Nigeria’s new Executive Order 9 (EO9) is quietly redrawing the map of who controls every naira flowing from the country’s oilfields into public coffers.

By suspending key carve-outs to the national oil company, gas infrastructure funds and the frontier exploration kitty, the directive promises cleaner revenue lines to the Federation Account and a bruising legal, political and investment debate over how far an executive order can bend the Petroleum Industry Act.

EO9 resets Nigeria’s oil money

President Bola Ahmed Tinubu’s Executive Order 9, issued in February 2026, has significantly altered Nigeria’s oil revenue flow without formally amending the Petroleum Industry Act.

The directive suspends key off-the-top deductions, including 30% allocations to the Frontier Exploration Fund, NNPC Limited’s 30% management fee on production-sharing contracts and gas-flare penalties previously earmarked for midstream infrastructure.

With immediate effect, all royalty oil, tax oil, profit oil, profit gas and flare penalties must now be remitted directly into the Federation Account, thereby increasing the volume of distributable oil revenue collected by federal, state and local governments.

The order is framed as a fiscal governance reform intended to safeguard national oil revenues, strengthen transparency and improve allocations through the Federation Account Allocation Committee.

However, it introduces legal and regulatory uncertainty, particularly regarding whether an executive authority can suspend statutory provisions established under the Petroleum Industry Act. This is according to an insight paper published by FinPolNomics GREEN FINANCE & FinPolNomics ANALYTICA, authored by Dr Olumuyiwa Adebayo JP, which notes that the durability of the reform will shape investor confidence and Nigeria’s policy-risk outlook.

For citizens and state governments, the reform promises greater public revenue amid fiscal strain. Conversely, NNPC, frontier-basin stakeholders and gas-infrastructure advocates face potential funding disruptions, creating tensions between short-term fiscal gains and long-term energy transition investment priorities.

Oil revenues pulled back onshore

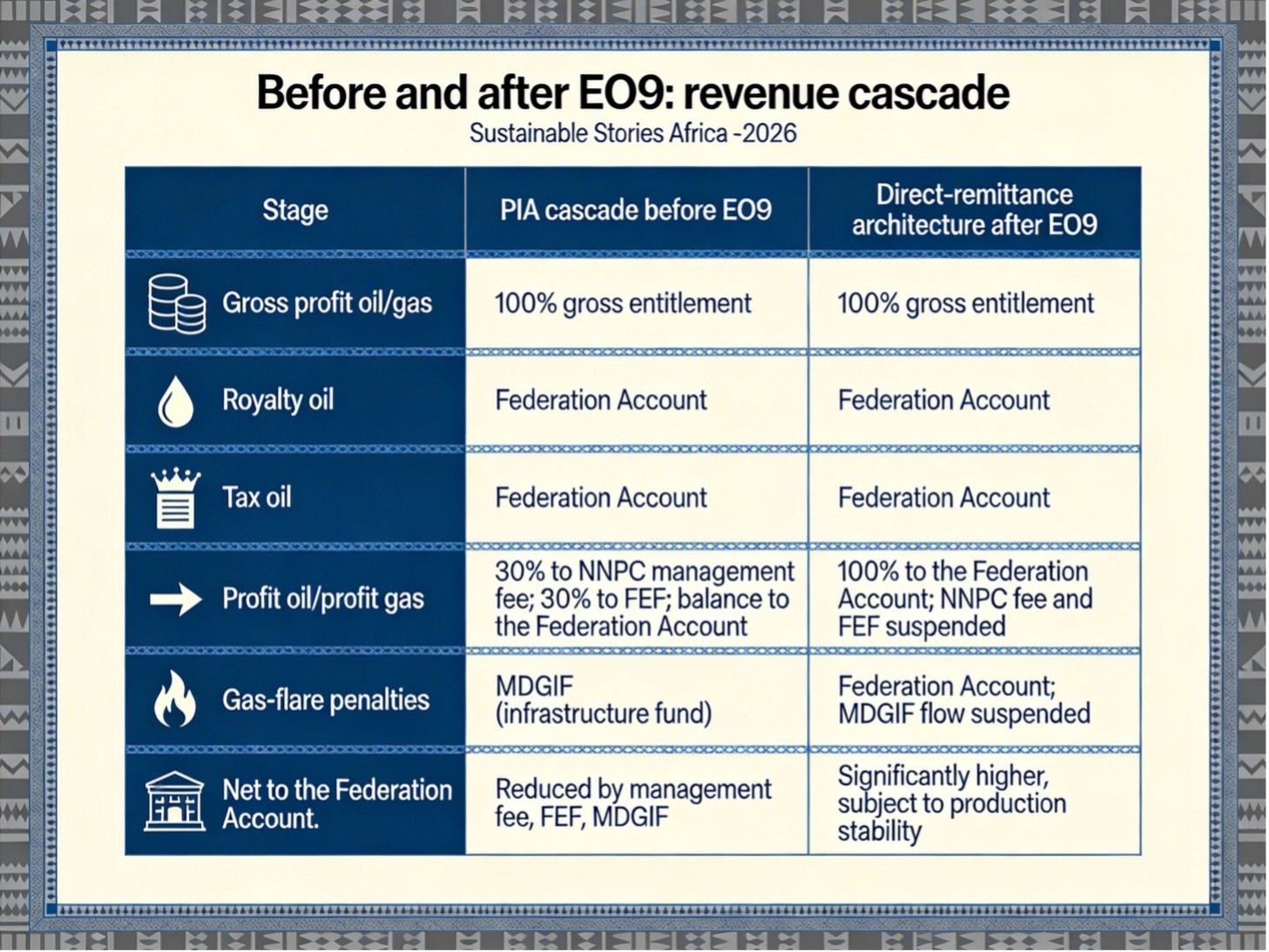

Executive Order 9 introduces a direct-remittance framework that reverses longstanding deductions from Nigeria’s oil revenues before they reach the Federation Account.

The directive suspends allocations to NNPC Limited’s management fees, the Frontier Exploration Fund and the Midstream and Downstream Gas Infrastructure Fund, requiring all royalties, taxes, profit oil, profit gas and flare penalties to be paid directly into the central revenue pool.

This reform aims to close leakages that diverted an estimated 23% of potential remittances, strengthen constitutional revenue alignment and reinforce fiscal discipline.

It also accelerates the shift toward positioning NNPC Limited strictly as a commercial operator rather than a revenue gatekeeper.

Before and after EO9: revenue cascade

| Stage | PIA cascade before EO9 | Direct‑remittance architecture after EO9 |

|---|---|---|

| Gross profit oil/gas | 100% gross entitlement | 100% gross entitlement |

| Royalty oil | Federation Account | Federation Account |

| Tax oil | Federation Account | Federation Account |

| Profit oil/profit gas | 30% to NNPC management fee; 30% to FEF; balance of the Federation Account | 100% to the Federation Account; NNPC fee and FEF suspended |

| Gas‑flare penalties | MDGIF (infrastructure fund) | Federation Account; MDGIF flow suspended |

| Net to the Federation Account | Reduced by management fee, FEF, MDGIF | Significantly higher, subject to production stability |

Inside the legal and political cross‑currents

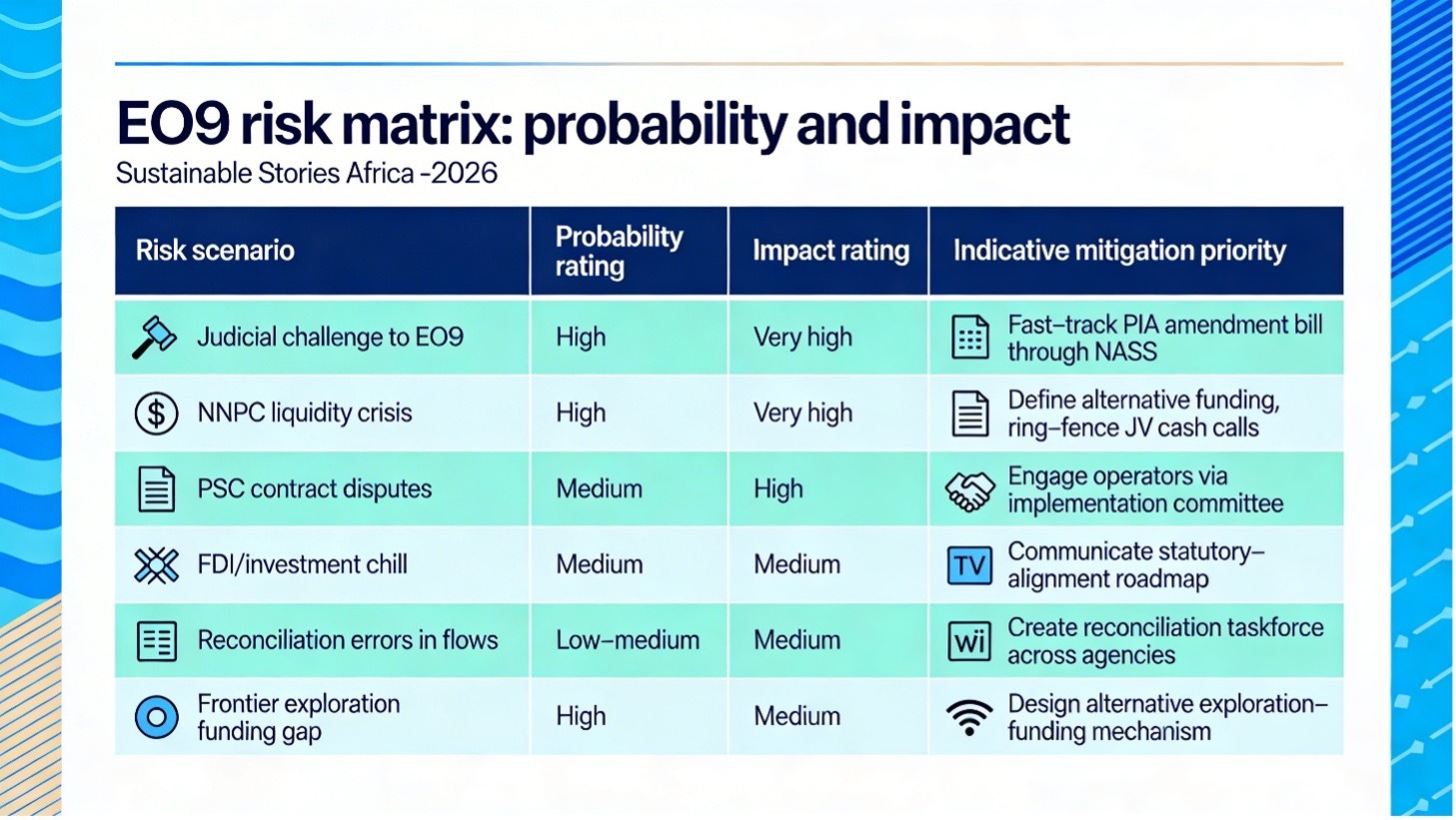

Executive Order 9 has elevated a critical legal and fiscal question within Nigeria’s oil revenue framework, testing the hierarchy between constitutional authority, statutory law and executive power.

While the order invokes constitutional supremacy over federal revenues, its practical effect is to suspend funding mechanisms embedded in the Petroleum Industry Act, including allocations to the Frontier Exploration Fund, the Midstream and Downstream Gas Infrastructure Fund and NNPC’s management-fee structure. This creates legal ambiguity over whether the directive reinforces constitutional revenue centralisation or unlawfully overrides legislative provisions.

FinPolNomics outlines two possible outcomes. Judicial endorsement could solidify EO9 as a legitimate fiscal reform, especially if supported by legislative amendments.

However, adverse rulings could trigger injunctions, litigation and uncertainty over revenue flows, particularly from affected stakeholders.

To ensure execution, the government has established inter-agency implementation and oversight committees involving regulators, fiscal authorities and legal institutions, tasked with reconciling oil revenue accounts.

Their effectiveness will determine whether EO9 delivers fiscal transparency or introduces operational and legal disruption.

Deeper implications for NNPC and investors

Executive Order 9 has created immediate financial implications for NNPC Limited by suspending the 30% management fee, which previously served as a critical source of working capital for joint-venture operations, capital expenditure and supplier payments.

FinPolNomics warns this could trigger a significant liquidity squeeze, potentially affecting production continuity, contractor confidence and the broader national content ecosystem.

Without a defined replacement funding mechanism, NNPC’s operational flexibility may face near-term constraints.

For international oil companies and financiers, EO9 presents a mixed signal. Direct remittance requirements and clearer institutional roles enhance the transparency and credibility of governance.

However, the executive-order basis, without statutory amendment, raises concerns over contract stability and policy predictability. The suspension of frontier exploration funding may also weaken long-term reserve development, increasing investor caution at a critical moment in Nigeria’s energy transition trajectory.

EO9 risk matrix: probability and impact

| Risk scenario | Probability rating | Impact rating | Indicative mitigation priority |

|---|---|---|---|

| Judicial challenge to EO9 | High | Very high | Fast‑track PIA amendment bill through NASS |

| NNPC liquidity crisis | High | Very high | Define alternative funding, ring‑fence JV cash calls |

| PSC contract disputes | Medium | High | Engage operators via the implementation committee |

| FDI/investment chill | Medium | Medium | Communicate the statutory alignment roadmap |

| Reconciliation errors in flows | Low–medium | Medium | Create a reconciliation taskforce across agencies |

| Frontier exploration funding gap | High | Medium | Design an alternative exploration‑funding mechanism |

Action points for government and industry

Executive Order 9 is designed as a transitional reform toward a more centralised and transparent petroleum fiscal regime, supported by a defined implementation timeline.

Within 30 days, the government is expected to establish implementation committees, issue remittance guidelines and align reconciliation protocols across operators, regulators, the Central Bank and FAAC.

Over the next 30 – 90 days, priorities include proposing amendments to the Petroleum Industry Act, defining NNPC’s replacement funding structure and resolving financial obligations tied to suspended infrastructure funds.

NNPC has initiated internal cash-flow stress tests, financial reporting adjustments and stakeholder engagements to align with the new revenue framework.

Industry participants are also reviewing contractual protections and updating financial protocols to reflect the direct-remittance model. Ultimately, the reform’s success will be judged by increased Federation Account receipts without disrupting production, triggering legal disputes or weakening operational stability, balancing transparency gains against potential liquidity and investment risks.

Path forward – Measuring EO9’s real reset

Executive Order 9’s long-term credibility will depend on whether it evolves into durable law.

A timely amendment of the Petroleum Industry Act, combined with redesigned NNPC funding structures and stronger fiscal transparency, could institutionalise revenue centralisation and strengthen governance.

Success will ultimately hinge on visible increases in Federation Account allocations, sustained production stability and improved financial disclosure.

If backed by legal reform, EO9 could anchor fiscal discipline; if left unresolved, it risks prolonging uncertainty and undermining investor confidence in Nigeria’s petroleum sector.