The African Development Bank has approved a $3.9 million grant to enable African countries to convert high-level energy transition compacts into real electricity connections.

The funding targets technical bottlenecks, from regulatory design to grid integration, that often stall implementation.

For policymakers and investors alike, the message is clear: ambition without execution will not light a single home.

From Pledges to Power Lines

Africa’s energy transition is no longer constrained by ambition. It is constrained by delivery.

This week, the African Development Bank approved a $3.9 million grant to enable countries translate energy compacts into bankable projects and grid-ready infrastructure.

The move seeks to bridge the gap between conference commitments and actual electricity connections.

For a continent where over 600 million people still lack access to electricity, implementation is not a technical footnote; it is the central question.

Implementation Gap Exposed

Across Africa, governments have signed energy compacts and initiatives such as Mission 300 as well as national transition frameworks. These compacts outline targets for renewables, grid expansion, and private-sector mobilisation.

However, progress often slows once the headlines fade.

The AfDB’s $3.9 million support package aims to address precisely that implementation gap, funding technical assistance, regulatory strengthening, and transaction structuring to ensure projects move from policy documents to power plants.

In energy economics, this stage is often invisible to the public, and it determines whether capital flows or stalls.

Why Technical Support Matters

Energy compacts typically set high-level goals:

- Expanding renewable capacity

- Reforming tariff structures

- Strengthening utilities

- Mobilising private investment

However, translating those goals into operational projects requires detailed work: feasibility studies, grid modelling, procurement design, and financial structuring.

Without these elements, investor confidence erodes.

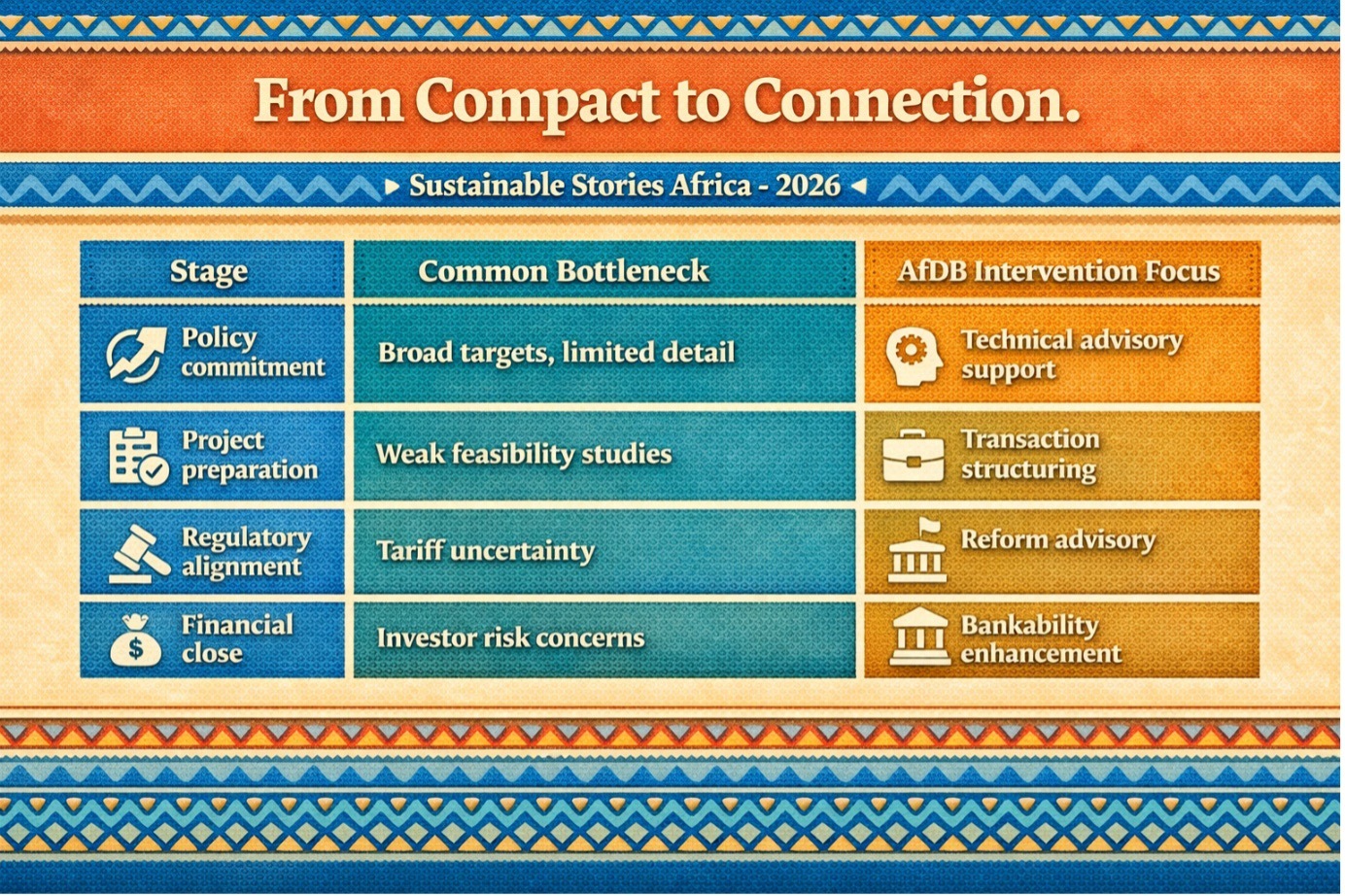

From Compact to Connection

Stage | Common Bottleneck | AfDB Intervention Focus |

|---|---|---|

Policy commitment | Broad targets, limited detail | Technical advisory support |

Project preparation | Weak feasibility studies | Transaction structuring |

Regulatory alignment | Tariff uncertainty | Reform advisory |

Financial close | Investor risk concerns | Bankability enhancement |

This targeted support reflects a broader AfDB strategy linking policy reform with private capital mobilisation, especially in renewable energy and grid expansion.

For investors watching Africa’s power sector, clarity and predictability matter as much as ambition.

The Promise of Execution

If successfully deployed, the $3.9 million grant could unlock significantly larger capital flows.

Energy transition financing operates on leverage. Small catalytic funds, especially those focused on preparation and reform, can pull in hundreds of millions in private or blended finance.

The stakes are substantial:

- Improved electricity reliability for households

- Reduced reliance on diesel generation

- Lower long-term energy costs

- Increased industrial competitiveness

Beyond infrastructure, access to energy influences healthcare, education, and economic growth.

Each link matters. Break one, and the chain stalls.

For African governments, this support signals recognition that technical capacity, not political will, is often the binding constraint.

Scaling from Millions to Billions

The AfDB’s intervention may appear modest in monetary terms, but its strategic intent is clear: de-risk early-stage processes to accelerate project pipelines.

Energy compacts, by design, are multi-year frameworks. What investors and citizens closely look out for is whether this technical assistance translates into measurable outcomes, such as additional megawatts, extended transmission lines, and connected households.

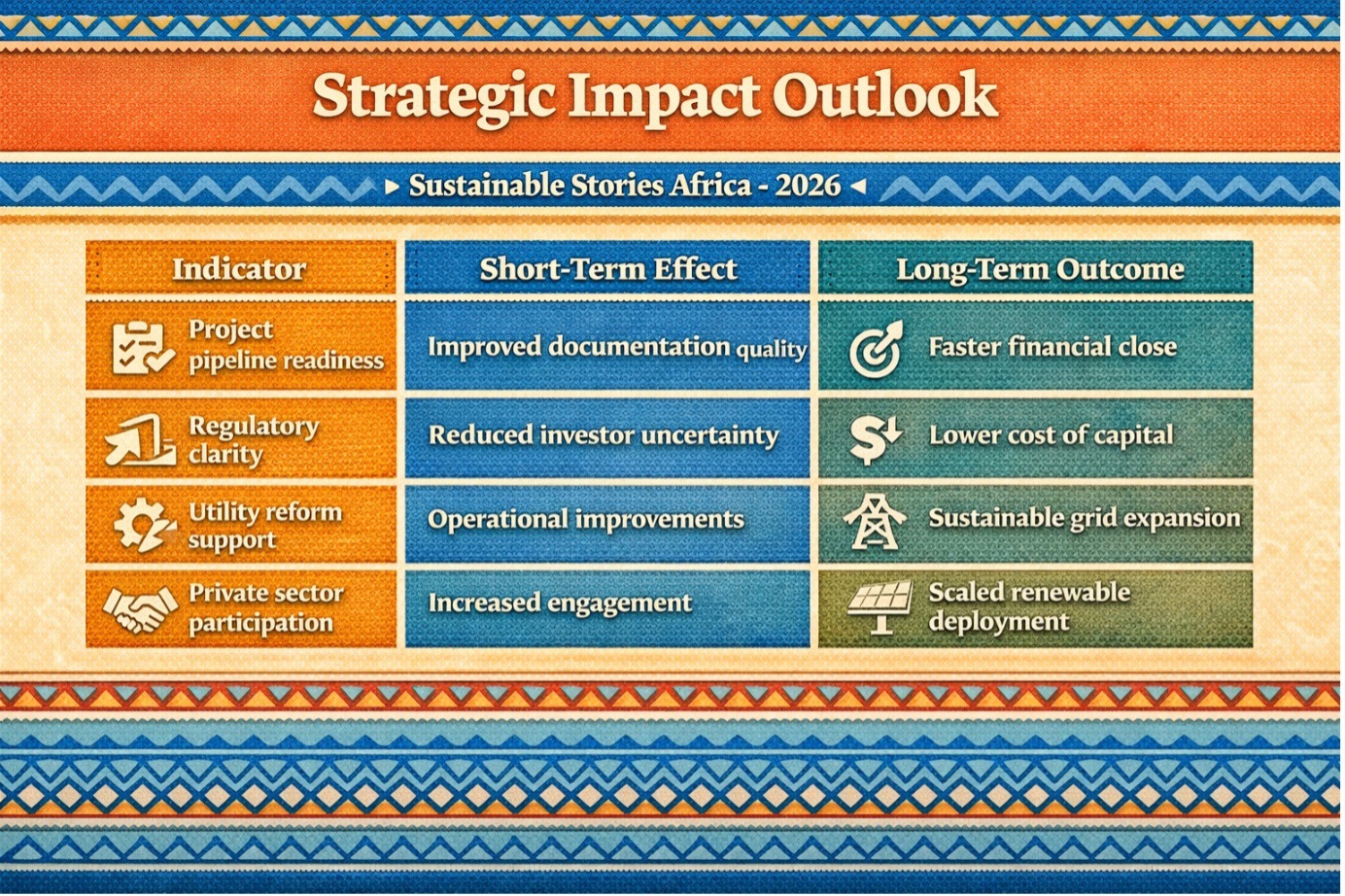

Strategic Impact Outlook

Indicator | Short-Term Effect | Long-Term Outcome |

|---|---|---|

Project pipeline readiness | Improved documentation quality | Faster financial close |

Regulatory clarity | Reduced investor uncertainty | Lower cost of capital |

Utility reform support | Operational improvements | Sustainable grid expansion |

Private sector participation | Increased engagement | Scaled renewable deployment |

The broader question is replication. If the model succeeds, similar catalytic technical funds could be deployed across other sectors, including water, transport, and digital infrastructure.

Execution, not ambition, will determine credibility.

PATH FORWARD – Bridging Policy and Power

African governments must prioritise technical readiness alongside political commitment. Regulatory reforms, credible tariffs, and robust project preparation frameworks are now central to unlocking scale finance.

For development partners, catalytic funding should focus on bankability and institutional capacity. Turning compacts into connections requires disciplined execution and consistent follow-through.