African boardrooms recalibrated in 2025.

Faced with tightening global disclosure rules, rising investor scrutiny and domestic regulatory reforms, directors across sectors shifted ESG from peripheral reporting to core governance architecture.

From embedding climate risk into enterprise strategy to tying executive pay to sustainability metrics, three dominant strategies emerged—reshaping how African companies compete for capital and credibility.

African Boards Redefined ESG Strategy in 2025

African corporate boards accelerated ESG integration in 2025, adopting three dominant strategies aimed at strengthening resilience, investor confidence and regulatory compliance.

According to industry analysis, directors increased the levels of incorporating sustainability into governance structures, linked executive compensation to measurable ESG outcomes, and invested in technology-enabled disclosure systems.

The shift reflects mounting pressure from global investors, evolving stock exchange mandates and domestic policy reforms across major African markets.

Boards Shift ESG From Compliance

In 2025, ESG ceased to be a box-ticking exercise. Instead, it became a board-level strategic priority.

Directors responded to global regulatory signals, including expanded climate disclosure requirements and supply chain due diligence mandates, by repositioning ESG within enterprise risk frameworks.

The message was clear: capital access increasingly depends on the credibility of governance.

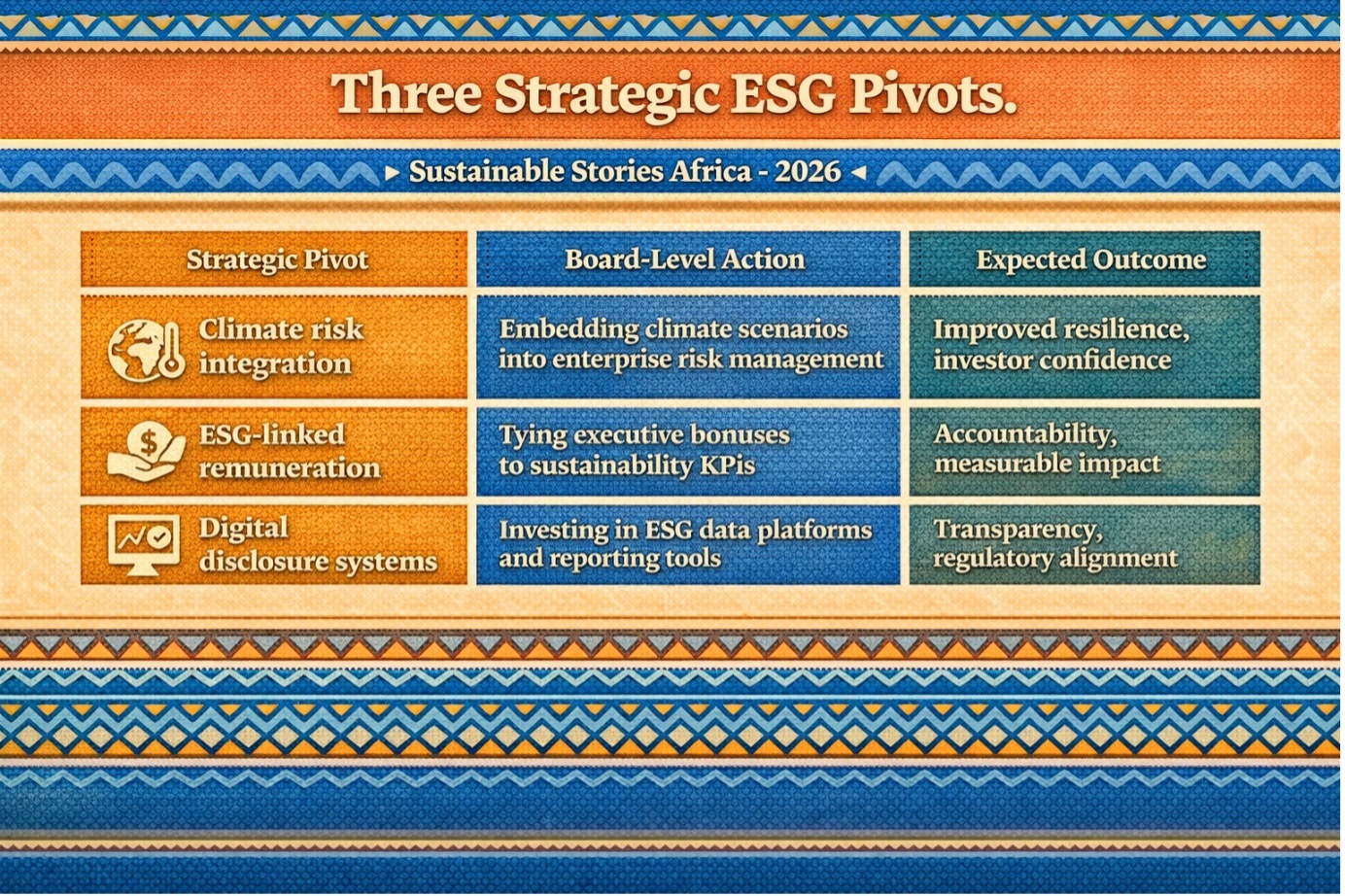

Three Strategic ESG Pivots Emerge

Analysis of board decisions across sectors highlights three core strategies adopted in 2025:

Strategic Pivot | Board-Level Action | Expected Outcome |

|---|---|---|

Climate risk integration | Embedding climate scenarios into enterprise risk management | Improved resilience, investor confidence |

ESG-linked remuneration | Tying executive bonuses to sustainability KPIs | Accountability, measurable impact |

Digital disclosure systems | Investing in ESG data platforms and reporting tools | Transparency, regulatory alignment |

Boards in financial services, energy and manufacturing sectors led the shift, particularly in markets with active exchange-level ESG guidance.

Speakers at governance forums noted that climate risk integration was increasingly treated as a financial risk, rather than merely an environmental issue.

Executive remuneration reforms were also prominent. Sustainability-linked performance indicators, ranging from emissions intensity to workforce diversity, influenced the structure for bonus payments.

Capital Access Drives Governance Reform

The incentive behind these changes is pragmatic.

Institutional investors, both domestic pension funds and international asset managers, are prioritising companies with credible ESG governance structures.

Companies that have embedded ESG into board oversight frameworks reported improved investor engagement and stronger eligibility for sustainability-linked financing instruments.

Failure to adapt, many observers warned, risks exclusion from global capital pools and an increase in the cost of capital.

Beyond finance, reputational capital also matters. In consumer-facing sectors, sustainability credibility increasingly shapes brand equity and market access.

Directors Urged To Institutionalise Oversight

Governance experts emphasised the need for formal board committees or expanded mandates within existing risk committees to oversee ESG performance.

Recommended actions for 2026 include:

- Conducting board-level ESG training and competency assessments

- Standardising climate and sustainability metrics

- Aligning disclosures with global frameworks (e.g., ISSB-aligned standards)

- Enhancing stakeholder engagement protocols

The transition from narrative reporting to metric-driven accountability remains ongoing, but 2025 marked a decisive inflexion point.

AIDAP Framework Breakdown

- Attention: Governance Pressure Intensifies Globally – Expanding global ESG mandates reshaped expectations for African corporates seeking cross-border capital.

- Interest: Strategy Shifts Inside Boardrooms – Boards integrated climate risk, compensation reform and digital reporting systems into governance structures.

- Decision: Link Incentives to Measurable Impact – Executive pay structures increasingly reflect sustainability performance indicators.

- Action: Institutionalise ESG Oversight Structures – Formal committees, data platforms, and disclosure alignment form the next phase of implementation.

Path Forward – Embed Accountability, Digitise, Align Standards

African boards are moving from ESG awareness to structural integration. The priority now is institutionalising oversight through formal committees and measurable KPIs.

Sustained credibility will depend on digital disclosure systems, executive accountability and alignment with evolving global sustainability standards.

Culled From: https://ethicalbusiness.africa/2026/01/05/top-3-esg-strategies-african-boards-adopted-in-2025/