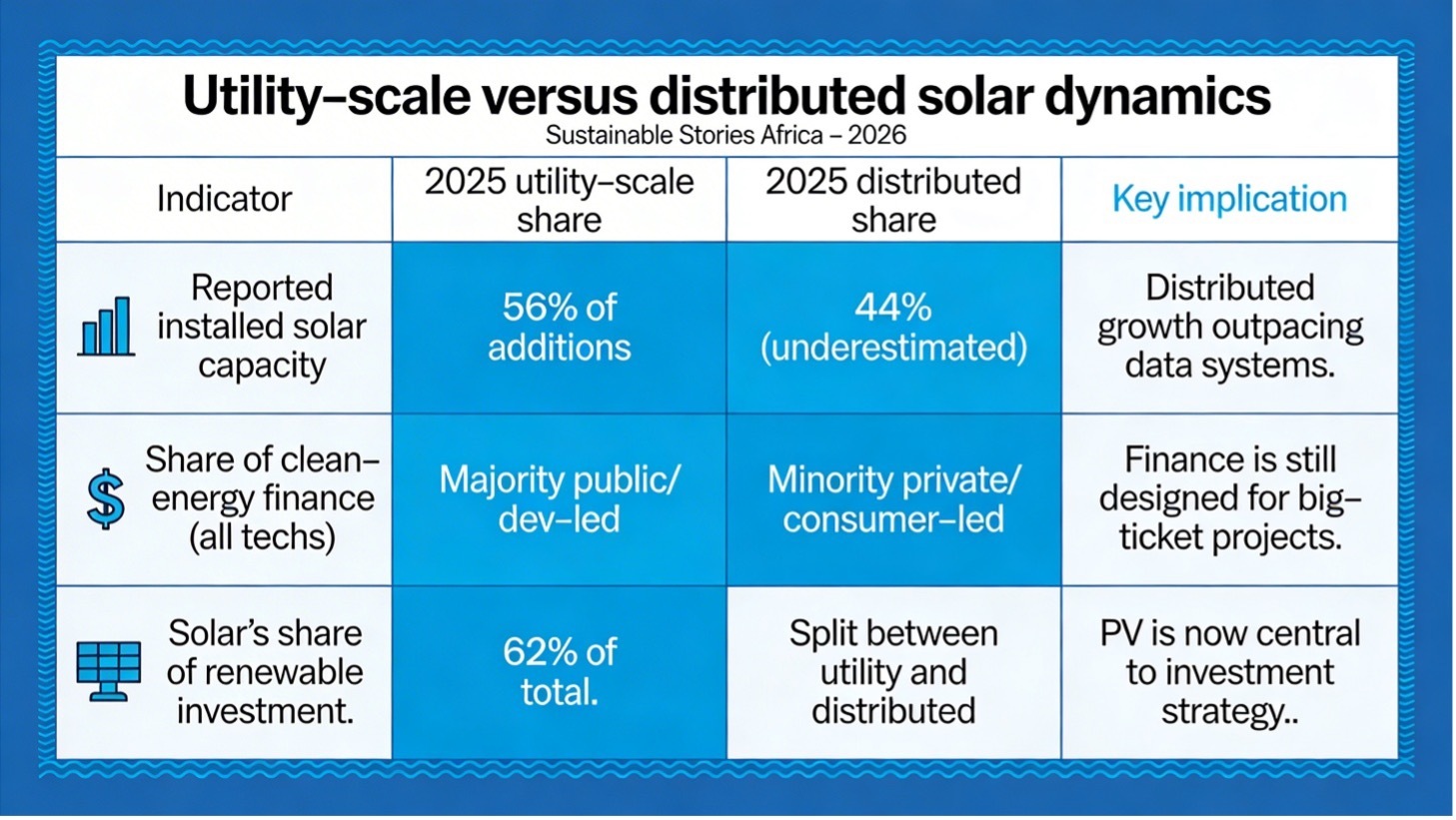

Finance and data are misaligned with reality

Africa’s solar expansion is accelerating faster than its financing architecture is adapting. About 82% of clean-energy finance still flows through public and development channels designed for utility-scale projects and sovereign offtakers, even as market dynamics shift decisively toward decentralised deployment.

Utility‑scale versus distributed solar dynamics

| Indicator | 2025 utility‑scale share | 2025 distributed share | Key implication |

|---|---|---|---|

| Reported installed solar capacity | 56% of additions | 44% (underestimated) | Distributed growth outpacing data systems. |

| Share of clean‑energy finance (all techs) | Majority public/dev‑led | Minority private/consumer‑led | Finance is still designed for big‑ticket projects. |

| Solar’s share of renewable investment | 62% of total | Split between utility and distributed | PV is now central to investment strategy. |

In 2025, Africa imported 18.2 GW of solar modules, exceeding projected utility-scale installations through 2027, highlighting the rapid growth of distributed and rooftop solar.

However, weak installation data limits capital access, distorts risk pricing, and creates regulatory and grid bottlenecks, leaving corporates and decentralised developers under-financed despite rising demand for captive, cost-efficient solar solutions.

levers for investors and policymakers

The medium-term outlook of the report suggests Africa could install more than 33 GW of new solar capacity by 2029, over six times the volume added in 2025, if current momentum is backed by fit‑for‑purpose policy and finance.

Three action levers stand out for decision‑makers seeking to turn today’s surge into a sustained, inclusive transition.

- First, finance models must be redesigned to serve distributed and consumer‑led solar at scale, including local‑currency facilities, blended‑finance structures for SMEs, and standardised contracts for commercial and industrial users.

- Second, regulators need improved data collection and planning frameworks that capture off‑grid and behind‑the‑meter systems so that grid reinforcement, storage and flexibility investments keep pace with deployment.

- Third, governments can crowd in private capital by streamlining permitting, clarifying tariff regimes and protecting contract sanctity for both IPPs and rooftop producers.

Path forward – aligning capital, policy, opportunity

Africa is pursuing two parallel energy transitions through an outdated financing system, risking inequality.

Aligning capital across utility-scale and distributed solar, while strengthening storage, grids, and performance data, could unlock more than 33 GW of new capacity by 2029 and reinforce long-term resilience.

For policymakers, investors, and development partners, distributed solar must be treated as core infrastructure. Elevating policy clarity and financing innovation can convert Africa’s vast solar potential, which attracts less than 3% of global investment, into a scalable foundation for inclusive growth and universal power access.